Trading Tuesday - Mixed Market Signals Amid Rising Inflation and Policy Expectations

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Nigerian markets saw short-term declines, though sectors like insurance and industrial goods remain strong year-to-date. The Naira showed mixed performance across markets, while investment in energy infrastructure continues to grow. Globally, markets are cautious ahead of Fed signals from Jackson Hole, with shifting oil trade patterns and geopolitical tensions influencing sentiment.

Nigerian News & Market Update

Naira appreciates in parallel market, trades at ₦1,550/$:

On Monday, the Naira appreciated in the parallel market, strengthening to ₦1,550 per dollar from ₦1,560 over the weekend.

However, at the official Nigerian Foreign Exchange Market (NFEM), the Naira weakened, closing at ₦1,534.8 per dollar, compared to ₦1,530 last Friday indicating a ₦4.8 depreciation, according to Central Bank of Nigeria (CBN) data. - TribuneNNPC, Sahara expand LPG fleet with launch of new vessel, MT Iyaloja (Lagos), in Korea:

NNPC Ltd. and Sahara Group, through their joint venture WAGL, have added a new 40,000 CBM LPG vessel, MT Iyaloja (Lagos), to their fleet, increasing total capacity to 162,000 Cubic Meters (CBM). The vessel was commissioned in South Korea and is part of efforts to boost Nigeria’s role in the clean energy market. President Tinubu praised the move, which aims to improve LPG access and affordability. WAGL plans to add more vessels within two years, further expanding its gas infrastructure across West Africa. - Guardian

Heirs Energies to Double Oil Output, Expand Growth across Africa:

Heirs Energies plans to double its oil production by 2030 and expand across Africa. The company has already increased output at its key asset, OML 17, from 27,000 to 55,000 barrels per day and aims to boost it further through drilling and upgrades. CEO Osa Igiehon says the company is focused on growth both in Nigeria and other African markets, especially by acquiring mature assets. - Thisday

Rising inflation, others endanger $1trillion GDP plan — Afrinvest:

Afrinvest doubts Nigeria’s plan to grow its economy to $1 trillion by 2030 due to inflation, low oil output, and power sector problems. Despite GDP rebasing that improved numbers, currency depreciation has kept the GDP’s dollar value at about $251 billion. Growth rates around 3.8% fall short of the ambitious targets, with the IMF and World Bank also forecasting modest growth through 2027. - Punch

NGF unveils new investment platform to bridge $100billion infrastructure gap:

The Nigeria Governors’ Forum launched Investopedia, a platform to attract investment, create jobs, and boost infrastructure across Nigeria. It showcases key projects and incentives from all 36 states to help investors invest confidently and address the country’s $100 billion infrastructure funding gap. Supported by institutions like the Central Bank and backed internationally, the platform aims to connect global capital with Nigerian state-level opportunities. - Punch

