Trading Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

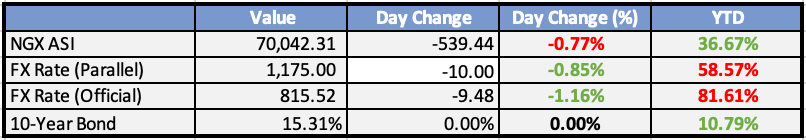

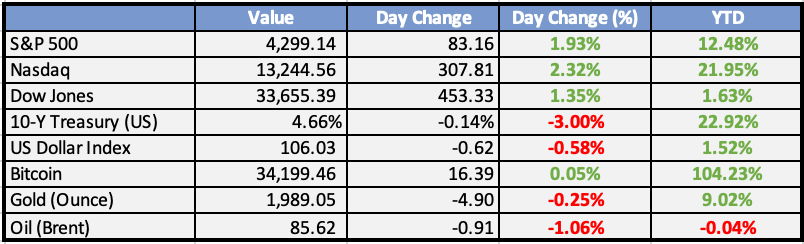

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Senate to pass N2.18tn supplementary budget Thursday - Punch

As mandated by the Senate on the strength of the request made by President Bola Tinubu, the Appropriations Committee has met with heads of the affected seven agencies supplementary budget proposals were provided for.

UK commits $26.5m to AFEX to address food security - BusinessDay

British International Investment (BII), the UK’s development finance institution and impact investor, on Monday announced a $26.5 million commitment to to AFEX, Africa’s leading commodities platform.

Relief for Nigeria as CBN begins to clear FX backlog - BusinessDay

The Central Bank of Nigeria (CBN) has delivered over 75 percent to 80 percent of outstanding matured FX forwards in banks. According to the source who who told BusinessDay, only international banks have been settled which include Citi Bank, Standard Chartered and Stanbic IBTC.

SON certifies Innoson vehicles as firm sees 500% production rise - TheGuardian

The Standards Organisation of Nigeria (SON) has said Innoson brand of vehicles manufactured by Innoson Vehicles Manufacturing Limited has met all international standards and therefore dim fit to be used in Nigeria and beyond.

Global

Fed holds rates steady, upgrades assessment of economic growth - CNBC

The Federal Reserve, during its latest policy meeting, decided to keep benchmark interest rates steady in a target range of 5.25%-5.5%, marking the second consecutive meeting without a rate change after 11 previous rate hikes, including four in 2023. The move was largely anticipated, with the committee's assessment of the economy slightly upgraded.

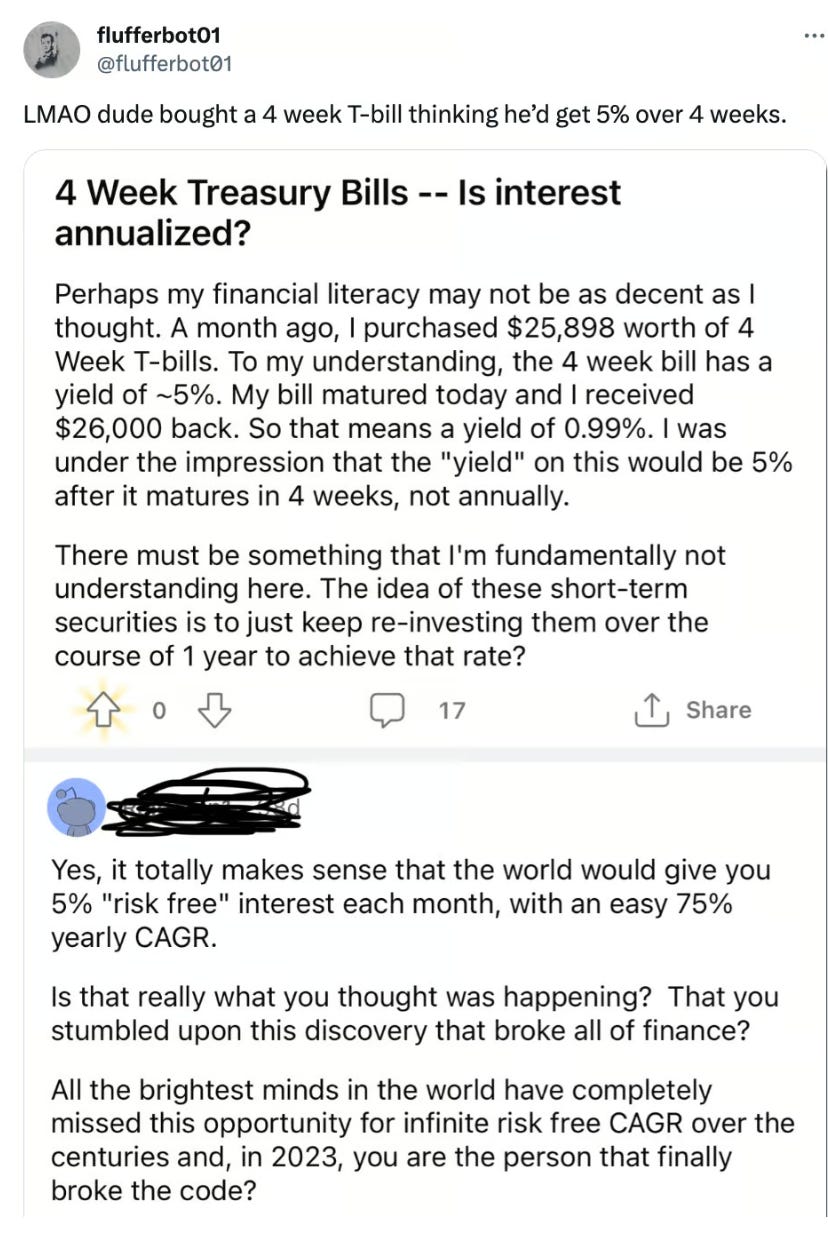

Treasuries US yields hit 2-week low as Fed nods to tightening impact of higher rates - Reuters

