Think Thursday - Power Moves & Profits Edition

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

The sun may be setting, but the markets never sleep. Here’s your evening roundup of the day’s key financial moves and insights.

Nigerian News & Market Update

UBA offers 3.15 billion new shares in N157bn rights issue:

UBA is raising over ₦157billion through a rights issue of 3.16 billion shares at ₦50 each, offering 1 new share for every 13 held as of July 16, 2025. This follows its strong ₦803.73billion profit before tax for 2024.- Punch

NGX Raises Over ₦14trn Capital H1 2025:

NGX’s market capitalization rose 16% to ₦126.73trillion in H1 2025, driven by equities growth from ₦62.76trillion to ₦75.95trillion. Fixed income remained at ₦50.56trillion, while ETFs rose to ₦25.79billion.

Over ₦4.63trillion was raised via the exchange, boosted by reforms, regulatory support, and the NGX Invest platform, which facilitated ₦2trillion+ for banking recapitalization. - Channels

Otedola Takes Over 40 Percent of FirstHoldco in Forced Exit of Otudeko:

Femi Otedola has increased his stake in First Bank Holdings Plc to 40% through a ₦324.47billion strategic investment, signaling strong confidence in the bank’s future. His leadership has already boosted market sentiment, with the share price rising 9.9% and market value exceeding ₦1.44trillion. With a focused strategy to raise ₦500billion in capital and address ₦1trillion in non-performing loans, the bank is now positioned for renewed stability and growth. - Thisday

