Think Thursday - Nigeria’s Strategic Energy Moves and Corporate Growth Amid Global Trade Tensions and Market Caution

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s Market kick off. In Nigeria, key corporate moves include Otedola upping his stake in First HoldCo, Seplat’s $3bn growth plan, and NNPCL securing new oil funding. Sector performance is mixed short-term but strong year-to-date. Globally, markets are cautious amid U.S.–EU trade tensions, Russia’s strikes on Ukraine, and China’s trade probes. Equities dipped, metals gained, and the U.S. dollar strengthened.

Nigerian News & Market Update

Femi Otedola Increases Stakes In First HoldCo, Acquires ₦1.21billion Direct Shares:

Olufemi Otedola increased his stake in First HoldCo Plc by purchasing 39.3 million shares worth ₦1.21 billion. Calvados Global Services, linked to him, also acquired 25.6 million shares at the same price. His direct and indirect holdings now stand at 7.77% and 8.34%, respectively. - Channels

Smart Energies expands renewable power solutions:

Smart Energies expands into renewable energy with electric motorcycles, solar stations, and a mobile app, offering affordable, flexible solutions and seeking partnerships to scale nationwide. - Punch

NNPCL secures ₦318billion to fund new oil exploration:

The Nigerian National Petroleum Company Limited (NNPCL) received ₦318billion for frontier oil exploration in eight months, sparking calls for transparency and reduction of the 30% Production Sharing Contract (PSC) deduction. Experts suggest more private sector involvement, while unions warn changes could harm NNPCL and the industry. - Punch

GCR Upgrades Sterling Bank’s Ratings with Stable Outlook:

GCR Ratings upgraded Sterling Bank’s ratings on stronger capitalisation, equity injection, and solid funding structure. Despite higher Non-Performing Loans (NPLs) at 5.4%, liquidity and depositor concentration remain healthy. Outlook is stable, with capital ratios expected to stay within 14–16% over the next 12–18 months. - dmarketforces

Marconi.NG EPC Appoints Unuigbe As Chairman:

Marconi.NG EPC Limited appointed Ahonsi Unuigbe, CEO of Petralon Energy and NGX chairman, as its new board chairman. He brings extensive oil & gas, capital markets, and governance experience to drive the company’s next growth phase. Marconi operates West Africa’s largest fabrication yard, serving oil, gas, and renewable energy projects across the continent. - Leadership

Seplat Energy’s 5-year Oil & Gas Development Plan To Gulp $3billion:

Seplat Energy announced a $3billion five-year investment plan to drill 120 wells and launch three gas projects. It projects $6billion cash flow by 2030, based on $65 oil and 200,000 bpd output. The company may also sell 10% of its NNPCL Joint Venture (JV) stake, reducing its holding to 30%. - Leadership

DICON, Oida sign deal to produce oilfield explosives:

DICON and Oida Energy signed a Memorandum of Understanding (MOU) to set up Nigeria’s first oilfield shaped charge manufacturing facility. The project aims to boost local content, create jobs, and reduce dependence on imported explosives. It highlights collaboration between Nigeria’s defence, regulators, and private sector in strategic energy and security technologies. - Punch

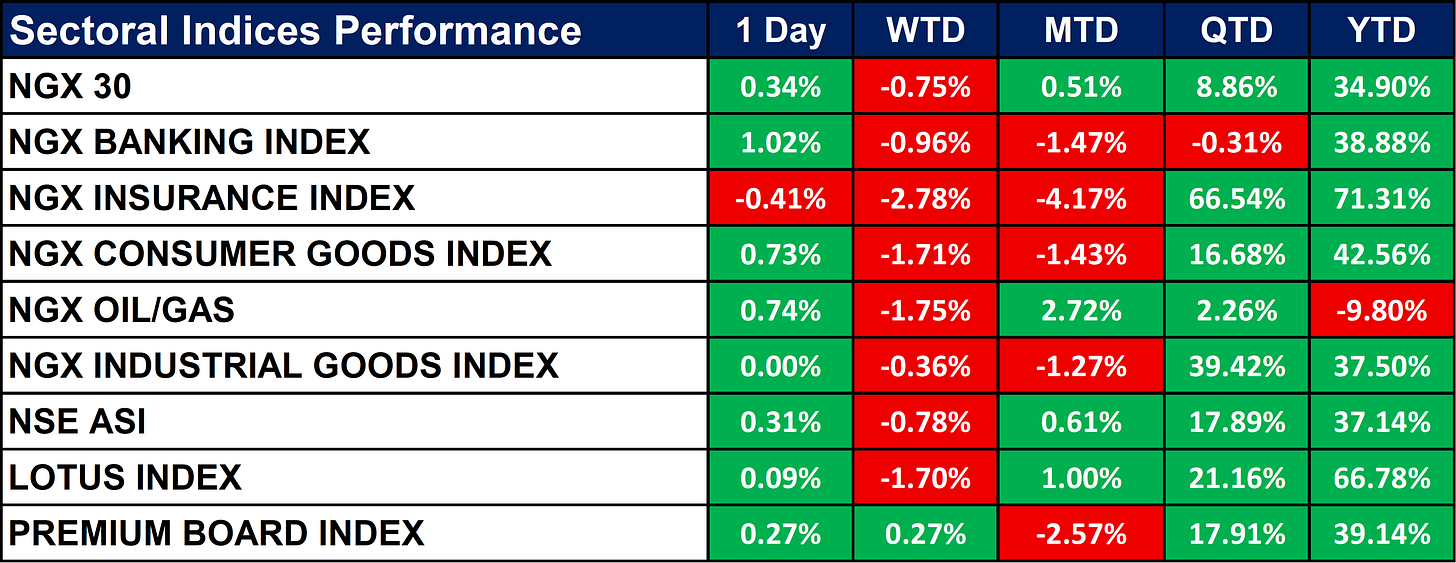

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian equities showed mixed short-term performance with modest daily gains across key sectors, though weekly and monthly trends remain broadly negative. Over the longer term, sectoral returns are strong, led by Insurance, Lotus, and Consumer Goods, while Oil/Gas is the main laggard year-to-date.

