Think Thursday - Nigeria Market Update: Oil Output Weakens, MTN Expands Spectrum; Fed Cuts Rates as Yields Climb

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s Market kick off. Nigeria’s energy, telecoms, and financial sectors saw major developments, from NNPC’s OPEC role to MTN’s new spectrum lease and the CBN’s push for financial inclusion. Globally, the Fed’s rate cut, rising U.S. Treasury yields, and falling Russian oil revenues signal shifting dynamics in the energy and financial markets.

Nigerian News & Market Update

NNPC’s MD appointed as Nigeria’s OPEC representative:

Maryamu Idris, MD of NNPC Trading, has been appointed Nigeria’s National Representative to OPEC, where she will help shape policies on production, pricing, and energy strategy. - Punch

MTN l to lease spectrum from T2 mobile:

MTN Nigeria will lease spectrum from T2 Mobile (formerly 9Mobile) for three years starting October 2025 to boost network capacity and support its roaming deal. It will not renew a similar lease with Natcom expiring in November 2025. - Punch

Crude output slips below OPEC quota again:

Nigeria’s oil production fell to 1.43 mbpd in August, below its OPEC quota, reversing recent gains and underscoring ongoing volatility despite government targets to boost output. - Punch

Rates Mix as Inflows to States Boost Liquidity to ₦2.87trillion:

CBN inflows of ₦410billion raised system liquidity to ₦2.87trillion, leaving money market rates mixed and NT-Bills’ average yield slightly lower at 18.43%. - dmarketforces

Nigerian Bonds Yield Rises on Portfolio Reshuffles:

Nigeria’s bond market stayed weak on portfolio rebalancing, but lower Treasury bill rates below 17% hint at policy easing. Benchmark yields fell to 16.27%, and sentiment is expected to improve with easing inflation and strong liquidity. - dmarketforces

CSCS clears ₦2.1trillion trades, eyes 2-day cycle by November:

CSCS will switch to a T+2 settlement cycle by Nov 28, 2025, to boost efficiency and attract investors. It settled ₦2.11trillion in trades between May–Aug 2025, up 138% YoY, alongside major digital upgrades. - TheSun

CBN grants licence to Apices Finance company limited:

The CBN has approved Apices Finance Company Limited to operate as a finance company, aiming to boost financial inclusion, expand credit access, and support SMEs, startups, and retail customers in Nigeria’s economy. - TheNation

Dangote refinery rejects DAPPMAN’s alleged ₦1.5trillion subsidy demand:

Dangote Refinery has rejected the Depot and Petroleum Products Marketers Association of Nigeria (DAPPMAN)’s demand for a ₦1.5trillion subsidy, accusing marketers of anti-competitive practices, while DAPPMAN threatens legal action. - DailyTimes