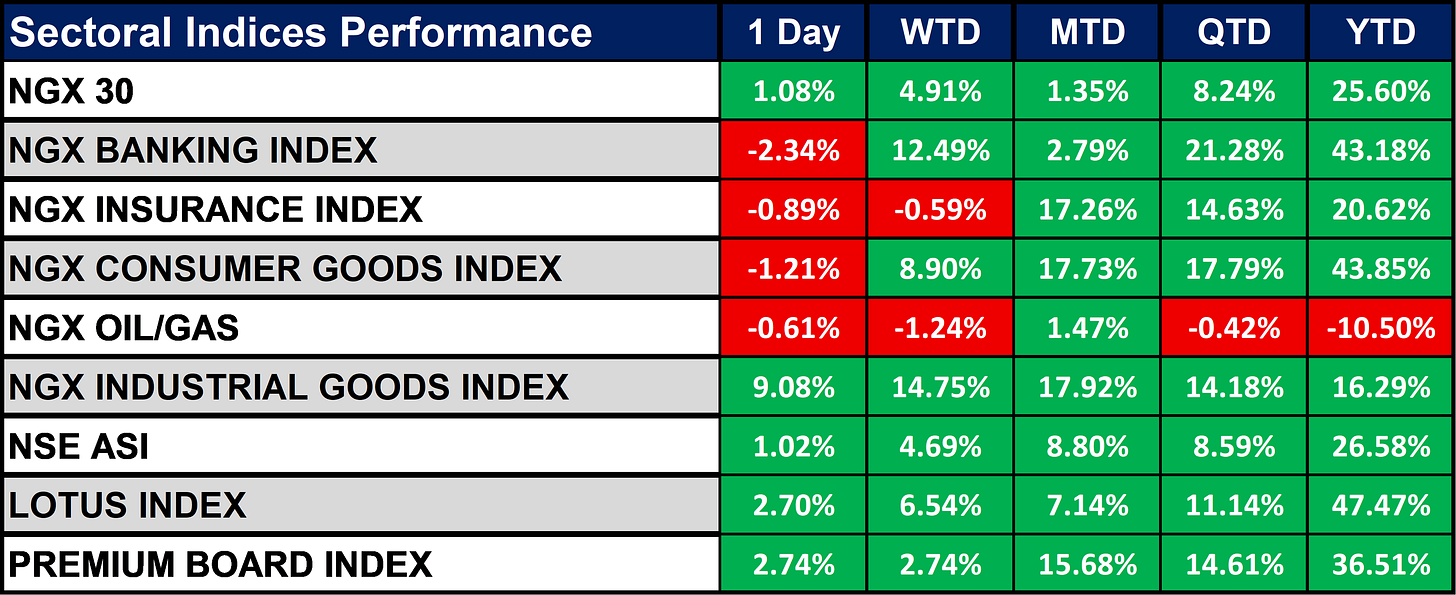

Nigeria Sectoral Indices Performance

The table above highlights a largely positive week across NGX sectoral indices. The Industrial Goods Index stood out with a remarkable +9.08% daily gain and +14.75% WTD, indicating strong momentum. While the Banking Index dipped -2.34%, it maintains a robust +43.18% YTD. The Consumer Goods and LOTUS Index continue to post strong YTD returns, reflecting sustained investor interest. In contrast, Oil & Gas remains the sole underperformer YTD (-10.50%). Overall, the data suggests a bullish tone across most sectors, with industrials and shariah-compliant equities driving growth.

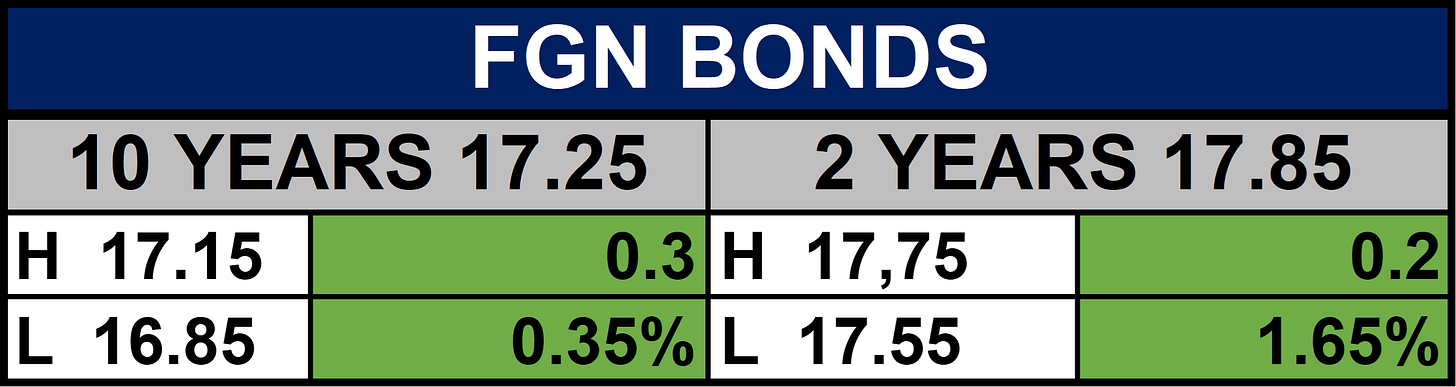

Fixed Income (FGN Bonds)

Global News & Market Update

Netflix earnings are after the bell. Here’s what to expect:

Netflix reports earnings Thursday, with Wall Street expecting $7.08 EPS(Earnings per share) and $11.07Billion revenue up 45% and 15% YoY(Year over Year). The key focus is the impact of price hikes and ad tier performance. Analysts see pricing driving 2025 growth, ads in 2026. Shares are up 40% YTD, 90% in 12 months. - CNBC

PepsiCo stock rises on earnings beat, turnaround plan:

PepsiCo beat earnings and revenue estimates, with $2.12 EPS and $22.73Billion revenue, despite weak North American demand. Volume declined, but Pepsi Zero Sugar grew strongly. The company is cutting costs, relaunching key brands, and focusing on healthier snacks. Full-year outlook remains unchanged. Shares rose 6%. - CNBC

S&P 500 Rises Toward Record on Solid Economic Data:

