Think Thursday - Nigerian Markets Rebound on Banking, Insurance Gains; Presco, Seplat Drive Energy Growth as Trump Ends Longest US Government Shutdown

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market update, where we explore key developments shaping both Nigerian and global markets. On the domestic front, major corporate moves like Presco’s ₦236.67billion rights issue and Seplat’s production boost highlight renewed growth momentum, while the government’s suspension of the 15% fuel import duty offers short-term relief for consumers. Global headlines including U.S. policy updates, as Russia offsets refinery damage and Blackstone’s U.S. investment signals rising power demand from AI-driven industries.

Nigerian News & Market Update

Presco begins ₦236.67billion rights issue:

Presco Plc launches a ₦236.67 billion rights issue to fund asset acquisitions and industrial expansion following strong nine-month financial performance and record profit growth. - Punch

Seplat rehabilitates oil wells, boosts output by 33,000bpd:

Seplat Energy Plc has rehabilitated 33 oil wells, with 26 now producing 33,000 barrels per day, boosting Nigeria’s output while advancing gas projects like ANOH and Sapele to strengthen national energy security and sustainability. - Punch

FG Halts Implementation Of Planned 15% Import Duty On Diesel, Petrol:

The Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) has suspended plans to implement the 15% import duty on petrol and diesel, assuring the public of sufficient fuel supply and warning against panic buying. - Channels

Bode Pedro appointed to landmark Insurance Act 2025 implementation committee:

Casava CEO Bode Pedro has been appointed to the Nigerian Insurance Industry Reform Act 2025 (NIIRA Act 2025) Implementation Committee’s Digital Working Group, marking a major step toward a technology-driven transformation of Nigeria’s insurance industry. - Thenation

