Think Thursday - Nigeria’s Capital Market Momentum Meets Shifting Global Policy Signals

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market briefing. This edition highlights strong capital market activity in Nigeria, improving liquidity conditions, evolving monetary policy signals, and major industrial and energy developments led by both the public and private sectors. Globally, policy moves around interest rates, energy transition, and critical minerals are shaping risk sentiment and cross-border investment flows.

Nigerian News & Market Update

RMB Nigeria leads Presco’s ₦236billion rights issue:

Rand Merchant Bank Nigeria led Presco Plc’s oversubscribed ₦236billion rights issue, the largest non-financial public capital raise of 2025, strengthening Presco’s growth plans in Nigeria’s oil palm industry. - Punch

Finance Minister Edun Signals Interest Rate Cuts If Disinflation Persists:

Nigeria’s Finance Minister Wale Edun signalled possible interest rate cuts if inflation continues to ease, aiming to lower borrowing costs and reduce the government’s heavy debt-servicing burden. - Channels

Banks Lodgements with CBN Keeps Liquidity Profile Strong:

Banks’ increased lodgements with the CBN pushed system liquidity above ₦2 trillion, keeping short-term interest rates relatively stable despite rising Treasury bill yields. - Dmarketforces

Paystack launches microfinance bank:

Paystack has launched Paystack Microfinance Bank, expanding beyond payments into deposit-taking and broader financial services for businesses and individuals in Nigeria. - Premiumtimes

NSA, NIMC, NCCC, 7 others to spend ₦16.7billion on software acquisition:

The Nigerian government plans to spend ₦16.7 billion on software and high-tech infrastructure across key agencies, prioritizing digital identity, cybersecurity, and efficient service delivery. - TheSun

NUPRC chief eyes increased oil revenue, 2m-barrel output:

NUPRC plans to boost Nigeria’s oil output to 2 million barrels per day by 2027 through faster approvals, recovery of shut-in assets, improved regulatory efficiency, and digital workflow implementation. - DailyTrust

Dangote Refinery Pushes 50million Litres Daily as Nigeria Enters Fuel Boom:

Dangote Refinery now produces over 50 million litres of high-quality fuel daily, ending Nigeria’s petrol shortages, stabilizing prices, and boosting exports and local industrial growth. - DailyTimes

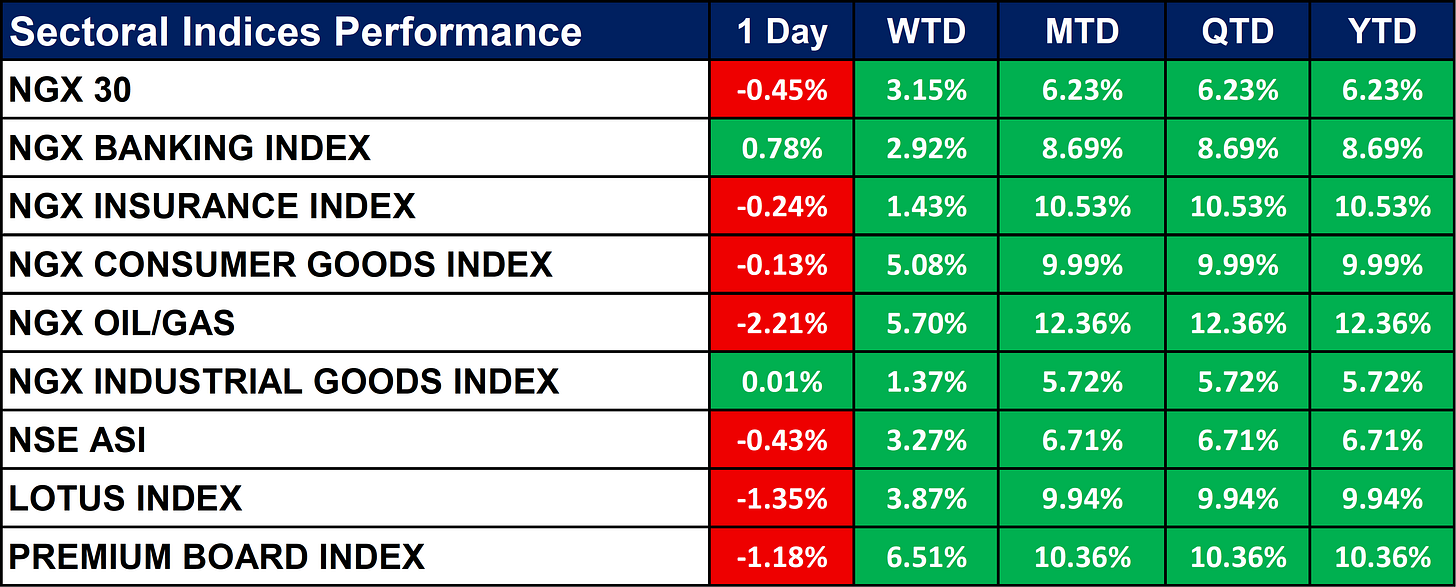

Nigeria Sectoral Indices Performance

The table below shows that the NGX sectoral indices closed mixed on the day, with Banking (+0.78%) and Industrial Goods (+0.01%) finishing higher, while Oil & Gas (-2.21%), Premium Board (-1.18%) and Lotus Index (-1.35%) led declines.

