Think Thursday - Nigeria’s Fuel Market Realigns Amid Policy Shifts as Global Central Banks Signal Cautious Monetary Outlook

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market kick-off. Today,, we spotlight key developments shaping Nigeria’s financial landscape from shifting fuel dynamics and Eurobond investor confidence to treasury bill rate adjustments and pension reforms. We also bring you notable global monetary and trade updates, alongside sector and asset performance insights to guide your investment decisions.

Nigerian News & Market Update

Oando suspends petrol imports as Dangote raises output:

Oando has halted petrol imports as Dangote Refinery reshapes Nigeria’s fuel market, cutting its trading revenue by 20% and shifting its focus to crude, gas, and metals trading for growth. - Punch

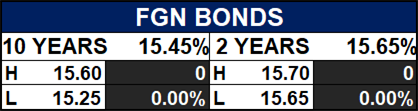

CBN Cuts Interest Rate on Nigerian Treasury Bills by 10bps:

CBN’s latest T-bill auction saw strong demand, prompting a 10bps rate cut on the 1-year paper to 16.04% while other tenors held steady. - dmarketforces

Tinubu approves ₦758billion bond to clear pension liabilities:

President Tinubu has approved a ₦758billion FGN bond to clear long-outstanding pension arrears, as the National Pension Commission (PenCom) moves to improve retirees’ welfare and fast-track pension payments. - Thesun

Nigeria’s $2.25billion Eurobond Oversubscribed Despite Trump’s Threat – Debt Management Office:

Nigeria’s $2.25bn Eurobond was oversubscribed by over 400%, reflecting strong investor confidence in its reform agenda despite geopolitical tensions. - Leadership

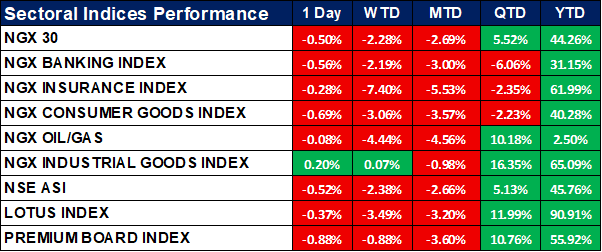

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian equities market closed lower as major indices declined, with the NSE ASI down 0.52% on the day and most sectors posting losses. The Industrial Goods Index was the only gainer, rising 0.20% due to resilience in key stocks. Despite the short-term pullback, Year-to-Date performance remains strongly positive across all indices, led by the Lotus Index (+90.91%) and Industrial Goods (+65.09%).

Fixed Income (FGN Bonds)

NTB Auction Result

Global News & Market Update

Chinese firm signs $5.2 billion of agricultural deals with traders including Cargill, LDC:

China’s Xiamen C&D signed over $5.2billion in supply deals with global agribusiness giants including Cargill and Louis Dreyfus to secure key commodities like soybeans, corn and cotton. - Reuters

Malawi activates grain export restrictions as 4 million people face hunger:

Malawi has tightened maize export restrictions to protect dwindling stocks as a poor harvest leaves about 4 million people facing hunger. - Reuters

Czech central bank sees upside price risks but no pledge on next rate move:

The Czech National Bank held its key rate at 3.50% for a fourth meeting, signaling tighter bias amid rising inflation risks and keeping future rate moves open. - Reuters

US trade negotiator eyes trade deal with Switzerland, says talks underway with Mexico:

The U.S. is in talks with Switzerland and other Western Hemisphere partners on potential trade deals, as Swiss firms seek relief from high U.S. tariffs and explore U.S. investment opportunities. - Reuters

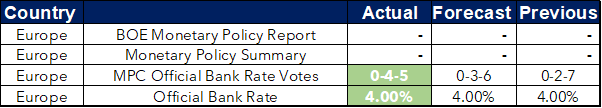

Bank of England holds rates in knife-edge vote that hints at December cut:

The Bank of England held rates at 4.0% in a tight 5–4 vote, boosting expectations of a possible rate cut in December amid easing inflation pressures. - Reuters

Brazil central bank holds rates, signals confidence in maintaining stance:

Brazil’s central bank held the Selic rate at 15% for a third meeting, signalling rates will stay high for a long period to steer inflation back to target. - Reuters

