Think Thursday - Nigeria’s Market Momentum Supported by Rights Issue and Policy Guidance; Global Oil and Geopolitical Factors Shape Outlook

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market briefing. Nigerian equities showed broad short-term strength, supported by corporate expansions like Eterna’s ₦21.5billion rights issue, easing funding costs, and fiscal guidance from the FEC for 2026–2028. Globally, mixed performance in indices and commodities, coupled with OPEC output declines and geopolitical developments, set a cautious but opportunity-driven market tone.

Nigerian News & Market Update

Eterna launches ₦21.5billion Rights Issue:

Eterna Plc has launched a ₦21.5billion rights issue to strengthen its balance sheet and fund strategic expansions across retail, LPG, lubricants, aviation fuelling, and ESG projects. - Punch

Funding Costs Ease as Banking System Liquidity Increases:

Improved banking system liquidity from the Open Market Operations (OMO) and T-bill maturities eased funding costs, pushing interbank rates and Treasury bill yields slightly lower. -Dmarketforces

Federal Executive Council Approves ₦1,512/$ Rate For 2026–2028 Medium Term Expenditure Framework:

The FEC approved the 2026–2028 MTEF with conservative oil benchmarks, key macro targets, and a projected ₦20.1trillion deficit, setting the fiscal foundation for the 2026 budget and new financing initiatives. - Leadership

Tinubu, others honour Keyamo for hosting Nigeria’s first airshow:

President Tinubu and top officials honoured Aviation Minister Festus Keyamo for successfully hosting Nigeria’s first-ever international airshow, marking a major step toward positioning the country as a competitive global aviation hub. - TheSun

AMCON repays ₦3.6trillion to CBN, projects ₦215billion in recovery for 2025:

AMCON recovered ₦156billion in 2024, targets ₦215billion for 2025, and says it has repaid ₦3.6trillion to the CBN while intensifying global asset-tracing and legal efforts to recover outstanding debts. - DailyTrust

Nigeria Sectoral Indices Performance

The table below shows that Most NGX sector indices posted gains across 1-Day, WTD, and MTD periods, showing broad short-term market strength. Insurance, Industrial Goods, and the Premium Board show particularly strong YTD performance, led by the Lotus Index at 86.10%. Oil/Gas and Insurance are the only sectors with notable QTD declines, despite strong overall yearly returns.

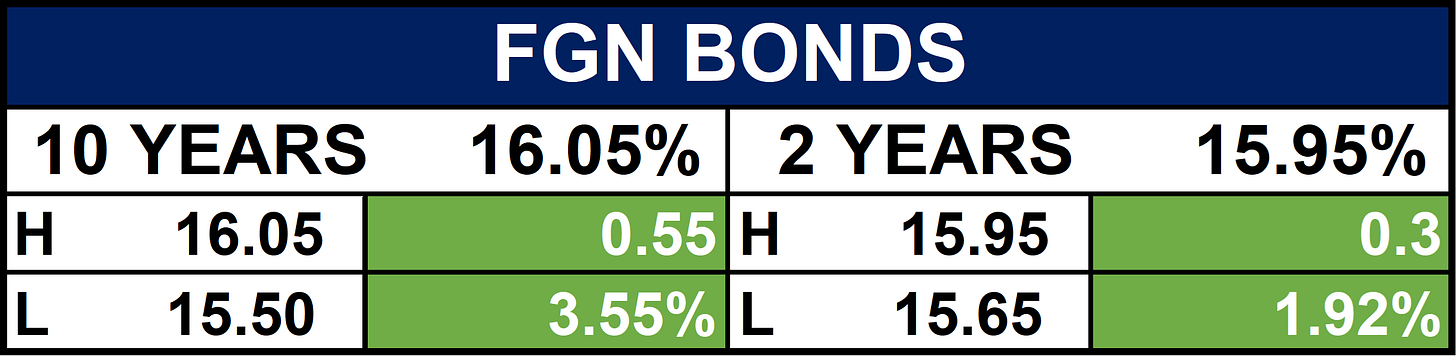

Fixed Income (FGN Bonds)

Global News & Market Update

UK sets out new sanctions against Russia after Novichok report:

The UK has sanctioned Russia’s entire GRU intelligence agency and summoned Moscow’s ambassador after an inquiry found Putin ordered the 2018 Novichok attack that killed Dawn Sturgess. - Reuters

Turkey extends Russian gas imports for a year as it plans US investment:

Turkey has extended its Russian gas contracts by one year while expanding U.S. LNG investments and pursuing Iranian, Turkmen, and nuclear energy deals to reduce long-term reliance on Moscow. - Reuters

Hungary’s minimum wage to rise 11% in 2026 despite weak economy:

Hungary will raise its minimum wage by 11% in 2026 despite economic stagnation, as Prime Minister Orban boosts incomes ahead of elections. - Reuters

