Think Thursday - Nigeria’s Strong Revenue, Bond Allotments, and Strike Resolution; Global Tensions Rise on U.S. Tariffs, Shutdown, and Energy Shifts

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s Market kick off. Nigeria’s markets remain resilient with ₦576.6billion bond sales, non-oil revenue above ₦20trillion, a $5.28billion current account surplus, and reserves at a six-year high. Risks eased as PENGASSAN ended its strike, while the $400million Otakikpo oil terminal is set to boost output. Globally, Trump’s new tariffs and the U.S. shutdown heighten uncertainty, Russia’s oil exports jumped, China backed Aramco’s gas project, South Korea’s inflation rose, and U.S. unemployment held steady at 4.3%.

Nigerian News & Market Update

DMO Allots Nigerian Bonds to Investors at 16.20% Marginal Rate:

The Debt Management Office (DMO) raised ₦576.6billion from oversubscribed ₦1.3trillion bids, allotting 5-year bonds at 16.0% and 7-year at 16.2%, while keeping original coupons of 17.945% and 17.95%. - dmarketforces

Tinubu - Nigeria Beats ₦20trillion Non-Oil Revenue Target in August:

Nigeria surpassed its ₦20trillion non-oil revenue target by August 2025, recording strong trade surpluses and export growth. Tinubu urged Nigerians to embrace local products and drive economic diversification. - dmarketforces

Nigeria’s current account surplus rises to $5.28billion as reserves hit six-year high:

Nigeria’s current account surplus rose to $5.28billion in Q2 2025, with reserves at a 6-year high of $43.05billion. CBN eased the bank Cash Reserve Ratio (CRR) to boost lending while tightening public deposits to control inflation. - TheSun

PENGASSAN suspends nationwide strike:

The Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) ended its strike after a deal with Dangote Refinery to redeploy 800 laid-off workers without pay loss, with union rights protected. - TheSun

Tinubu to commission $400million onshore crude oil export terminal in Rivers:

Tinubu will commission the $400million Otakikpo oil terminal on Oct 8, Nigeria’s first indigenous onshore facility in 50 years. It will boost crude output by serving 40 stranded fields and lowering production costs. - TheNation

Nigeria Sectoral Indices Performance

The table below shows that the NGX indices closed mostly positive, with the NSE ASI up 0.19% (WTD +1.29%). Insurance (-2.76% WTD) and Oil/Gas (-6.86% YTD) remain weak, while Lotus (+70.66% YTD) and Insurance (+66.59% YTD) lead in annual gains. Overall, the market shows broad strength YTD, led by Banking, Consumer Goods, and Lotus Index.

Fixed Income (FGN Bonds)

Global News & Market Update

Trump sets 10% tariff on lumber imports, 25% on cabinets and furniture:

Trump set new tariffs on timber, lumber, and furniture starting Oct. 14, rising to as high as 50% in January. He cited national security risks to justify the move, hitting Canada, Vietnam, and Mexico hardest. Some allies like the EU, UK, and Japan will face lower capped rates. - Reuters

Trump, budget chief to discuss cuts on day two of US government shutdown:

Trump threatened cuts to “Democrat agencies” amid the shutdown, which has furloughed 750,000 workers and disrupted services. The standoff stems from a budget clash, with fears of prolonged disruption. - Reuters

China’s banks lend to Saudi gas project while its funds sit out of BlackRock-led deal, sources say:

Chinese banks lent $3.7bnillion to Aramco’s $11bn Jafurah gas project, but funds skipped equity due to U.S.–China tensions. The project is central to Saudi plans to boost gas output 60% by 2030. - Reuters

Russia’s western port oil exports up 25% after drone attacks:

Russia’s oil exports from western ports rose 25% in September to 2.5million bpd, as refinery outages from Ukrainian drone attacks freed more crude for shipment. - Reuters

South Korea September inflation +2.1% y/y, slightly above forecast:

South Korea’s inflation rose 2.1% in September, above forecasts, with prices up 0.5% month-on-month after August’s one-off dip. - Reuters

US unemployment rate likely steady at 4.3% in September, Chicago Fed says:

Chicago Fed estimated U.S. unemployment at 4.3% in September, unchanged from August, as the official report is delayed by the shutdown. The data shows no sharp labor weakness, though markets still expect more Fed rate cuts. - Reuters

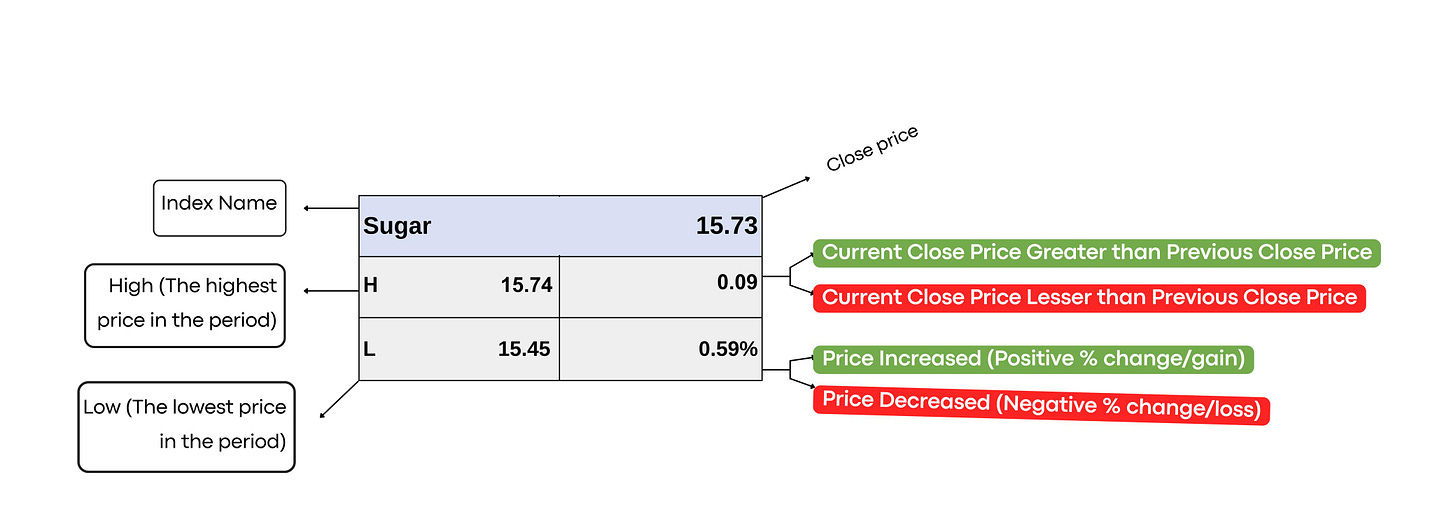

Indices, Commodities & Currencies

The table below depicts that the Global equities were mixed: Dow Jones 0.22%, Nasdaq 0.55%, while S&P 500 fell -0.16%. In commodities, oil (WTI -1.15%, Brent -1.15%) slipped, but natural gas jumped +2.91%; metals also weakened with gold -1.07% and silver -3.54%. In currencies, the USD strengthened, while EUR (-0.25%) and GBP (-0.44%) edged lower.

Fixed Income (USA Bonds)

Events

Conclusion

Nigeria’s outlook is strengthening with higher non-oil revenue, robust reserves, and eased labor tensions, supporting equities in banking and consumer sectors, while oil & gas may benefit from new infrastructure. Globally, risks from U.S. tariffs and the shutdown persist, but resilient energy demand and Chinese capital flows offer support. Investors should brace for short-term volatility yet watch opportunities in defensive sectors, fixed income, and undervalued Nigerian stocks.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.