Trading Tuesday - High Yields at Home, Volatility Abroad: Nigeria’s Bonds Attract as Global Oil and Rate Narratives Evolve

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap, where Nigerian fixed income takes center stage as the DMO offers attractive double-digit, tax-exempt yields and money market liquidity remains supportive. Policy and regulatory themes also feature, with tax law clarifications and corporate governance updates shaping domestic sentiment. Globally, investors will track oil supply dynamics, trade disruptions, and renewed political pressure on the U.S. Federal Reserve over interest rates.

Nigerian News & Market Update

DMO Offers Investors 15.396% Rates In January 2026 FGN Savings Bond:

Nigeria’s Debt Management Office (DMO) has opened January 2026 FGN Savings Bond subscriptions, offering retail investors tax-exempt yields of up to 15.396% on 2- and 3-year government-backed bonds. - Channels

FG Meets With KPMG Officials Amid Tax Law Controversy:

The Federal Government met with KPMG officials in Abuja to resolve concerns over Nigeria’s new tax laws, agreeing that ongoing dialogue is needed to clarify provisions and reduce taxpayer confusion. - Channels

Money Market Rates Diverge, DMBs Placements Decline:

Nigeria’s money market rates diverged as strong system liquidity eased funding costs, while deposit money banks’ placements with the CBN declined and Treasury bill yields mostly fell in the secondary market. - Dmarketforces

Presco announces board change, appoints new non-executive director:

Presco Plc has appointed Adewale Arikawe as a non-executive director, replacing Felix Nwabuko, as part of a board reshuffle aimed at strengthening leadership and driving strategic growth. - Leadership