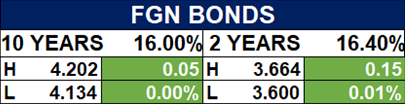

Fixed Income (FGN Bonds)

Global News & Market Update

US implements EU trade deal, 15% autos tariffs retroactive to Aug 1:

The U.S. confirmed a 15% tariff on EU autos and parts, retroactive to August 1, while exempting aircraft, generic drugs, and key raw materials. German automaker stocks rose, reflecting relief after weeks of uncertainty. The move finalizes the U.S.-EU trade deal and adjusts tariff schedules accordingly. - Reuters

Russian attacks cut off power for 70,000 consumers in Chernihiv region, Ukraine says:

Russian strikes cut power for 70,000 people in Ukraine’s Chernihiv region, with restoration efforts underway. Attacks also hit Vinnytsia energy facilities, sparking fires and outages. Moscow has intensified assaults on Ukraine’s energy and rail systems ahead of winter. - Reuters

China probes US, Mexican pecan imports, Mexico’s restriction measures:

China has launched an anti-dumping probe into U.S. and Mexican pecan imports, alleging they harm its domestic industry. It also opened a separate investigation into Mexico’s planned tariffs on Chinese goods, calling them protectionist. The moves reflect rising trade tensions as Beijing, Washington, and Mexico navigate tariff disputes and negotiations. - Reuters

India buys record Argentine soyoil volume after export duty scrapped, sources say:

India made a record purchase of 300,000 tons of soyoil from Argentina after Buenos Aires scrapped export taxes. The deals, priced at $1,100–$1,120/ton, are for October–March shipments. The move may reduce India’s palm oil imports from Indonesia and Malaysia as traders shift to cheaper soyoil. - Reuters

Russia’s Nabiullina says the central bank will cut rates with caution:

Russia’s central bank will cautiously ease rates to avoid reigniting inflation, Governor Nabiullina said. She noted the planned VAT hike may cause only a temporary inflation spike, not lasting pressure. The bank expects inflation to fall back to 4% by 2026, with rates averaging 12–13% that year. - Reuters

Indices, Commodities & Currencies

The table below depicts that the Global markets were cautious: equities broadly declined, commodities traded mixed with metals outperforming, and currencies saw a firm USD against weaker EUR and GBP.

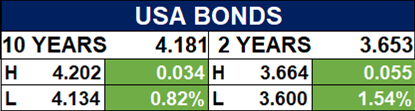

Fixed Income (USA Bonds)

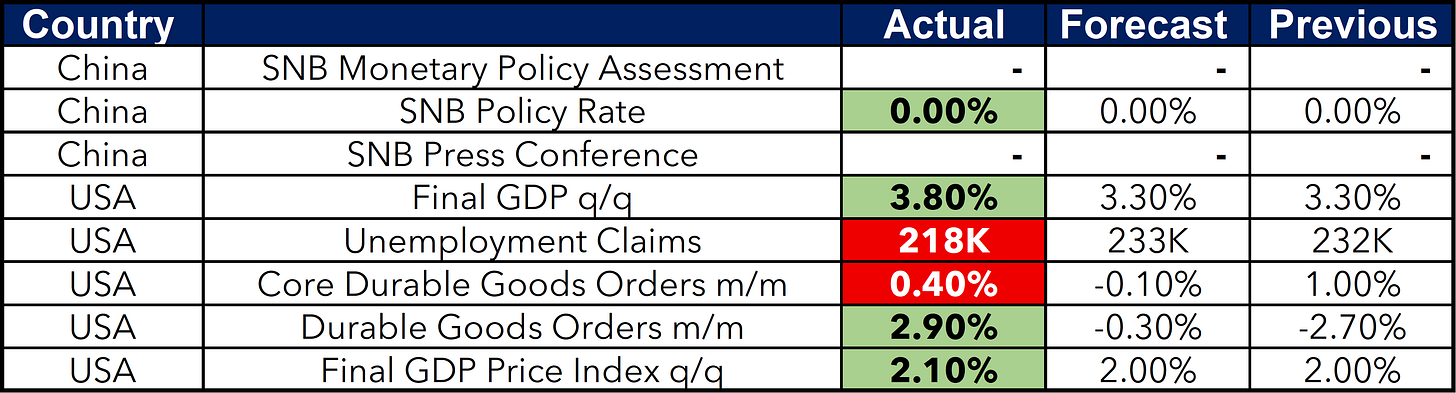

Events

Conclusion

As Nigeria drives forward with energy investments, financial sector stability, and growing local content in manufacturing, the domestic market shows strong long-term potential despite short-term volatility. Globally, escalating trade friction and geopolitical risks weigh on investor sentiment, while commodity and currency markets remain fluid. We’ll continue to monitor how these developments shape both the local and global investment landscape.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.