Despite the daily pullback, all sectors recorded solid gains across WTD, MTD, QTD, and YTD, reflecting sustained positive market breadth.

Oil & Gas remains the strongest performer over longer periods (+12.36% MTD/YTD), while Insurance, Consumer Goods, and Premium Board indices also posted double-digit gains year-to-date.

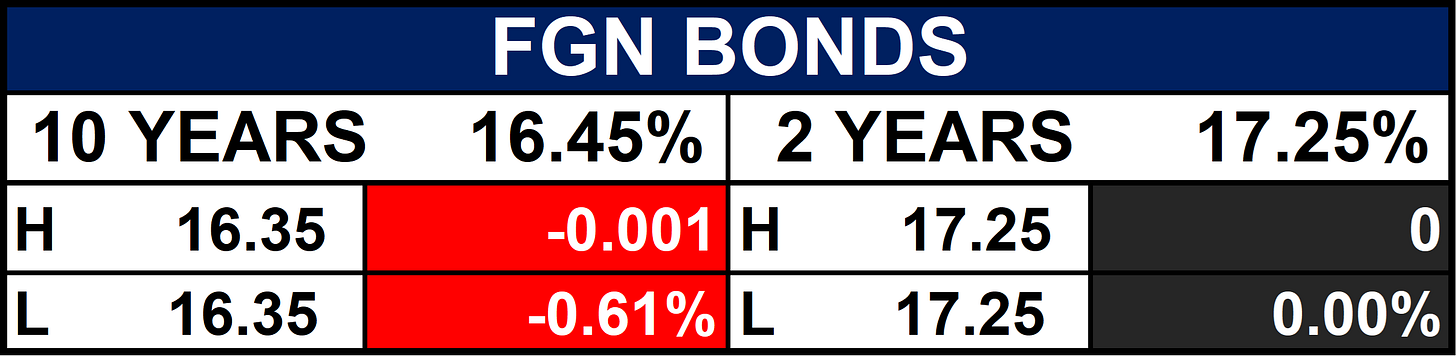

Fixed Income (FGN Bonds)

Global News & Market Update

US to finalize 2026 biofuel quotas by early March, drop import penalties:

The U.S. plans to finalize 2026 biofuel blending quotas by early March, maintaining higher targets while dropping import penalties to balance interests of producers and refiners. - Reuters

Ghana to scrap mining stability pacts, double royalties:

Ghana will end long-term mining stability agreements and double royalties to increase government revenue and boost local content in the gold sector. - Reuters

Critical Metals forms JV with Saudi conglomerate for rare earth processing:

Critical Metals forms a joint venture with a Saudi conglomerate to build a rare earth processing facility, supplying 25% of output to the U.S. defense sector. - Reuters

Coal India eyes rare earth pacts in Australia, Russia and Africa:

Coal India is exploring rare-earth mining partnerships in Australia, Russia, Africa, and other countries to reduce reliance on China and expand global supply. - Reuters

China central bank to cut sector-specific rates to boost economy:

China’s central bank cuts sector-specific rates and expands relending programs to support tech, agriculture, and SMEs, signaling potential broader rate and reserve requirement cuts. - Reuters

