Think Thursday - Nigeria’s Disinflation Lifts Market Sentiment as Global Energy and Liquidity Risks Persist

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s Market kick off. Nigeria’s disinflation streak and ₦1trillion telecom investment boost investor optimism, while lower yields across bonds and T-bills signal expectations of a near-term CBN rate cut. Globally, policy tensions from Qatar’s LNG warning to Italy’s financial levy and tightening U.S. liquidity shape market sentiment.

Nigerian News & Market Update

NCC links tariff reforms to ₦1trillion telecom infrastructure investment

The Nigerian Communications Commission (NCC) said tariff reforms attracted ₦1 trillion in new telecom investments, leading to 2,700 new sites and better service quality.

It also updated service regulations and enhanced protection for critical telecom infrastructure. - PunchInflation drops to 18.02% in six-month streak

Nigeria’s inflation fell to 18.02% in September, its sixth monthly drop and first below 20% in three years. The decline was driven by CPI rebasing and stable FX, raising expectations of a CBN rate cut. - Punch

Bonds Yield Falls, Real Interest Rate Widens on Disinflation:

Nigerian bonds gained as yields fell to 15.98% on easing inflation (18.02%) and rate cut expectations. Investors locked in yields amid stable FX and improving outlook. - dmarketforces

Nigerian Treasury Bills Yield Falls to 17.39% on Disinflation:

Treasury bill yields fell to 17.37% on strong demand and disinflation (18.02%), while Open Market Operations (OMO) yields rose to 20.5% amid rate cut expectations. - dmarketforces

NUPRC expect additional 600,000bpd crude from fresh investment:

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) approved 28 projects adding 600,000 bpd oil and 2b scf gas daily, backed by $18.2billion CAPEX. Oil output rose to 1.8mbpd under PIA reforms, with a new Block Licensing Round upcoming. - Businessday

Food inflation drops to 16.87% in September on maize, grains decline:

Food inflation fell to 16.87% in September from 21.87% as staple prices dropped during harvests, easing overall inflation to 18.02%. - Businessday

Nigeria Sectoral Indices Performance

The table below shows that the NGX Industrial Goods Index led gains (+1.44%) while Insurance fell (-1.35%) on profit-taking. Overall, the All-Share Index rose 0.41%, supported by broad sectoral strength.

Year-to-date, Industrial (+51.9%) and Insurance (+77.9%) remain top performers despite mild daily fluctuations.Fixed Income (FGN Bonds)

Global News & Market Update

Qatar’s energy minister warns EU law could stop it supplying LNG to Europe:

Qatar warned it may stop LNG supplies to the EU over strict sustainability rules, citing high compliance risks. It currently provides 12–14% of Europe’s LNG. - Reuters

Spain’s Cox plans to invest $6.4 billion through 2028 with focus on Mexico:

Cox will invest €5.5billion in renewables and water by 2028, mainly in Mexico, after acquiring Iberdrola’s assets. The deal is mostly debt-funded, and the firm expects revenue and EBITDA to double by 2028. - Reuters

Italy seeks $12.8 billion from banks, insurers to fund 2026-2028 budget:

Italy plans to raise €11bn from banks and insurers to fund its budget.

The move includes tax cuts and higher defence spending.

Banks oppose the levy, recalling a failed 2023 windfall tax. - ReutersUS banks tap Fed repo facility as overnight rates climb, signaling funding strain:

U.S. banks borrowed $6.5 billion from the Fed’s repo facility the highest since COVID amid tighter liquidity and rising repo rates. Analysts link the strain to large Treasury settlements and shrinking market reserves. - Reuters

Oil steady, possible Indian halt of Russia imports lends support:

Oil prices steadied as Trump said India would halt Russian oil imports, though India emphasized energy stability over politics. Meanwhile, Ukrainian strikes disrupted Russian refineries and the UK imposed new sanctions on Rosneft and Lukoil. - Reuters

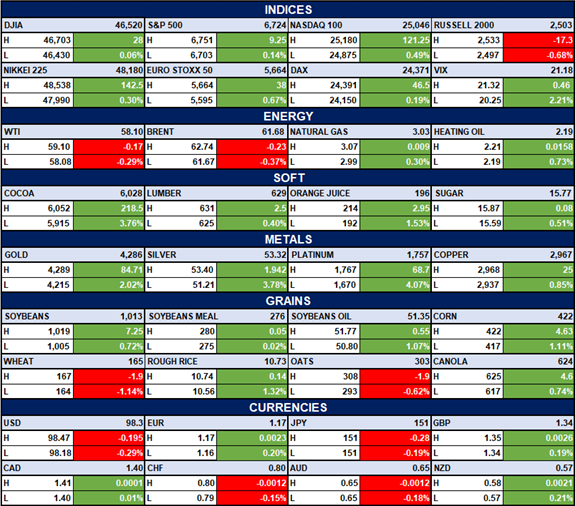

Indices, Commodities & Currencies

The table below depicts that the Global markets traded mixed. U.S. indices gained slightly (S&P 500 +0.14%, Nasdaq +0.49%), while Russell 2000 dipped (-0.68%).

In commodities, oil prices eased (WTI -0.29%, Brent -0.37%), while most metals and grains advanced. The U.S. dollar weakened against major peers, with gains in EUR and GBP.

Fixed Income (USA Bonds)

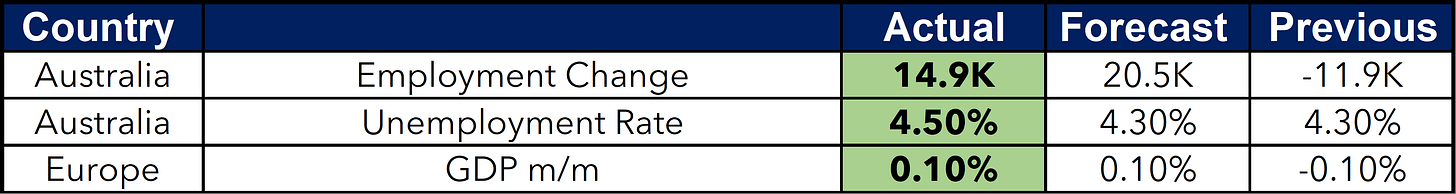

Events

Conclusion

Looking ahead, Investors could watch for continued buying interest in Nigerian fixed income as yields compress, alongside selective equity gains in industrial and banking sectors. Globally, energy market volatility and monetary shifts in the U.S. may drive short-term risk rebalancing, but easing inflation trends could support broader asset recovery ahead.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.