Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

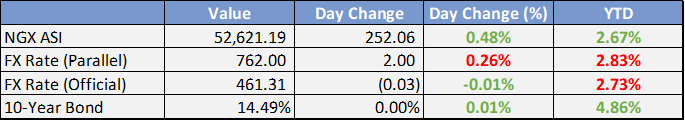

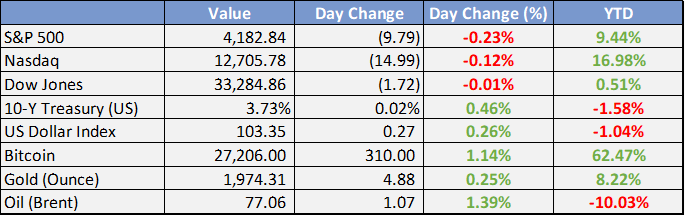

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Dangote refinery petrol hits market July, FG to save N7tn - Punch

The Dangote Refinery in Nigeria, the world's largest single-train petroleum refiner, could save the Federal Government about N35tn in fiscal expenditure over the next five years. The refinery aims to eliminate import dependency and meet the nation's demand for higher quality petroleum products.

FG begins shutdown of unlicensed fuel marketers - Punch

From June 1, 2023, unlicensed petroleum product dealers in Nigeria will be prohibited from loading products, with the government planning to shut down non-compliant businesses. The Nigerian Midstream and Downstream Petroleum Regulatory Authority emphasized the need for a license, stating "no license, no loading."

Expectations high as MPC meets to take interest rate decision - The Sun

The Central Bank of Nigeria's Monetary Policy Committee (MPC) will decide on interest rates after their meeting, with expectations of a modest rate hike of 50 basis points. The previous meeting saw a 50 basis points increase to curb inflation and align with global trends.

Global

Europe’s energy market still challenged, says IEA - Punch

Europe has reduced its reliance on Russian oil and gas but still faces energy challenges, according to the International Energy Agency. While energy markets have transformed and Russian gas share decreased, Europe must address energy security, emissions, and potential winter crises.

President Biden and House Speaker McCarthy met again last night to continue debt ceiling discussions.

No deal was struck but both admitted the evening’s talks were productive, with the Speaker calling them “better than any other” thus far.

The meeting followed another letter from Janet Yellen who once again warned the Treasury was “highly likely” to run out of cash by early June.

Meanwhile, Treasury markets are discounting at least some chance of a default: yields on 1-, 2-, 3-, 4-, and 5-month T-bills are now all higher than the Fed funds rate.

Four Fed presidents spoke yesterday—here’s what they said:

St. Louis’ James Bullard was the most hawkish, backing 2 more rate hikes this year to fight inflation.

San Francisco’s Mary Daly expressed the need for caution, declining to commit one way or another.

Atlanta’s Raphael Bostic advocated for a pause amid emerging tightness.

Richmond’s Thomas Barkin remains unconvinced inflation has been defeated and declined to “prejudge” the June decision.

Market probabilities for a pause next month are currently hovering around 80%.

America’s biggest bank, JPMorgan, held its investor day yesterday–here are some highlights:

CEO Jamie Dimon did his best Jordan Belfort impression, declining to offer a timeline about when he might be stepping down.

Expecting a boost from its First Republic acquisition, the bank raised its net interest income forecast to $84 billion from $81 billion.

Investment banking and trading, on the other hand, is expected to decline 15% YoY.

Dimon warned commercial real estate loans were likely to create problems for some banks.

Saudi Energy Minister Prince Abdulaziz issued a warning to short-sellers:

“I keep advising them that they will be ouching”

OPEC+ is set to meet on June 3-4 to discuss production policy for the second half of 2023.

Will the alliance make another surprise cut to production similar to April’s move?

Weekly Investment Watchlist

Market Commentary

Asia and Australia

Japan manufacturing PMI returns to growth, services expands at fastest pace on record

Samsung and SK Hynix May Benefit From China's Micron Ban

Europe, Middle East, Africa

Eurozone flash Composite PMI declined more than expected in May to 53.3 vs 53.5 expected and 54.1 prior. Reason is the disappointing performance in manufacturing, which posted the 11th straight contraction at 44.6 vs 46 expected, the lowest since May 2020

BoE paper says QE portfolio may be cut in half to £400B

Latest UK PMI sees activity slow from April's one year high

The Americas

Biden and McCarthy met to discuss debt ceiling, talks described as "productive”; Yellen reiterates highly likely US will run out of cash as early as 1-Jun

Fed survey shows deterioration of consumer financial health from elevated inflation

Fed members still discussing the possibility of a rate hike

The Week Ahead:

Monday: Fed talk - Bullard, Barkin, Bostic, Daly

Tuesday: Redbook, S&P Global flash PMIs, new home sales, Richmond Fed manufacturing, API crude oil stock change

Wednesday: FOMC minutes

Thursday: Initial jobless claims, GDP growth, pending home sales

Friday: Core PCE, personal income & spending, durable goods orders, Michigan consumer sentiment

Investment Tip of The Day

Your risk tolerance may change over time due to various factors. It's important to reassess it periodically and adjust your investments accordingly to ensure they align with your comfort level.