Trading Tuesday - CBN Rate Cut, GDP Growth, and Global Trade Shifts Shape Investor Outlook

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. we spotlight major developments across the Nigerian financial and economic landscape from the CBN’s surprise rate cut and strong Q2 GDP growth, to the performance of NGX sectoral indices amid broader market pressures. We also bring you key global stories shaping investor sentiment, including renewed trade tensions, bond market movements, and evolving monetary policies across emerging and developed economies.

Nigerian News & Market Update

14 banks have met CBN’s new capital requirement – Cardoso:

CBN says 14 banks have met the ₦500billion recapitalisation target, showing sector resilience, and urged continued efforts while ending forbearance measures to boost stability. - Punch

CBN Reduces Interest Rate By 50 Basis Points To 27%:

The Monetary Policy Committee (MPC) eased policy by cutting rate to 27% and the Cash Reserve Ratio (CRR) to 45%, while tightening public deposit rules. It cited falling inflation and stronger reserves, with the Gross Domestic Product (GDP) growing 4.23% in Q2 2025 on industry and services. - Channels

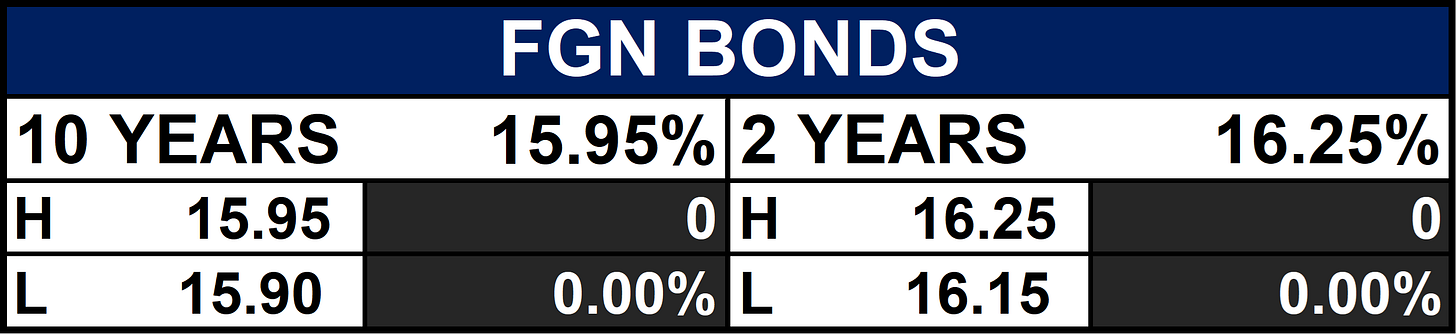

Bonds Yield Drops as Investors Increase Bets on Naira Assets:

Nigerian bonds gained as investors piled into naira assets, pushing average yields down to 16.49%. Strong demand hit 2026 maturities and T-bills yields down to 18.48%), while the Open Market Operations (OMO) yields fell sharply to 22.02%. - dmarketforces

Oil production raises GDP by 4.23%:

Nigeria’s GDP grew 4.23% in Q2 2025, boosted by oil output hitting 1.68mbpd, a four-year high. The oil sector expanded 20.46%, while the non-oil sector grew 3.64%, led by agriculture and ICT. Overall, industry grew 7.45%, services 3.94%, and agriculture 2.82%, reflecting broad recovery. - DailyTrust

