Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

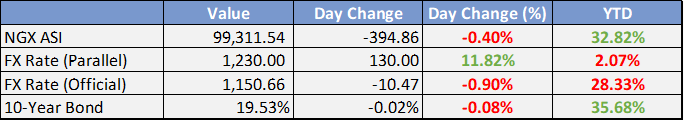

Local

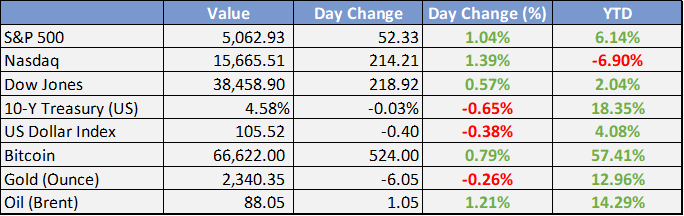

Global

*Data as of 4pm WAT

Market News

Local

Naira tumbles to N1,234/$ at official market, speculators resume hoarding

N200bn Intervention Fund: FG begins disbursement to MSMEs, manufacturers

Nigeria blames international community for illicit funds, terrorism, illegal mining in Africa

Alake commends Nasarawa’s commitment to completion of lithium processing factory

Global

Market Commentary:

Currencies/Macro:

The US dollar index experienced minor fluctuations, ultimately closing down 0.1% for the day.

EUR experienced volatility, traveling from 1.0660 to 1.0624 before settling.

USD/JPY increased slightly, reaching a 34-year high of 154.85 from a start of 154.60.

The Chicago Fed's national activity index saw a modest increase to 0.15, slightly above the expected 0.09, following a revision of the previous month from 0.05 to 0.09.

Eurozone consumer confidence declined slightly to -14.7, marginally worse than the anticipated -14.5 and a minor improvement from the previous -14.9.

Interest Rates:

The US 2-year Treasury yield decreased from 5.00% to 4.95%, and the 10-year yield fell from 4.66% to 4.61%.

Markets currently price an 85% chance of a Fed funds rate cut by September, with the rate expected to remain unchanged at the next meeting on May 2.

Primary market activity was subdued. In Europe, approximately EUR 3.25 billion was priced by four issuers, including Prologis with a dual tranche EUR 550 million 10-year and GBP 350 million 16-year, and P&G with EUR 1.5 billion across 4 and 10 years.

The US market was quieter, with American Express's post-earnings USD 3.5 billion offering being the only deal, comprising a mix of 3-year non-call 2-year and 6-year non-call 5-year senior notes, along with an 11-year non-call 10-year Tier 2 offering.

Commodities:

Crude markets were steady with the June WTI contract down slightly by 0.1% at $82.14, and the June Brent contract also down by 0.1% at $87.20.

Stability in crude prices is influenced by two main factors: limited escalation in Middle East conflicts capping potential gains, and moves to sanction Iran’s oil sector helping to limit losses.

Developments in Iraqi oil exports remain uncertain, as a government spokesman indicated that resuming Kurdish oil exports through the Ceyhan pipeline, which stopped on March 25, will take time with no specific timeline set for resolving negotiations with foreign oil companies in the region.

In gas market news, the EU is considering a ban on Russian LNG imports as part of its potential 14th round of sanctions, aiming to further reduce dependence on Russian energy resources.

Investment Tip of The Day

Review and adjust your financial plans and investment strategies in response to major life events such as marriage, the birth of a child, career changes, or retirement. These events can significantly alter your financial needs and goals, requiring adjustments to your asset allocation, risk tolerance, and savings plans to ensure they remain aligned with your current and future financial objectives.