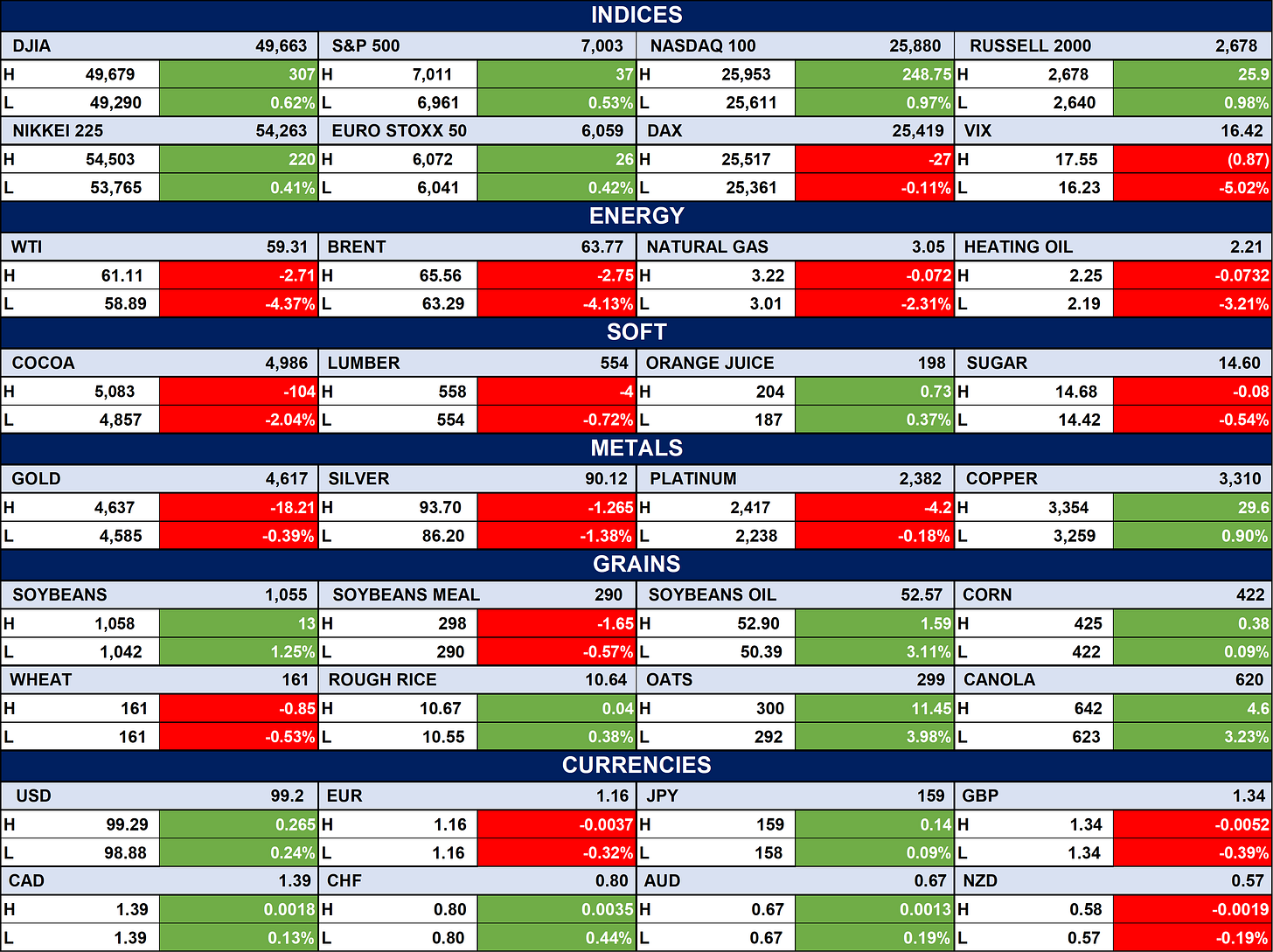

Indices, Commodities & Currencies

The table below depicts that the Global equities closed mostly higher, with the S&P 500, NASDAQ 100, Russell 2000, Nikkei 225, and Euro Stoxx 50 gaining, while the DAX edged slightly lower and volatility (VIX) declined.

Energy commodities weakened broadly as WTI, Brent, natural gas, and heating oil fell, while mixed moves were seen in metals, with copper higher but gold, silver, and platinum under pressure. Agricultural markets were mixed to positive across grains and softs, while currencies showed a firmer dollar against major peers, with modest gains versus the yen.

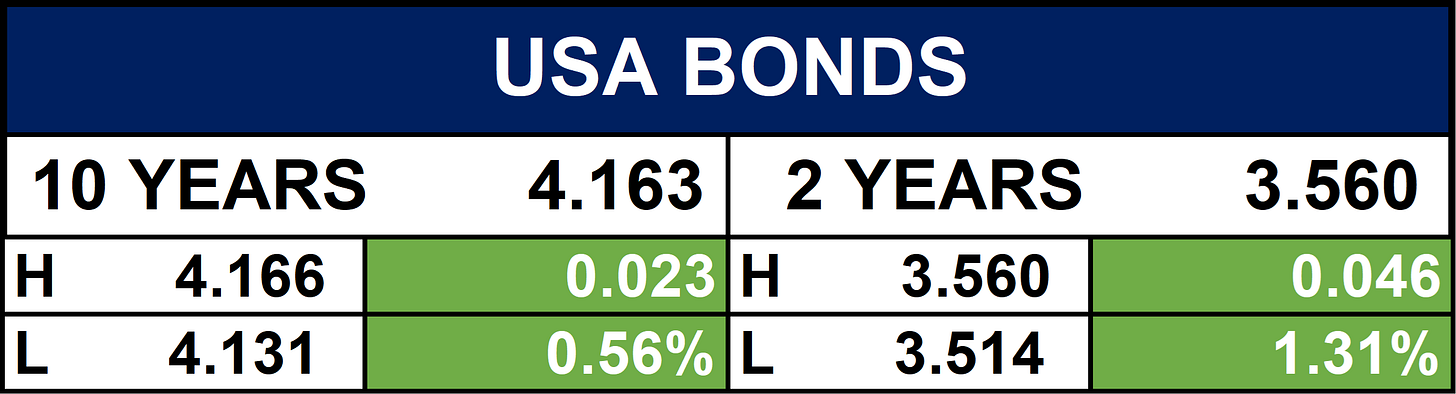

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, investors may watch closely for signs of easing monetary policy in Nigeria, sustained banking system liquidity, and further gains from domestic refining and digital finance expansion. On the global front, interest rate adjustments and strategic shifts in critical minerals and energy policy could influence commodity prices and capital allocation. Overall, near-term market direction is likely to be driven by policy clarity, inflation trends, and execution of large-scale industrial and infrastructure initiatives.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.