Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

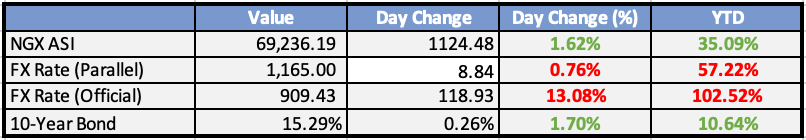

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Tinubu canvasses N2tn Discos’ recapitalisation, tariff review - Punch

Bola Tinubu is advocating for the recapitalization of Nigerian electricity distribution companies (DISCOs) to address power sector challenges. He also emphasizes the need for a tariff review to ensure fair pricing and improve the electricity distribution system. This proposal is significant in light of Nigeria's persistent power supply issues that hinder economic growth and development.

FEC Approves N2.18tr 2023 Supplementary Budget - Daily Trust

The Federal Executive Council (FEC) in Nigeria has given approval to a supplementary budget of N2.18 trillion for 2023. This additional budget is intended to address critical needs and ongoing projects, providing the necessary funds for various sectors, including infrastructure, security, and economic recovery programs.

MTN, FIRS in unending legal battle over back taxes - Business Day

MTN Nigeria and the Federal Inland Revenue Service (FIRS) remain entangled in a prolonged legal dispute over back taxes. MTN challenges the FIRS's claims, arguing that they've settled all outstanding tax obligations, while the FIRS insists on further payment. The dispute, which began in 2018, centers on issues of transfer pricing and other tax-related matters.

Naira to regain true value before December 2023 – Oyedele - Punch

Economic expert Johnson Chukwu predicts that the Nigerian naira will regain its actual value by December 2023, suggesting that this will be achieved through proper policy adjustments and measures, rather than continued interventions in the foreign exchange market.

Germany to assist in providing cheap electricity to Nigeria, other ECOWAS countries - BNR

Germany has expressed its commitment to helping Nigeria and other ECOWAS countries access affordable and sustainable electricity. This assistance aims to improve energy infrastructure, foster economic development, and support environmental sustainability in the region.

Sub Saharan Africa Mergers and Acquisition transactions totalled $14.2bn in first nine months of 2023—LSEG - BNR

Mergers and acquisition (M&A) transactions in Sub-Saharan Africa amounted to $14.2 billion in the first nine months of 2023. This indicates robust M&A activity in the region, driven by various sectors including finance, technology, and energy. The strong performance reflects a growing interest in Sub-Saharan Africa as an investment destination.

Global

US Treasury Cuts Quarterly Borrowing Estimate to $776 Billion - Bloomberg

The US Treasury reduced its estimate for federal borrowing for the current quarter thanks to stronger-than-expected revenues, offering some relief for investors concerned about the rapidly widening fiscal deficit.

Wall Street Raked in $1.7 Billion in Fees From NYC Pensions Last Year - Bloomberg

New York City’s pensions paid Wall Street money managers about $1.7 billion in fees last year, a roughly $150 million increase from the prior year.

Walmart to upgrade 1,400 stores with $9 billion investment - CNBC

U.S. retail chain Walmart on Monday said it is investing more than $9 billion over a two-year period to upgrade and modernize some U.S. stores with improved layouts, expanded product selections and new tech additions.

Pentagon awards $1.3 billion in contracts to Northrop Grumman and York for 100 satellites - CNBC

The Pentagon's Space Development Agency announced about $1.3 billion in contracts to York Space and Northrop Grumman to build communications satellites.

X says it is worth $19bn one year after Elon Musk’s $44bn acquisition - Financial Times

Social media platform X, formerly known as Twitter, has valued its equity at $19bn, the company told employees, a year after Elon Musk acquired it in a $44bn deal

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities traded mostly lower on Tuesday. The most significant losses were observed on the Hang Seng, which was impacted by poor PMI data, while mainland China benchmarks also faced downward pressure.

Battery stocks led to more substantial losses for the Kospi, and the Taiex also experienced a decline. In Southeast Asia and India, equity markets saw losses, although Australia managed to close a few points higher.

Japan, after an early dip, managed to end the day higher post a move by the Bank of Japan (BOJ).

China’s Official manufacturing PMI was 49.5 in October, below the expected steady reading of 50.2. This was due to slowing production growth, a decline in new orders, and faster-paced export reductions. Employment and finished goods inventories continued to decline.

Japan’s Industrial production declined by 0.1% month-on-month in September, against a consensus forecast of a 0.2% gain. The main drivers behind this decline were autos, general/business purpose machinery, and ceramics, while electric/IT equipment experienced a fall. Additionally, retail sales edged down by 0.1% month-on-month, also softer than the anticipated 0.2% gain, following the previous month’s 0.2% advance.

South Korea’s Industrial production rose by 1.8% month-on-month in September, contrasting with expectations of a 0.9% decline. This extended the 5.2% gain observed in the previous month. Manufacturing shipments increased more sharply, which led to inventories decreasing for the first time in three months.

Europe, Middle East, Africa:

European equity markets traded higher.

Euro Area GDP details showed 0.1% quarterly growth in France, 0.3% in Spain, and 0.5% in Belgium. However, these figures failed to offset a 0.1% quarterly slump in Germany, no growth in Italy, and contractions in Austria, Portugal, Ireland, Estonia, and Lithuania.

Regarding Euro Area Inflation, there were encouraging developments in services inflation, which was at 4.6% compared to the previous 4.7%. However, energy, food, and services prices still remained well above the ECB’s 2% target. Weaker demand is leading to an increasing momentum in the disinflation trend.

Around 40% of EU companies have disclosed their Q3 earnings results. There has been 7% earnings growth year-on-year, compared to the expected 13% decline. Energy has been the main drag, while financials have contributed positively.

UK insolvency practitioner, Begbies Traynor, reported a 46% jump in the number of construction firms in critical financial distress compared to the second quarter. Real estate businesses also saw a 38% increase in distress.

Inflation in the UK continues to ease. Shop price inflation reached the lowest level in over a year at 5.2% compared to a year earlier, down from 6.2% in September. It marks the fifth month of softer price growth and is the weakest level since August 2022. Grocery prices have been up 8.8% in the year to October, marking the sixth consecutive month of deceleration and a decrease from the 9.9% increase in September.

The Americas:

US blue-chip companies initiated a wave of bond sales on Monday, raising $22.5 billion. Borrowers are looking to sell new debt in a week filled with bond auctions, central bank meetings, and fresh economic data.

New U.S. export controls could potentially lead Nvidia to cancel approximately $5 billion in next-year orders for its advanced chips to China. Such a move could deprive Chinese tech companies of crucial AI resources.

Apple introduced new MacBook Pro and iMac computers along with three new chips to power them. The company noted that it had redesigned its graphics processing units (GPUs), which is a key part of the chip market where Nvidia currently dominates.

The World Bank has issued a warning that oil prices could jump above $100 in response to even a small disruption in crude supplies.

The Week Ahead:

Monday:

Tuesday:

Employment Cost Index q/q (US)

CB Consumer Confidence (US)

Wednesday:

ADP Non-Farm Employment Change (US)

ISM Manufacturing PMI (US)

JOLTS Job Openings (US)

Federal Funds Rate (US)

Thursday:

BOE Monetary Policy Report

Unemployment Claims (US)

Friday:

Average Hourly Earnings m/m (US)

Non-Farm Employment Change (US)

Unemployment Rate (US)

ISM Services PMI (US)

Investment Tip of The Day

Maintain Currency Diversification: If you hold investments in different currencies, maintain a well-diversified currency allocation to minimize exposure to a single currency's fluctuations.