Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

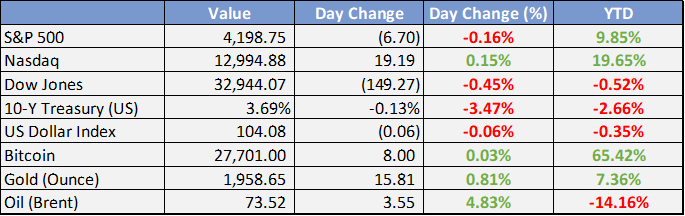

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Nigeria approves 10-Year tax break for EV manufacturers - Nairametrics

The NADDC DG has said that the government has provided a 10-year tax relief for EV manufacturers in Nigeria. This move is expected to increase investments in Nigeria’s auto sector. The NADDC in recent years has been building human and infrastructural capacity for electric vehicles.

House of Representative Raises CBN Ways and Means FGN Loan Limit to 15% - The Cable

Following the continuous violation of the 5% Ways and Means Advances ceiling stated in the CBN Act, where government advances from CBN have risen to 127.3% of the previous year’s revenue in 2018 and 177.5% in 2019. The House of Representatives has approved an amendment to the CBN Act, raising the ceiling of ways and means advances to 15%.

Tinubu, Shettima Sworn in As Nigeria's New Leaders - All Africa

Bola Tinubu has been sworn in as the 16th President of the Federal Republic of Nigeria. Kashim Shettima was also sworn in as the Vice President of Nigeria. Their oath of office was administered by the Chief Justice of Nigeria, Olukayode Ariwoola, at Eagle Square in Abuja.

Tinubu to review Buhari’s Naira redesign policy, says implementation was too harsh - The Guardian

He emphasized the need for a unified exchange rate and reducing interest rates to encourage investment and consumer purchasing. Tinubu criticized the Central Bank of Nigeria for the harsh implementation of the currency swap, which did not consider the number of unbanked Nigerians.

IPMAN opposes Tinubu subsidy removal plan, queues return - Punch

The Independent Petroleum Marketers Association of Nigeria opposes President Tinubu's plan to remove fuel subsidy by June. Tinubu argues that continuing to pay subsidies is no longer justifiable due to the high opportunity cost for the government. He intends to redirect funds to public infrastructure, education, healthcare, and job creation.

Nigeria introduces brown card for permanent residence for eligible foreign nationals - Business News Report

The Nigerian government has introduced the 'Brown Card' as a legal instrument for permanent residency for eligible foreign nationals. During a conferment ceremony, 385 foreign nationals from various countries were granted Nigerian citizenship. The Brown Card initiative received approval from President Muhammadu Buhari and the Federal Executive Council.

Global

The debt ceiling issue now has somewhat of a resolution. An initial deal was reached yesterday, and the debt ceiling suspended until 2025. A few agreements reached:

Non-defense discretionary spending roughly flat next year and rise by 1% in 2025 before caps removed in 2026.

Spending on defense and veterans will rise in-line Biden's budget request

Roughly $29B in unspent Covid aid funding was rescinded and $20B cut from IRS funding for enhanced tax enforcement.

Increased age-related work requirements from 49 to 54 for the SNAP benefit benefit programs with waivers for veterans and the homeless, but no additional requirements for Medicaid.

New rules to ease permitting around energy projects but clean energy tax incentives remain.

Persistent inflation is making the Fed’s upcoming policy decision more difficult.

The headline personal consumption expenditures (PCE) index rose by 0.4% in April while core PCE—the Fed’s preferred inflation gauge—also increased by 0.4%.

Both figures were above market expectations.

Meanwhile, “Supercore” inflation—which measures the cost of services excluding housing and energy—saw the largest monthly increase since the start of the year

Investors are treating outperforming big tech stocks as a safe haven.

Healthy balance sheets amid an uncertain economic outlook are attracting investor flows.

In the week ending May 19, stocks saw their largest inflow since October at $2.6 billion, with $2.2 billion flowing into large caps while small caps experienced net outflows.

Their dominance this year has powered the Russell 1000 (large companies) to its widest margin of outperformance over the Rusell 2000 (small companies) since 1997.

As OPEC+ prepares to meet later this week, tensions between two of its member countries are rising.

Saudia Arabia—OPEC’s de facto leader—is upset with Russia for not fully reducing its oil production as promised.

Russia meanwhile, has kept production high as it looks to maximize revenue to fund its war with Ukraine.

Oil prices are down roughly 10% from April, which is when OPEC+ first shocked the market with a surprise production cut.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

Japan's unemployment rate falls for the first time in three months, boding well for wage growth

Hong Kong banks borrow the largest amount of short-term cash from HKMA's discount window since Jan-2021

Australian building approvals drop to lowest in 11 years

Europe, Middle East, Africa

Spanish inflation slowed more than expected to nearly a two-year low in May

Eurozone M3 money supply growth continued to trend lower in April, up 1.9% y/y versus consensus 2.1% and prior 2.5% gain

Eurozone sees further signs of a slowdown in credit creation, with loans to households up 2.5% versus the prior 2.9%, while loans to non-financial firms at 4.6% from 5.2%.

The Americas

White House and GOP leaders confident they have enough votes to pass debt ceiling agreement

Wall Street lenders return to funding leveraged buyouts after a painful year in which fees were hit hard

The Week Ahead:

Monday - Markets Closed

Tuesday

9:00 am S&P Case-Shiller home price index (20 cities)

10:00 am Consumer confidence

Wednesday

8:15 am ADP employment

10:00 am Job openings

Thursday

8:30 am Initial jobless claims

8:30 am U.S. productivity

9:45 am IS&P U.S. manufacturing PMI

10:00 am ISM manufacturing

Friday

8:30 am U.S. employment report

8:30 am U.S. unemployment rate

8:30 am U.S. hourly wages

8:30 am Hourly wages year over year

Investment Tip of The Day

Inflation erodes the purchasing power of your money over time. Factor in the impact of inflation when setting your investment goals and aim for returns that outpace inflation to maintain your wealth.