Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Federal government records N930 billion fiscal deficits in two months - Punch

The Central Bank of Nigeria reported that the Federal Government had a fiscal deficit of N930.8 billion in January and February 2023, with a drop in retained revenue contributing to the increase.

Mele Kyari: Private companies in Nigeria authorized to commence fuel imports from June 2023 - NairaMetrics

Nigeria will open fuel imports to private firms in June 2023 as the NNPCL shifts to cash payments. President Tinubu's deregulation plan aims to attract investments, encourage competition, and alleviate the government's financial burden.

Global

SEC Files Lawsuit Against Binance, Crypto Exchange Platform - WSJ

The U.S. SEC has sued Binance, alleging it operated an illegal trading platform and misused customer funds. Binance founder Changpeng Zhao is also named. The SEC seeks to freeze assets and appoint a receiver. Binance denies allegations and asserts user assets are safe.Abdulaziz bin Salman, said the July reduction could be extended if needed.

Leadership remains exceptionally narrow with the top 7 stocks accounting for virtually all of the S&P 500’s gains YTD.

But that isn’t stopping investors from piling into stocks: equity funds saw their biggest inflows of the year last week, including record inflows into tech funds.

Optimism is also being reflected in the use of call options, where volume reached the 6th highest on record last week with tech call options nearing levels last seen in the post-pandemic boom.

To watch: CBOE Volatility Index (VIX) is down at levels that have historically preceded a sharp reversal.

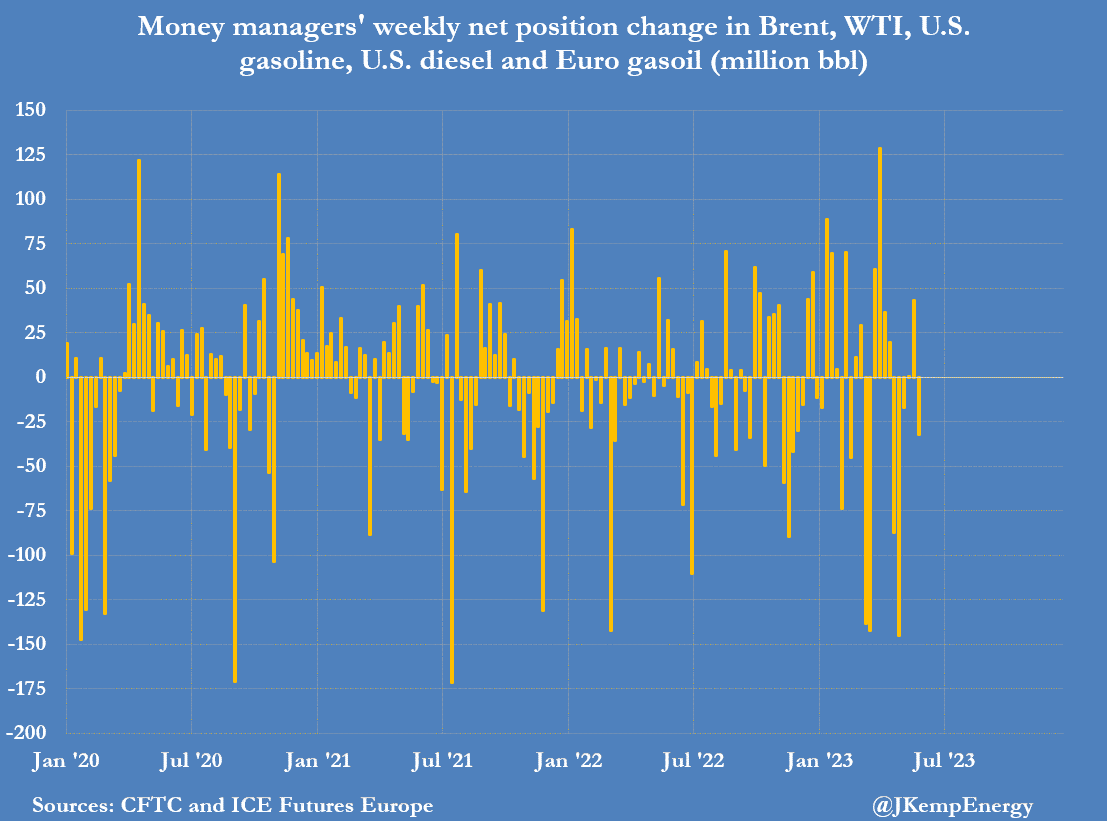

Concerns about global economic growth are outweighing the effects of Saudi Arabia’s announced production cuts.

Worries about a possible recession and the potential impact of higher interest rates are souring demand.

According to a note from Citi, these factors are likely to keep oil prices from reaching the sustained range of high $80s to low $90 Saudi Arabia would like to see.

Meanwhile, money managers are largely ignoring production cuts

Weekly Investment Watchlist

Market Commentary

Asia and Australia

Japan’s real wage growth falls for the 13th straight month by -3% and real household spending falls by -4.4% YoY. As long as real wages are not increasing and consumption is not increasing, it’s unlikely we see a policy change to tightening.

China continues to ease - Chinese authorities have asked its biggest banks to cut deposit rates for second time in 12M, marking significant ramp-up in efforts to boost economy.

China is likely to cut RRR, interest rates in H2 while monetary policy will continue to focus on structural policy tools for now

Japan crypto exchanges hit with tougher money laundering curbs

Europe, Middle East, Africa

ECB April Consumer Expectations Survey suggested inflation over next 12 months seen at 4.1% vs 5.0% prior.

Eurozone retail sales increased by 2.6% y/y in April below consensus forecast of 3.0% and below the previous reading of 3.3%.

German factory orders down for second month, adding to industry weakness

UK consumer spending slows in May amid high food prices

Construction activity a bright spot in UK economy with latest PMI data seeing activity increasing at fastest pace in three months at 51.6 versus consensus 51.1 and prior 51.5.

The Americas

Apple’s VR headset wasn’t too well received because of the price. At $3,499, the price tag is being seen as excessive. The launch date is next year. Apple also unveiled their iOS 7 and new 15-inch MacBook Air, the new Mac OS Sonoma, a new Journal app.

Property delinquencies are rising. Rark Hotel disclosed that, starting in June, the company ceased making payments towards the $725M non-recourse CMBS loan scheduled to mature in Nov-23, secured by two San Francisco hotels - the 1,921-room Hilton San Francisco Union Square and the 1,024-room Parc 55 San Francisco.

The Week Ahead:

Monday: US May ISM Services index comes in at 50.3; est 51.8.

Tuesday: IBD/TIPP economic optimism, API crude oil stock change

Wednesday: US trade deficit, EIA stocks change, consumer credit change

Thursday: Initial jobless claims, wholesale inventories

Friday: WASDE report

Investment Tip of The Day

Practice patience and avoid market timing: Trying to time the market is notoriously difficult and can lead to suboptimal investment results. Practice patience, focus on your long-term goals, and avoid making frequent changes to your investment strategy based on short-term market movements.