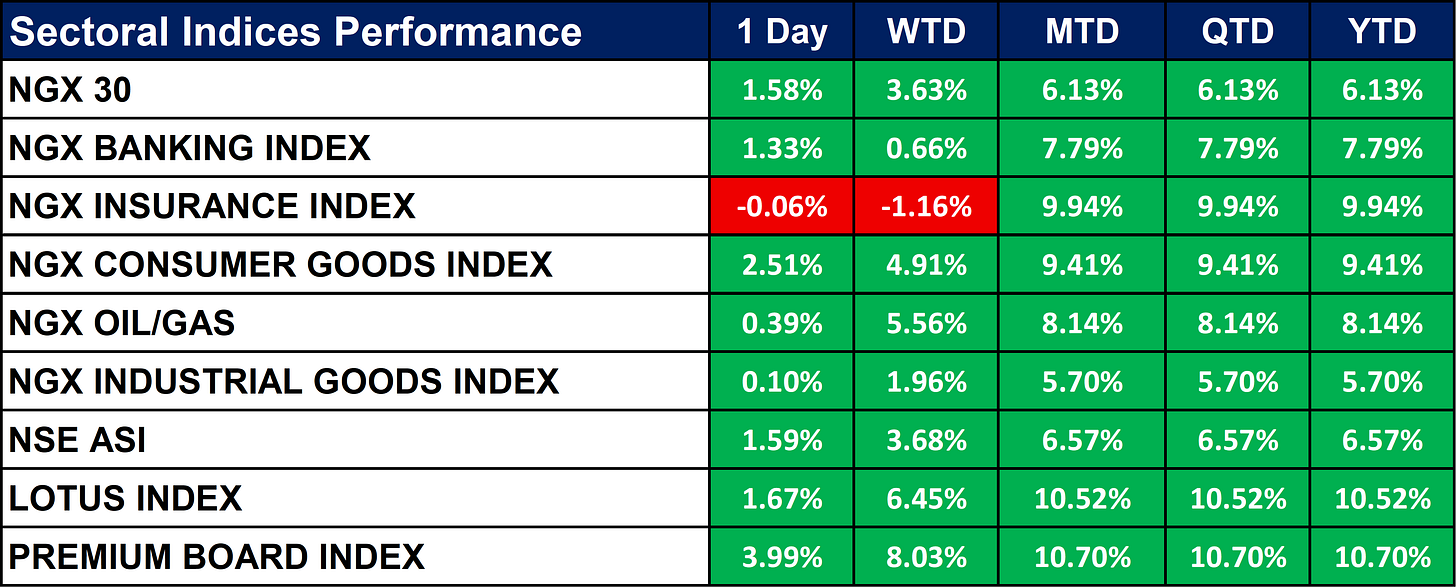

Nigeria Sectoral Indices Performance

The table below shows that the NGX sectoral indices closed broadly positive, led by the Premium Board (+3.99%) and Consumer Goods (+2.51%) on the day, while Insurance was the lone laggard, down marginally (-0.06%). Short-term momentum remains strong, with WTD gains highest in the Premium Board (+8.03%), Lotus Index (+6.45%), and Oil & Gas (+5.56%). Medium- to long-term performance is robust across sectors, as MTD/QTD/YTD returns peak in the Premium Board (+10.70%), Lotus Index (+10.52%), and Insurance (+9.94%).

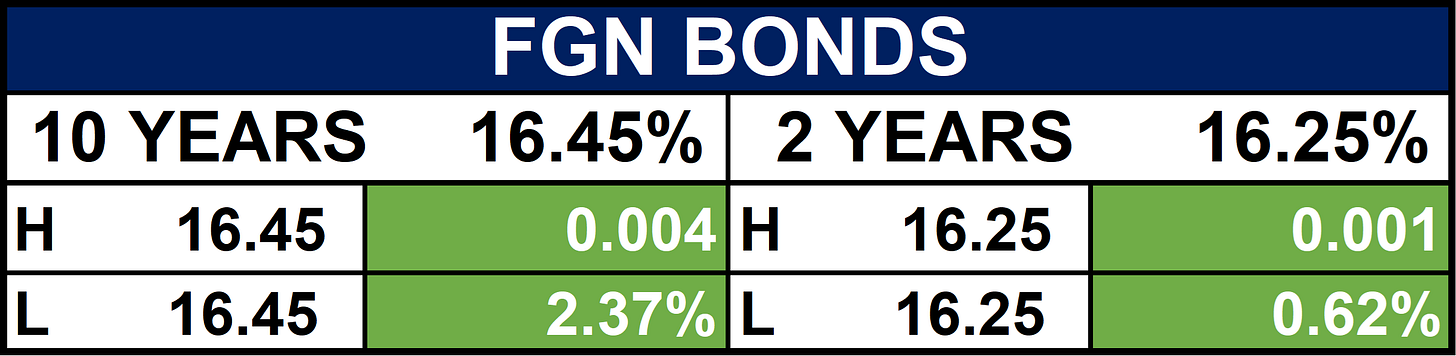

Fixed Income (FGN Bonds)

Global News & News Update

Venezuela begins reversing oil output cuts as exports resume:

Venezuela has begun reopening oil wells and resuming crude exports after weeks of near-standstill production, with two supertankers shipping crude as U.S.-linked supply deals revive flows. - Reuters

India’s rice exports to top buyer Iran stall on protests, tariff worries:

India’s basmati rice exports to Iran have stalled as protests, currency collapse and fears of U.S. tariffs raise payment risks and deter exporters from signing new deals. - Reuters

