Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

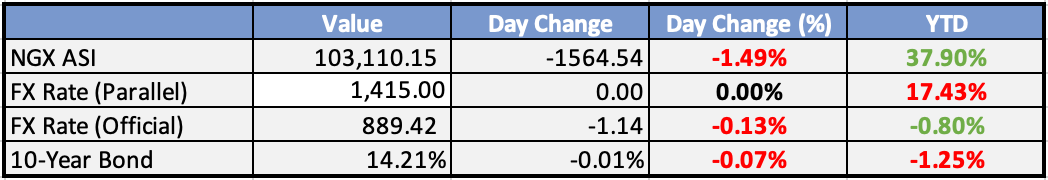

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

United States Commits $9.5m to Drive Food Production in Africa - This Day

US grants $9.5 million to boost Africa's food production through AfDB's TAAT initiative, aiming to double crop yields and feed millions by 2025. Both US and AfDB officials optimistic about Africa's potential to become food secure and even export food globally.

Global

Neuralink implants brain tech in human patient for the first time - CNBC

Neuralink successfully implanted its brain-computer interface in a human for the first time, aiming to help paralyzed patients control devices with their minds. The company sees potential for communication, social media access, and surpassing typing speed for people with severe conditions like ALS.

Singapore Investment Pledges Almost Halved to $9.5 Billion - Bloomberg

Singapore's 2023 investment commitments fell from record highs but remained above long-term goals, offering confidence despite a challenging global outlook. Job creation expected across service, R&D and manufacturing sectors. Future outlook cautious due to global uncertainties.

Market Commentary:

Overview

US and European bond yields declined due to dovish ECB comments and reduced US borrowing projections. US stocks closed at a record high. Key events today include: Eurozone Q4 GDP, and US January consumer confidence.

Currencies/Macro:

The US dollar had mixed performance, with EUR/USD falling from 1.0845 to 1.0796 amid dovish ECB commentary.

GBP/USD remained choppy but ultimately little changed around 1.2710.

USD/JPY followed the decline in US yields from 148.20 to 147.50.

In the US, the January Dallas Fed manufacturing survey fell to -27.4 (est. -11.0, prior -9.3), driven by a decline in the production component to a low since mid-2020.

ECB officials hinted at rate cuts, expressing optimism about the evolution of inflation.

Interest Rates:

The US 2yr treasury yield fell from 4.35% to 4.31%, and the 10yr yield fell from 4.14% to 4.08%.

Markets anticipate the Fed funds rate, currently 5.375%, to remain unchanged on February 1, with a 40% chance of a cut in March.

Markets expect the RBA cash rate to be unchanged on February 6, with a 75% chance of a cut in August.

Credit was mixed, with Main slightly wider at 58.5, and US IG cash giving up 1-2bp. CDX moved half a bp better at 54, following a late move in rates markets.

Commodities:

Crude markets showed signs of profit-taking on supply and overbought conditions. The March WTI contract is down 1.4% at $76.91, and the March Brent contract is down 1.3% at $82.46.

In gas markets, an outage at Freeport Energy in the US will see one of three production units out of action for about a month.

Metals had mixed performance, with copper up 0.4% at $8,578, aluminium down 1% at $2,251, and nickel falling 1.9% to $16,470.

Iron ore markets were mixed, with the March SGX contract down $1.75 at $135.00, while the 62% Mysteel index is up $1.80 at $137.85.

Day Ahead:

US

In the US, the November S&P/CS home price index and the Conference Board's January consumer confidence index are due.

The December JOLTS job openings are also expected to point to a balanced labor market.

The Week Ahead:

Monday:

Tuesday:

CB Consumer Confidence (US)

JOLTS Job Openings (US)

Wednesday:

ADP Non-Farm Employment Change (US)

Employment Cost Index q/q (US)

Federal Funds Rate (US)

Thursday:

Unemployment Claims (US)

ISM Manufacturing PMI (US)

Friday:

Average Hourly Earnings m/m (US)

Non-Farm Employment Change (US)

Unemployment Rate (US)

Revised UoM Consumer Sentiment (US)

Investment Tip of The Day

Stay Mindful of Political Gridlock Risks: Political gridlock can impact policy implementation. Assess the potential risks and opportunities for your investments in periods of political deadlock.