Think Thursday - Nigeria Sees Major Corporate Moves as Helios Buys Beta Glass, Lasaco Raises ₦25bn as Global Central Banks Adjust Rates; OPEC Forecasts Balanced Oil Supply

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market briefing. In this edition, we highlight major corporate developments in Nigeria, including Helios’ €100million acquisition of Beta Glass, Lasaco Assurance’s ₦25billion capital raise, and PZ Cussons’ renewed commitment to Nigeria. Globally, we focus on central bank policy updates, from the Fed’s third consecutive rate cut to OPEC’s forecast of balanced oil supply and demand in 2026, offering key insights for both local and international investors.

Nigerian News & Market Update

Helios acquires Beta Glass in €100m deal:

Frigoglass Group is selling its entire stake in Beta Glass to Helios Investment Partners for up to €100 million, marking a major ownership change in Nigeria’s glass manufacturing sector. - Punch

Shell Nigeria Gas seals deals with Ogun steel firm:

Shell Nigeria Gas is expanding its Ogun State operations with a new gas supply deal to SG Industrial FZE, reinforcing its growing customer base and support for Nigeria’s domestic gas development agenda. - Punch

Lasaco Assurance Shareholders Approve ₦25billion Capital Raise:

Lasaco Assurance shareholders have approved a ₦25billion capital raise through private placement and rights issue to strengthen the insurer’s financial base and competitiveness ahead of industry recapitalisation. - Dmarketforces

CBN Hikes Interest Rate on Nigerian Treasury Bills to 17.95%:

The CBN has raised the 364-day Treasury bill rate to 17.95% amid heavy oversubscription, reinforcing strong investor demand for longer-tenor government securities. - Dmarketforces

PZ Cussons Jettisons Africa Exit Over Nigeria’s Economic Recovery, Growth:

PZ Cussons has scrapped plans to exit Africa, opting instead to retain and expand its Nigeria-led operations after concluding that offers received undervalued the business. - Channels

FG launches first gas trading, clearing platform:

Nigeria has launched its first gas trading licence and clearing house to boost transparency, competitiveness, and investment in the gas sector under the Decade of Gas initiative. - Businessday

JTB begins transition to implement new tax laws:

Nigeria’s Joint Tax Board has rebranded and begun transitioning into the new Joint Revenue Board ahead of January 2026 tax law reforms aimed at unifying and modernising national revenue administration. - Punch