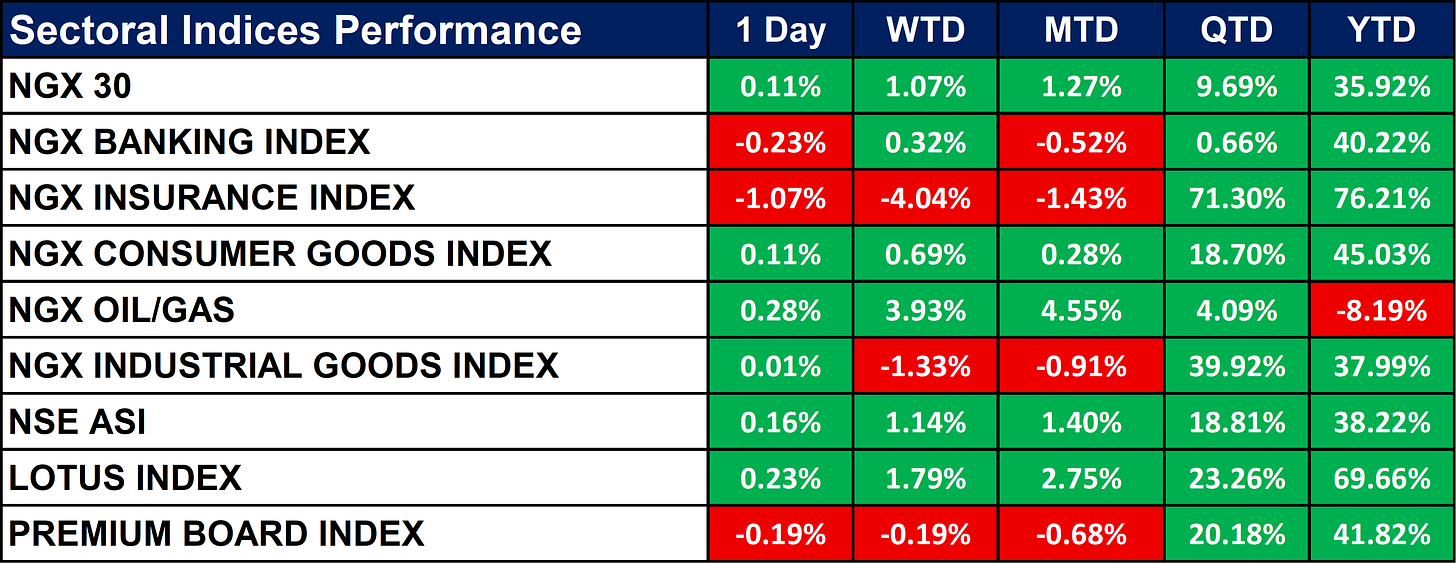

Nigeria Sectoral Indices Performance

The table below shows that the NGX sector indices showed mixed performance. Insurance and Industrial Goods fell WTD, while Oil/Gas and Consumer Goods gained. YTD, Insurance (+76.21%), Lotus (+69.66%), and Consumer Goods (+45.03%) lead, while Oil/Gas is the only laggard (-8.19%).

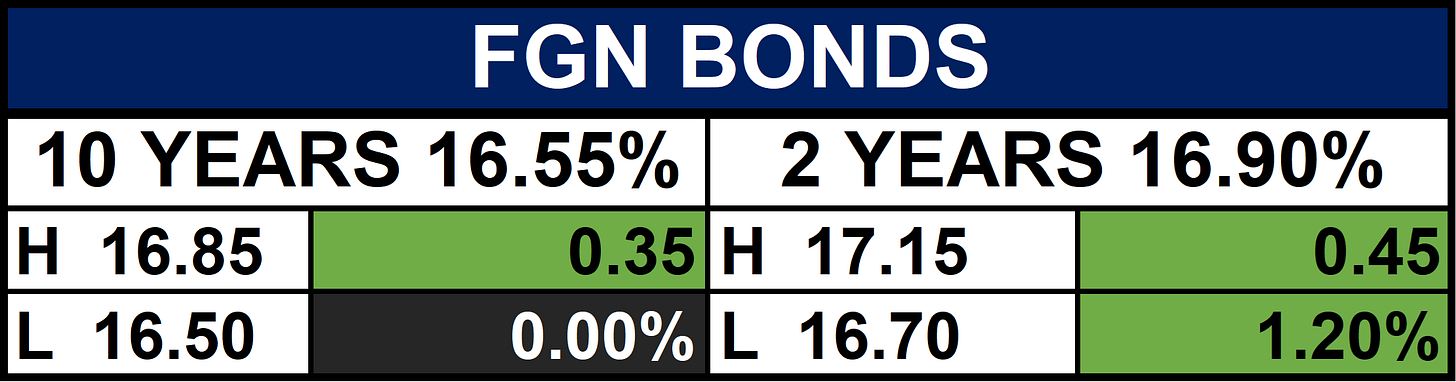

Fixed Income (FGN Bonds)