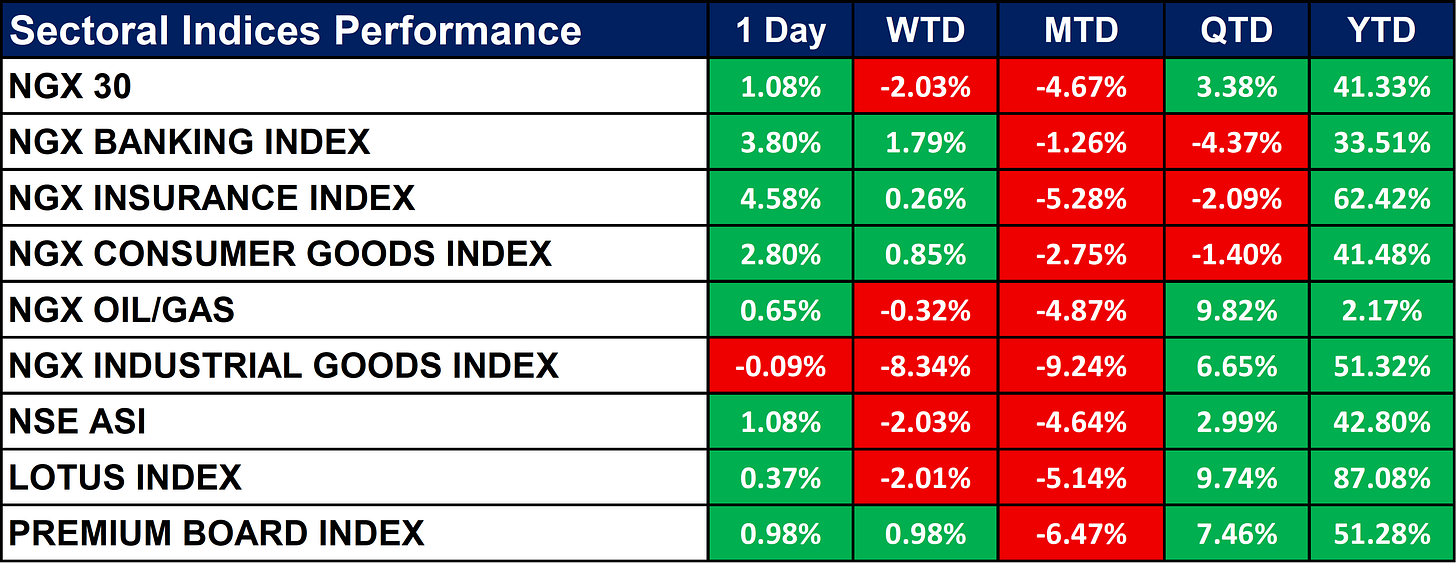

Nigeria Sectoral Indices Performance

The Nigerian market closed positive, with the NGX All-Share Index up 1.08% driven by strong gains in the Banking (+3.80%), Insurance (+4.58%), and Consumer Goods (+2.80%) sectors. Despite the daily rebound, most indices remain negative month-to-date, reflecting recent market corrections. Year-to-date performance remains robust, led by the Insurance (+62.42%), Lotus (+87.08%), and Industrial Goods (+51.32%) indices.

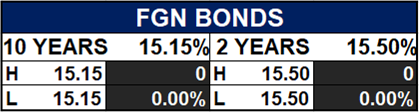

Fixed Income (FGN Bonds)

Global News & Market Update

Trump signs deal to end longest US government shutdown in history:

President Trump signed legislation ending the 43-day U.S. government shutdown, restoring federal operations and funding through January 30, 2026, amid ongoing partisan disputes over healthcare subsidies. - Reuters

Russia using spare oil refining capacity to offset Ukrainian drone damage:

Despite Ukraine’s intensified drone attacks on its refineries, Russia’s oil processing has only fallen about 3% in 2025, as refineries leveraged spare capacity to sustain fuel production. - Reuters

Vietnam to raise minimum wage by 7% in new year:

Vietnam will raise its minimum wage for contracted workers by over 7% from January 2026, increasing monthly pay to between 3.7 million and 5.31 million dong to reflect regional differences. - Reuters

EU to impose customs duties on small parcels in 2026 in hit to China’s Shein, Temu:

EU finance ministers will introduce customs duties on low-value parcels, mainly from China’s Shein and Temu, by early 2026, two years earlier than planned to curb import surges and protect local businesses. - Reuters

Blackstone to invest $1.2 billion in power generation facility in West Virginia:

Blackstone will invest $1.2 billion to build a 600 MW gas-fired power plant in West Virginia to meet rising electricity demand driven by AI and data centers. - Reuters