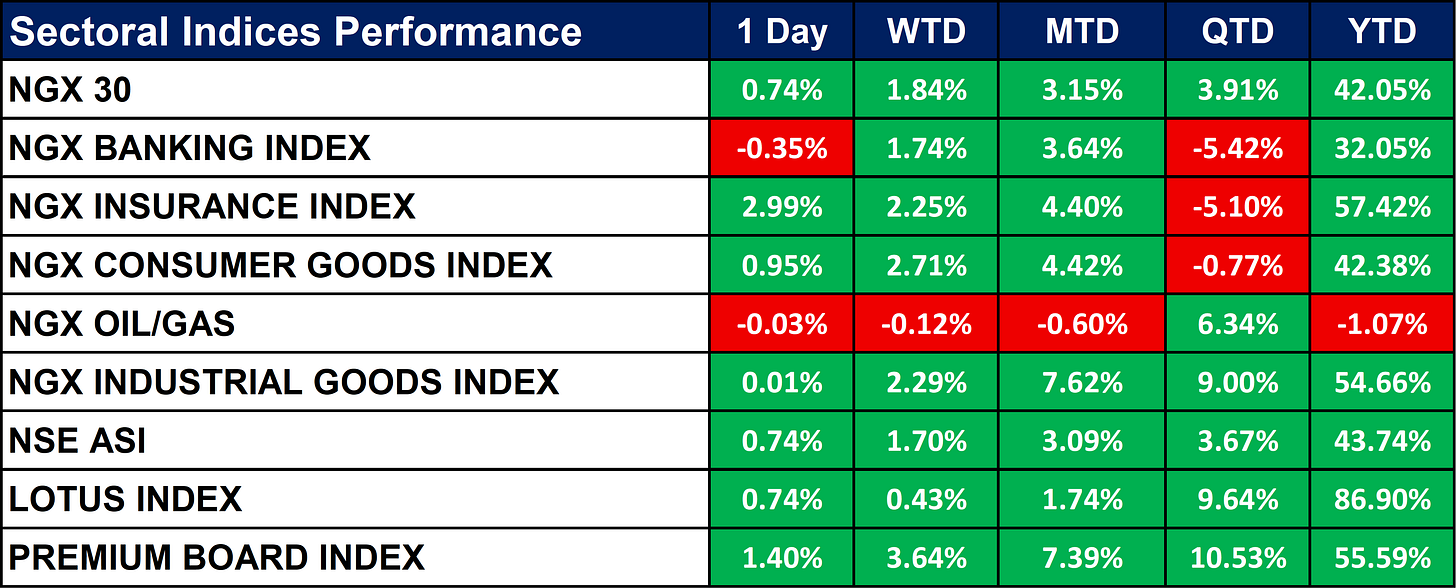

Nigeria Sectoral Indices Performance

The table below shows that Most NGX sector indices closed positive on the day, with Insurance (+2.99%) and the Premium Board Index (+1.40%) leading gains, while Banking (-0.35%) and Oil/Gas (-0.03%) declined. Month-to-date and quarter-to-date performance are broadly strong across sectors, except Banking and Insurance which show QTD declines. Year-to-date, all major indices remain positive, with the Lotus Index (+86.90%) and Insurance (+57.42%) posting the strongest gains.

Fixed Income (FGN Bonds)

Global News & Market Update

Federal Reserve lowers its benchmark interest rate by 0.25 percentage points in third straight cut:

The Federal Reserve cut its benchmark rate by 0.25% to 3.5–3.75%, marking the third cut in 2025, signaled a likely pause with only one potential cut in 2026, amid mixed labor market signals and internal committee dissent. - CBSNews

Turkey cenbank cuts rates 150 pts to 38% on ‘improving’ signals:

Turkey’s central bank cut its policy rate by 150 basis points to 38%, citing improving inflation trends, and signaled continued easing toward a 28% rate by end-2026 despite ongoing economic risks. - Reuters

Brazil central bank holds interest rates, gives no hint of cuts:

Brazil’s central bank kept its Selic rate at 15% for the fourth straight meeting, maintaining a hawkish stance while slightly lowering inflation forecasts, signaling that rate cuts may begin cautiously in 2026. - Reuters

BOJ to hike rates to 0.75% in Dec, 1.0% by next Sept:

The Bank of Japan is expected to raise its policy rate by 25 basis points to 0.75% in December, with economists projecting it could reach at least 1% by September 2026 amid cautious wage growth and inflation trends. - Reuters

OPEC data indicate close oil supply-demand balance in 2026, no glut:

OPEC forecasts that world oil supply and demand will be closely balanced in 2026, with OPEC+ pausing production hikes despite the International Energy Agency (IEA) predictions of a significant global oversupply. - Reuters

