Think Thursday - Nigerian Banking, Telecoms, and Gold Markets Gain Traction as Global Commodities and Energy Deals Influence Sentiment

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market briefing. In this edition, we cover key developments shaping Nigeria’s financial landscape, from UBA’s record capital raise to MTN’s growing 5G subscriber base, alongside expanding opportunities in commodities with LCFE’s gold listing. Global market movements, including U.S. energy deals and shifts in copper supply, also highlight trends that may impact local investors. Stay tuned for actionable insights on sectors and investment opportunities to watch.

Nigerian News & Market Update

Sovereign Trust Insurance Gets New MD:

Sovereign Trust Insurance Plc has appointed Dr. Lucas Durojaiye as its new MD/CEO following the retirement of long-serving chief executive Olaotan Soyinka. - Leadership

LCFE to list Kian Smith’s N21 bn gold bars:

The Lagos Commodities and Futures Exchange will list over ₦21 billion worth of Kian Smith’s LBMA-certified gold bars, marking a major step in expanding Nigeria’s structured commodities and alternative investment market. - Vanguard

UBA surpasses ₦500billion capital mark after N178bn rights raise:

UBA has raised ₦178.3billion via a rights issue, pushing its capital base above ₦500bn and making it one of the first Tier-1 banks to meet the CBN’s recapitalisation requirement ahead of the 2026 deadline. - TheSun

MTN’s 5G subscribers reach 15million:

MTN Nigeria has reached about 15 million 5G subscribers, driven by heavy network investment and rapid 4G/5G and fibre rollout that boosted data usage and profitability. - DailyTrust

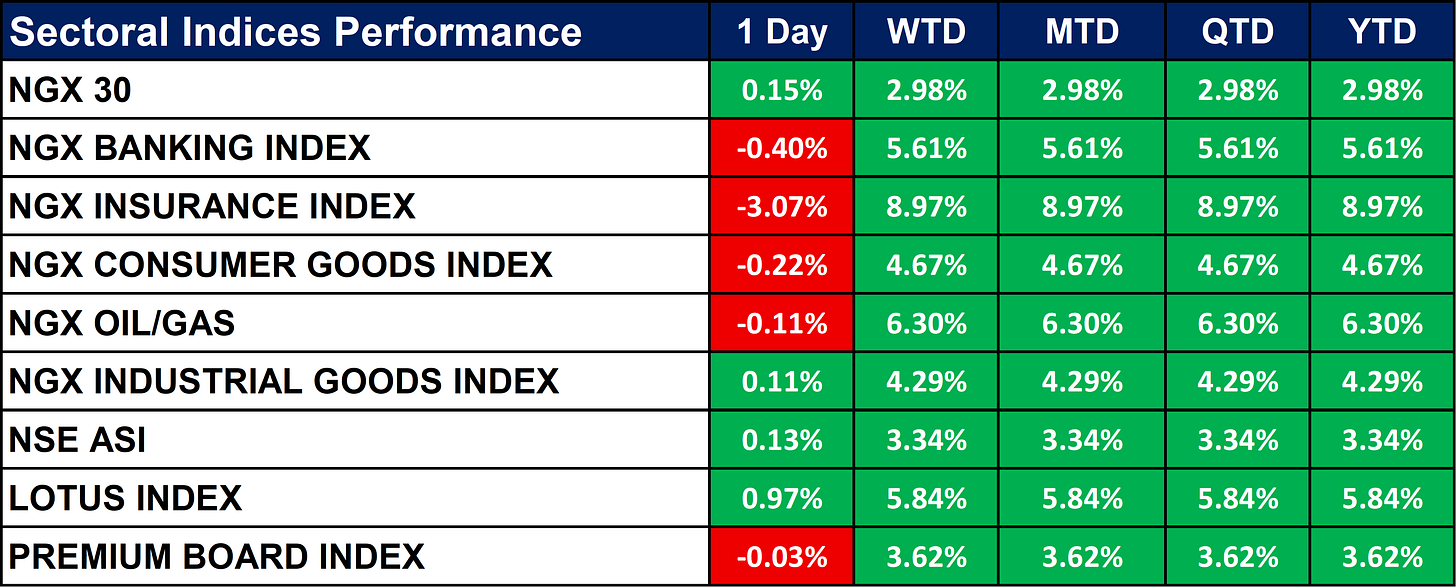

Nigeria Sectoral Indices Performance

The table below shows that the NGX market showed modest mixed performance today, with the overall NGX 30 up slightly by 0.15% while key sectors like Banking (-0.40%), Insurance (-3.07%), and Consumer Goods (-0.22%) retreated. Oil & Gas (-0.11%) and Premium Board (-0.03%) were also marginally down, while Industrial Goods (+0.11%) and broader indices like NSE ASI (+0.13%) and Lotus Index (+0.97%) recorded gains. On a weekly to year-to-date basis, all sectors remain positive, led by Insurance (+8.97%) and Oil & Gas (+6.30%), signaling sustained market momentum despite daily fluctuations.