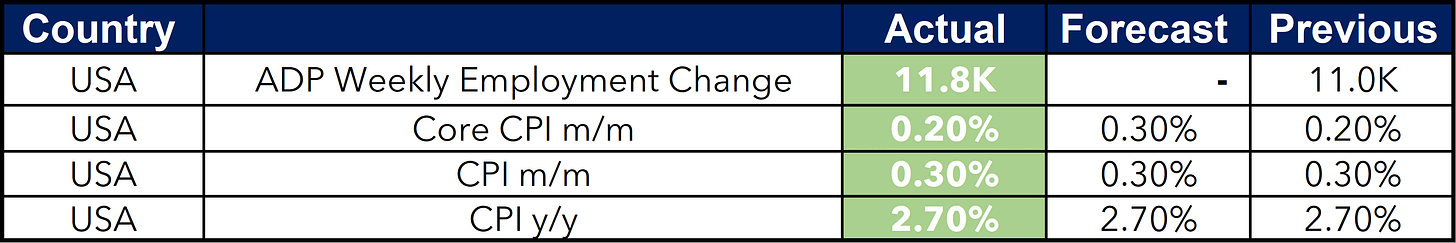

Trump says inflation data means Fed should cut interest rates:

President Donald Trump cited December inflation data to renew his call for the Federal Reserve to cut interest rates, even as markets expect the Fed to hold rates steady this month. - Reuters

Russia counters Trump’s assertion over oil in Venezuela:

Russia rejected President Trump’s claim over Venezuela’s oil, insisting its state-owned firm Roszarubezhneft legally owns and will continue operating Russian oil assets in the country. - Reuters

