Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

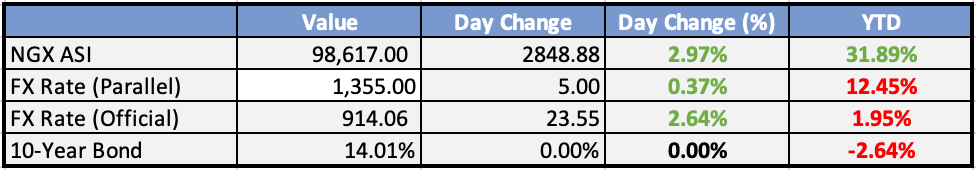

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Access Holdings to float new subsidiary - Punch

Access Holdings Company Plc has received regulatory approval to set up a consumer lending subsidiary, named Oxygen X Finance Company Limited.

FG seeks $1.5bn loans to shore up naira, boost budget - Punch

Nigeria is seeking $1.5bn aid from the World Bank to tackle the severe dollar shortage contributing to the decline of the naira.

Nigeria’s crude oil production rises to 1.4mbd (OPEC) - Punch

Nigeria’s crude oil production rose to 1.418mbpd in December 2023, a report by the Organisation of the Petroleum Exporting Countries has said.

Non-Oil export falls 24% to $4.46bn (CBN) - Vanguard

Nigeria’s Non-Oil exports earnings fell by 24 per cent, year-on-year, YoY, to $4.46 billion in nine months to September 30th 2023, defying various efforts of the government to enhance this critical source of foreign exchange.

Global

China Weighs Stock Market Rescue Package Backed by $278 Billion - Bloomberg

Chinese authorities consider $278 billion stock market rescue plan using offshore SOE funds, but investors remain skeptical due to weak economy and limited scale of the package. Market initially rose but later dipped. Global investors still wary due to property woes.

Market Commentary:

Overview:

Global stocks kept climbing on Monday, with the S&P 500 reaching another all-time high. Economic data releases were light today, but key events to watch out for include the Bank of Japan's policy decision, due later today.

Currencies/Macro:

US dollar showed little change against most majors, with commodity currencies underperforming defensive ones.

EUR/USD down 15 pips to 1.0880, GBP/USD returned to 1.2705, USD/JPY ranged between 147.62 and 148.33.

US Conference Board’s Leading Index for December rose to -0.1%, indicating improved economic conditions.

Interest Rates:

US 2yr treasury yield little changed at 4.39%, 10yr yield fell from 4.12% to 4.10%.

Markets expect Fed funds rate to remain unchanged in the next meeting, with a 35% chance of a cut in March.

Credit spreads, including Main and CDX, were little changed.

Commodities:

Crude markets tested 2-month highs on Middle East tensions and a drone attack, with WTI at $75.19 and Brent at $79.98.

Gas prices in Europe continued to decrease despite Red Sea and Baltic Sea developments.

Metals, including copper, aluminium, and nickel, remained weak, while iron ore markets saw small gains.

China instructed some local governments to halt state-funded infrastructure projects due to concerns about potential default.

Day ahead:

Eurozone:

Eurozone recovery faces headwinds in consumer confidence, with interest rates and the cost of living being crucial factors.

US:

In the US, fragility in manufacturing conditions is expected in January's Richmond Fed index.

The New Hampshire presidential primary results are due during Wednesday Sydney time.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

Flash Manufacturing PMI (UK)

Flash Services PMI (UK)

Flash Manufacturing PMI (US)

Flash Services PMI (US)

Thursday:

Main Refinancing Rate (EA)

Advance GDP q/q (US)

Unemployment Claims (US)

Friday:

Core PCE Price Index m/m (US)

Investment Tip of The Day

Stay Cautious of Overlapping Investments: Review your portfolio for overlapping investments in similar industries or sectors. Overconcentration can amplify risks during market downturns. Diversify strategically to mitigate this risk.