Think Thursday - Nigeria’s Financial Sector Strengthens Amid Liquidity Surge and Pension Growth as Global Markets React to U.S.–China Trade Deal and Inflation Pressures

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s Market kick off. Nigeria’s financial sector showed resilience as banks’ placements with the CBN rose to ₦4.1trillion, pension assets surpassed ₦25trillion, and Tinubu’s 15% fuel import duty aims to drive local refining despite inflation risks. Globally, markets reacted to major policy shifts as Trump and Xi agreed on tariff cuts, Turkey faced persistent inflation pressures, Ukraine moved to secure gas imports, and OpenAI prepared for a potential $1 trillion IPO.

Nigerian News & Market Update

Rates Ease, Nigerian Banks’ Placement with CBN Hits ₦4.1trillion:

Nigerian banks increased their placements with the CBN to ₦4.1 trillion amid strong liquidity and easing interbank rates around 24.5%. - dmarketforces

Pension Assets Exceeds ₦25trillion, Says PenCom DG:

PenCom announced that Nigeria’s pension assets have surpassed ₦25 trillion, reflecting stronger governance, wider coverage, and ongoing reforms to enhance retirees’ welfare. - dmarketforces

Tinubu approves 15% import duty on petrol, diesel:

President Tinubu approved a 15% import duty on petrol and diesel to boost local refining and energy security, though critics warn it may raise fuel prices. - Premiumtimes

KEDCO to install 128,000 meters with $500milion World Bank loan:

The Kano Electricity Distribution Company (KEDCO) will install 128,000 free prepaid meters across Kano, Katsina, and Jigawa using a $500 million World Bank loan to improve efficiency and end estimated billing. - Dailytrust

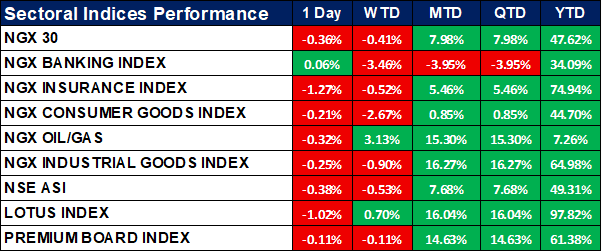

Nigeria Sectoral Indices Performance

The table below shows that the Most sectoral indices declined on a 1-day and week-to-date (WTD) basis, with NGX Insurance (-1.27%) and Lotus Index (-1.02%) showing notable drops. The NGX Oil/Gas index stands out with a positive WTD gain of 3.13%, reflecting some sector strength despite a slight 1-day dip. Year-to-date (YTD) performance is strong across all indices, led by the Lotus Index (97.82%) and NGX Insurance Index (74.94%), indicating solid longer-term growth.

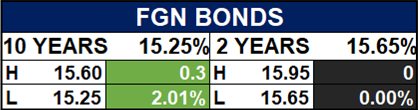

Fixed Income (FGN Bonds)

Global News & Market Update

Fed delivers expected rate cut; Powell says December rate cut not assured:

The U.S. Federal Reserve cut interest rates by 0.25% amid concerns over a weakening labor market and liquidity, signaling uncertainty about further cuts while stopping quantitative tightening. - Reuters

Trump shaves China tariffs in deal with Xi on fentanyl, rare earths:

Trump and Xi agreed to cut U.S. tariffs on China to 47% in exchange for Beijing curbing fentanyl exports, resuming U.S. soybean purchases, and pausing rare earth export curbs for a year. - Reuters

Turkey’s monthly inflation seen at 2.83% in October, year-end seen 32%:

Turkey’s October inflation is forecast at 2.83% monthly and 33% annually, with economists expecting year-end inflation to rise to 32%, above the central bank’s 24% target. - Reuters

Ukraine will resume gas imports via Transbalkan route in November, ExPro says:

Ukraine will resume gas imports from Greece via the Transbalkan pipeline in November to offset losses from Russian attacks that cut its gas production by over half. - Reuters

OpenAI lays groundwork for juggernaut IPO at up to $1 trillion valuation:

OpenAI is preparing for a potential IPO as early as 2026 that could value the company at up to $1 trillion, aiming to raise funds for massive AI infrastructure expansion. - Reuters