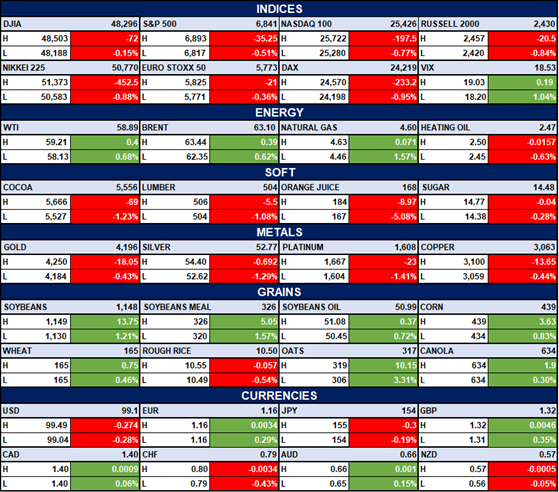

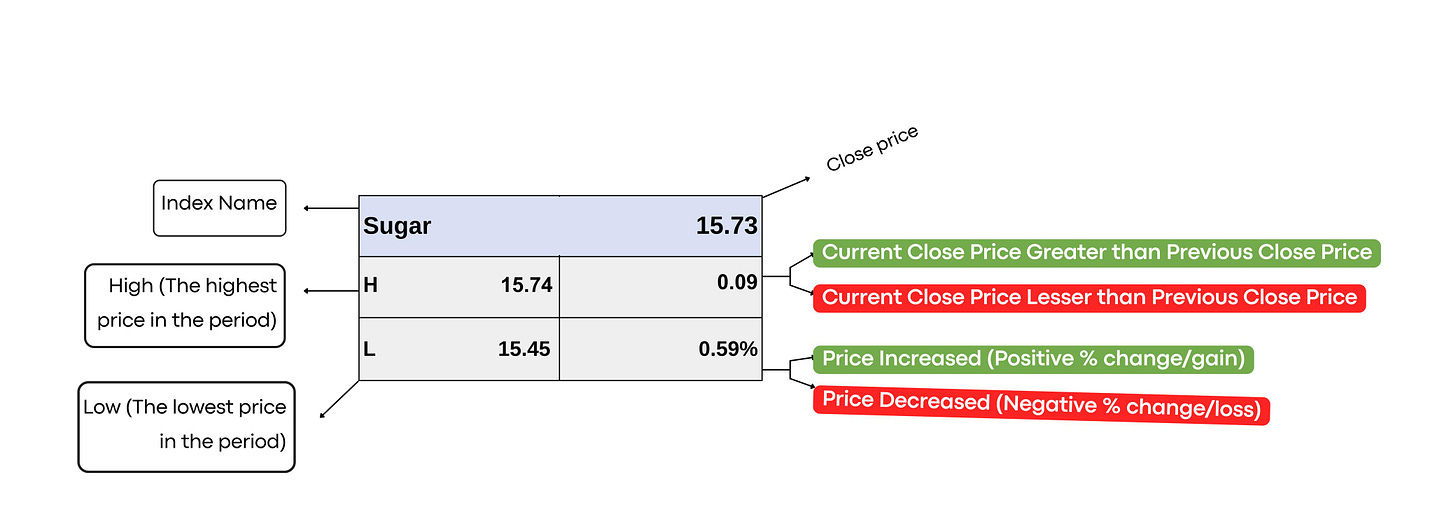

Indices, Commodities & Currencies

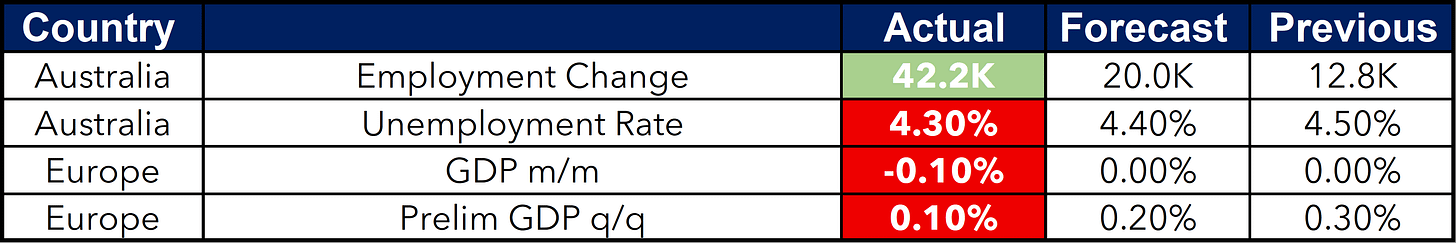

The table below depicts that the Global equity indices traded lower across major markets, with the Dow Jones, S&P 500, and Nasdaq all posting slight declines, while volatility (VIX) edged higher. Energy commodities gained as WTI and Brent crude rose around 0.6%, supported by stronger natural gas prices. Agricultural grains advanced broadly, led by soybeans and corn, while metals and soft commodities mostly weakened.

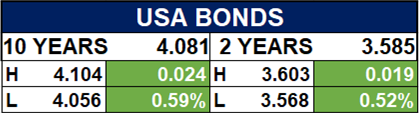

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, Nigerian equities may see continued sectoral gains in banking, insurance, and consumer goods, supported by strong corporate earnings and energy sector progress. Global economic and geopolitical developments, such as U.S. fiscal policies and commodity movements, could influence domestic market volatility and investment opportunities. Investors should monitor both local reforms and global market signals to strategically position their portfolios.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.