Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

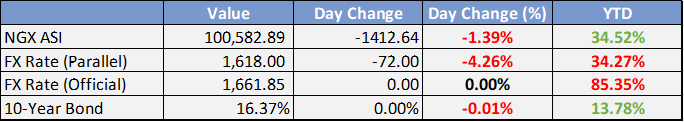

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

MPC MEETING HIGHLIGHTS

At the end of the bimonthly MPC meeting, the committee voted to:

Raise the MPR by 400 bps to 22.75%.

Change the asymmetric corridor from +100/-300 t0 +100/-700 around the MPR.

Raise the CRR from 32.50% to 45.00%

Hold the liquidity ratio constant at 30.00%.

12 years after, Tinubu adopts Oronsaye report, merges agencies - Punch

TWELVE years after it received the Stephen Oronsaye Report, the Federal Government, on Monday, approved the implementation of some of its recommendations to reduce the cost of governance. Consequently, 29 government agencies will be merged even as eight parastatals will be subsumed into eight other agencies.

Marketers await Dangote fuel, four weeks after production take-off - Punch

Oil marketers, on Monday, declared that they were still awaiting the supply of refined petroleum products from the $20bn Dangote Petroleum Refinery, four weeks after the launch of production at the multi-billion dollar plant. On January 12, 2024, Dangote refinery announced that it had commenced the production of Automotive Gas Oil, popularly called diesel, and aviation fuel or JetA1.

Ariwoola restores full complement of S’Court, inaugurates 11 judges - Guardian

The Chief Justice of Nigeria (CJN), Olukayode Ariwoola, yesterday, swore in 11 justices of the Supreme Court to fulfil the statutory 21 judges. He charged the jurists to be morally upright and discharge their duties according to the Constitution and other extant laws. Ariwoola reminded them that their inauguration marks a significant milestone for the judiciary, assuring a stronger legal system.

Foreign investors hit brakes on Nigeria over volatile naira - Business Day

Foreign investors are holding off on new investments into Nigeria until the naira finds some stability. A fresh inflow of around $700 million was expected to come but that has now been suspended as investors grow cold feet and fear losses piling over the naira volatility.

Global

U.S. New Home Sales Climb Sluggishly at Start of Year - Morning Star

Sales of new single-family homes increased by less than expected in the U.S. in January, adding to signs of a weak housing market at the beginning of the year. Here are the main takeaways from the Commerce Department report released Monday:--New home sales increased by 1.5% from the month before, reaching a seasonally adjusted rate of 661,000.

Apple Ponders Whether to Develop Smart Glasses, Fitness Ring - Bloomberg

Apple has explored the idea of developing new wearable devices — including a fitness ring, smart glasses and even AirPods with cameras — to broaden one of its most important business areas. Also: Hear the latest on a HomePod with a screen, Apple’s new Sports app, an iMessage security upgrade and the departure of a key AirPods executive.

Microsoft and Mistral AI announce new partnership to accelerate AI innovation and introduce Mistral Large first on Azure - Azure

The AI industry is undergoing a significant transformation with growing interest in more efficient and cost-effective models, emblematic of a broader trend in technological advancement. In the vanguard is Mistral AI, an innovator and trailblazer.

Market Commentary:

Currencies/Macro:

The US dollar exhibited mixed performance against major currencies, with fluctuations remaining within a narrow range of +/-0.3%. The EUR/USD pair increased by 0.3% to 1.0850, GBP/USD saw a modest rise of 0.1% to 1.2685, and USD/JPY edged up by 20 pips to 150.70.

In the US, new home sales for January reported a modest increase of 1.5%, falling short of the expected 3.0% rise and marking a significant decrease from the previous month's 7.2% growth. Meanwhile, the Dallas Fed manufacturing survey for February showed improvement, coming in at -11.3, which is better than the anticipated -14.0 and a notable recovery from the previous -27.4.

From the European Central Bank (ECB), member Yannis Stournaras, representing Greece and known for his dovish stance, projected the possibility of the ECB's first rate cut occurring in June. He cited significant progress towards inflation targets, with expectations for inflation to approach 2% by autumn.