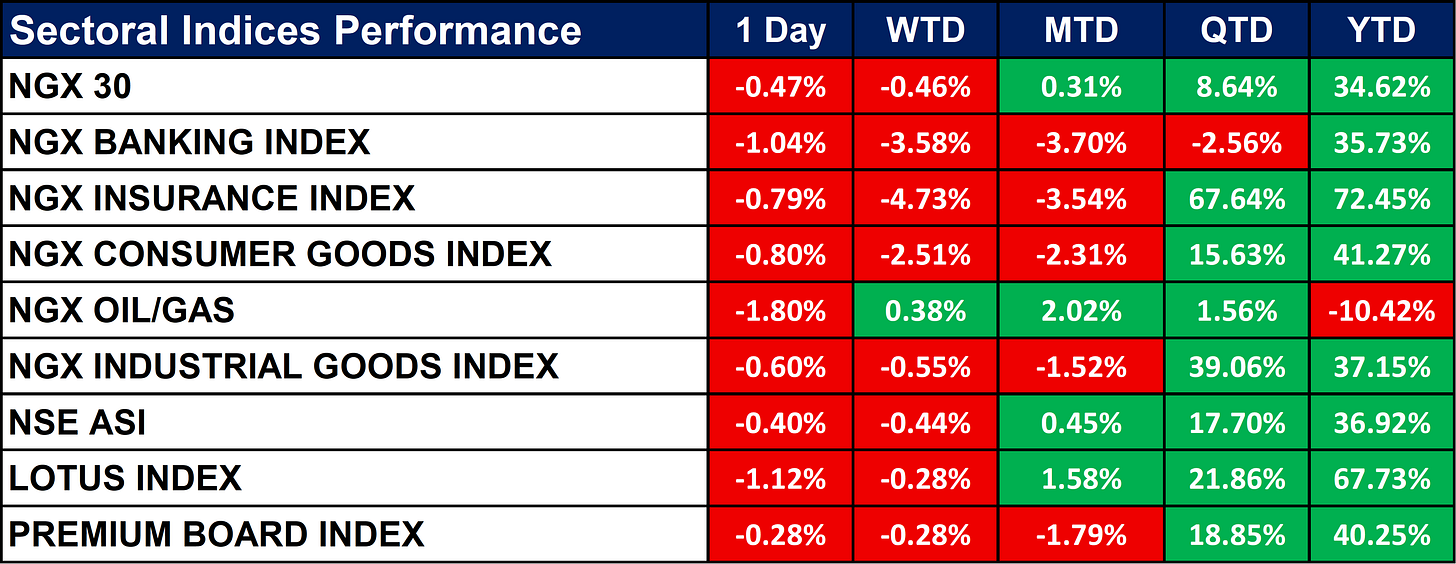

Nigeria Sectoral Indices Performance

The table below shows that the NGX sectoral indices mostly recorded negative daily and weekly performances, with only NGX Oil/Gas showing positive movement week-to-date. Despite recent declines, most indices have posted strong year-to-date gains, led by the NGX Insurance Index (+72.45%) and the Lotus Index (+67.73%). However, the NGX Oil/Gas Index remains the only one with a negative YTD performance (-10.42%).

Fixed Income (FGN Bonds)

Global News & News Update

China buys Argentine soybeans after tax drop, leaving US farmers sidelined:

China booked at least 10 Argentine soybean cargoes after Argentina scrapped export taxes, undercutting U.S. farmers during peak season. The move strengthens South America’s position as China avoids U.S. supplies amid trade tensions. - Reuters

Trump scraps meeting with Democrats, raising government shutdown risk:

Trump canceled a planned meeting with Democratic leaders over a funding dispute, raising the risk of a government shutdown after Sept. 30. The House passed a stopgap funding bill, but it failed in the Senate, leaving both parties trading blame. If unresolved, a shutdown could halt key federal services and furlough hundreds of thousands of workers. - Reuters

Argentina bonds, peso extend rally ahead of expected Trump-Milei meeting:

Argentina’s bonds and peso surged ahead of a planned Trump–Milei meeting on potential U.S. economic support. Markets rallied on hopes of aid, though uncertainty remains over whether support will come as loans, swaps, or investments. Despite recent gains, Argentina’s assets remain volatile amid political scandals and election setbacks. - Reuters

Finland's unemployment rate rises to 20-year high at 10%:

Finland’s unemployment hit a 20-year high of 10% in August, reflecting prolonged economic stagnation. Weak trade with Russia, high energy costs, and austerity measures have slowed growth and triggered layoffs. The budget deficit is projected at 4.3% of GDP in 2025, above EU limits, with debt rising to nearly 87%. - Reuters

Hungary keeps EU's highest base rate steady as inflation risks loom:

Hungary’s central bank kept rates at 6.5% to fight inflation, which is projected to stay above target into 2026. Government measures boosting consumption ahead of elections are pressuring prices, limiting scope for monetary easing.

The forint’s strength helps curb inflation, but fiscal loosening risks could force the bank to stay tight longer. - Reuters