NTB Auction Result

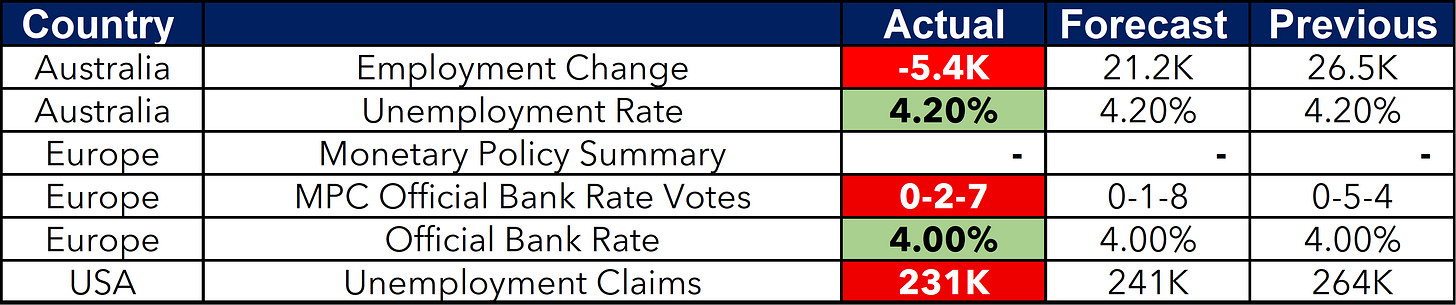

Global News & Market Update

Federal Reserve lowers interest rates by 0.25 percentage points in first cut since December:

The Fed cut rates by 0.25% to 4.0–4.25%, its first in 2025, citing weak job growth. Officials project a few more cuts ahead, though inflation is still above target. - CBSNEWS

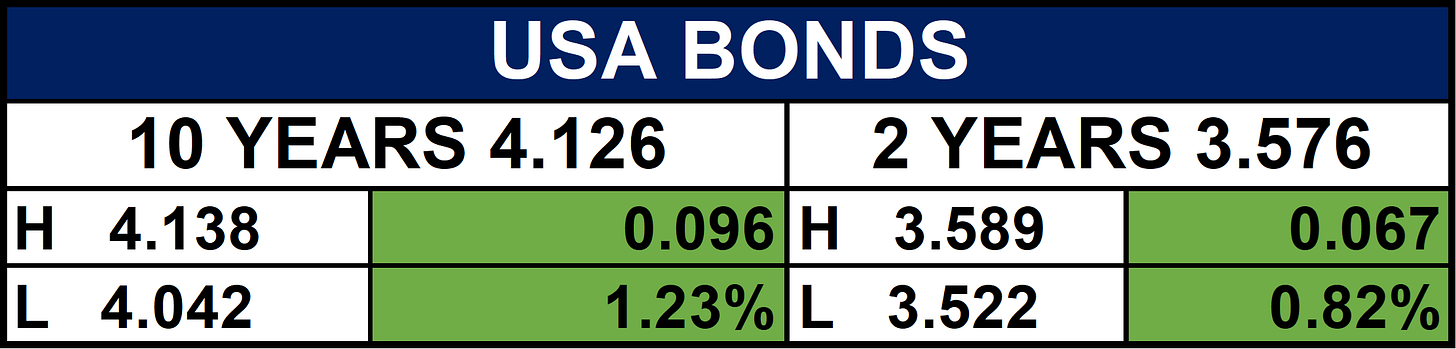

10-year Treasury yield rises above 4.11% after jobless claims signal labor market in OK shape:

U.S. Treasury yields rose as jobless claims fell to 231,000, easing labor market concerns. The 10-, 2-, and 30-year yields all increased despite the Fed cutting rates to 4–4.25%. - CNBC

Russia's September oil and gas budget revenue seen falling 23%:

Russia’s September oil and gas revenue is set to drop 23%, with year-to-date revenue down 20.5%, straining the budget amid high military spending and a slowing economy. - Reuters

S.Africa's Transnet agrees port equipment deal with Liebherr:

Transnet signed a 10-year crane supply and 20-year maintenance deal with Liebherr to modernize South African ports and improve efficiency. - Reuters

Ukrainian drones target Russian petrochemical complex and oil refinery:

Ukraine launched drone strikes on Russian oil facilities in Bashkortostan and Volgograd, causing minor damage but no casualties, aiming to disrupt Moscow’s energy sector. - Reuters

South African central bank holds key rate to assess impact of earlier cuts:

South Africa’s central bank held the repo rate at 7%, citing low inflation and ongoing assessment of previous rate cuts, while raising growth forecasts to 1.2%. - Reuters