Benchmark U.S. 10-year Treasury yields fell to a two-week low after the Federal Reserve decided to leave policy rates steady. Although Fed Chair Jerome Powell suggested that the Fed might still consider another rate hike if inflation remains above desired levels, market expectations for a December rate increase dropped from 29% to 20%.

US weekly jobless claims rise moderately; productivity surges in Q3 - Reuters

The number of Americans filing new claims for unemployment benefits increased moderately last week as the labor market continued to show few signs of a significant slowdown.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities ended mostly higher on Thursday. The strongest gains were observed in tech-dominated South Korea and Taiwan, with Japan also recording gains for the third consecutive day. Meanwhile, Australia closed higher, and New Zealand saw a surge. Greater China markets exhibited mixed performance, as mainland bourses fell, while Hong Kong held onto gains but was well off its peak. Southeast Asia and India also ended on a positive note.

The Japanese cabinet was set to approve a $112 billion stimulus package. A key feature of this package was the introduction of a temporary tax cut starting as early as June 2024, including an income tax cut of JPY 300,000 per person and a resident tax rebate of JPY 10,000. Low-income households exempt from residential taxes would receive JPY 70,000. The stimulus also included an extension of gasoline, electricity, and gas subsidies until April 2024.

A PBOC report on loans of financial institutions indicated that China’s outstanding amount of loans to the property sector had fallen by CNY 100 billion from a year earlier, amounting to CNY 53.19 trillion ($7.3 trillion) by the end of September. This marked the first year-on-year decline on record since data became available in 2005, contrasting with the 10.9% growth observed in overall loans.

Bank Negara Malaysia (BNM) decided to keep its benchmark interest rate unchanged at 3.0% on Thursday.

In South Korea, October inflation rose 3.8% year-on-year, marking the third consecutive monthly gain and surpassing expectations of 3.6%. On a month-on-month basis, prices rose 0.3%, compared to September’s 0.6%, but exceeding market forecasts by 0.15%. Core inflation stood at 3.6%, down from 3.8% in September. This adds to the dilemma regarding whether the Bank of Korea (BoK) should start easing or not. The BoK has maintained its rates since January 2023.

Europe, Middle East, Africa:

European equity markets traded sharply higher, following a positive close on Wednesday.

In Germany, unemployment rose more than forecast in October, with the number of people out of work increasing by 30,000 to 2.678 million, versus a consensus for a 15,000 rise and the prior month’s gain of 10,000. The unemployment rate rose to 5.8% from 5.7%.

Ireland’s October Unemployment Rate came in higher at 4.8%, compared to a consensus of 4.2% and the prior month’s 4.7%.

Novo Nordisk reported Q3 EPS of DKK 5.00, exceeding the consensus of DKK 4.78. The company’s revenue reached DKK 58.73 billion, compared to the consensus of DKK 57.81 billion. Ozempic sales were lower than expected at DKK 23.91 billion, versus the consensus of DKK 24.12 billion, while Wegovy's revenue outperformed at DKK 9.65 billion, compared to the consensus of DKK 7.75 billion. The company reconfirmed its guidance of 32-38% sales growth and 40-46% operating profit growth.

The Americas:

Several data points were released for the US:

October US Challenger planned job cuts were 36,836, down from 47,457 in September.

September US JOLTS reported 9,553K job openings, with the August figure being revised to 9,497K from 9,610K. The quits rate remained stable at 2.3%.

October US ISM Manufacturing showed a reading of 46.7, falling short of the consensus of 49.0. New orders decreased to 45.5, down from 49.2.

October US ADP Employment added 113,000 jobs, missing the consensus of +143,000.

The Atlanta Fed revised its GDP growth estimates for Q4, 2023 to 1.2% on November 1, down from 2.3% on October 27.

The Week Ahead:

Monday:

Tuesday:

US Employment Cost Index q/q rose 1.1% quarter-over-quarter (q/q, 4.4% annualized)

US CB Consumer Confidence decreased from 103 in September to 102.6 in October

Wednesday:

US ADP Employment Change is at a current level of 113000.0, up from 89000.00 last month

US ISM Manufacturing PMI dropped to 46.7 in October from 49.0 in September

US initial jobless claims up by 5,000 to 217,000

US Federal Funds Rate remains steady at 5.25% to 5.5%

Thursday:

BOE Monetary Policy Report

Unemployment Claims (US)

Friday:

Average Hourly Earnings m/m (US)

Non-Farm Employment Change (US)

Unemployment Rate (US)

ISM Services PMI (US)

Investment Tip of The Day

Stay Aligned With Financial Objectives: Continuously assess your investment choices to ensure they align with your evolving financial goals and life circumstances. Adjust your portfolio as needed to stay on track.