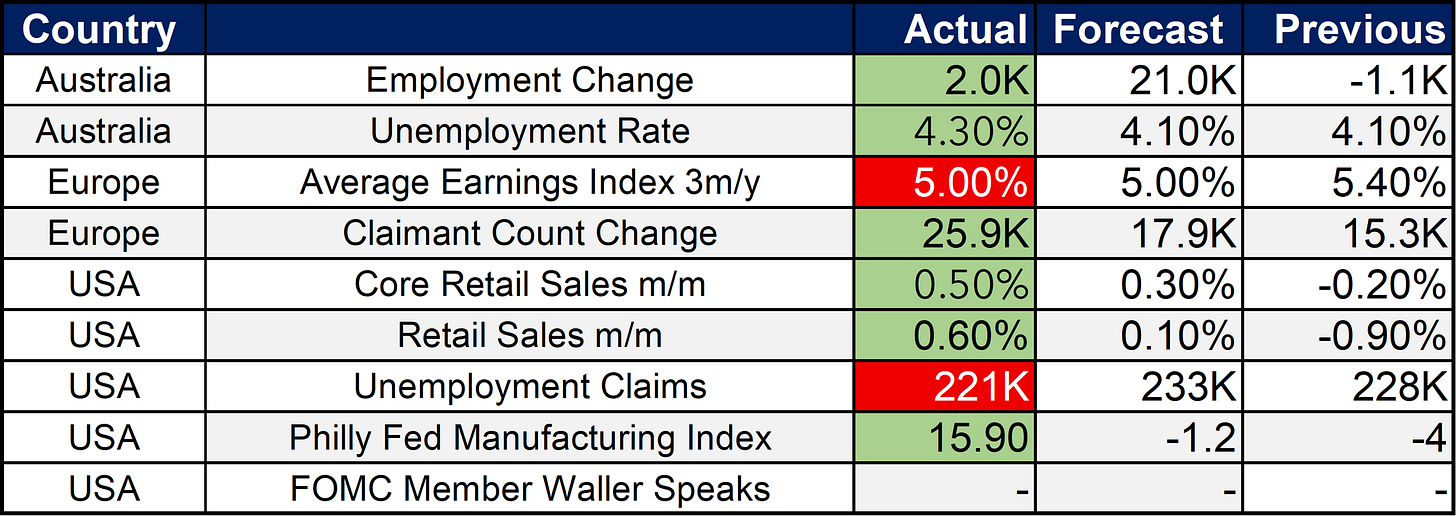

Stocks rose as strong U.S. retail sales and lower jobless claims signaled economic resilience. The S&P 500 neared a record, and the Russell 2000 gained 1%. Tech climbed on upbeat AI demand from TSMC, while PepsiCo jumped on solid earnings. The dollar rose, and short-term bonds fell. - Bloomberg

