Think Thursday - Nigeria’s Market Momentum Builds on Corporate Expansion and Policy Shifts; Global Investors Weigh Mixed Commodity and Bond Signals

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s Market kick off. Nigeria’s markets remain upbeat amid policy reforms and strong corporate moves. UAC expanded into the seasoning market and gained approval to acquire CHI Limited, deepening its consumer goods presence. In energy, Nigeria cut oil block signature bonuses to $10million and launched the $400million GEIL oil terminal to attract foreign investment. Investor confidence is steady, with Eurobond yields near 8% and the NGX up 42.05% YTD, led by Insurance (+77.43%) and Consumer Goods. Globally, markets were mixed, but reforms in Colombia, Indonesia, and India could boost sentiment toward frontier markets like Nigeria.

Nigerian News & Market Update

UAC expands product portfolio with Zuri Seasoning:

UAC Foods launched Zuri Seasoning, its first entry into Nigeria’s seasoning market, made with natural ingredients to enhance taste and fun in cooking. The company says it marks a key step in its innovation and consumer-focused growth. - Punch

Nigeria Cuts Signature Bonus on Oil to $10million, Targets 2.5 mbpd:

Nigeria slashed oil block signature bonuses to $10 million to attract investors and reach 2.5 million bpd by 2027. The NUPRC says this has boosted investor confidence, cut oil theft, and advanced gas and energy transition goals. - dmarketforces

Nigeria’s Eurobond Yields Stay Firm as Regional Borrowing Costs Climb:

Nigeria’s Eurobond yields stayed at 8.02% as investors remained cautious despite economic gains. Moody’s says Sub-Saharan Africa (SSA) nations face high borrowing costs, with Nigeria still attracting investors for its high-yield bonds. - dmarketforces

Federal Government inaugurates $400million terminal in Rivers:

President Tinubu inaugurated the $400million Green Energy International Limited (GEIL) oil export terminal in Rivers State, Nigeria’s first indigenous terminal in 50 years. The project will boost crude exports, support the $5billion African Energy Bank, and unlock over 40 stranded oil fields. - Thenation

UAC’s bid to take over CHI Limited gains regulatory approval:

UAC of Nigeria got the Federal Competition and Consumer Protection Commission (FCCPC) approval to acquire CHI Limited from Coca-Cola, adding Chivita and Hollandia to its portfolio. The deal expands UAC’s food and beverage division and supports its growth strategy. - Premiumtimes

Ellah Lakes enters pact to acquire Tolaram’s agro-processing business:

Ellah Lakes will acquire Agro-Allied Resources & Processing Nigeria Ltd from Tolaram and Valuestar, gaining over 11,000 hectares of farmland. The deal will double its production capacity and strengthen its agro-industrial expansion. - Premiumtimes

