Trading Tuesday

Ranora Daily - Your daily source for reliable market analysis and news.

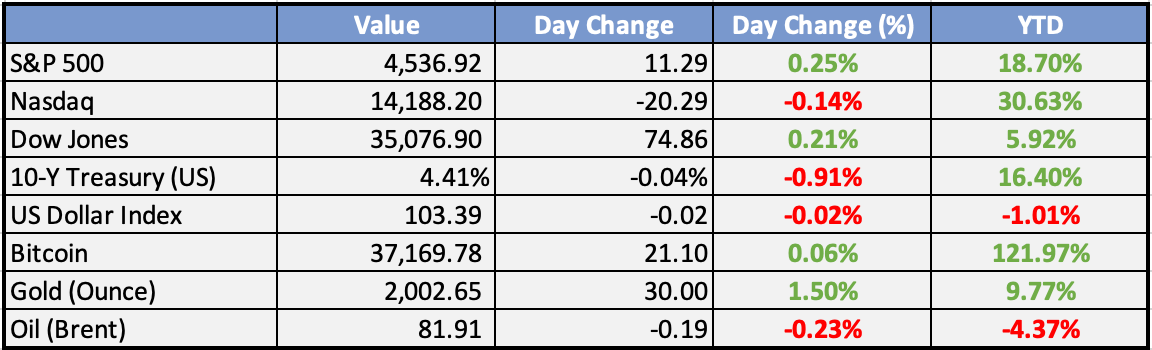

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Tinubu woos G-20 investors, FAAC meets over multiple taxation - Punch

President Bola Tinubu has assured international investors from G20 nations that their money is safe within the borders of the country.

Again, CBN Postpones MPC Meeting - New Telegraph

The Central Bank of Nigeria (CBN) has once again postponed the Monetary Policy Committee (MPC) meeting after the same was done in September 2023.

Subsidy removal pushes FG's monthly revenue to over N1trn — Minister -BusinessDay

Wale Edun, the Minister of Finance and Co-ordinating Minister of the Economy, has said that the Federation Account is witnessing improved revenue inflow

Nigeria’s transport inflation surprisingly falls for the first time in 2 years - Nairametrics

The National Bureau of Statistics (NBS) released Nigeria’s inflation report last week, indicating a surprising decline in transport inflation for the first time in over two years.

OPL 245: Federal Govt Open To Malabu Oil Well Restoration – NUPRC - Leadership

The federal government has expressed its readiness and openness to restoring the production of the Oil Prospecting Licence (OPL) 245, also known as Malabu Oil

Delta, Ondo, Ekiti plan to repurchase BEDC shares from Fidelity bank, to solve electricity crisis–Obaseki - BusinessNewsReport

The Edo State Governor, Mr. Godwin Obaseki, has said plans are underway by Edo, Delta, Ekiti, and Ondo States, to buy back their shares from the Benin Electricity Distribution Company (BEDC) and reorganise the distribution company, providing a lasting solution to the electricity crisis in the affected States.

Global

OpenAI employees threaten to quit unless board resigns - WSJ

The future of OpenAI is uncertain as most employees threaten to quit if the board doesn't resign and reinstate ousted CEO Sam Altman. Microsoft CEO Satya Nadella announced hiring Altman and OpenAI's resigned President Greg Brockman, signaling a potential rift between OpenAI and its board. Over 700 employees threatened to leave, citing lack of clarity on Altman's removal.

Bitcoin ETF hype has Wall Street eyeing $100B crypto potential - Bloomberg

The anticipation of Bitcoin exchange-traded funds (ETFs) gaining SEC approval is fueling optimism in the cryptocurrency market. The ETF structure offers a tax-efficient and cost-effective wrapper, potentially growing the spot-Bitcoin ETF market to a $100 billion industry.

Nvidia tops $504 per share for first time - CNBC

Nvidia's stock reached an all-time high, closing at $504, ahead of its Q3 results. Analysts anticipate over 170% revenue growth. The forecast for Q4 suggests almost 200% growth. Nvidia's stock has surged 245% in 2023, surpassing others in the S&P 500. The market cap is now $1.2 trillion, exceeding Meta and Tesla.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities concluded Tuesday with a mixed performance. Taiwan had another strong day as it approached an 18-month high, and South Korea also experienced solid gains.

Hong Kong initially performed well, particularly with gains in property stocks, but it fell in the afternoon session and failed to break its key 18,000 resistance level. Mainland stocks showed mixed results.

Australia closed with small gains, India ended higher, and Southeast Asia had a mixed performance. However, Japan closed slightly lower.

The People’s Bank of China (PBOC) directed banks to accelerate some lending projects to Q4 2023 and cap loans in Q1 2024 to smooth the credit cycle. While this could bring positive flows to equities, there is skepticism in the market about the effectiveness of these measures.

The Reserve Bank of Australia minutes revealed a debate on whether to hike or hold. Despite the debate, the minutes appeared hawkish, expressing concerns about not reaching inflation targets even by 2025. There is a suggestion that the hiking cycle for Australia may not be over.

Europe, Middle East, Africa:

European equity markets mostly weakened, following little change in the prior session.

Bank of England (BoE) Governor Bailey cautioned in a late Monday speech that it is too early to declare victory on inflation. He emphasized the need to ensure prices return all the way back to the 2% target and stated that it is premature to think about rate cuts, warning of a potential increase in borrowing costs in the coming months.

The BoE is not alone in warning about rate hikes. Belgian central bank chief Wunsch cautioned that bets on ECB rate cuts could prompt rate increases if it undermine the current policy stance. He suggested that rates should stay unchanged in December and January.

Central bankers are attempting to reverse the loosening of financial conditions since the start of April as bond yields pull back and equity markets turn bullish.

Sweden’s Riksbank is expected to hike by another 25bps, likely to be the final hike due to lower growth concerns. Inflation is decelerating but remains high at 6.1% YoY core inflation. The weakness in the Swedish Krona means costly imports could push inflation up further.

The Americas:

Yesterday’s 20Y Treasury Auction went relatively well, with decent demand and a subsequent fall in the 20Y yield post-auction. Bullish momentum continues in the pre-market.

Demand for new credit in the U.S. over the last year has declined and is expected to stay soft in the future, according to a survey by the New York Federal Reserve. The survey showed a “notable” decline in credit over the last year, with application rates at 41.2%, compared to 44.8% in 2022 and the pre-pandemic 2019 level of 45.8%.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

Unemployment Claims (US)

Revised UoM Consumer Sentiment (US)

Thursday:

Flash Manufacturing PMI (UK)

Flash Services PMI (UK)

Friday:

Flash Services PMI (US)

Flash Manufacturing PMI (UK)

Investment Tip of The Day

Review Global Debt Levels: High levels of global debt can pose systemic risks. Monitor global debt trends and assess their potential impact on financial markets.