Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

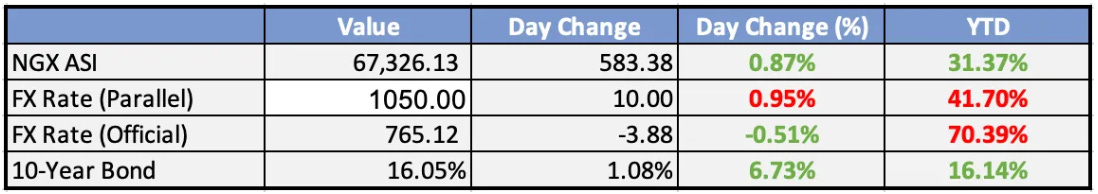

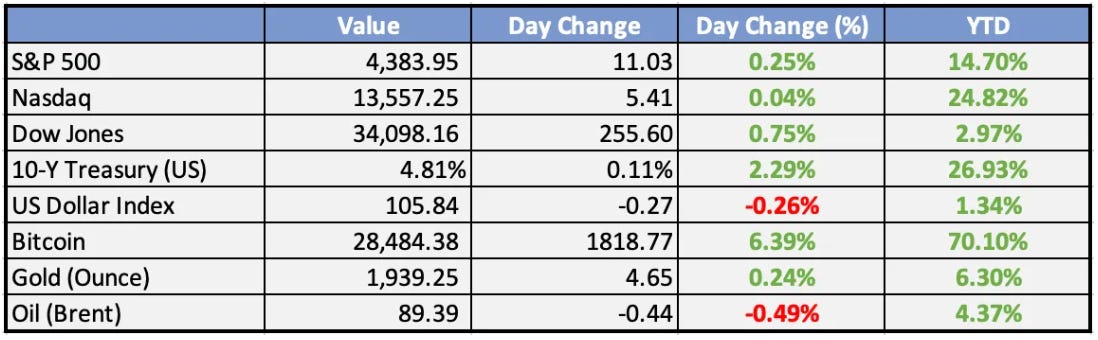

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

FG proposes N26.01trn for 2024 Appropriation - Vanguard

The Nigerian Federal Government has proposed a budget of N26.01 trillion for the 2024 fiscal year. This budget estimate was submitted to the National Assembly by President Muhammadu Buhari and it reflects an increase from the 2023 budget. The proposal aims to boost economic growth and development in Nigeria.

Nigeria’s capital importation declines by 32.90% to $1.03bn - Punch

Nigeria has experienced a significant decline in capital importation, which dropped by 32.90% to $1.03 billion. This decrease is attributed to factors like uncertainties in the global market and the persistent COVID-19 pandemic. Despite these challenges, the country is making efforts to attract more investments to stimulate economic growth and development.

Global

US business inventories increase in August - Reuters

U.S. business inventories rose by 0.4% in August, surpassing expectations of a 0.3% increase. This growth, along with rising sales, suggests inventory investment could contribute to economic growth in the third quarter. Inventories play a crucial role in the country's Gross Domestic Product (GDP).

US retail sales beat expectations in boost to third-quarter GDP growth expectations - Reuters

U.S. retail sales for September exceeded expectations, rising 0.7%, as households increased purchases of motor vehicles and spent more at restaurants and bars. This data points to expectations of an acceleration in economic growth in the third quarter, but it also raises the possibility of the Federal Reserve raising interest rates in December.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities ended mostly higher on Tuesday. Japan led gainers, reversing around half of the losses experienced on Monday. Hang Seng and Kospi were among the notable gainers, while mainland China benchmarks ended mixed, Taipei remained flat, and Southeast Asia was mostly higher. India hovered just below month-long highs, and Australia closed higher.

China’s GDP data was set to be released, with Bloomberg’s consensus forecast looking for Q3 GDP growth of 4.5% YoY, following 6.3% in the previous quarter and returning to its Q1 pace. However, general sentiment remained cautious despite some annual forecast upgrades, reflecting recent improvements.

A China Beige Book survey reported a slump in Q3 corporate borrowing to the second-lowest levels on record, going back to 2012. The report noted the weakness compared to the pre-pandemic period, despite limited impact from PBOC easing.

China’s property developer, Country Garden, faced the possibility of a default on its entire offshore debt pile unless a $15.4 million coupon payment was made by the deadline at the end of a 30-day grace period. Non-payment was likely to trigger cross defaults in other bonds, leading to one of China’s biggest corporate debt restructurings.

