Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

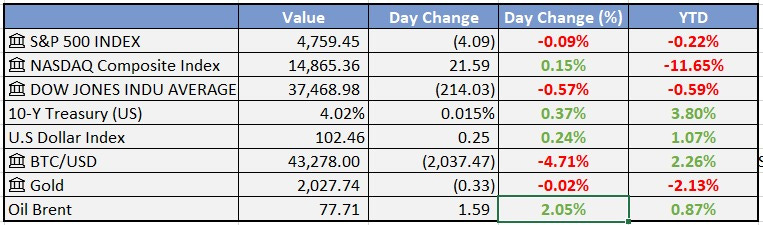

Market Data

Local

Global

x*Data as of 4pm WAT

Market News

Local

FG to sell Kaduna power distribution firm over N110bn debt - Business News Report

Nigeria's Kaduna electricity company to be sold due to $130 million debt and failed turnaround. Struggling utility, one of 11 in the country, will see assets auctioned off as regulator appoints interim management. Millions in Nigeria rely on private generators for power due to insufficient national production.

Access Bank Zambia Limited Completes Acquisition of Atlas Mara - Access Bank

Access Bank merges with Atlas Mara Zambia to become Zambia's top 5 bank, promising expanded banking services, broader network, and enhanced focus on SMEs and digital banking. Both banks remain operational until fully integrated, creating one of the country's leading financial institutions.

Nigeria Boosts Oil Production Output As OPEC’s Remain Steady - Leadership

OPEC production held steady in December, with Nigeria's increase offsetting cuts from other members. Expect output to drop in January as OPEC+ implements further cuts to prevent a surplus and protect declining prices. Saudi Arabia and UAE lead the reductions, while Angola's withdrawal reflects years of underinvestment.

Dangote set for production as crude supply hits 6million barrels - Punch

Nigeria's massive Dangote refinery finally received its final crude oil batch, signaling imminent production start and promising to end fuel shortages in Nigeria and beyond. The world's largest single-train refinery will churn out gasoline, diesel, and more, aiming to fulfill all of Nigeria's fuel needs and even have a surplus for export.

Global

US small business sentiment up, but labor, inflation worries persist - Reuters

Small business optimism ticked up for the first time in months, but high labor costs, persistent inflation, and economic uncertainty continue to dampen owner confidence. Despite a slight improvement, outlook remains gloomy with inflation still top concern and expectations for future conditions mostly negative.

Hewlett Packard Enterprise nears $13 billion deal to buy Juniper Networks - source - Reuters

Tech giant HPE in talks to acquire networking company Juniper Networks for $13 billion, potentially boosting HPE's AI offerings with Juniper's networking expertise. Deal could be announced soon, sending Juniper shares soaring while HPE dips.

Cryptoverse: Bitcoin derivatives traders bet billions on ETF future - Reuters

US crypto market braces for potential Bitcoin ETF approval this week, fueling derivatives trading and investor anticipation. Open interest surges to near-record levels, but bumpy road ahead with potential price swings depending on SEC decision and profit-taking.

Market Commentary:

Asia and Australia

Asia-Pacific region mostly moved lower on Monday, with Japanese markets closed for a holiday.

China's Shanghai Composite Index slumped by 1.4%, while Hong Kong's Hang Seng Index plunged by 1.9%.

Indian shares gave up early gains on Tuesday, ending flat despite strong global cues and a previous tumble in oil prices.

S&P BSE Sensex breached the 72,000 mark before ending up 31 points at 71,386.21.

NSE Nifty index settled 32 points higher at 21,544.85 after reaching a high of 21,724 earlier.

Adani Enterprises, Apollo Hospitals Enterprise, SBI Life, Adani Ports, and Hero MotoCorp jumped 2-3%, while HDFC Life, Nestle India, Bajaj FinServ, and Britannia Industries fell around 1%.

Zee Entertainment Enterprises slumped 8%, clarifying baseless and factually incorrect reports on the proposed Sony-Zee merger.

Rupee traded higher, and oil rebounded nearly 2% after a 4% slump in the previous session.

Europe, the Middle East, and Africa:

Major European markets closed higher; U.K.'s FTSE 100 edged up 0.06%, Germany's DAX climbed 0.74%, France's CAC 40 advanced 0.4%, and the pan-European Stoxx 600 gained 0.38%.

European stocks traded lower on Tuesday after opening higher due to expectations for Fed rate cuts and a soft landing for the world's largest economy.

Reversed gains as Germany's industrial production unexpectedly declined in November, marking the sixth consecutive monthly fall.

French trade deficit narrowed more-than-expected in November to EUR 5.9 billion.

Pan-European STOXX 600 down 0.2% at 477.38 after rising 0.4% on Monday.

German DAX and France's CAC 40 both slipped 0.2%, while the U.K.'s FTSE 100 was down 0.1%.

German insurance giant Munich Re dropped half a percent after sharing an update on the cost of natural disasters in 2023.

The Americas:

U.S. stocks ended positively on Monday, with the Nasdaq outperforming thanks to robust buying in the technology sector.

Drop in bond yields and optimism about the outlook for stocks, despite recent uncertainty about near-term interest rate cuts.

Dow up 216.90 points (0.58%) at 37,683.01; S&P 500 climbs 66.30 points (1.41%) to 4,763.54; Nasdaq gains 319.70 points (2.2%) at 14,843.77.

Boeing shares weigh down Dow, falling 8% after FAA orders airlines to ground dozens of 737 Max 9 aircraft.

American Airlines climbs over 7%; chipmaker Nvidia rallies more than 6%; Intel and Advanced Micro Devices Inc climb about 5.5%.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

Thursday:

Core CPI m/m (US)

Unemployment Claims (US)

Friday:

GDP m/m (UK)

Core PPI m/m (US)

Investment Tip of The Day

Stay Cautious of Earnings Manipulation: Scrutinize financial statements for signs of earnings manipulation. Companies engaged in such practices can pose heightened investment risks.