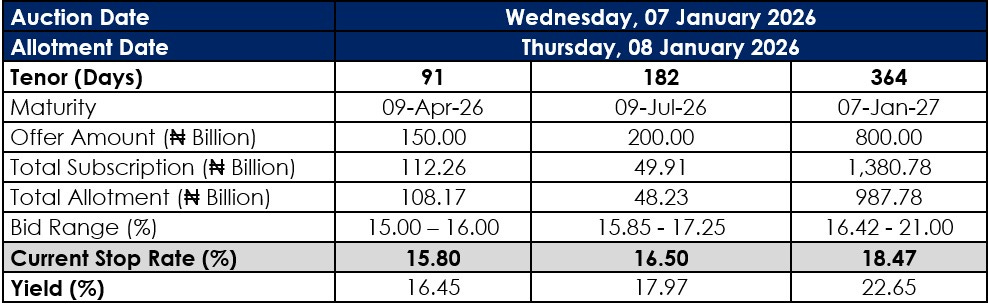

TB Auction Result

Global News & Market Update

American Electric Power signs $2.65 billion deal for fuel cells:

American Electric Power has struck a $2.65 billion deal to buy Bloom Energy fuel cells and signed a 20-year offtake agreement to supply power from a planned Wyoming fuel cell facility. - Reuters

India sugar export deals gain traction on lower prices, weak currency:

India’s sugar export deals are picking up slowly as falling domestic prices and a weaker rupee make overseas sales more viable, with about 180,000 tonnes contracted so far this season. - Reuters

Lebanon to sign gas exploration deal on Friday:

Lebanon is set to sign a gas exploration deal with a QatarEnergy–TotalEnergies–Eni consortium for offshore Block 8 as it seeks energy discoveries to ease its economic crisis. - Reuters

US tariff pull on copper drains China’s bonded warehouses:

U.S. tariff fears have driven copper premiums higher, pulling metal out of China’s bonded warehouses and distorting global copper supply flows as traders ship inventories to the United States. - Reuters