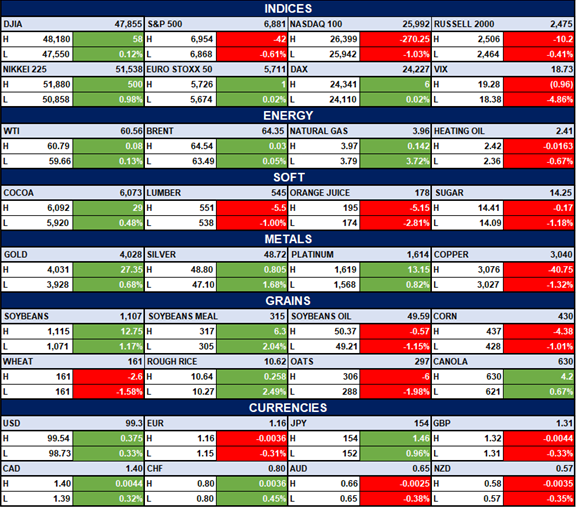

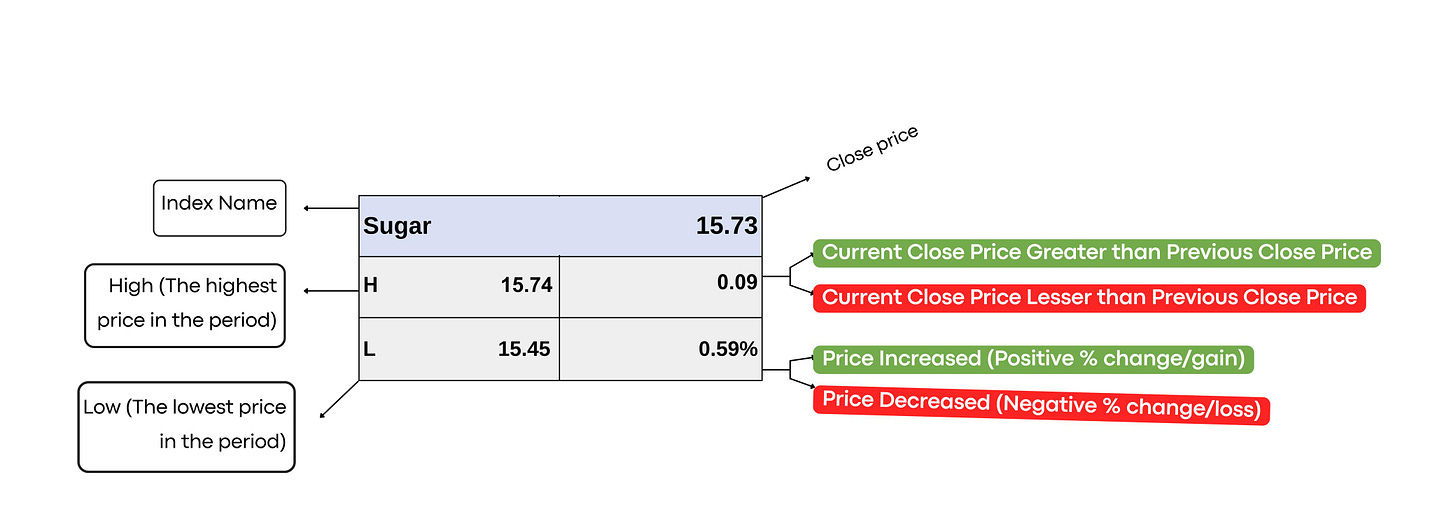

Indices, Commodities & Currencies

The table below depicts that the Major indices showed mixed performance: DJIA and Nikkei 225 rose, while S&P 500 and NASDAQ 100 declined sharply. Energy prices were mostly steady with slight gains in WTI, Brent, and natural gas, but heating oil dipped. Commodities saw gains in gold, silver, and some grains like soybeans, while copper, lumber, and orange juice fell; USD strengthened versus most currencies except JPY.

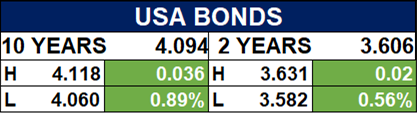

Fixed Income (USA Bonds)

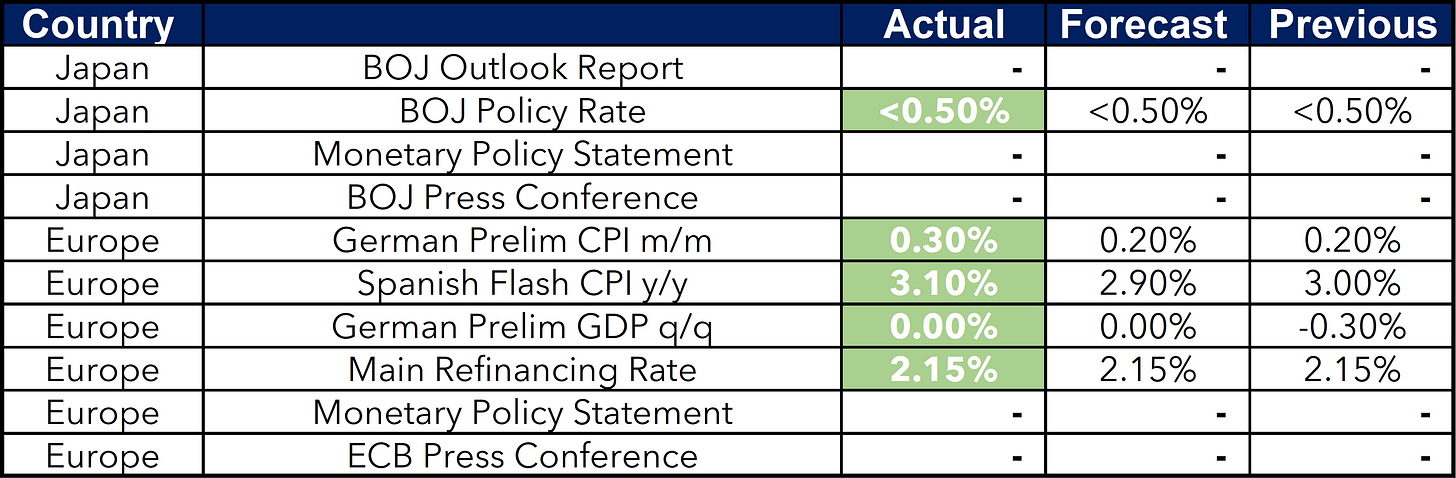

Events

Conclusion

Investors could watch local liquidity trends and global policy developments, as Nigeria’s reforms and global trade adjustments could set the tone for near-term market sentiment and investment opportunities.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.