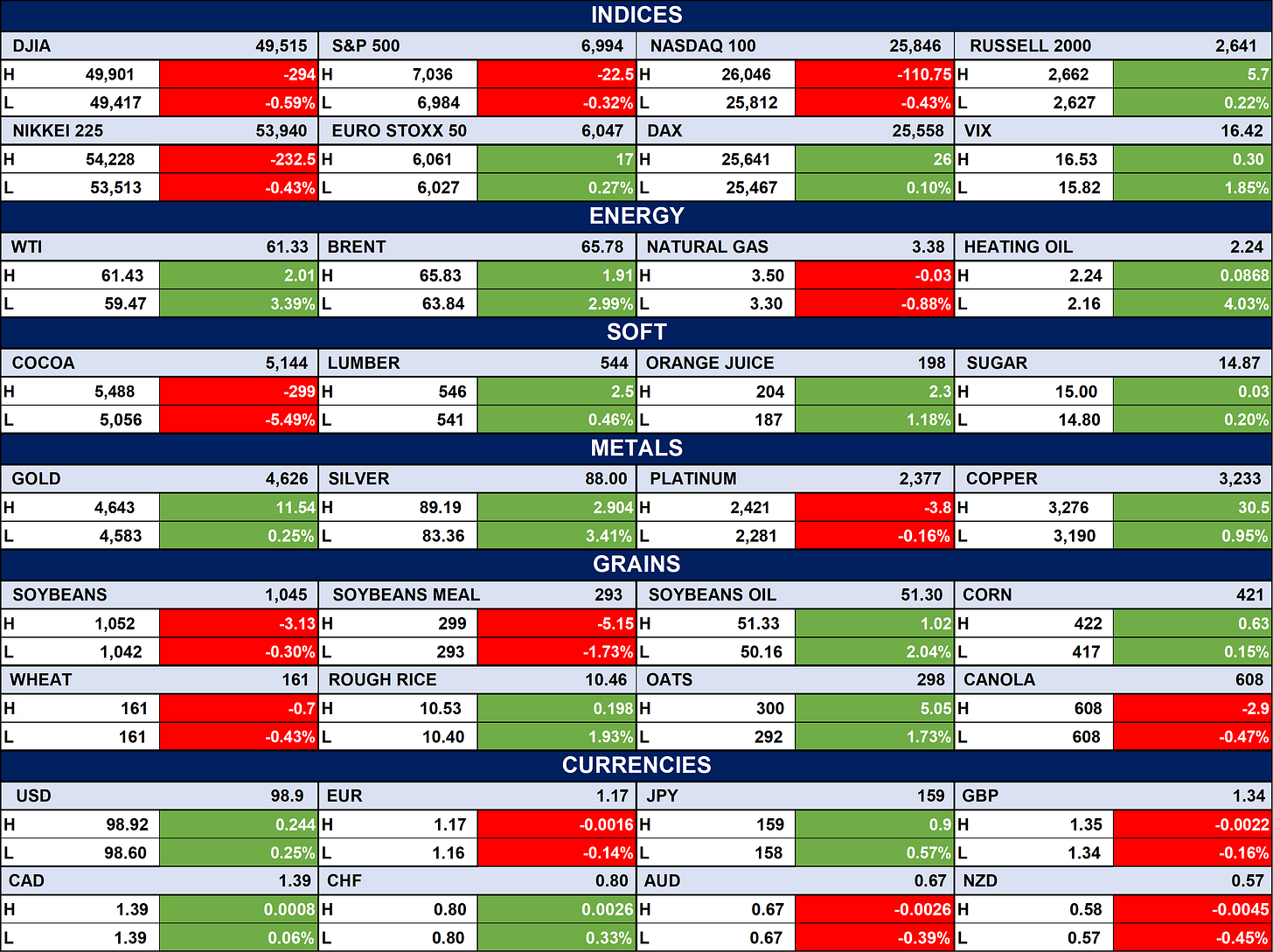

Indices, Commodities & Currencies

The table below depicts the Global equities were mixed, with U.S. indices broadly lower (DJIA, S&P 500, Nasdaq) while Europe (DAX, Euro Stoxx 50) and Asia’s Nikkei showed modest gains. Energy prices strengthened as WTI and Brent rose sharply, while natural gas dipped; metals were mostly higher with strong gains in silver and copper, offset by a slight drop in platinum. In commodities and FX, grains were mixed, cocoa fell sharply, and the U.S. dollar firmed modestly against major currencies amid generally stable forex movements

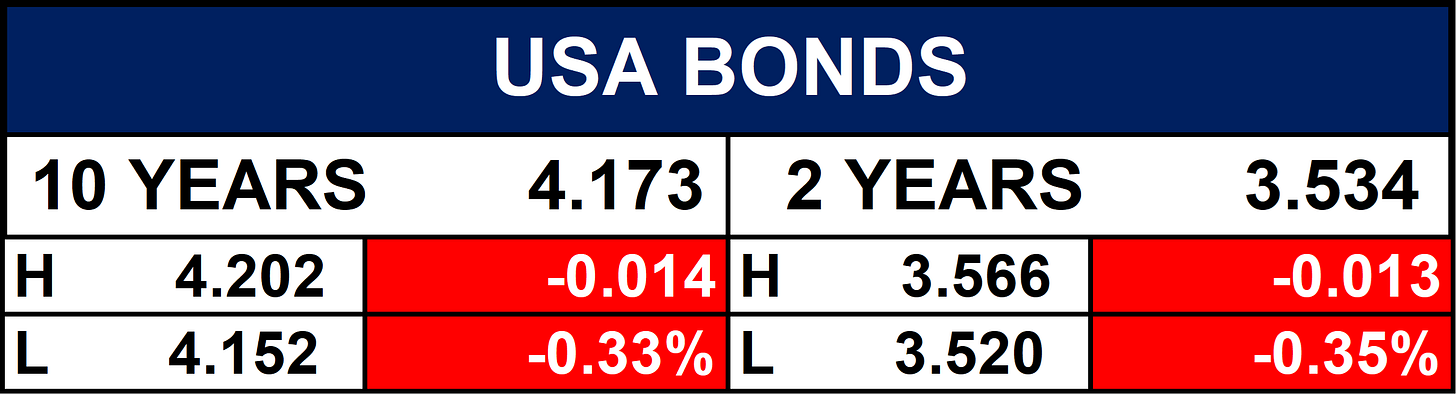

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, elevated sovereign yields and easing money market rates may continue to draw local investors toward government securities, while equity performance remains sector-selective. Clarity on tax reforms and liquidity management will be key near-term domestic catalysts. Globally, shifts in oil output, trade flows, and U.S. rate expectations could influence risk appetite, FX trends, and commodity-linked assets in the sessions ahead.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.