Trading Tuesday - Market Holds Steady on Strong Earnings, Policy Stability, and Global Optimism

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

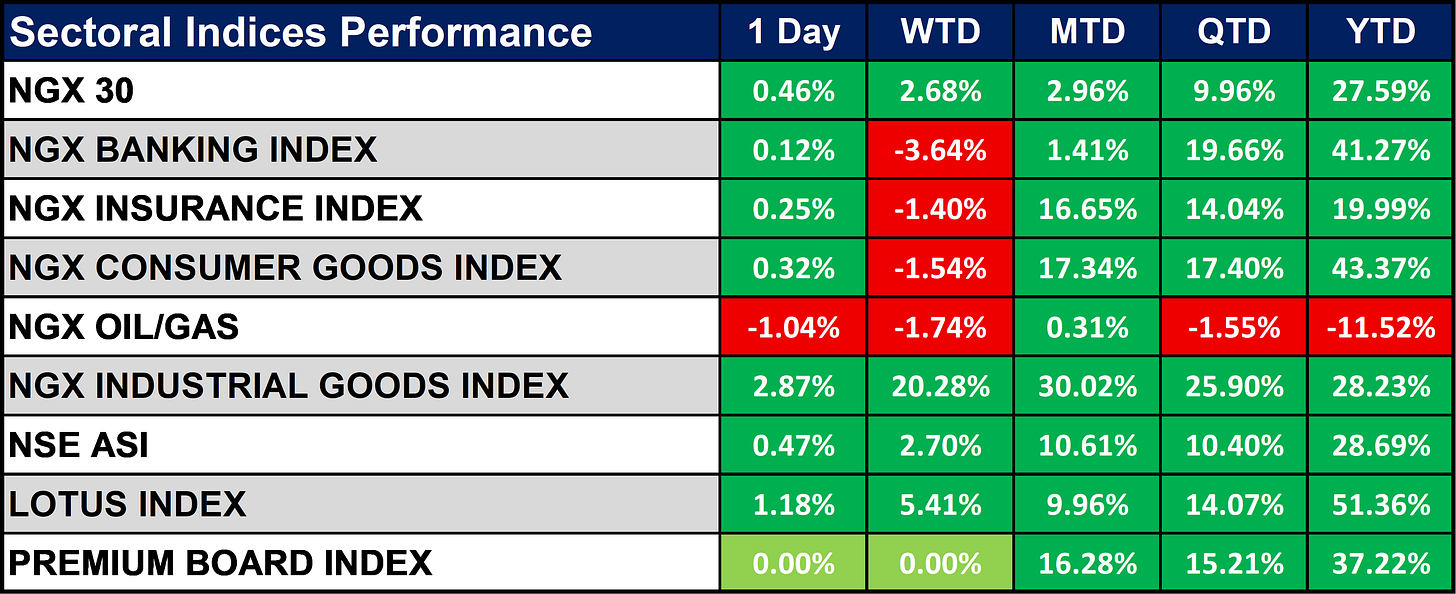

Good evening and welcome to today’s market kickoff. Today’s market snapshot reflects cautious optimism. The NGX edged up by 0.18% to 131,826.77, lifting YTD(Year-To-Date) returns to 28.08%. Industrial Goods outperformed, thanks to Lafarge Africa’s strong earnings, while Oil & Gas continued to lag.

In this newsletter, expect insights into sector trends, key earnings highlights, global market shifts, and monetary policy updates including the CBN’s decision to hold rates steady at 27.5%. We’ll also explore how global banking strength and a booming crypto market are shaping investor sentiment heading into Q3.

