Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

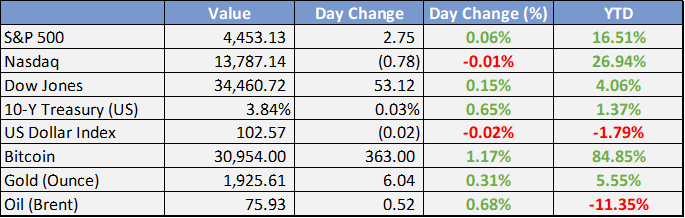

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

IPMAN denies plan to further hike petrol price to N700/litre - Nigeria Business News

The Independent Petroleum Marketers Association of Nigeria denies plans to raise petrol prices to N700 per litre, urging the public not to panic. Civil Society Organizations vow to resist the alleged increase.

FG targets N12bn from new vehicle tax – Punch

The Nigerian government aims to generate approximately N12 billion annually from the N1,000 Proof of Ownership Certificate verification fee imposed on motorists. The certificate is intended to enhance vehicle registration and combat car theft, with an estimated 11.76 million vehicles in Nigeria as of Q2 2018.

N5 billion rice contract launched on commodities exchange - The Guardian

Lagos Commodities and Futures Exchange (LCFE) has launched the N5 billion series one of N30 billion Eko Rice Contract to boost agriculture in Nigeria. The forward contract aims to create a market for rice spots and futures derivatives, standardize products, and support small suppliers.

Global

In a 6-3 vote, the Supreme Court has shot down President Biden’s plan to cancel student loan debt.

At ~$430 billion, the plan would have been among the most expensive executive acts in US history.

According to Morgan Stanley, only 29% of roughly 40 million Americans holding student loan debt totaling $1.8 trillion debt are confident they can start making payments without adjusting in other areas.

Some 34% say they can’t make payments at all.

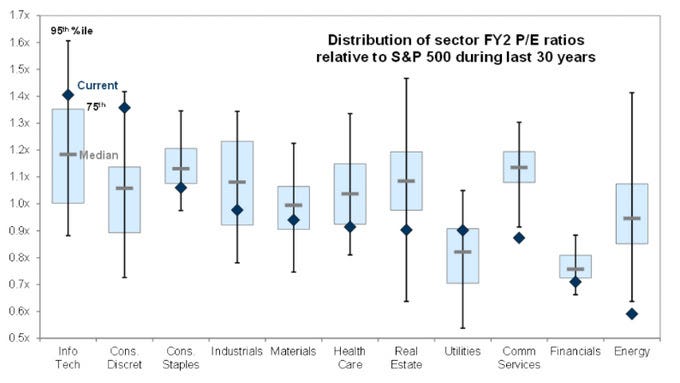

The first half of the year is in the books–here were its biggest winners and losers:

Winners: Technology (+40%), Communication Services (+36%), and Consumer Discretionary (+32%).

Losers: Utilities (-6%), Energy (-5%), and Healthcare (-2%).

In terms of valuations, most sectors are relatively cheap compared to their long-term medians.

The exceptions are two of the year’s leaders (Tech and Discretionary)

Weekly Investment Watchlist

Market Commentary

Asia and Australia

China Caixin manufacturing PMI in expansion for second straight month, while growth slows; Caixin manufacturing PMI was 50.5 in June, versus consensus 50 and 50.9 in May, indicating a marginal expansion in factory activity.

BoJ’s Tankan Metrics: Headline business conditions index for large manufacturers was 5 in June, above consensus 3 and follows 1 in March. Broadly confirms the first improvement in seven quarters.

RBA decision will be a close call with economists split on whether central bank will hike by 25 bp or hold.

PBoC announcement places Pan Gongsheng in line to be next bank governor

China is on track to become world's top LNG importer in 2023.

Europe, Middle East, Africa

OPEC+ producers ****hold their monthly meeting as Saudi Arabia's voluntary production cut takes effect from this month. Saudis extend voluntary production cut to August.

Eurozone final manufacturing PMI revised lower after Italian and Spanish updates; revised lower to 43.4 versus 47.7 consensus and prior 43.2.

EU gas prices rally in June despite consumption cuts, but shortages unlikely this winter

The UK labor market is still showing signs of tightness, which might make the BoE's inflation fight more difficult.

The Americas

Tesla announces record 466K deliveries in Q2, beating 445K estimates.

Apple forced to make major cuts to Vision Pro headset production plans on manufacturing problems.

Goldman Sachs in talks to move its Apple financial products business to American Express.

10Y Treasury pushing back toward 4% despite best bond investor sentiment in a decade.

PE firms warn new US antitrust rules could delay deals.

Investment Tip of The Day

Monitor geopolitical risks: Stay informed about geopolitical risks that can impact the global economy and financial markets. Monitor geopolitical events, such as political tensions, trade disputes, or changes in government policies, and evaluate their potential implications for your investments.