Think Thursday - Nigeria Strengthens Energy Output as Global Markets Brace for Policy Shifts, Cooling Inflation, and Rising Tech-Driven Trade

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market kick-off, where we unpack the major developments shaping Nigeria’s energy reforms, capital markets, and regulatory landscape. This edition highlights key updates from the NNPC–Heirs Energies gas boost, NAICOM’s new capital rules, and fresh corporate financing moves. We also track global shifts across OPEC+, Asian trade momentum, and inflation trends guiding monetary policy in major economies.

Nigerian News & Market Update

NNPC/Heirs Energies JV Adds Over 135 MMscf/d To Gas Supply:

The NNPC/Heirs Energies OML 17 JV has doubled its gas output through Nigeria’s first rigless well recompletion, significantly boosting domestic power generation and strengthening national energy security. - Channels

NAICOM Sets July 2026 Deadline for New Capital Requirement Licence:

The National Insurance Commission (NAICOM) has set July 2026 as the final deadline for insurers and reinsurers to meet the new minimum capital requirements under the Nigeria Insurance Industry Recapitalisation Agenda (NIIRA) 2025, marking a major step toward a stronger, risk-based and more competitive insurance sector. - Dmarketforces

Legend Internet Secures 119.7% Oversubscription For ₦10billion Commercial Paper:

Legend Internet Plc’s Series 1 Commercial Paper was oversubscribed at 119.7%, reflecting strong investor confidence and supporting its nationwide digital infrastructure expansion plans. - Leadership

AfDB approves $500million loan for Nigeria’s energy reforms:

The African Development Bank has approved a $500 million loan to support Nigeria’s fiscal reforms, energy-sector restructuring, and climate transition under the second phase of its Economic Governance and Energy Transition Support Programme. - Punch

Nigeria Sectoral Indices Performance

The table below shows that the NGX saw mild gains across major indices, with Insurance (+1.27%) leading the market on a 1-day basis.

Despite positive quarterly performance in key sectors like Oil & Gas and Lotus, most indices remain deeply negative month-to-date.

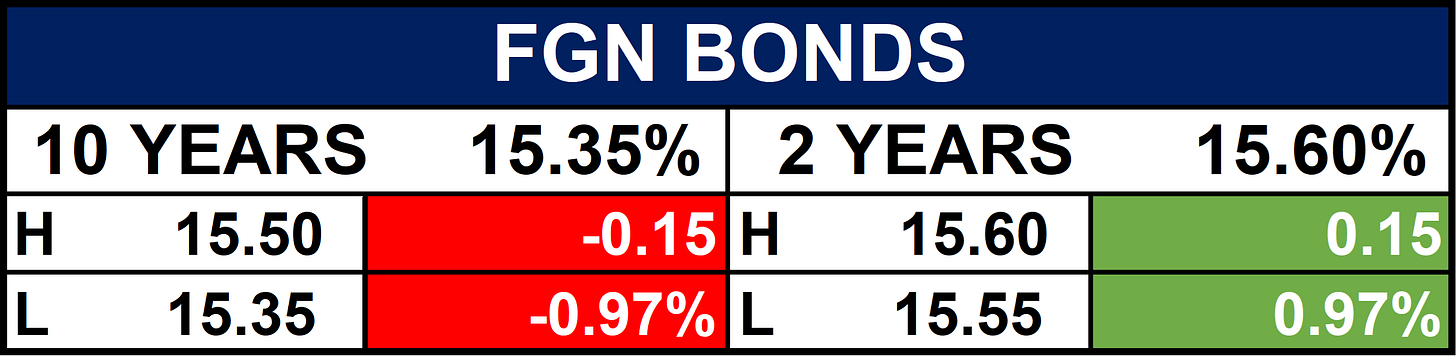

Year-to-date returns stay strong overall, led by the Lotus Index (+83.40%) and Insurance (+54.33%), reflecting sustained long-term market momentum.Fixed Income (FGN Bonds)

Global News & Market Update

OPEC+ expected to hold oil output policy steady for Q1, sources say:

OPEC+ is expected to keep oil output levels unchanged for 2026 and agree on a new mechanism to assess members’ production capacity at its upcoming Sunday meetings. - Reuters

China issues first batch of 2026 crude oil import quotas for independent refiners:

China has issued its first batch of 2026 crude oil import quotas to independent refiners, boosting imports and helping alleviate the current supply glut. - Reuters

Brazil’s annual inflation back within target range for first time since January:

Brazil’s annual inflation fell to 4.5% in mid-November, returning within the central bank’s target range and raising expectations of an interest rate cut early next year. - Reuters

India’s central bank expected to cut rates to 5.25% on December 5:

Economists expect the Reserve Bank of India to cut its key interest rate by 25 basis points to 5.25% on December 5, following record-low inflation and amid weak consumption pressures. - Reuters

South Korea exports seen rising in November on tech demand, US trade deal:

South Korean exports are forecast to rise 5.7% in November, driven by strong semiconductor demand and a finalized U.S. trade deal, while the trade surplus is expected to widen to $8.4 billion. - Reuters

Indices, Commodities & Currencies

The table below depicts that the Global equity indices were mostly mixed, with modest declines in U.S. markets while European and Japanese indices saw slight gains.

Energy commodities broadly strengthened, led by natural gas and heating oil, while metals were softer with gold and copper declining.

Agricultural commodities showed a mixed pattern, and some major currencies moved narrowly, reflecting a steady but cautious global risk environment.

Fixed Income (USA Bonds)

Conclusion

As Nigeria strengthens its energy supply, accelerates fiscal reforms, and tightens insurance sector regulation, investors could watch for renewed momentum in credit markets, infrastructure plays, and domestic consumption. Globally, steady OPEC+ policy, easing inflation in emerging markets, and improving Asian export activity could support risk sentiment, though oil demand uncertainties and currency pressures remain key variables to monitor in the weeks ahead.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.