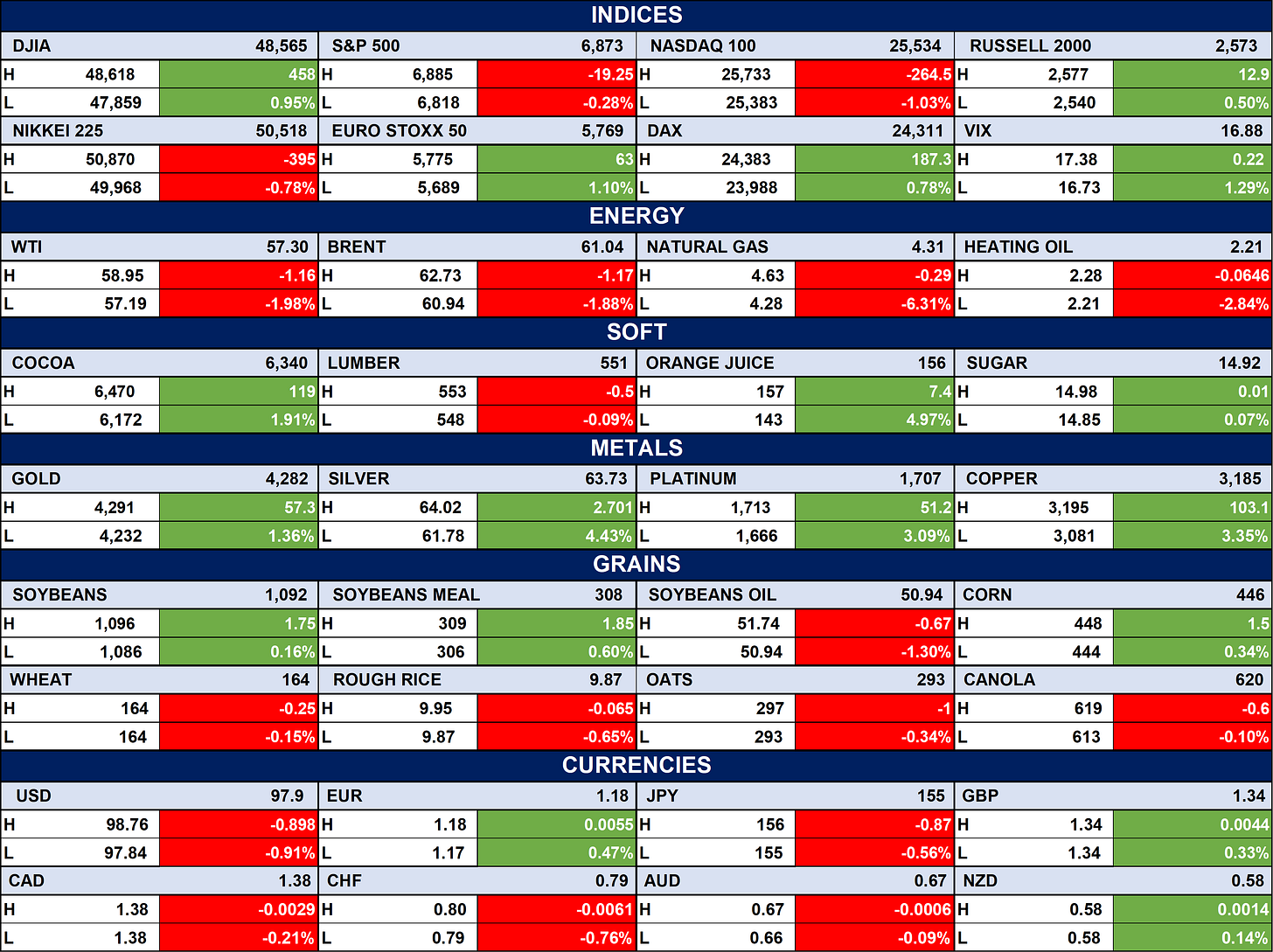

Indices, Commodities & Currencies

The table below depicts that the Global equities were mixed, with the S&P 500 and Nasdaq slipping while the Euro Stoxx 50 and DAX advanced.

Commodities showed broad strength, led by sharp gains in natural gas, silver, platinum, copper, and softs like orange juice.

Currencies were mostly steady, with the euro and pound firming slightly while the dollar index edged lower.

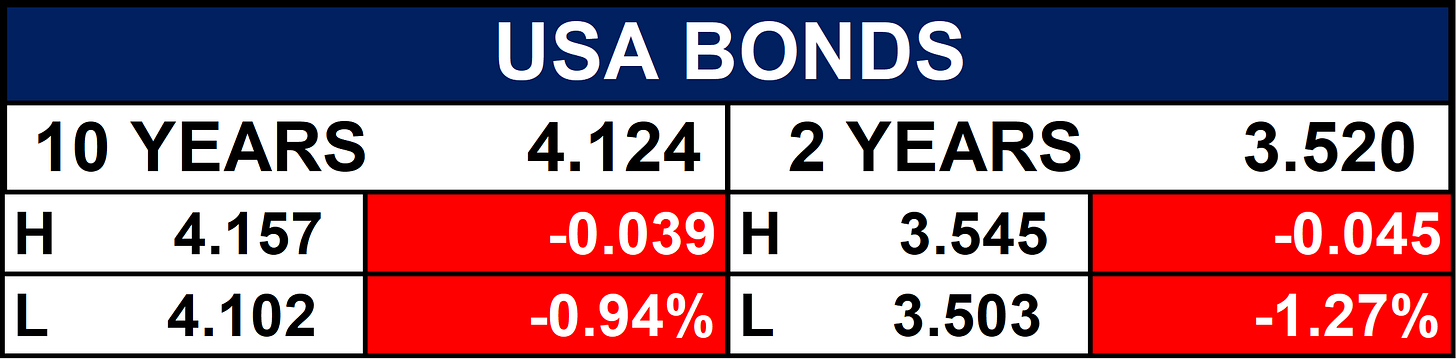

Fixed Income (USA Bonds)

Events

Conclusion

Investors should monitor Nigeria’s financial and industrial sectors as recapitalisations and gas sector initiatives may drive market activity, while global monetary shifts particularly in the US, Turkey, Brazil, and Japan could influence capital flows and commodity prices. Strategic positioning in high-performing sectors like insurance and industrials, alongside attention to currency and bond movements, will be key for navigating the evolving market landscape in the coming months

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.