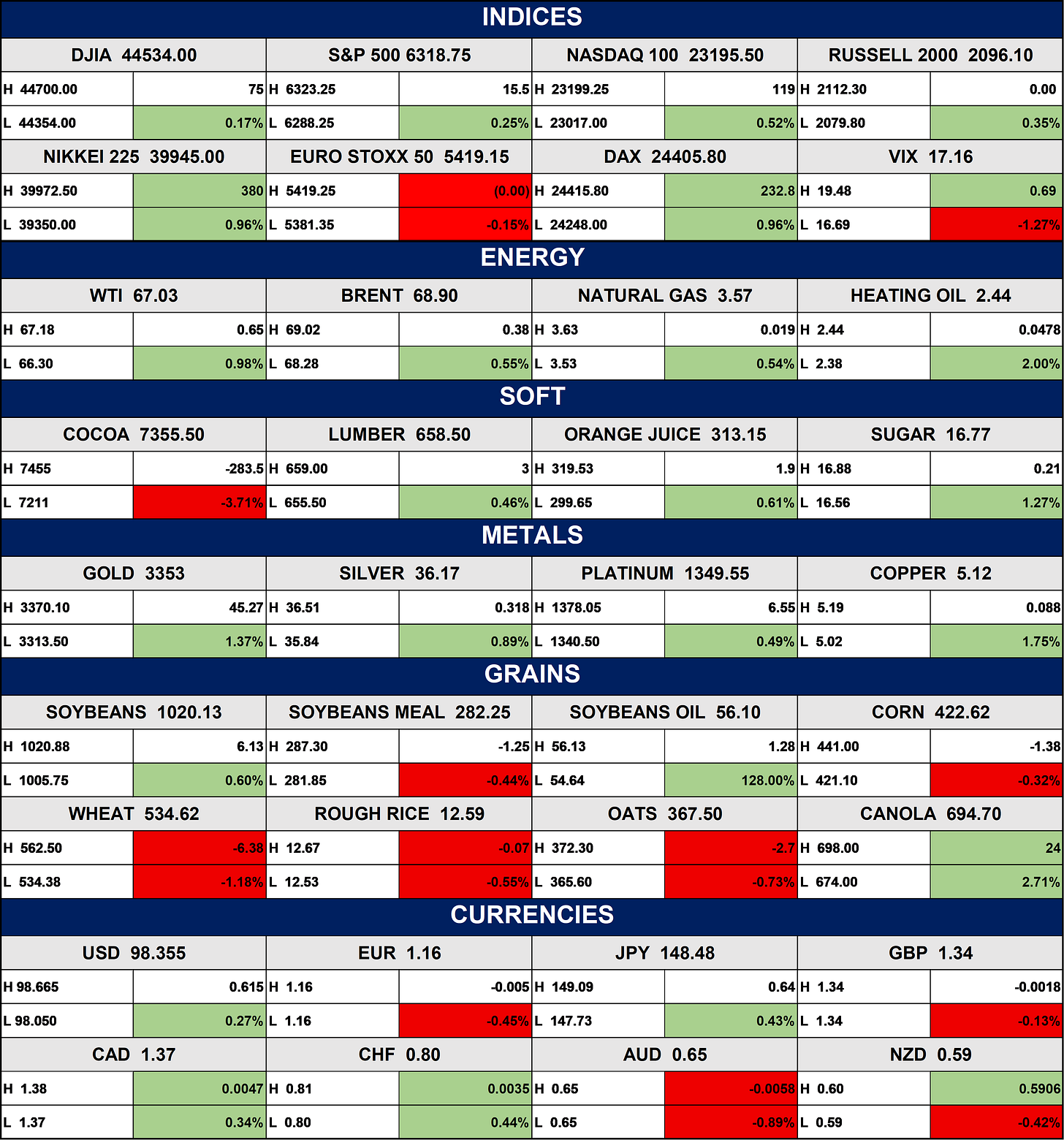

Indices, Commodities & Currencies

The table above shows that market remain risk-on with broad strength in equities and energy, stable precious metals, and lower volatility. Agriculture showed divergence, and currency markets stayed range-bound. Traders should watch for confirmation in commodity trends and anomalies like the soybean oil spike.

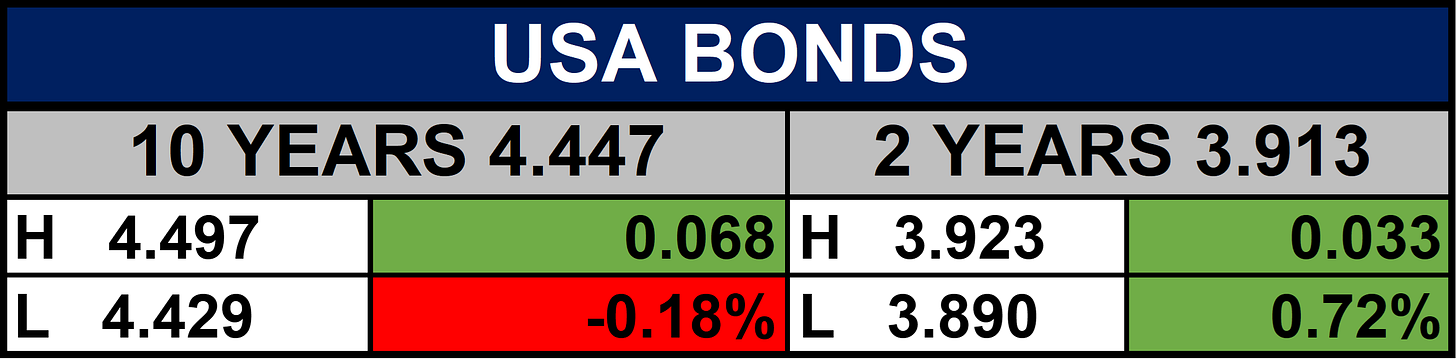

Fixed Income (USA Bonds)

Events

Highlights of the Day

Markets climbed on strong earnings and economic data. UBA’s ₦157bn rights issue and Otedola’s 40% stake in First Bank boosted local sentiment. The NGX saw over ₦14tn in H1 capital growth, led by industrials. Globally, the S&P 500 neared a record, PepsiCo jumped on solid earnings, and investors await Netflix’s Q2 results. Tech gained on AI optimism from TSMC.

Takeaway: Strong earnings and strategic moves locally, combined with U.S. economic resilience, support a cautiously optimistic Q3 outlook.