Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

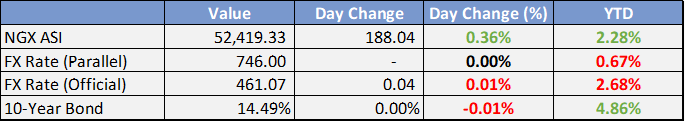

Local

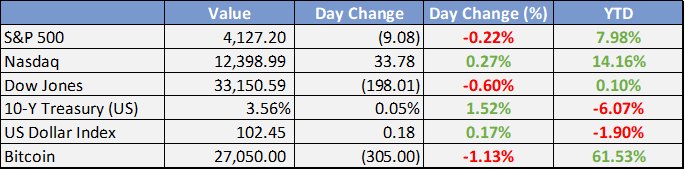

Global

*Data as of 6pm WAT

Market News

Local

FG spends N13tn on subsidy, sets removal guidelines - Punch

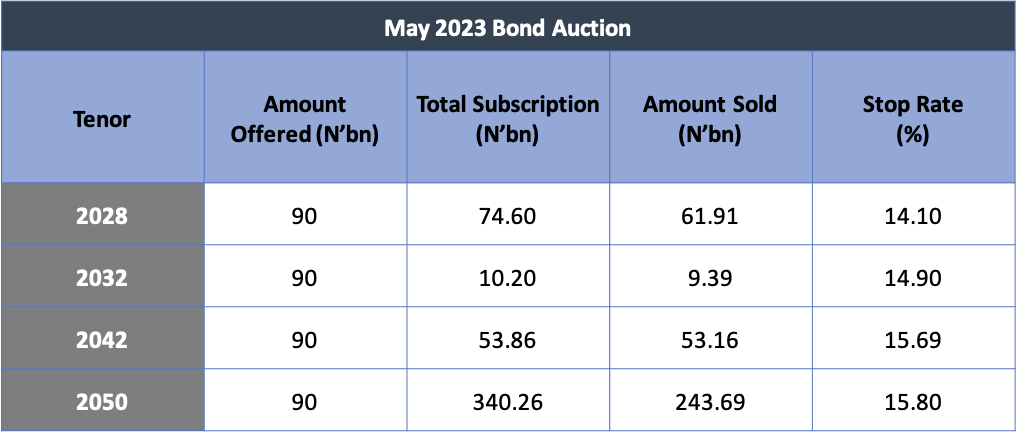

The Federal Government, on Monday, said it was developing a comprehensive guide for the incoming administration of Bola Tinubu, on how to manage the removal of subsidy on Premium Motor Spirit, popularly called petrol.Investor demand for long-dated bonds remained high in the May auction, with a subscription of N478 billion

The 2050 tenor saw the strongest demand, while other tenors had limited interest. The Debt Management Office (DMO) allocated N368.15 billion. Marginal rates increased for certain tenors compared to the previous auction. Analysts anticipate reduced buying in the secondary market due to cautious investor sentiment influenced by the April CPI rise to 22.22%.$800m Loan: World Bank Clears Air, Says Decision to Draw Down Facility Rests with Incoming Govt - This Day

Following the controversy surrounding President Muhammadu Buhari’s recent request for the National Assembly to approve an $800 million World Bank facility, the multilateral institution yesterday clarified that the loan request was not a fresh one, adding that the decision to withdraw the facility would rest with the incoming government.FG: $1.3bn Zungeru Hydroelectric Plant Completed, Ready for Inauguration - This Day

The Minister of Power, Abubakar Aliyu, has revealed that the 700 megawatts Zungeru Hydroelectric power project has been completed, stressing that the facility will be able to send power to the Transmission Company of Nigeria (TCN) soon. THISDAY learnt that the project worth over $1.3 billion, is being constructed by CNEEC and SINOHYDRO in Niger state, Nigeria.Nigeria’s N12.1trn 2023 Budget Deficit May Widen as Oil Production Shrinks by 58m Barrels in Four Months – This Day

Nigeria’s already high budget deficit of N12.1 trillion may widen in 2023, following the country’s underproduction of crude oil to the tune of 58 million barrels in the first four months of this year, THISDAY analysis of data from the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has shown.

Global

Fed officials expect interest rates to remain high, possibly rise - Reuters

U.S. central bankers on Monday signaled they see interest rates staying high and, if anything, going higher, given inflation that may be slow to improve and an economy showing only tentative signs of weakness.

Eurozone avoids a recession in Q1. Eurostat and reported that Eurozone preliminary GDP Q/Q came out 0.1% vs 0.1% expected, equivalent to 1.3% y/y vs 1.3% expected.

According to CME Group’s FedWatch Tool, markets give virtually zero (0.4%) chance that interest will remain at their current level of 5-5.25bps by the end of the year.

Yesterday, however, Fed officials pushed back on those odds.

Atlanta President Raphael Bostic said he doesn’t predict any rate cuts until “well into 2024”.

Minneapolis Fed President Neel Kashkari (who is a voting member this year), meanwhile, said the Fed still has “more work to do…to bring down inflation”.

Total consumer debt has hit a new record at over $17 trillion.

The fresh highs come despite the lowest level of mortgage originations since 2014.

For the first time in 20 years, consumers failed to pay down their credit card balances in Q1.

This suggests households are struggling under the pressure of higher prices.

Microsoft (MSFT) deal to acquire Activision Blizzard receives EU approval - WSJ

Manufacturing activity in New York collapsed to its lowest level in 4 months, falling to -31.8 in May.

Excluding the pandemic, the 42.6 drop was the largest ever.

Relative to expectations, it was the 3rd largest drop on record.

The biggest drops were seen in new orders (-53.1), shipments (-40.3), and inventories (-20.5).

Was April’s 10.8 reading a false breakout

US Securities and Exchange commission is not considering a ban on short-selling - Bloomberg

The US is planning to buy up to 3 million barrels of sour crude oil in August to restock its Strategic Petroleum Reserve (SPR).

The government drained the SPR by 2.9 million barrels last week.

At ~372 million barrels, reserves are currently at the lowest level since 1983.

Weekly Investment Watchlist

The Week Ahead:

Monday: US NY Empire manufacturing comes in at -31.8; est: -4.0.

Tuesday: Retail sales, industrial & manufacturing production, business inventories, NAHB housing market index

Wednesday: Building permits, housing starts

Thursday: Initial jobless claims, Philly Fed manufacturing, existing home sales, CB leading index

Friday: Powell speech

Investment Tip of The Day

Putting all your money into one investment or asset class can be risky because if that investment underperforms, you could lose a significant amount of money. Instead, consider diversifying across multiple investments to reduce your risk and increase your chances of achieving your investment goals.