Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

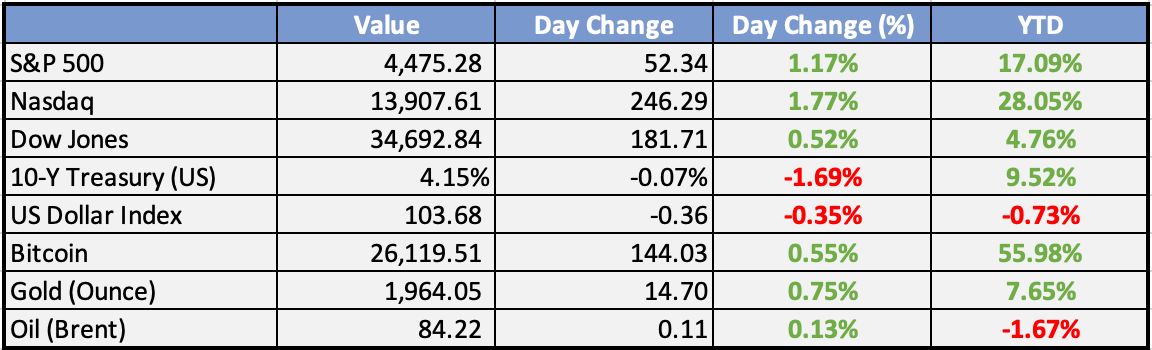

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

FG ends borrowing – Finance Minister - Vanguard

The Nigerian Finance Minister announces the end of the federal government's borrowing program. This decision aims to reduce debt and stimulate economic growth, focusing on revenue generation and prudent financial management.

NBS kicks as ex-statistician general faults new employment data - Punch

The Nigerian Bureau of Statistics (NBS) responds to criticism from a former Statistician General regarding the new employment data methodology. The NBS defends its approach, emphasizing transparency and adherence to international standards in data collection.

97% of Nigerians not insured –NAICOM – The Sun

The insurance penetration rate in Nigeria is low, with only about 3% of Nigerians being insured. This is due to a number of factors, including lack of awareness, low purchasing power, and the perception that insurance is not necessary. The low insurance penetration rate is a major concern for the Nigerians, as it leaves people and businesses vulnerable to financial losses.

Bilateral currency swap agreement with China up, running –CBN - The Sun

The Central Bank of Nigeria (CBN) has renewed its currency swap deal with China in 2021. The deal allows the CBN to draw up to 9 billion yuan, of which 6 billion yuan has been utilized and 3 billion yuan is still outstanding.

Global

OpenAI has released ChatGPT Enterprise aimed at business customers - Bloomberg

OpenAI launched a corporate version of ChatGPT with added features and privacy safeguards, including unlimited use of GPT-4, data encryption, and a guarantee that OpenAI won't use data from customers to develop its technology. The new tool is aimed at attracting a broad mix of business customers and boosting revenue from OpenAI's best-known product.

PIF’s AviLease to Buy StanChart’s Jet Lessor for $3.6 Billion - Bloomberg

Standard Chartered is selling its global aviation finance leasing business to Saudi Arabia-based AviLease for about $3.6 billion. The deal is part of a drive by Standard Chartered to streamline its operations and focus on business areas where it stands out from competitors. AviLease is a jet lessor owned by Saudi Arabia's sovereign wealth fund, the Public Investment Fund (PIF).

Google to begin selling maps data to companies building solar products - CNBC

Google is planning to license new sets of mapping data to companies to use in renewable energy products, hoping to generate up to $100 million in its first year. The company will sell access to Solar and Air Quality APIs, which could be used by solar installers, real estate companies, and utilities.

The US raises restriction concerns with China - Reuters

U.S. Commerce Secretary Gina Raimondo and Chinese Commerce Minister Wang Wentao held talks in Beijing to address concerns about restrictions on American businesses and to start exchanging information on export controls. The two countries also agreed to form a new working group on commercial issues and to convene experts to discuss the protection of trade secrets.

Weekly Investment Watchlist

Market Commentary

Asia and Australia:

Asian equities ended higher across the region Tuesday, with Hong Kong’s three high-growth sectors leading the gains.

China’s Bank of Communications to discuss repricing of existing mortgage rates.

Bloomberg consensus forecast for 2023 GDP growth shaved to 5.1% from the prior 5.2%, while 2024 was revised down to 4.5% from 4.8%.

Vietnamese exports sank for a sixth consecutive month; factory output grew for the second month; credit growth slowed again in August.

Japanese labor market unexpectedly softened - the unemployment rate was 2.7% in July, higher than consensus and the previous month’s 2.5%.

Iron ore futures on China’s Dalian exchange are trading near their highest levels since mid-March after rallying ~15% from this month’s lows.

Europe, Middle East, Africa:

European equity markets are higher. FTSE 100 outperforms as UK markets play catchup after Monday bank holiday. Basic Resources, Utilities, and Telecom lead; Construction/Materials, Healthcare, and Technology lag.

German Gfk consumer confidence weakened to -25.5 for September versus consensus -24.3 and prior revised to -24.6 from -24.4 initially reported.

Holzmann and Nagel reiterate the hawkish stance ahead of the September meeting.

UK shop price inflation hit a 10-month low in August, which may ease some of the pressure on BoE policymakers.

Unions have given notice they will initiate stoppages at Chevron’s Gorgon and Wheatstone LNG projects in Western Australia from next week and escalate the action every week after that.

French consumers massively cutting essential purchases, Carrefour CEO warns.

The Americas:

S&P Global Mobility cut its 2023 forecast for new vehicle sales by around 500K units to 15.2M. The report cited rising rates, tighter credit conditions, and high new vehicle pricing increasingly adding pressure on consumers.

JM Smucker reports a beat on EPS and miss on Revenues - this is a phenomenon will we continue to see with inflation retreating from highs lowering revenues, and cost improvements leading to still stable EPS numbers. They cited tough macro challenges but marginally raised guidance.

Best Buy posted a double beat but, barely. Comments said results were better than they expected and that this year will still remain the low point for tech and electronics demand, after the past two years of overly strong demand and pull-forward buying.

MMM board approves $6B faulty earplug settlement.

Walmart, Walgreens, and CVS introducing new care options normally available only at doctor’s offices.

The Week Ahead:

Monday:

China PBOC Interest Rate Decision

Tuesday:

US Existing Home Sales Change (MoM)(Jul)

Wednesday:

S&P Global/CIPS Composite PMI (Aug) PREL (UK)

Retail Sales (MoM)(Jun) (Canada)

S&P Global Manufacturing PMI (Aug) PREL(US)

Consumer Confidence (Aug) PREL (EU)

Thursday:

ECB Monetary Policy Meeting Accounts (EU)

Durable Goods Orders (Jul)

Friday:

GFK Consumer Confidence (Aug) (UK)

Investment Tip of The Day

Avoid leverage: Leverage is the use of borrowed money to invest. This can magnify your profits, but it can also magnify your losses. If you are not experienced, it is best to avoid leverage.