Japan’s 20-year JGB didn’t attract as much interest as expected, pushing rates higher. Banks and life insurance companies are typically buyers at longer tenors, as well as “income-oriented” investors. The prospect of tightening in Q1, 2024, seemed to deter demand for government bonds.

New Zealand’s Headline CPI rose 5.6% YoY in Q3, the lowest rate in two years, below consensus expectations of 5.9% and the previous quarter’s 6.0%. New Zealand had raised rates aggressively to 5.5% and held steady since June. The “higher for longer” policy appeared to be working.

Europe, Middle East, Africa:

European equity markets closed higher in choppy trade, following higher levels in Asia.

In the UK, wage data was released, an important data point as it has been driving core inflation higher. The numbers came in marginally softer than expected and prior readings. Average weekly earnings were up 8.1% YoY, slightly below consensus expectations of 8.3% and the previous 8.5%. Average weekly earnings, excluding bonuses, came in at 7.8%, down from 7.9% the previous month. While not a drastic change, a trend toward lower wage growth could indicate better inflation readings in the future, possibly prompting a pause by the Bank of England.

German ZEW economic sentiment increased in October to -1.1, surpassing the consensus of -9.3 and the previous reading of -11.4. The current situation index remained deeply negative at -79.9 but exceeded the consensus of -80.8 and the previous -79.4. The ZEW highlighted that the data indicated a bottoming out of sentiment, with a notable uptick in the economic expectations of financial market experts.

Eurozone ZEW economic sentiment data turned positive for the first time in five months, rising from -8.9 to 2.3. This data point is pre-war, so it wouldn’t be surprising if it turned negative again next month. Nevertheless, the positive change is hopeful, suggesting that the economy is poised to improve with lower inflation and likely ECB rate hike pauses.

The Americas:

The latest BofA Global Fund Manager Survey indicated that investors have turned bearish again. This shift was reflected in a 0.4% increase in the cash level to 5.3% and an increase in expectations for a hard landing, up 9% MoM to 30%.

A Deloitte survey projected a 14% increase in holiday season spending this year. While holiday spending is expected to rise compared to last year, the increase among middle-income shoppers is forecasted to be smaller due to the impact of student loans and lower wage growth. The outlook for the holiday season will be influenced by the trucking industry and inventory levels.

Johnson & Johnson (J&J) reported upbeat earnings, beating EPS and revenue expectations. EPS was $2.66, surpassing FactSet’s estimate of $2.52, and revenue was $21.35 billion, exceeding FactSet’s estimate of $21.04 billion. J&J increased its guidance marginally, with adjusted EPS in the range of $10.07 to $10.13, compared to the prior guidance of $10.00 to $10.10. Worldwide sales were up 6.8% YoY. The pharmaceutical sector, now referred to as Innovative Medicine, was up 5.1%, and excluding Covid Vaccine, it was up 5.9%. Medical devices, however, performed lower at +10%, below the expected +11.8%. J&J shares were trading higher.

Choice Hotels (CHH) announced a proposed acquisition of Wyndham Hotels (WH) for $90.00 per share in a cash-and-stock transaction. Wyndham’s shares surged by 15.7% in pre-market trading.

Bank of America also reported a double beat but barely. Q3 EPS was $0.90, beating FactSet’s estimate of $0.83, and revenue was $25.2 billion, surpassing FactSet’s estimate of $25.13 billion. The provision for credit losses of $1.2 billion increased by $336 million. Net charge-offs of $931 million increased compared to the prior year but remained below Q4-19 pre-pandemic levels. Fee earnings were lower than expected. Brian Moynihan, CEO of Bank of America, stated, “We did this in a healthy but slowing economy that saw US consumer spending still ahead of last year but continuing to slow.”

The Week Ahead:

Monday:

Empire State manufacturing index dropped -6.5 points to -4.6 in October

Tuesday:

US retail sales up 0.7% in September

Wednesday:

CPI y/y (UK)

Thursday:

Unemployment Claims (US)

Friday:

Retail Sales m/m (UK)

Investment Tip of The Day

Stay Cautious of Behavioral Biases: Continuously be vigilant against behavioral biases like loss aversion and recency bias. They can influence your investment decisions and potentially increase risk.