In the UK, the Confederation of British Industry (CBI) retail sales survey for February exceeded expectations. The survey index stood at -7, considerably more positive than the forecasted -31 and a significant improvement from the previous month's -50. The survey highlighted gains across various sectors, including wholesaling, motor sales, and total distribution.

Interest Rates:

In the US, the yield on 2-year Treasury notes increased slightly from 4.69% to 4.72%, while the yield on 10-year Treasury notes also rose, moving from 4.25% to 4.28%. These changes occurred in the context of record-sized auctions for 2-year and 5-year notes, which performed weaker than anticipated. Market expectations for the Federal Reserve's funds rate, which is currently at 5.375% (midpoint), remain unchanged for the upcoming meeting on March 20, with a 60% probability of a rate cut by June.

In the credit markets, some of the previous week's gains were reversed, with the Main credit index widening by 1 basis point to 55 and the CDX index widening by half a basis point to 52.5. Investment grade (IG) cash spreads also widened by 1-2 basis points. The week started strong in terms of primary market activity, in anticipation of important data releases, including the Personal Consumption Expenditures (PCE) index on Wednesday. In Europe, the primary market saw activity from 6 issuers, pricing a total of EUR 5.6 billion.

Commodities:

Crude oil markets experienced a rebound, though prices remained within previously established ranges, supported by signs of physical demand and Chinese purchasing. The April WTI contract increased by 1.58% to $77.70, and the April Brent contract rose by 1.29% to $82.67. These movements occurred amid softer trading volumes as industry participants were attending International Energy Week in London. Analysts from Goldman Sachs suggested that Brent crude would likely oscillate between $70 and $90, predicting a peak at $87 during the summer due to disruptions in the Red Sea that could lead to larger-than-expected drawdowns from OECD stockpiles. Francisco Blanch from Bank of America remarked that crude prices are expected to remain stable, with substantial non-OPEC+ supply growth anticipated to set a ceiling, while OPEC+ is seen as capable of establishing a floor price around $70. JP Morgan highlighted the impact of fully or hybrid electric vehicles (EVs), projecting a cumulative decrease in global gasoline demand by 900 thousand barrels per day (kbpd) by 2030, with the first annual decline outside of a recession occurring in 2025 due to electrification and efficiency gains.

In the gas sector, OilChem noted that China's LNG import capacity is expected to increase by one-third this year, as eight new LNG terminals commence operations and two others expand, boosting the import capacity to 170 million tonnes per annum (mtpa).

The metals market saw declines, influenced by a significant increase in copper inventory in Shanghai after the Lunar New Year, which dampened sentiment. Copper prices fell by 1.4% to $8,449, and nickel dropped 2.3% to $17,095. The rise in Chinese copper inventory, almost fivefold so far this year, brought it to its highest level since March of the previous year, suggesting a decrease in physical demand around the Lunar New Year break. Bloomberg reported that physical copper cathode was trading at a discount to futures contracts in Shanghai. In the aluminum sector, Alcoa proposed a $2.2 billion acquisition of its Australian joint-venture partner Alumina Ltd to consolidate ownership of crucial upstream assets. Bloomberg's analysis indicated that nearly half of all nickel operations are operating at a loss at recent prices, with Indonesia contributing more than half of the global supply. Anglo American noted a significant structural challenge from Indonesian nickel, resulting in a $500 million write-down on its nickel business.

Iron ore markets saw a significant downturn, with a sharp increase in steel stockpiles as reported by CISA, reaching the highest level in a year and more than one standard deviation above the four-year average for this period. The March SGX contract decreased by $5.90 to $114.10, and the 62% Mysteel index dropped by $4.95 to $115.90, reaching lows not seen since early November. Bloomberg reported that China's local governments seem hesitant or unable to increase borrowing to stimulate growth, with planned new bond issuances for the first quarter totaling 1.08 trillion yuan, 13% less than the previous year and the lowest since 2021, although several local governments have yet to disclose their plans.

Investment Tip of The Day

Automate your investments to ensure consistent market participation and take advantage of dollar-cost averaging. By setting up regular, automatic transfers to your investment accounts, you can invest without having to time the market, potentially reducing the impact of volatility on your portfolio. This strategy simplifies investing and can help build wealth steadily over time.