Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

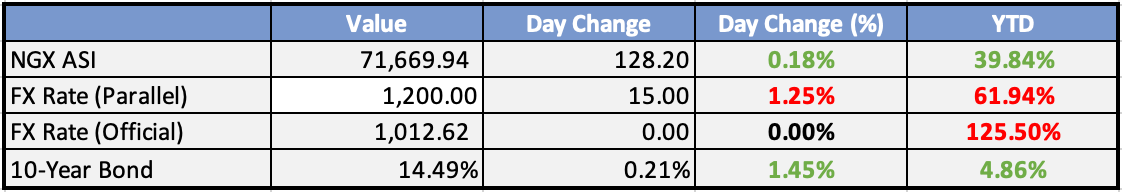

Market Data

Local

Global

x*Data as of 4pm WAT

Market News

Local

Niger, Mali and Burkina Faso to move toward monetary alliance, Niger leader says - Nigeria Business News

Niger, Mali and Burkina Faso are eyeing a political and monetary alliance, Niger’s military leader said on national television of a move that could mark a further break with the West African regional bloc

Access Bank UK receives approval to commence operations in Hong Kong - Nigeria Business News

Access Bank UK, has received approval to commence operations in Hong Kong. The approval, granted by the Hong Kong Monetary Authority, stands as a testament to Access Group’s international capabilities and strategic partnerships.

CBN says Nigerian banks are sound, strong, resilient; suspends processing fees for large cash deposit in banks - Nigeria Business News

The Central Bank of Nigeria (CBN) says the Nigerian banking industry is sound, strong and resilient just as it has suspended processing fees for large cash deposit in banks. CBN in a statement said banks were meeting up with the different regulatory requirements.

Global

US House passes bill banning uranium imports from Russia - Reuters

The US House of Representatives passed a bill banning Russian uranium imports to pressure Russia for its war in Ukraine. The bill allows waivers for domestic reactor supply concerns and will need Senate approval and Biden's signature to become law. US nuclear plants import 12% of their uranium from Russia, with a gradual reduction planned if the bill becomes law.

IMF board approves $900 mln in funds for Ukraine - Reuters

The IMF has approved a $900 million disbursement for Ukraine, praising the country's economic resilience despite the war. Ukraine's economy is expected to grow 4.5% in 2023 and 3-4% in 2024, but concerns remain about external financing and potential donor fatigue. The IMF urged Ukraine to conduct an "ambitious" debt restructuring in 2024.

Global Market Commentary

Overview

US bond markets experienced volatility, but overall changes were limited, and the market had a quiet calendar. The Japanese yen retraced much of the previous week’s sharp rally, while other G10 currencies showed little net change against the USD. Noteworthy events include comments from RBA Governor Bullock, NAB business confidence, UK wages data, and the global focus on US November CPI.

Currencies/Macro:

The Japanese yen unwound a significant portion of last week’s sharp rally.

G10 currencies, excluding JPY, showed minimal changes against the USD.

EUR/USD remained flat at 1.0765, while GBP/USD traded flat at 1.2555.

US November NY Fed Inflation Expectations Survey reported a dip in the 1yr profile to 3.36%.

UK December Rightmove house prices decreased by -1.9%m/m, resulting in a -1.1%y/y change.

Interest Rates:

The US 2yr treasury yield experienced fluctuations, rising to 4.77% and later tumbling to 4.71%.

10yr yields rose to 4.28% but slid back to 4.23%.

Markets did not price in any move for upcoming FOMC announcements, with May 2024 pricing at around 100% for a cut.

Credit spreads saw little change, with Main at 67, CDX at 61.5, and US IG cash flat to a bp tighter.

Primary markets completed final deals for the year, with limited supply in Europe and four issuers in the US.

Commodities:

Crude markets marked time with a focus on the Venezuela/Guyana dispute, and EIA and OPEC monthly reports awaited.

Metals traded lower, with copper down 1.25% to $8,343 and aluminum sliding 0.5% to $2,124, a closing low since September 2022.

Iron ore softened as weak China CPI and ongoing construction equity slump weighed on sentiment.

Day Ahead:

US:

Headline US CPI is expected to remain flat m/m in November, with potential surprises.

US November NFIB small business optimism is likely to remain little changed due to credit constraints and softer growth impacting small businesses.

EuroZone:

The Germany December ZEW survey of investor and analyst expectations is expected to show optimism about the economy.

UK average weekly earnings in the three months to October are anticipated to ease as the labor market softens.

The Week Ahead:

Monday:

Tuesday:

Core CPI m/m (US)

Wednesday:

GDP m/m (UK)

Core PPI m/m (US)

Federal Funds Rate (US)

FOMC Economic Projections (US)

Thursday:

Official Bank Rate (UK)

Main Refinancing Rate (EU)

Core Retail Sales m/m (US)

Unemployment Claims (US)

Friday:

Flash Manufacturing PMI (UK)

Flash Services PMI (UK)

Empire State Manufacturing Index (US)

Flash Manufacturing PMI (US)

Flash Services PMI (US)

Investment Tip of The Day

Evaluate Cybersecurity Measures: In an increasingly digital world, scrutinize companies' cybersecurity measures. Cyberattacks can pose significant risks, impacting operations, reputation, and shareholder value.