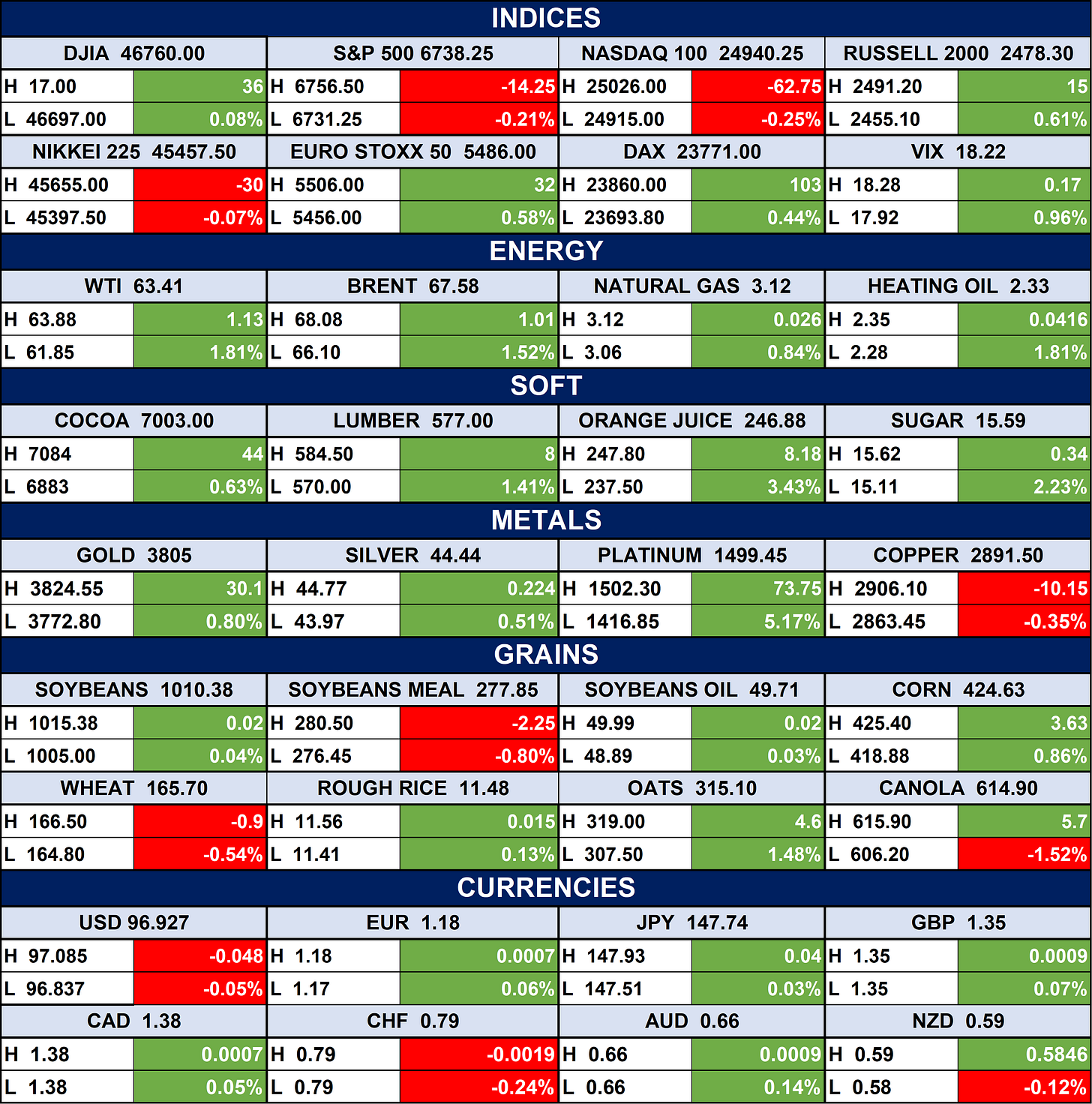

Indices, Commodities & Currencies

The table below depicts that the Global Markets mostly rose, with gains in DJIA, DAX, and Brent Crude, while S&P 500, NASDAQ 100, and Copper fell. Platinum and Orange Juice saw strong gains; Canola dropped. Currencies were steady, led by NZD; CHF edged down.

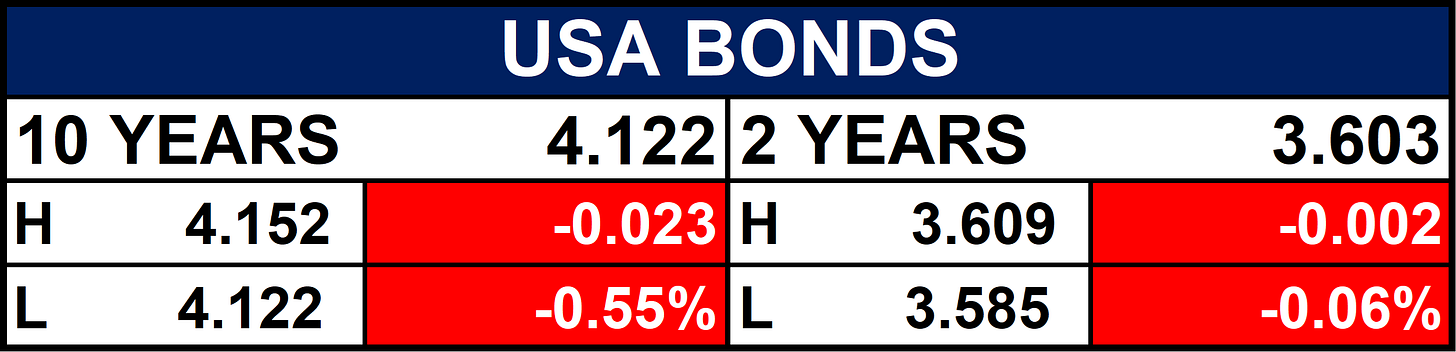

Fixed Income (USA Bonds)

Conclusion

Nigeria’s economy is improving with strong GDP growth, falling interest rates, and rising demand for local bonds. Equity markets remain mixed, urging investors to focus on resilient sectors like insurance and consumer goods. Globally, trade shifts, inflation risks, and political tensions (e.g., U.S. shutdown, China-Argentina deals) call for diversification and caution.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.