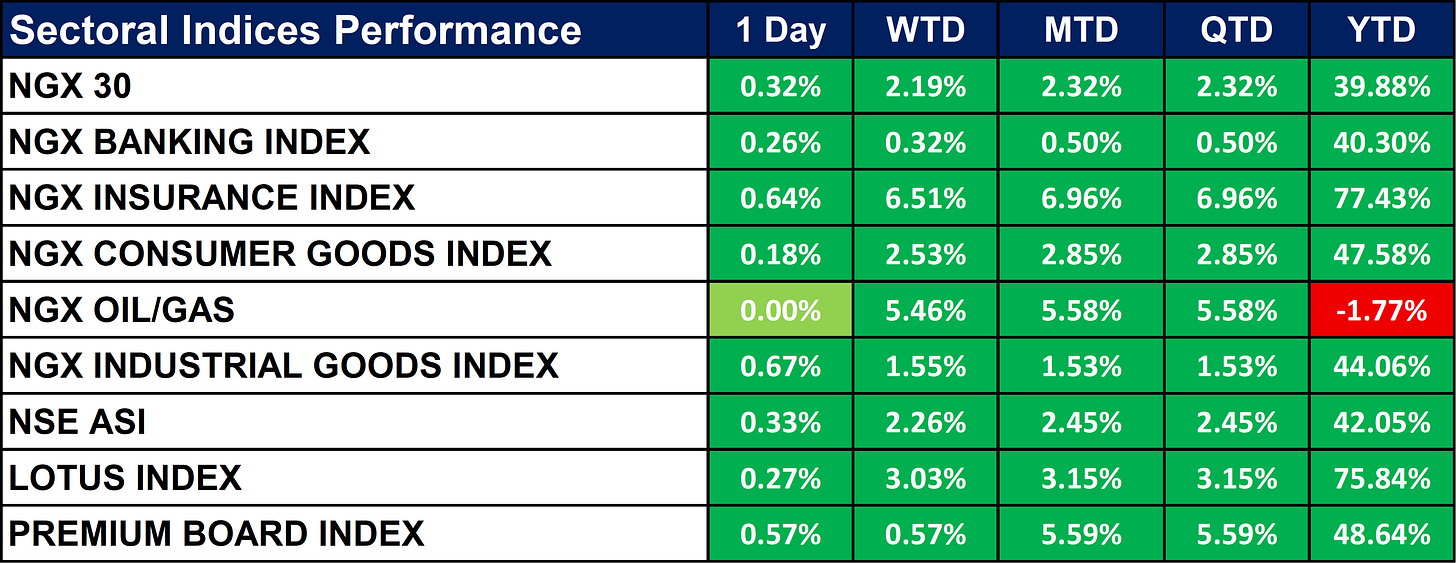

Nigeria Sectoral Indices Performance

The table below shows that the NGX sectoral indices mostly closed positive across all time frames. The Insurance Index led gains YTD (+77.43%), while the Oil/Gas Index remained the only laggard (-1.77% YTD). Overall market performance (NSE ASI) was strong, up 42.05% year-to-date.

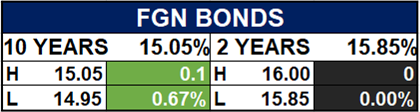

Fixed Income (FGN Bonds)

Global News & Market Update

Copper output from Chile’s Codelco slides 25% in August after deadly mine accident:

Chile’s Codelco copper output fell 25% in August after a fatal collapse at its El Teniente mine. BHP’s Escondida output was stable, while Collahuasi’s fell 27% on lower ore grades. - Reuters

Colombia carries out largest domestic debt swap in history for $11.2 billion:

Colombia completed its largest-ever domestic debt swap worth 43.4 trillion pesos ($11.2 billion), exchanging bonds maturing in 2025–2050 for those due 2029–2058. The move will save 1.7 trillion pesos ($438 million) in interest this year as part of its debt management strategy. - Reuters

Brazil inflation rebounds in September despite falling food prices:

Brazil’s inflation rose 0.48% in September, lifting annual inflation to 5.17% despite falling food prices. Economists expect disinflation to continue, with interest rates held at 15%. - Reuters

India’s Bharti Telecom to open $1.7 billion mega bond issue next week, bankers say:

Bharti Telecom will raise ₹150 billion ($1.7 billion) in India’s biggest bond sale this year at 7.35–7.45% rates, its cheapest in four years, aided by lower interest rates and a Credit Rating Information Services of India Limited (CRISIL) AAA rating. Funds will support debt refinancing and capex. - Reuters

Indonesia finance minister expects growth of 6% after $12 billion liquidity injection:

Indonesia projects growth to hit 6% next year after a ₨200 trillion ($12B) liquidity boost, over half already loaned out. The move aims to lift Q4 growth above 5.5% under new finance minister Purbaya Yudhi Sadewa. - Reuters

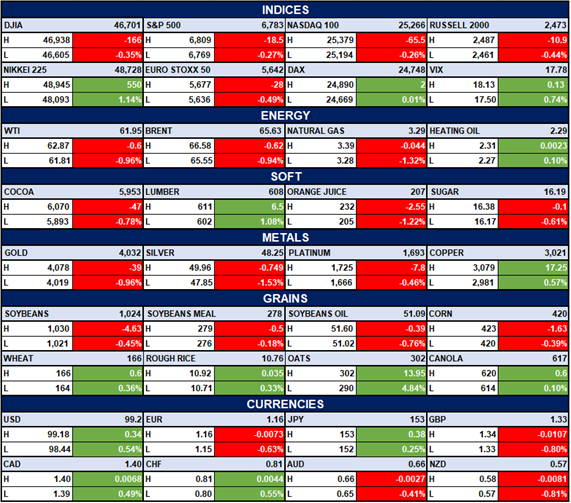

Indices, Commodities & Currencies

The table below depicts that the Global markets were mixed. Dow Jones, S&P 500 and Nasdaq slipped slightly. In commodities, most oil prices declined, gold and platinum declined. Among currencies, the USD strengthened, while the EUR and GBP weakened against major peers.

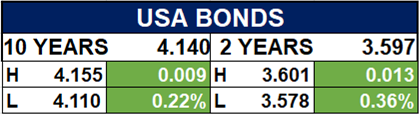

Fixed Income (USA Bonds)

Conclusion

Looking ahead, investor sentiment in Nigeria remains cautiously optimistic. Ongoing CBN tightening and infrastructure projects point to stability that could sustain earnings into Q4. Rising M&A and new product launches highlight growing strength in consumer and industrial sectors. Globally, commodity trends and U.S. monetary policy will guide capital flows to emerging markets. If oil stays stable and fiscal discipline holds, Nigeria’s equities could extend gains, led by dividend-paying blue chips and strong non-oil firms. Overall, the market is shifting from stabilization to recovery, favoring selective investments in quality stocks and fixed income for solid year-end returns.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.