Trading Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

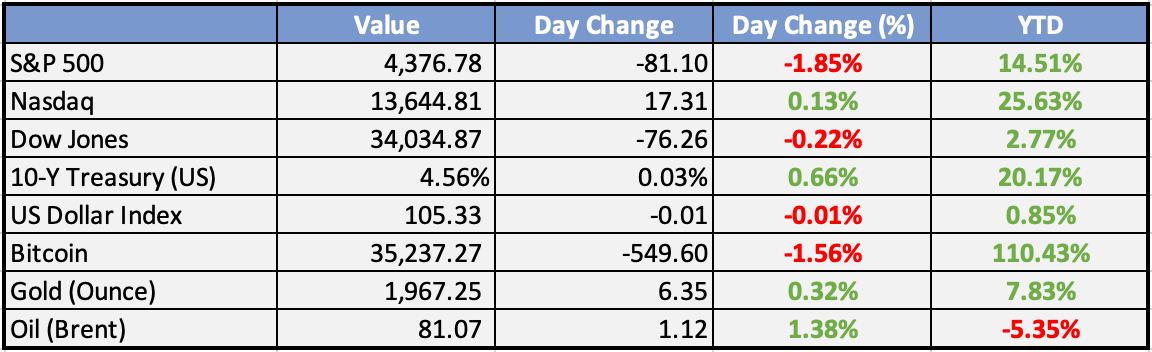

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Domiciliary account balance rises to $29bn amid weaker naira - BusinessDay

The total balance in the domiciliary accounts in Nigeria’s commercial and merchant banks rose by more than a fifth in June, an analysis of data from the Central Bank of Nigeria (CBN) shows.

Bank deposits soar on CBN loans, dollar accounts - BusinessDay

Nigeria’s five biggest banks have seen their customer deposits grow at a faster pace this year, even as money supply in the country has risen by more than a quarter

Global

US jobless claims fall in latest week in still-strong labor market - Reuters

The number of Americans filing new unemployment claims fell by 3,000 to 217,000 for the week ending November 4, indicating that the labor market is showing few signs of significant slowdown. This comes despite a cooling job market, slower hiring, and a slight increase in unemployment. The U.S. central bank kept interest rates steady last week but left room for future rate increases.

Bitcoin surges to its highest level in 2023, notching a 130% gain over the past year - Business Insider

Bitcoin reached its highest price of 2023 at $37,200, an 18-month high, marking a 122% gain for the year and a 134% increase over the last 12 months. This surge follows renewed talks between the SEC and Grayscale regarding spot bitcoin ETFs, with a strong chance of approval predicted by Bloomberg Intelligence strategists.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian stock markets displayed mixed performance on Thursday. Japan’s Nikkei outperformed with a notable 1.5% gain, while smaller increases were observed in Australia, South Korea, and Taiwan. Greater China markets faced challenges due to disappointing inflation data, leading to another decline in Hong Kong’s market. In Southeast Asia, the market was a mixed bag, with Thailand experiencing a significant decline, while India remained relatively flat.

China’s headline Consumer Price Index (CPI) decreased, mainly due to a substantial 4% drop in food prices, whereas core inflation rose by 0.6% year-on-year, although it was lower than the 0.8% increase seen in the previous month.

China’s weakening economy and the downturn in the property sector have resulted in a rise in bad loans, prompting closer scrutiny of bank balance sheets. Data indicates that non-performing loans have increased by CNY183.2 billion since the beginning of the year, reaching a total of CNY4 trillion.

The Bank of Japan (BOJ) released a Summary of Opinions, stating that its Yield Curve Control (YCC) adjustment aimed to mitigate side effects on market functioning and acknowledged an increasing likelihood of achieving the inflation target in a stable and sustainable manner. Meanwhile, Governor Ueda, speaking at an FT conference, described unwinding the central bank’s ultra-loose monetary policy as a “significant challenge,” which boosted Japanese equities.

The Philippines’ GDP grew by 5.9% year-on-year in Q3, surpassing the forecasted 4.7% and the previous quarter’s 4.3% growth. The stronger-than-expected growth was attributed to increased government spending, rising fixed investments, export growth, and a simultaneous decline in imports during the quarter.

Europe, Middle East, Africa:

European Union (EU) equity markets rebounded after early losses. This followed the first clearly positive close for the Stoxx 600 this week, although it remained below the high from the previous week.

Shares in ADYEN surged by over 24% in pre-market trading on Thursday as traders reacted positively to the Dutch payment company’s new, more realistic targets. Adyen had previously issued a profit warning in August and lowered its medium-term sales target, earning praise from analysts who deemed the new forecast more attainable.

The Americas:

Retail sales in Brazil showed improvement last month, recording a 0.6% month-on-month increase compared to a 0.1% decrease in the previous month. Year-on-year, sales grew by 3.3%, surpassing the 2.4% from the previous month.

Mexico’s inflation continued to decline, registering at 4.26% year-on-year, down from the previous month’s 4.45%. Core inflation also dropped to 5.5% year-on-year from 5.76% in the previous month. The Central Bank of Mexico is expected to announce its interest rate decision today, and consensus suggests it will remain unchanged.

Disney reported a beat on earnings per share for its fiscal quarter (FQ4), although its revenue fell slightly short of expectations. The positive results were attributed to growth in ESPN+ subscription revenue and reduced production costs within the sports segment, while the entertainment segment lagged, facing some challenges in linear networks, including lower advertising and affiliate revenues. Disney’s focus is now on robust free cash flow in FY24, aided by updates to its cost-cutting program and a $2 billion reduction in cash content spending.

There is increasing discussion about a potential government shutdown after November 17 when the funding authorization from the September 30 stopgap bill expires, with no clear plan forward.

The New York Federal Reserve’s quarterly report on debt and credit indicates ongoing upward trends in both new delinquencies and new serious delinquencies as a share of current outstanding debt, although the figures remain below pre-pandemic levels.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

Thursday:

US Unemployment Claims Jobless claims dip to 217000

Friday:

GDP m/m (UK)

Prelim UoM Consumer Sentiment (US)

Investment Tip of The Day

Assess Industry Disruptors: Industries are subject to disruption from innovative technologies or business models. Identify companies that are positioned to adapt and thrive in changing landscapes.