Think Thursday - Rising Reserves, Energy Realignments, and Global Contract Disputes Steer Nigerian and Global Markets

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market kick-off, where we highlight the major shifts shaping Nigeria’s financial markets and global risk sentiment.

This edition examines key domestic developments from FX pressures and recapitalisation moves to energy-sector updates alongside major global commodity and corporate news. Investors can expect insights into how these dynamics may influence liquidity, sector performance, and broader market direction in the days ahead.

Nigerian News & Market Update

CBN Intervenes in FX Market with $50million as Naira Faces Pressure:

Nigeria’s naira weakened despite a $50million CBN intervention, but rising foreign reserves now at a seven-year high are boosting confidence and narrowing the FX market spread. - Dmarketforces

TotalEnergies and Conoil agreed to an offshore asset swap that boosts TotalEnergies’ stake in the Oil Prospecting Licence (OPL) 257 to 90%, enabling it to advance the Egina South appraisal and future tie-back development to the Egina FPSO. - Punch

Recapitalisation: SUNU Assurances plans ₦9billion capital raise:

SUNU Assurances secured shareholder approval to raise ₦9billion for recapitalisation to meet NIIRA 2025 requirements, strengthen solvency, and boost market competitiveness. - Dailytrust

Govt eyes ₦1.49trillion electricity export revenue:

Nigeria projects nearly $1billion yearly from exporting 600MW of electricity to 15 West African countries after successful regional grid synchronisation ahead of full integration in 2026. - Punch

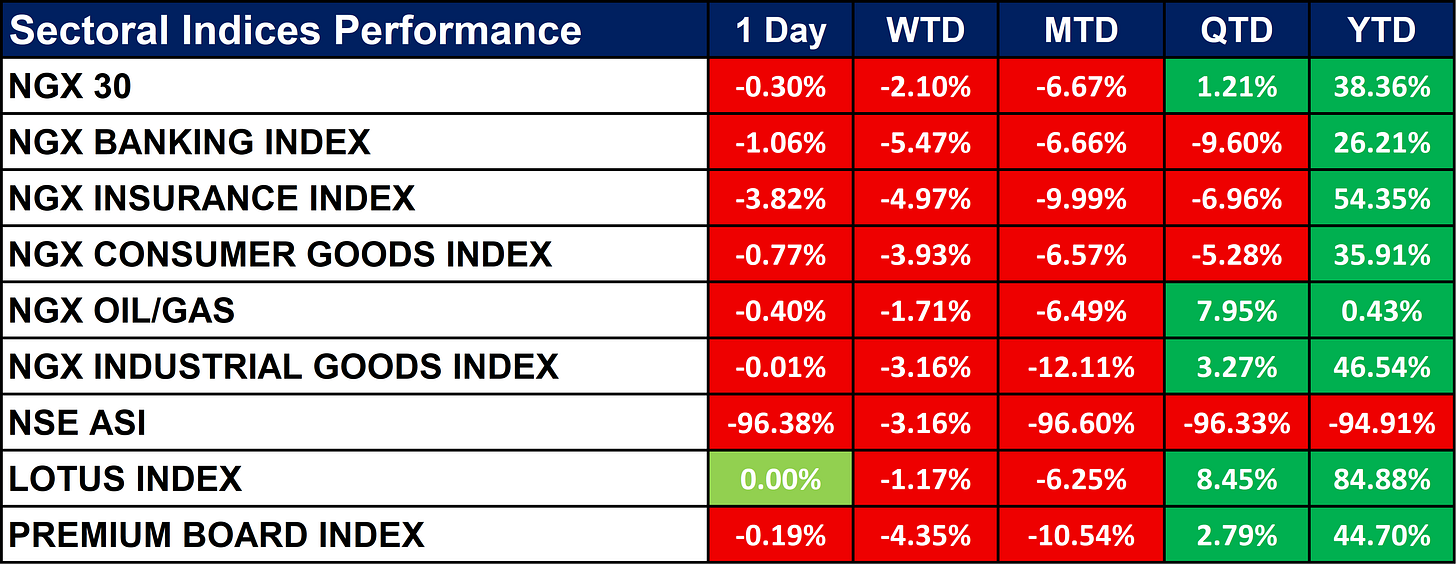

Nigeria Sectoral Indices Performance

The table below shows that the Most NGX sector indices posted losses across 1-Day, WTD, and MTD, reflecting broad market weakness. Despite short-term declines, QTD and YTD performance remain positive for most sectors, with the Lotus Index and Insurance Index showing particularly strong YTD gains.

The NSE ASI shows an extreme decline across all periods, likely due to a data anomaly rather than actual market movement.

