Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

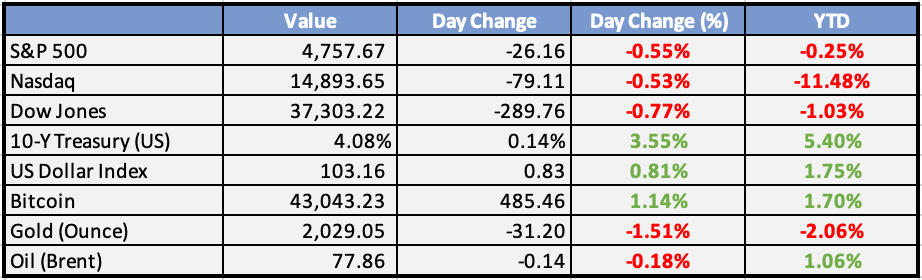

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

NNPC Retail, MRS, OVH Energy, Total Nigeria Plc others register as distributors of Dangote refinery products - BNR

11 Plc, Conoil Pl, Ardova Plc, MRS Oil Nigeria Plc, OVH Energy Marketing Limited, Total Nigeria Plc and NNPC Retail are the seven oil marketers that have registered as distributors of Dangote Refinery products.

NNPC shops for operators of Port Harcourt oil refinery - BNR

Nigeria National Petroleum Limited, NNPC Ltd is shopping for an operator for the Port Harcourt oil refinery in the Niger Delta, which is expected to begin production in the first quarter of this year, the company said.

Nigeria requires $80bn investments for Agenda 2050, says minister - Punch

The Minister of Budget and Economic Planning, Sen. Atiku Bagudu said Nigeria needs at least $100bn in investments to achieve Nigeria Agenda 2050, with over 80 per cent expected from the private sector.

How Oil Output from Addax-operated OMLs Fell from 130,000bpd to 7,000bpd Amid OPEC Deficit - This Day

Production from assets operated by Addax Petroleum slumped massively from 130,000 barrels per day to 7,000bpd amid disagreements with the federal government, a new document released by the Nigerian National Petroleum Company Limited (NNPC) has revealed

FG issues 13 new power generation, distribution licences - Punch

The Federal Government through the Nigerian Electricity Regulatory Commission has issued 13 new licences for the generation of off-grid and embedded power, independent electricity distribution, as well as for the trading of electricity.

Global

US lawmakers reach $78bn tax deal for businesses, families - Reuters

US lawmakers struck a $78 billion bipartisan deal offering tax breaks for businesses and families, including expanded Child Tax Credit, boosted housing credit, and company deductions. The deal faces Senate and House approval, aiming to avert government shutdown and keep agencies funded.

Market Commentary:

Overview:

The US dollar firmed slightly during an otherwise quiet trading session as the US observed a holiday. ECB officials continued to push back on rate cut speculation. Today’s calendar includes UK November average earnings, and a speech by Fed governor Waller.

Currencies/Macro:

The US dollar rose against most G10 FX on the day. EUR/USD ranged between 1.0934 and 1.0968, while GBP/USD slipped -0.2% to 1.2730.

Eurozone industrial production in November fell -0.3%m/m (as expected) and fell -6.0%y/y (est. -6.8%y/y).

German (preliminary) GDP in 2023 fell -0.3% (also -0.3%q/q for Q4) but narrowly escaped a technical recession due to Q3 being revised to flat q/q (from -0.1%q/q).

The 2023 preliminary budget deficit ratio to GDP scraped in at -2.0% (est. -2.3%) from -2.5% in 2022.

ECB officials Nagel (Germany) and Holzmann (Austria) both said that it was too early to consider any discussion of rate cuts.

Interest Rates:

The US treasury market was closed for the holiday. German 2yr government bond yields rose from 2.54% to 2.60%, while the 10yr yield rose from 2.20% to 2.23%.

Credit spreads were a touch weaker on a quiet session for secondary credit. Main was a basis point wider at 61, and EUR cash credit marked 1-2bp wider.

Commodities:

Crude markets dipped again despite continued extreme cold in the US and a further deterioration in the situation in the Red Sea. The February WTI contract is down 0.25% in light holiday trade at $72.50, while the March Brent contract is down 0.1% at $78.20.

Yemeni Houthi rebels hit a US-owned commercial ship with an anti-ship ballistic missile on Monday. The world’s largest shipping association BIMCO recommended “companies avoid shipping operations in the area”.

In gas markets, Qatar announced it had paused gas shipments through the Red Sea after US-led airstrikes on Houthi targets in Yemen.

Metals were mixed with copper up 0.5% at $8,384 but aluminium down 0.88% at $2,200.

Iron ore markets pushed lower again yesterday with prices falling below $130 on rising inventory and weak steel production into the end of last year.

Day ahead:

Eurozone:

The January ZEW survey of investor and analyst sentiment for Germany is expected to show expectations still somewhat positive at +12 but the current conditions index still very weak at -77.

US:

The New York Fed’s Empire State manufacturing index for January should depict softer conditions (market f/c: -5pts). Influential Fed governor Waller will speak. He was very hawkish as rates were being raised but by Q4 23 had softened his tone notably.

The first formal votes of the 2024 US presidential primary process are cast today in the Iowa caucus, with results due late today AEDT. Former president Trump seems certain to win easily but the performance of Nikki Haley and Ron DeSantis could impact how long they stay in the race.

The Week Ahead:

Monday:

Tuesday:

US Empire State Manufacturing Index fell twenty-nine points to -43.7

UK unemployment at 4.2% in quarter to December

Wednesday:

CPI y/y (UK)

Core Retail Sales m/m (US)

Thursday:

Unemployment Claims (US)

Friday:

Retail Sales m/m (UK)

Prelim UoM Consumer Sentiment (US)

Investment Tip of The Day

Stay Cautious of Overlapping Investments: Review your portfolio for overlapping investments in similar industries or sectors. Overconcentration can amplify risks during market downturns. Diversify strategically to mitigate this risk.