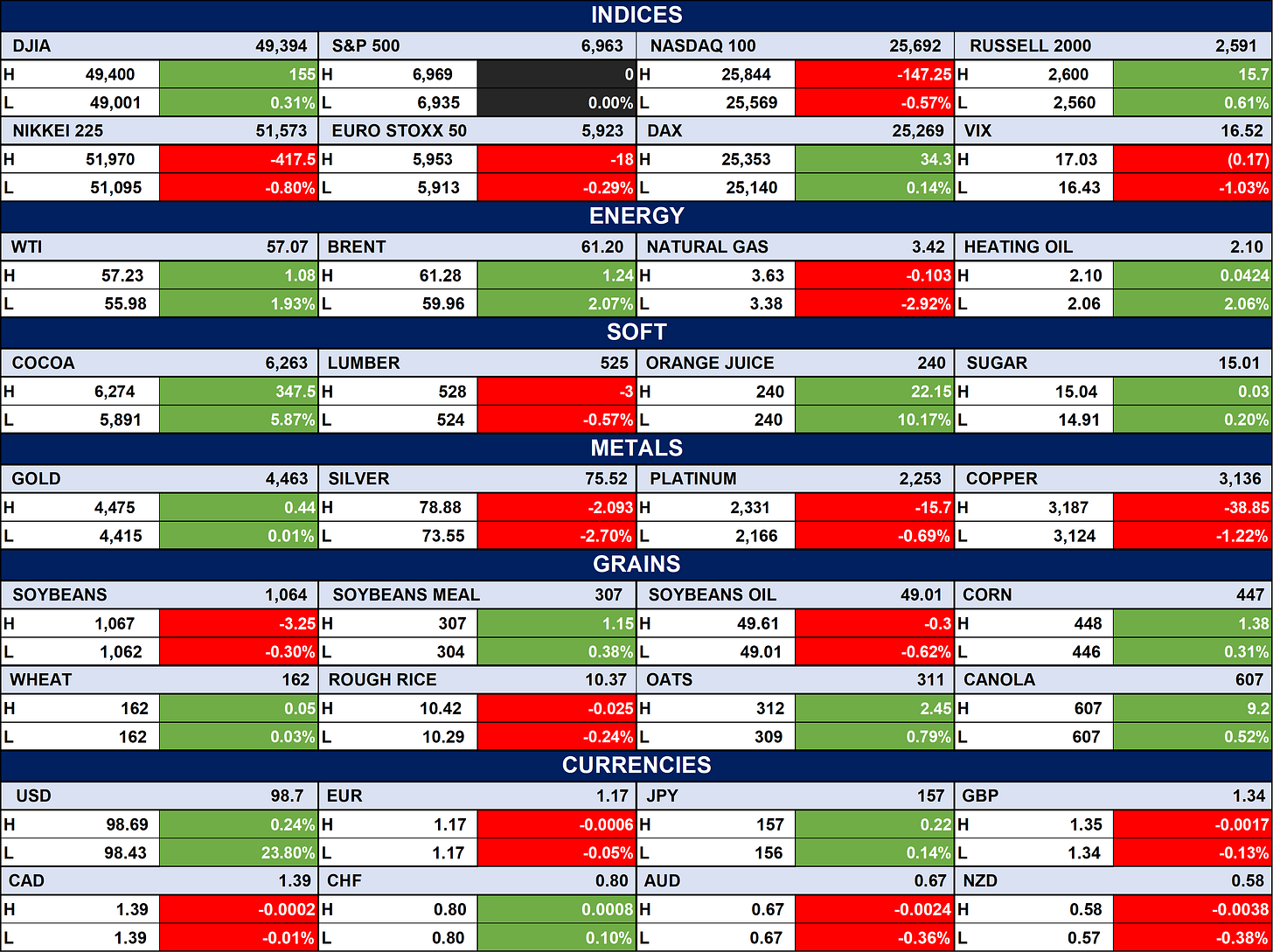

Indices, Commodities & Currencies

The table below depicts that the Global equity markets showed mixed performance, with U.S. indices slightly higher (DJIA +0.31%, Russell 2000 +0.61%) while major Asian and European indices fell, led by Nikkei 225 (-0.80%) and Euro Stoxx 50 (-0.29%).

Energy and soft commodities posted gains, with WTI (+1.93%), Brent (+2.07%), Cocoa (+5.87%), and Orange Juice (+10.17%) leading, while metals like Silver (-2.70%) and Copper (-1.22%) retreated. Currencies were broadly stable, with USD slightly up (+0.24%), JPY strengthening (+0.22%), and minor losses in GBP and AUD; overall, markets reflect cautious optimism amid commodity strength and selective equity gains.

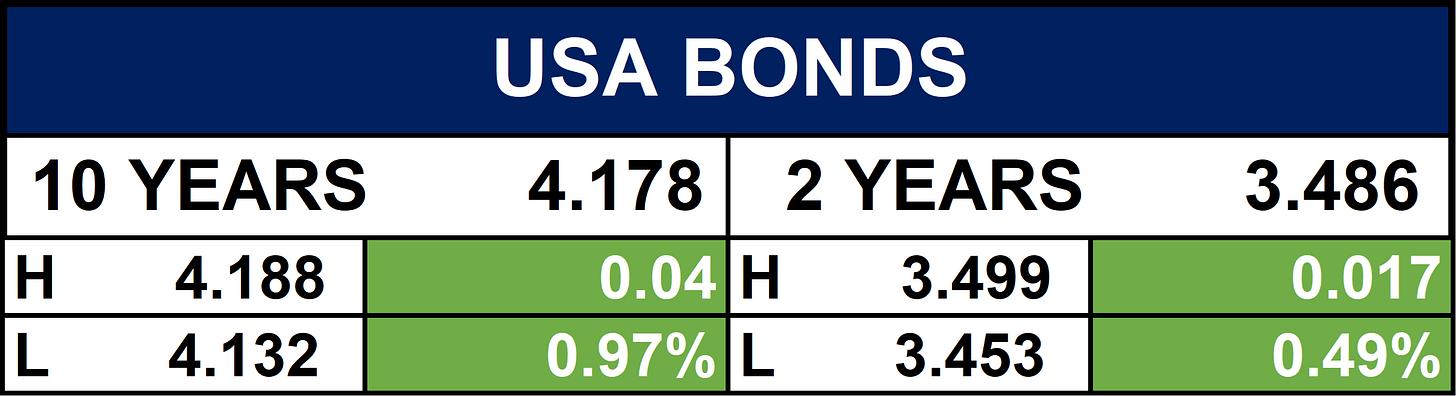

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, Nigerian markets may see momentum in banking and telecommunications, supported by recapitalisation milestones and tech-driven growth, while commodities and structured investments gain traction. Globally, supply chain shifts and energy agreements could influence local market sentiment and investment flows, signaling opportunities for strategic positioning in both domestic and international assets.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.