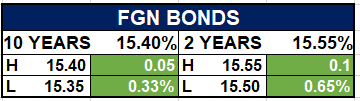

Fixed Income (FGN Bonds)

Global News & Market Update

India’s Reliance stops importing Russian crude for refinery operations:

Reliance Industries has stopped importing Russian crude ahead of sanctions deadlines and will export only products made from non-Russian oil starting December 1.- Reuters

China expands BHP iron ore ban to new product as talks drag, sources say:

China’s state-owned CMRG has ordered steel mills and traders to stop buying another type of BHP’s low-grade iron ore, escalating their contract dispute. -Reuters

Exxon to acquire 40% stake in Enterprise Bahia NGL pipeline:

Exxon Mobil is buying 40% of Enterprise’s Bahia NGL pipeline and co-expanding it to boost Permian gas-liquids capacity to 1 million barrels per day by 2026. - Reuters

KKR aims to raise $15 billion for latest Asia private equity fund, sources say:

KKR is seeking $15 billion for its fifth Asia private equity fund, one of the region’s largest, as investor interest and PE activity rebound across Asian markets. - Reuters

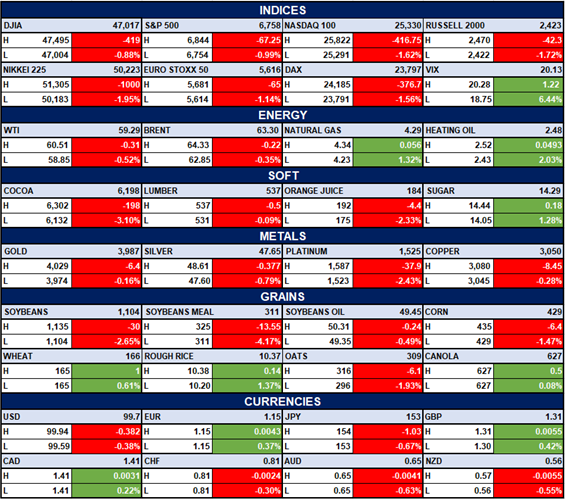

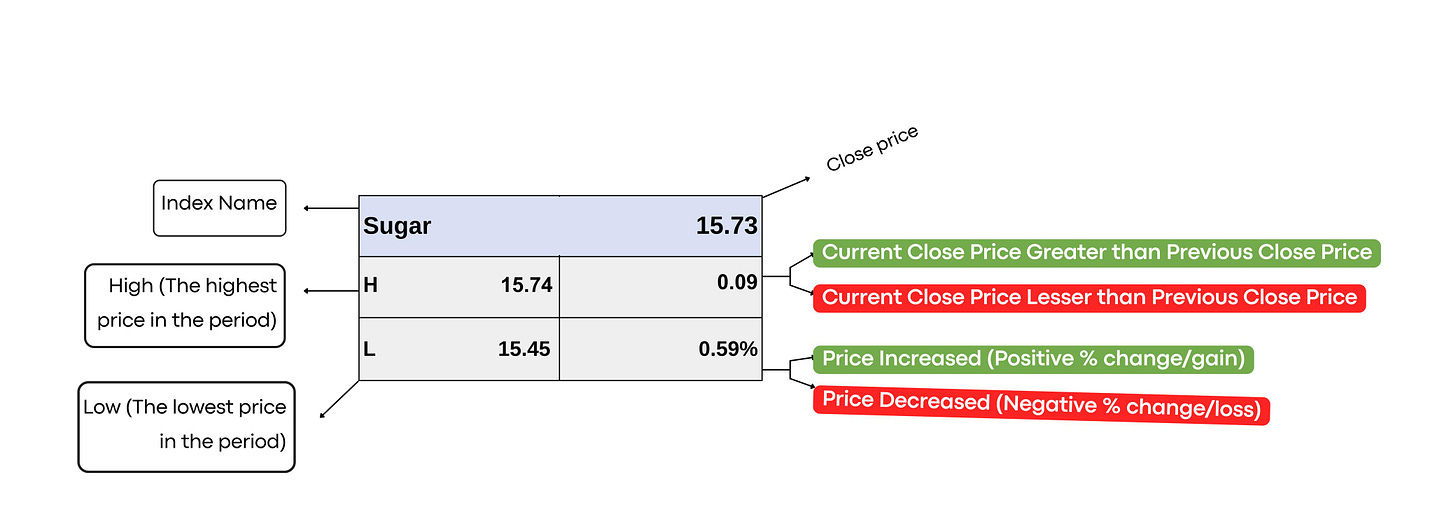

Indices, Commodities & Currencies

The table below depicts that the Global markets traded mostly lower as major U.S. and European equity indices declined, while the VIX spiked over 6%, signalling increased risk-off sentiment. Energy was mixed with slight losses in oil but gains in natural gas, while soft commodities showed volatility, particularly cocoa and orange juice.

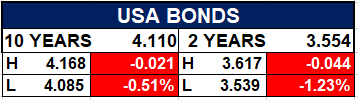

Fixed Income (USA Bonds)

Events

Conclusion

As markets navigate FX uncertainties, sectoral pullbacks, and shifting global commodity flows, investors should remain attentive to policy actions and cross-border developments.

Nigeria’s rising reserves, recapitalisation efforts, and regional energy opportunities may support medium-term stability despite short-term volatility.

Globally, evolving supply constraints and corporate expansions suggest heightened market sensitivity, making disciplined positioning and risk management essential.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.