Swiss exports to US drop over a fifth after Trump tariffs:

Swiss exports to the U.S. fell 22% in August after President Trump imposed 39% tariffs, hitting their lowest level since 2020. Exports to the EU and Canada rose, with Germany overtaking the U.S. as Switzerland’s top export market. - Reuters

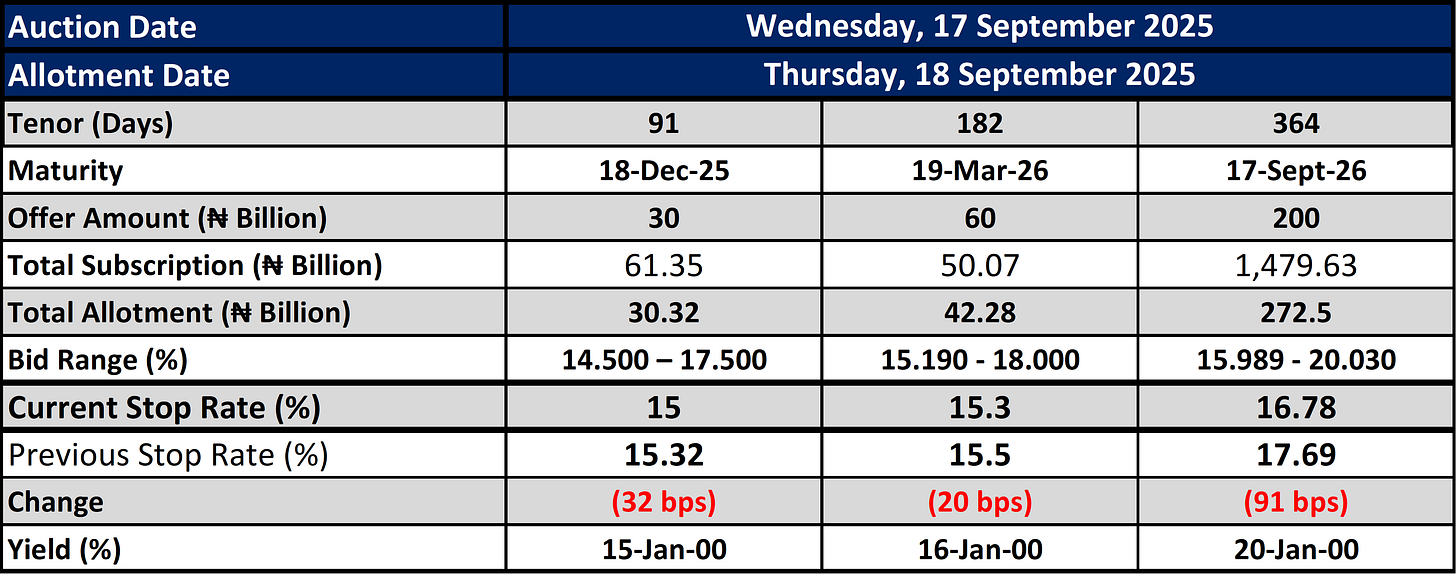

Indices, Commodities & Currencies

The table below depicts that the Global equities were broadly positive, with Nikkei (+2.32%), Russell 2000 (+2.10%), and DAX (+1.34%) leading gains, while volatility (VIX) eased. Energy prices slipped, as WTI (-0.60%) and Brent (-0.41%) fell, but natural gas (+0.61%) rose. Commodities were mixed: cocoa (-2.19%) and platinum (-2.68%) fell, while canola (+0.53%) and oats (+1.95%) advanced; the U.S. dollar strengthened (+0.81%).

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, Nigerian equities may benefit from strong liquidity, easing inflation, and reforms like CSCS’s T+2 settlement, though oil output weakness remains a drag. Globally, the Fed’s cautious easing and resilient U.S. labor market suggest stable risk appetite, while falling Russian revenues and trade tensions highlight geopolitical risks. Investors should expect continued volatility in energy and commodities but opportunities in Nigerian consumer, insurance, and financial sectors remain strong.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.