OPEC oil output slips in November despite agreed hike:

OPEC’s November oil output fell slightly despite planned increases, as outages in Iraq and Nigeria pushed production further below target. - Reuters

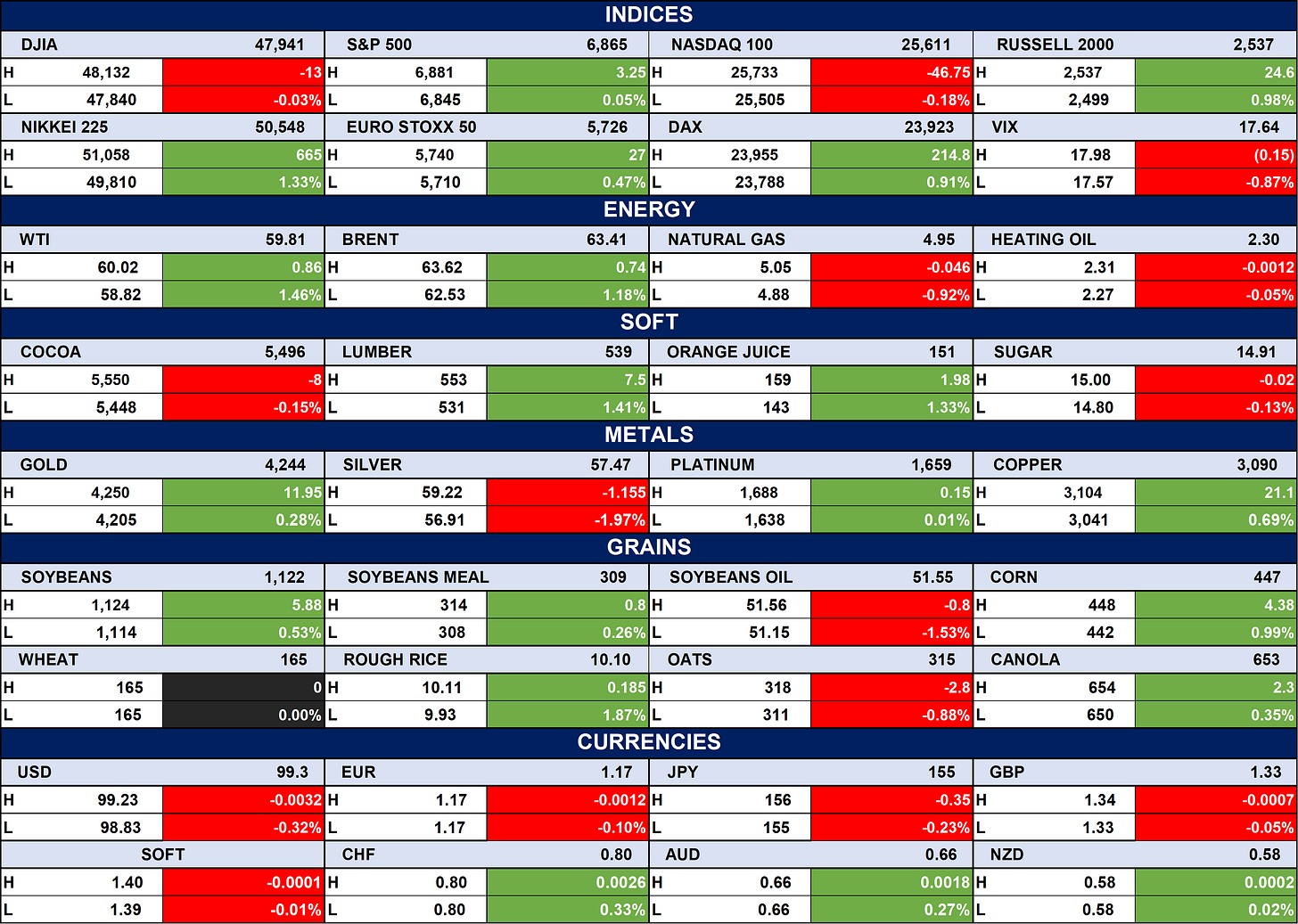

Indices, Commodities & Currencies

The table below depicts that the Global indices traded mixed, with gains in Euro Stoxx 50, Nikkei while the S&P 500 was flat and Nasdaq saw slight declines.

Energy and metals were mostly positive, led by strong gains in WTI, Brent, gold, and platinum, while silver and natural gas dipped.

Most grains and soft commodities rose, and major currencies were broadly stable with only marginal movements.

Fixed Income (USA Bonds)

Events

Conclusion

Investors could watch for continued liquidity-driven movements in Nigeria’s fixed income and equity markets, while global oil supply constraints and geopolitical risks may influence commodity prices and capital flows in the near term. Strategic positioning in resilient sectors like insurance, industrial goods, and energy could offer defensive gains amid market uncertainties.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.