Nigeria News & Market Update

NGX index gains 0.18% amid mixed sentiments:

NGX opened the week slightly positive, with the ASI up 0.18% to 131,826.77 and market cap at ₦83.4trillion. Despite a weekly gain of 4.5% (YTD: +28.08%), trading slowed significantly. Market breadth was negative, led by Nigeria Computer Society (+10%) among gainers, while Meyer Plc (-10%) topped losers. Industrial Goods led sector gains; Oil & Gas dipped slightly. - Punch

Lafarge Africa posts N132.7bn profit:

Lafarge Africa’s H1 2025 profit rose sharply to ₦132.7billion, driven by strong sales growth and lower finance costs. Revenue increased by 75% to ₦517billion, while Q2 profit alone surged 248% to ₦84billion. The company launched new eco-friendly products, including ECOPlanet cement, to support sustainability. Management remains confident in maintaining growth through innovation and operational efficiency. - Punch

Dangote reveals refinery exported one million tonnes of petrol in 50 days:

Dangote refinery has started exporting petrol, with 1 million tonnes exported between June and July 2025, making Nigeria a net exporter of refined products. Aliko Dangote disclosed this at the Global Commodity Insights Conference. Despite this, marketers still import petrol into Nigeria. The refinery also exports aviation fuel to Europe and Saudi Arabia, while Dangote targets $500million cement and clinker exports by 2027. - Punch

CBN Retains Interest Rate At 27.5%:

