Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

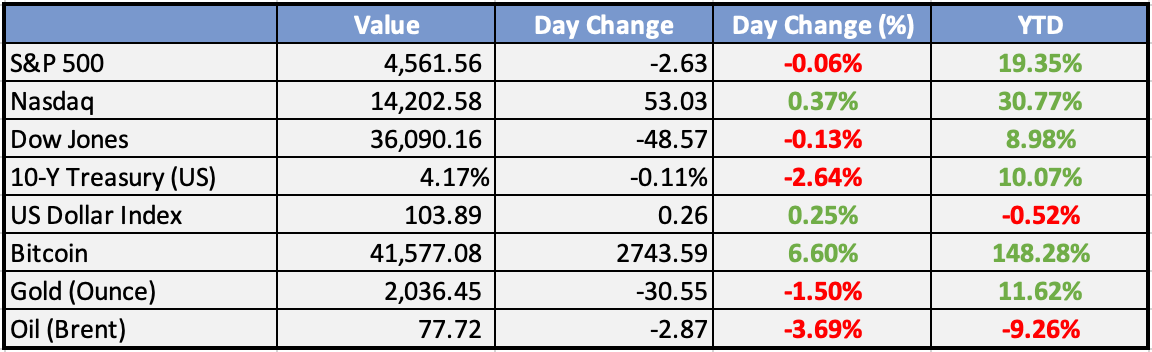

Market Data

Local

Global

x*Data as of 4pm WAT

Market News

Local

NNPC to get $7.5b investment from Fox to overhaul operations - The Guardian Nigeria News

Fox Petroleum Group, yesterday, said $7.5 billion will be injected into the Nigerian National Petroleum Company Limited (NNPCL) in the next three years, to enable the state oil firm to overhaul its operations across the upstream, mainstream and downstream petroleum sector.

FG plans to revoke unused oil licences - Punch

Although about 53 exploration leases were issued from 2003 till date; over 60 per cent of the prospecting licenses issued to local and foreign oil firms had expired.

FG to earn N298.4bn from privatisation in 2024 to finance budget - Nigeria Business News

The federal government is looking to generate N298.4 billion in revenue from selling off certain government assets in 2024. This is contained in a breakdown document of the 2024 appropriation bill.

FG to disburse ₦150bn grant to businesses in 774 local government areas as palliative - Nigeria Business News

Minister for Industry, Trade and Investment, Dr Doris Uzoka-Anite has said that the Federal Government has confirmed it will start the disbursement of funds under its Presidential Palliative Programme aimed at easing the impact of the fuel subsidy removal.

Nigeria Records N1.88 Trillion Trade Surplus in Third Quarter - ThisDay

Nigeria’s total external merchandise trade increased to N18.80 trillion in the third quarter of the year (Q3 2023), with exports accounting for N10.35 trillion, the National Bureau of Statistics (NBS) disclosed yesterday.

Global

US Bank plans to issue $2.5B of auto credit-linked notes - Bloomberg

US Bank is issuing $2.5 billion in credit-linked notes tied to a pool of auto loans. This is the bank's first venture into such a form of securitization and reflects the growing popularity of credit-linked notes as a financial instrument. Moody's Investors Service has provided a preliminary ratings report on this new issuance, indicating that it has been assessed for investment risks.

Swiss bank Banque Pictet admits hiding $5.6B of Americans’ money from IRS - CNBC

Banque Pictet, the private banking division of the Pictet Group, has admitted to conspiring with U.S. taxpayers to hide over $5.6 billion from the Internal Revenue Service. The bank will pay about $122.9 million in restitution and penalties as part of an agreement with prosecutors.

Gold climbs as US dollar, bond yields slip - The Business Times

Gold prices rose as the US dollar and Treasury yields fell. Investors are slightly paring bets for an interest rate cut by the US Federal Reserve in the first quarter of 2024. Spot gold was up 0.4 per cent at US$2,037.29 per ounce by 0328 GMT. US gold futures for February delivery rose 0.7 per cent to US$2,055.50.

Global Market Commentary

Overview

Despite limited news and data, US yields and the USD recovered some of Friday’s steep falls. US equities slipped. Today’s crowded calendar includes the RBA policy decision, Q3 balance of payments and public demand, and US November services ISM and October JOLTS jobs survey.

Currencies/Macro:

Supported by the rise in Treasury yields, the US dollar rose against all G10 currencies.

EUR/USD tumbled from 1.0880 to test 1.0805 before edging back to 1.0835 (-0.4%).

GBP/USD slipped -0.6% to 1.2635. USD/JPY rose 0.3% to 147.25.

NZD/USD retraced from recent highs to 0.6165 (-0.7%). AUD/NZD ground down to test 1.0730.

US October factory orders fell -3.6%m/m (est. -3.0%m/m) and -1.2%m/m ex-transport.

Interest Rates:

The US 2yr treasury yield rebounded from 4.54% to 4.63%; 10yr yields lifted +6bps to 4.26%.

Fed funds rate, currently 5.375% (mid), continues to suggest unchanged policy at the next week’s FOMC meeting.

Markets priced a 60% chance of a March 2024 cut, pared from 65% on Friday, and 12bps of cuts priced into December 2024 (at 4.105%).

Credit reflected weaker sentiment with both Main CDX a bp wider at 67 and 62, but cash credit remained firm.

Europe saw 2 issuers; Rodamco’s EUR750M green deal notable in the REIT space. The US saw 8 issuers price USD9.4bn with GM’s USD3bn, 2 tranche offering the largest on the day.

Commodities:

Crude markets saw further losses despite the Saudi Energy Minister stating that OPEC+ cuts can “absolutely” be extended.

January WTI contract is down 1.44% at $73.00; February Brent contract is down 1.12% at $78.00.

Gas prices slumped to a two-month low in Europe due to low demand preserving winter inventories.

Metals gave back much of the previous day’s gains; copper was down 2% at $8,443, and aluminum slid 1.22% to $2,182.

Gold hit a record high, only to finish the day down about 2%.

Iron ore markets softened as inventory rose; January SGX contract at $128.05; 62% Mysteel index at $130.70.

Day Ahead:

Eurozone: Deflation in October’s PPI should slow (market f/c: -9.5%yr).

US: November’s non-manufacturing ISM and October’s JOLTS job openings reflect a gradual cooling in the services sector and the labor market. The final estimate of November’s S&P Global Services PMI is due for Japan, the Eurozone, the UK, and US.

The Week Ahead:

Monday:

Tuesday:

ISM Services PMI (US)

JOLTS Job Openings (US)

Wednesday:

ADP Non-Farm Employment Change (US)

Thursday:

Unemployment Claims (US)

Friday:

Average Hourly Earnings m/m (US)

Non-Farm Employment Change (US)

Unemployment Rate (US)

Prelim UoM Consumer Sentiment (US)

Investment Tip of The Day

Monitor Interest Rate Expectations: Stay informed about expectations for interest rate movements. Anticipate the impact on bond prices, stock valuations, and overall portfolio performance.