Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

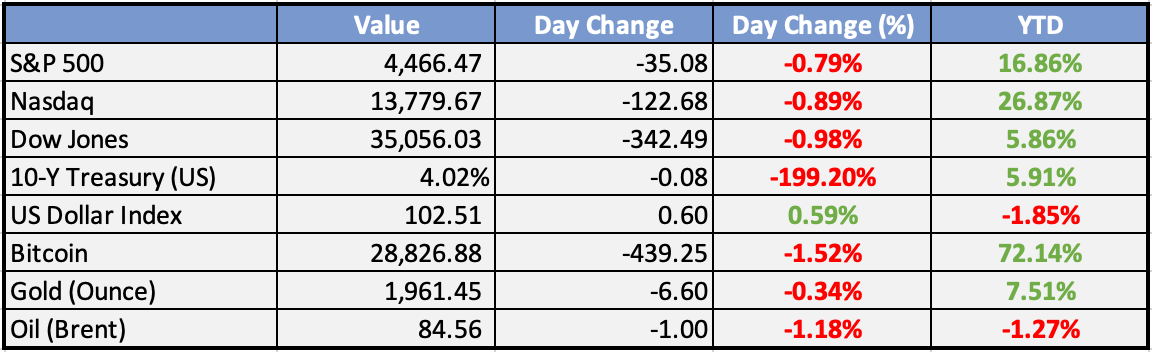

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Tax reforms: FG moves to stop taxes on tomatoes, raw food items soon - Nairametrics

The Chairman of the Joint Tax Board (JTB), Mr. Muhammad Nami, says that the Federal Government has concluded plans to stop taxes on tomatoes and other raw food items as soon as possible.

NNPC Plans CNG Deployment by Q4, 2024 - This Day

The Nigerian National Petroleum Company Limited (NNPC) and NIPCO Gas Limited, have disclosed a plan to ramp up the first phase of the Compressed Natural Gas (CNG) penetration plan in Q1, 2024.Restoration of 3000 hectares of shorelines in Ogoniland begins with 10 million mangrove seedlings to be planted - Nigeria Business News

The Hydrocarbon Pollution Remediation Project, HYPREP, has disclosed that it has begun the restoration of over 3000 hectares of degraded shorelines in the ongoing cleanup project of Ogoniland

Global

Alphabet dumps more than 90% of its stake in Robinhood - CNBC

Google parent Alphabet has pared back large positions in multiple publicly traded firms, including the trading platform Robinhood, 23andMe and Duolingo.

PayPal Launches a Stablecoin in Latest Crypto Payments Push - Bloomberg

PayPal Holdings Inc. is rolling out a stablecoin, the first by a large financial company and a potentially significant boost to the sluggish adoption of digital tokens for payments

July jobs report: U.S. payroll growth totaled 187,000, lower than expected - CNBC

Nonfarm payrolls expanded by 187,000 for the month, slightly below the Dow Jones estimate for 200,000. Though the headline number was a miss, it actually represented a modest gain from the downwardly revised 185,000 for June.

Weekly Investment Watchlist

Market Commentary

Asia and Australia:

Asian equities ended Tuesday with a mixed performance, notably with more underperformance seen in Hong Kong. Hang Seng was dragged lower by property stocks, and mainland real estate names also underperformed.

China-based property developer Country Garden announced that it had missed payments on two dollar bond coupons worth a combined $22.5 million due on Tuesday. This raises concerns for the Chinese property market and the broader economy, as stimulus measures are not taking effect swiftly enough.

China’s exports fell by 14.5% YoY in July, worsening from the 12.4% drop in the previous month and marking the weakest performance since February 2020. A significant surprise was a 12.4% contraction in imports, following a 6.8% decline in June. The decline in US-bound shipments by 23.1% led to double-digit declines across much of Asia.

In Japan, real wages decreased by -1.6% compared to -0.94% the previous month. Real household spending fell to -4.2% YoY, worse than expectations of a -3.8% decline and following a -4.0% drop in May. These numbers suggest that easing measures will likely continue.

Corporate bankruptcies in Japan surged by 53% YoY in July, marking the fastest pace since early 2020 and the first back-to-back increase in about 23 years.

Europe, Middle East, Africa:

European equity markets experienced declines and were trading near their worst levels. Banks were under pressure due to an Italian banking tax and Moody’s downgrades of US small/mid banks.

Italy surprised markets with a 40% windfall tax on profits for domestic lenders, which rattled Europe’s banking sector.

Germany reported that consumer prices increased by 0.3% MoM in July, in line with expectations and unchanged from June. This translates to 6.2% YoY, in line with expectations, and down from 6.4% in June.

ECB consumer inflation expectations for the next 12 months declined to 3.4% in June from 3.9% in May.

BoE’s Pill noted that UK inflation persistence is due to imported goods prices.

Ukraine announced its intention to target Russian ports and cargoes on the Black Sea, increasing risks in the region.

The Americas:

Moody’s lowered credit ratings on ten small and midsize banks and warned that it may downgrade US Bancorp, Bank of New York Mellon, State Street, and Trust. This was due to higher funding costs, potential regulatory capital issues, and risks related to exposure to commercial real estate (CRE) and softening demand for office space.

Meta (formerly Facebook) shifted its focus from blue-sky research to revenue-generating commercial AI projects.

US Treasuries faced a test from $103 billion in auctions scheduled for the week.

UPS cut its FY23 revenue guidance by around 4% and operating margin guidance by 100 basis points. This was attributed to macro uncertainty, dampened pricing power, and sticky wage pressures, which raised concerns about consensus expectations for an earnings recovery starting in the second half of the year.

The Week Ahead:

Monday:

Tuesday:

Exports (China)

Wednesday:

Consumer Price Index (China)

Thursday:

Consumer Price Index (US)

Economic Bulleting (EA)

Monthly Budget Statement (US)

Friday:

Gross Domestic Product (US)

Consumer Price Index (France)

Producer Price Index ex. Food & Energy (US)

Michigan Consumer Sentiment Index (US)

Investment Tip of The Day

Research tax-efficient investment strategies Explore tax-efficient investment strategies to minimize your tax liability. This may include tax-loss harvesting, maximizing contributions to tax-advantaged accounts, or investing in tax-efficient funds. Consult with a tax professional for personalized advice.