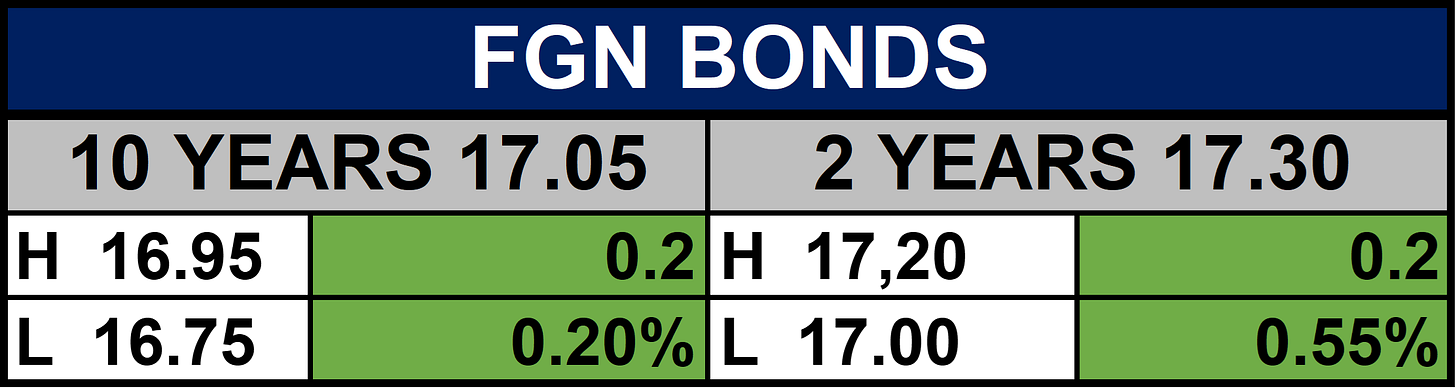

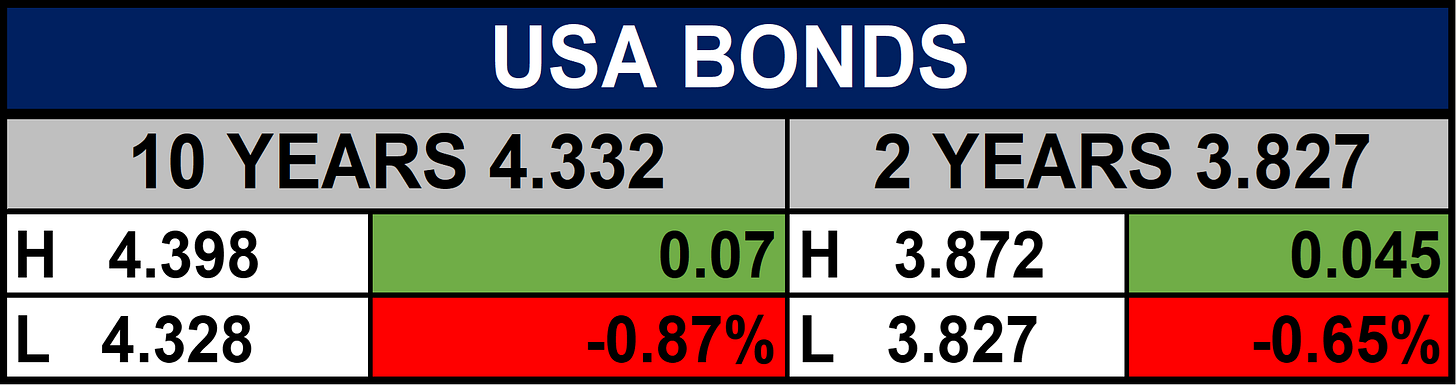

CBN kept the Monetary Policy Rate at 27.5% to sustain disinflation and manage price pressures, with all other parameters unchanged (CRR at 50%, Liquidity Ratio at 30%). Foreign reserves stand at $40.1billion, covering 9.5 months of imports. Governor Cardoso said monetary and fiscal authorities will keep working to reduce inflation to single digits, while the MPC continues to monitor economic conditions for future decisions. - Channels

Nigeria Sectoral Indices Performance

Fixed Income (FGN Bonds)

Global News & News Update

Banks are thriving so far in Trump’s economy. Here's what that means for markets and the consumer:

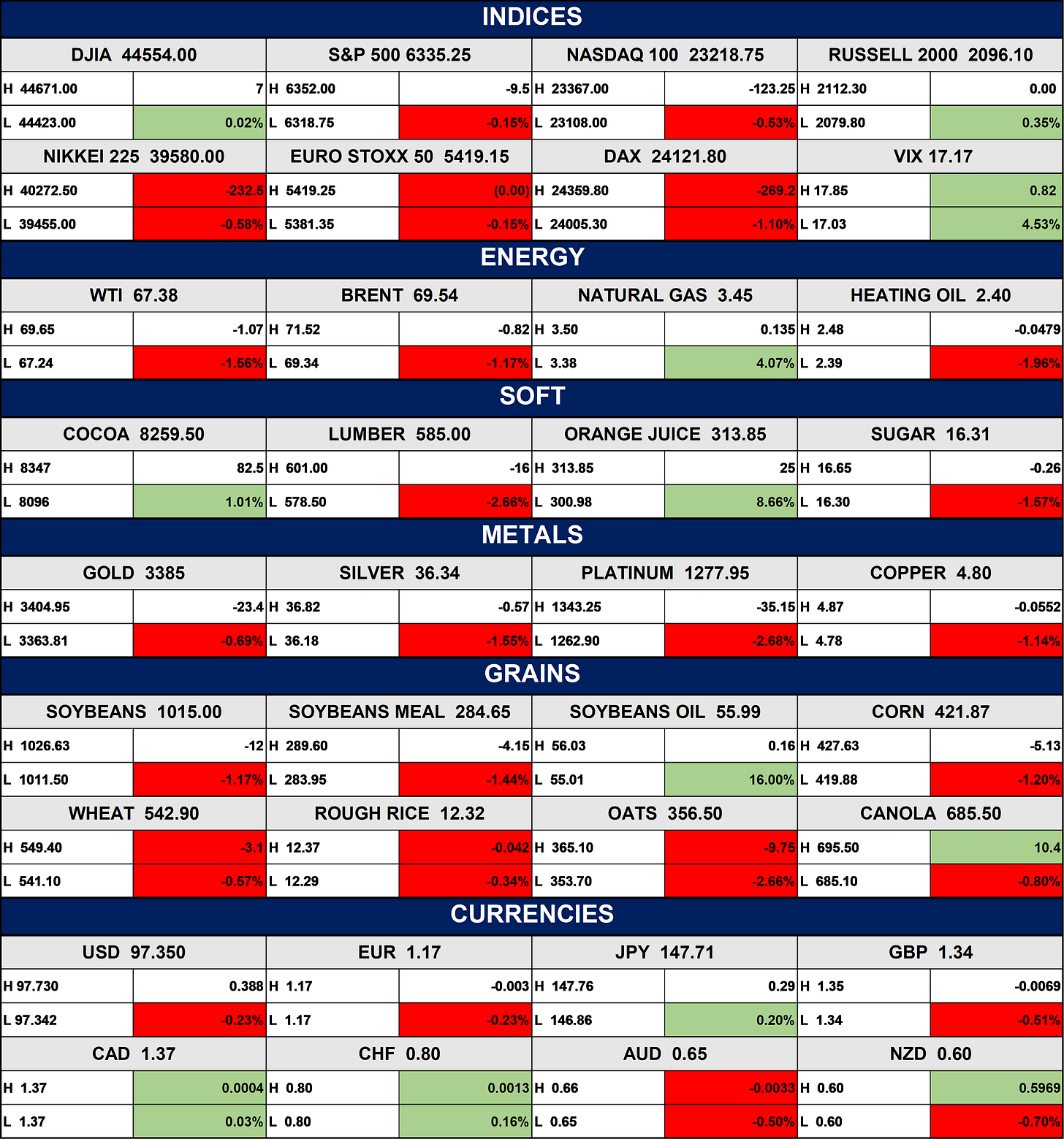

US banks posted strong Q2 profits of $39billion, up over 20% from last year, driven by booming stock and bond trading and increased corporate deals and loans. Despite earlier market turmoil from President Trump’s “Liberation Day” tariffs in April, consumer spending and borrowing remained resilient, creating an unusually profitable environment for financial firms. - CNBC

Global crypto assets hit $4tn as industry wins backing of US lawmakers:

The global crypto market hit a record $4trillion, driven by US legislative support and expectations of Wall Street investment. Bitcoin reached $123,000, with ether and Solana also surging. Congress passed the Genius Act regulating stablecoins, paving the way for banks to create their own tokens. This marks a strong recovery from 2022’s crypto crash. Critics warn that deeper ties to traditional finance could pose systemic risks, but Trump’s administration continues to back crypto expansion. - Financial Times

Indices, Commodities & Currencies

Fixed Income (USA Bonds)

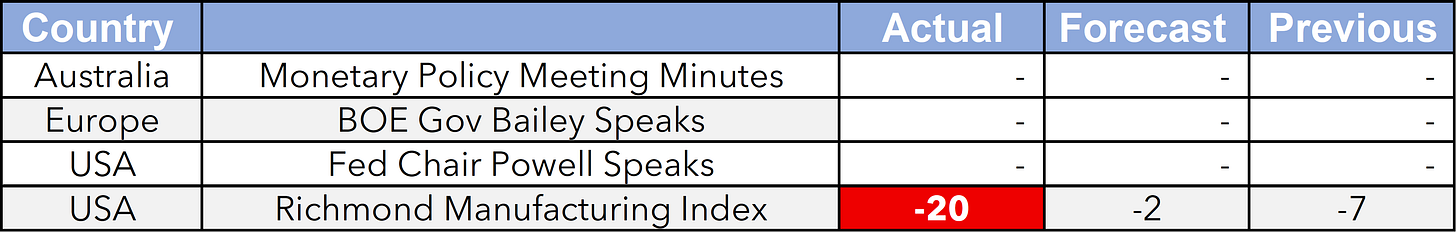

Events

Conclusion

Momentum remains strong in Consumer Goods, Banking, and Industrial Goods, backed by solid earnings and stable policies. While Oil & Gas lags, Dangote’s exports could signal a sector rebound. Looking ahead, steady rates and global optimism may sustain market gains, with fundamentally strong stocks likely to lead performance.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.