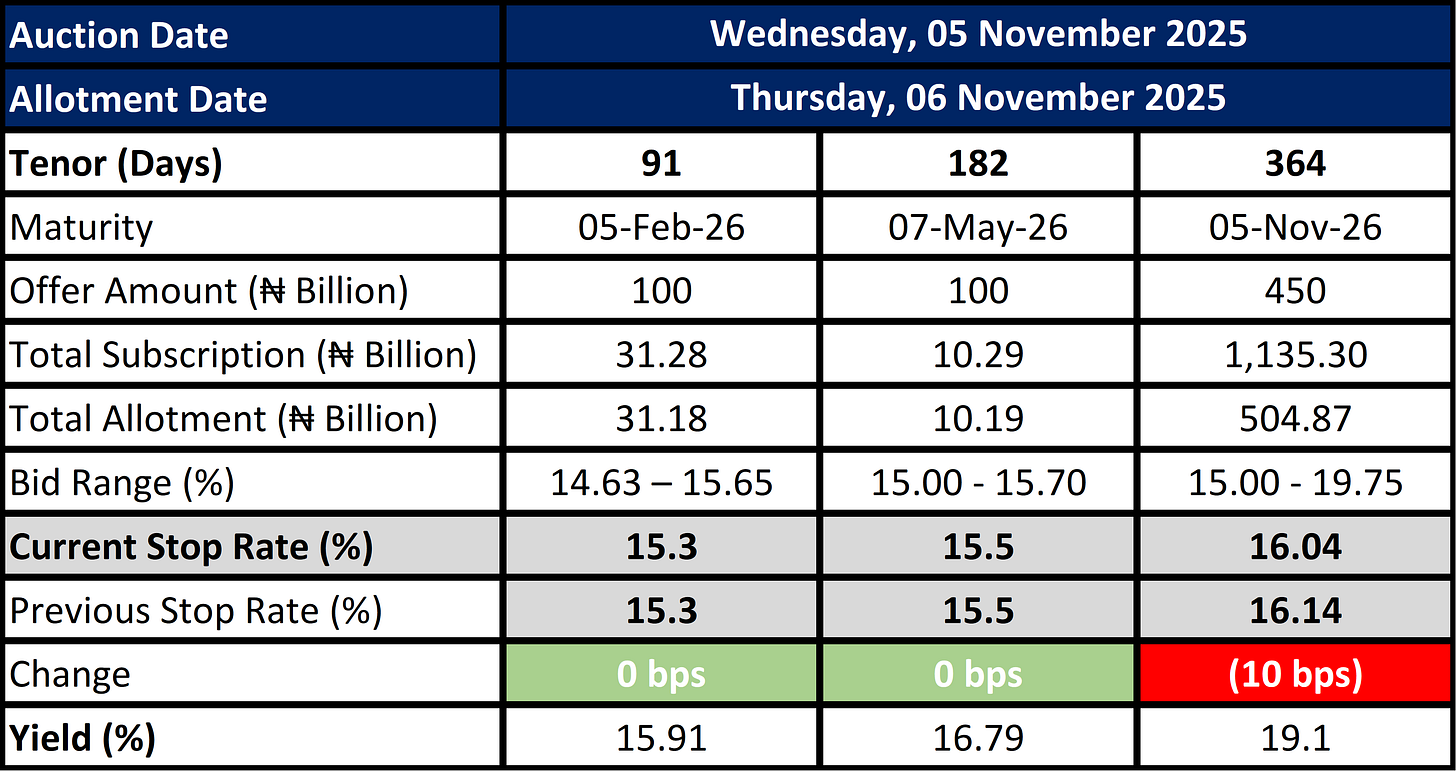

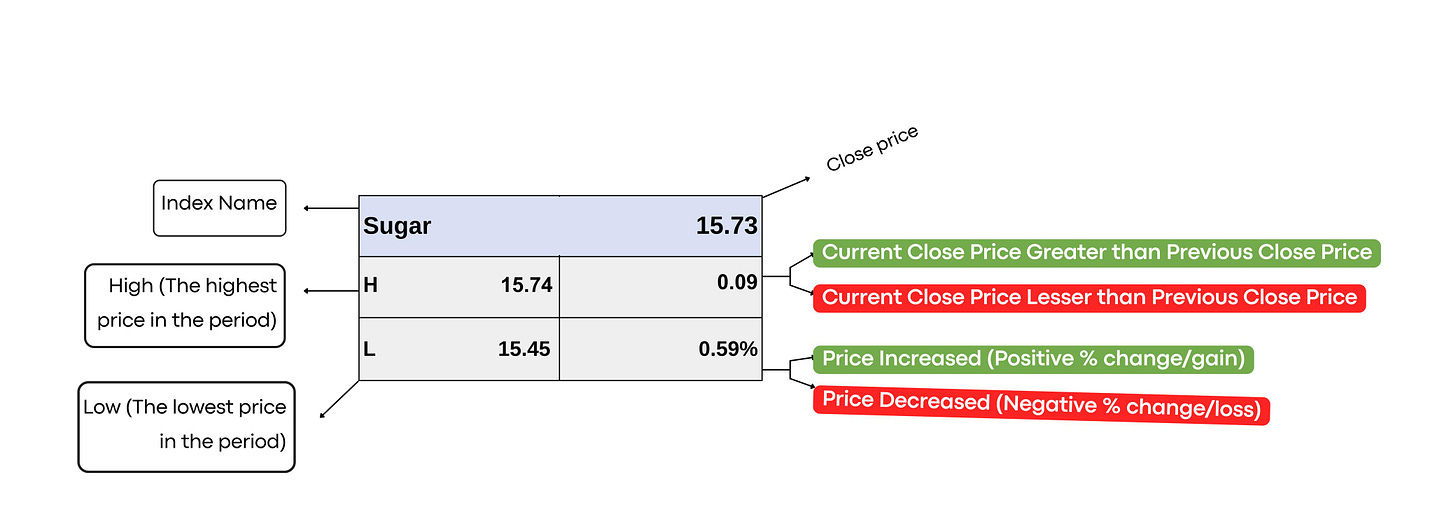

Indices, Commodities & Currencies

The table below depicts that the Global markets traded mostly lower as major U.S. and European equity indices declined, while the VIX spiked over 6%, signalling increased risk-off sentiment. Energy was mixed with slight losses in oil but gains in natural gas, while soft commodities showed volatility, particularly cocoa and orange juice. The U.S. dollar weakened slightly against peers, with mild gains seen in the euro, pound, and Canadian dollar.

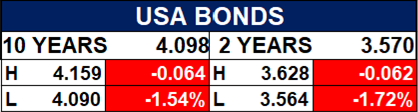

Fixed Income (USA Bonds)

Events

Conclusion

As the market navigates policy shifts, global rate decisions, and commodity volatility, investors should stay selective, favoring fundamentally strong counters and defensive sectors amid short-term pullbacks. Nigeria’s Eurobond oversubscription and pension reforms may support medium-term market sentiment, while global central bank signals point to potential rate cuts that could spur risk-asset flows. Cautious accumulation and close tracking of upcoming economic data remain key in positioning for opportunities ahead.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.