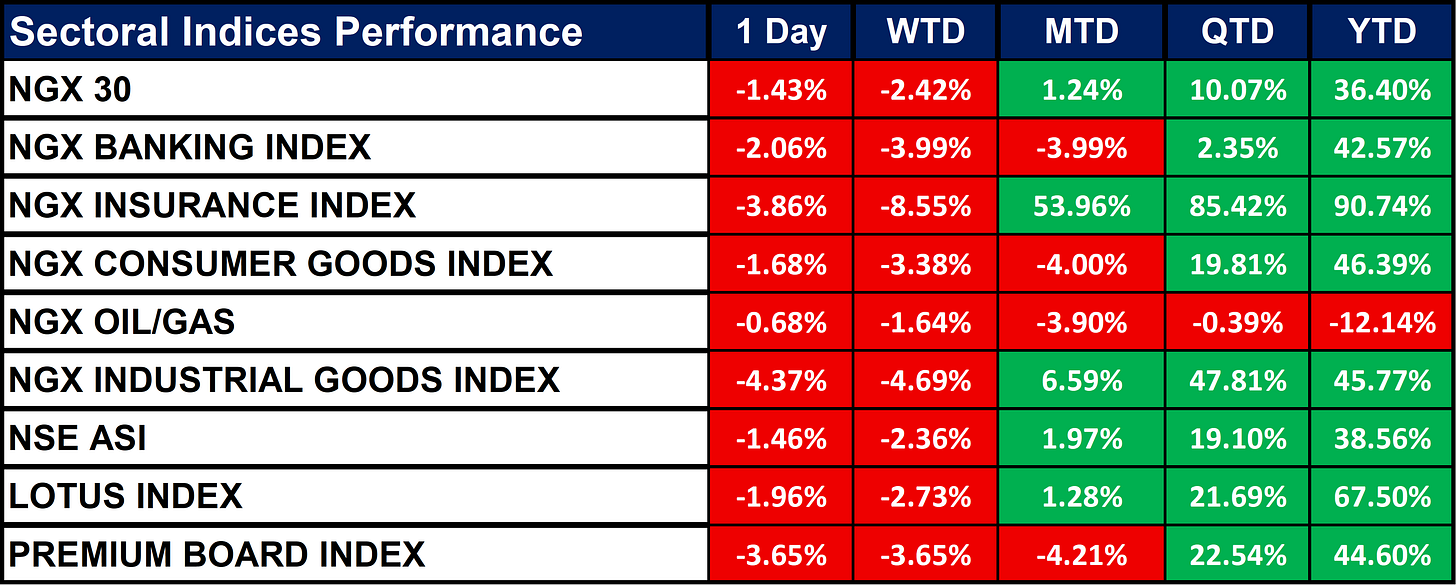

Nigeria Sectoral Indices Performance

The table below shows that all NGX sector indices declined over the last day and week. However, most show strong gains year-to-date, led by the Insurance (+90.74%) and Industrial Goods (+45.77%) indices. The only sector with a negative YTD performance is Oil/Gas (-12.14%). Despite short-term losses, long-term performance remains positive overall.

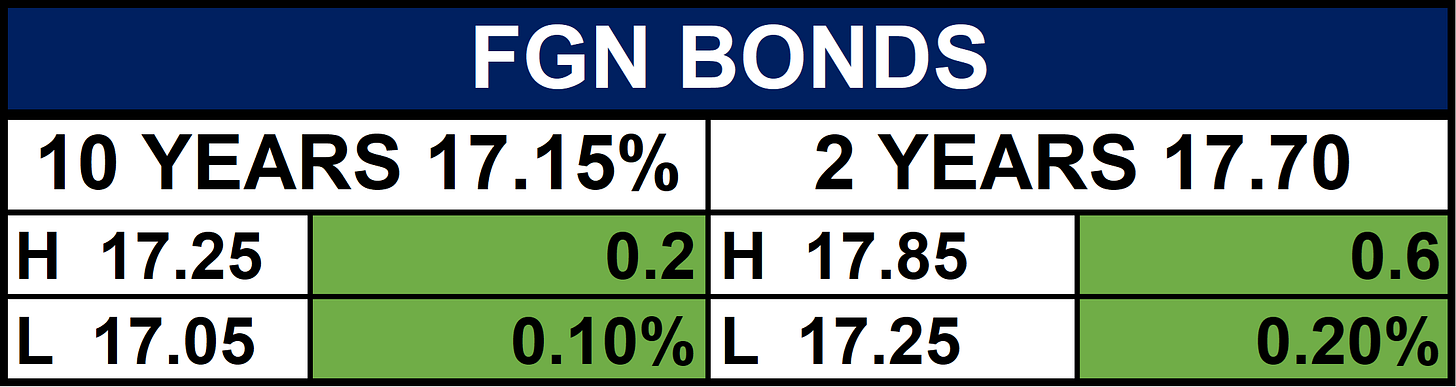

Fixed Income (FGN Bonds)

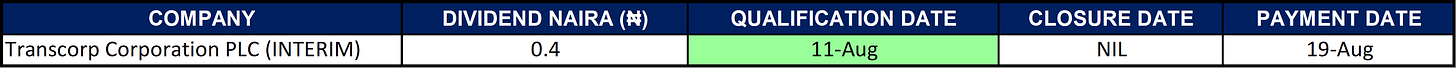

Dividends

Global News & News Update

India's Russian oil imports dip in July, skips LatAm supply, data shows:

India’s Russian oil imports fell by 24.5% in July due to reduced discounts and lower seasonal demand. Imports are expected to decline further as state refiners shift to Middle Eastern and U.S. oil, following U.S. pressure. Despite the drop, Russia remained India’s top supplier. OPEC’s share rose, and India did not import any oil from Latin America for the first time since 2011. - Reuters

Dollar slips as traders wait on Jackson Hole:

The U.S. dollar slightly weakened as traders await Fed Chair Powell’s speech at the Jackson Hole symposium for clues on interest rate cuts. Markets expect 54 basis points in cuts by year-end. Meanwhile, U.S. housing data showed a rise in July. Currency moves remained quiet, and focus also shifted to potential Ukraine peace talks involving Zelenskiy, Trump, and Putin. - Reuters

Trump's interest rate demands put 'fiscal dominance' in market spotlight:

Rising U.S. debt and pressure from President Trump for interest rate cuts have raised concerns about fiscal dominance where the Fed may prioritize cheap government financing over controlling inflation. Though Trump argues lower rates would save the U.S. money, the Fed insists it remains independent. Investors worry this could lead to higher inflation or market instability, especially as long-term yields stay high despite expected Fed cuts. - Reuters

S&P affirms US 'AA+' credit rating, cites tariff revenue:

S&P Global affirmed the U.S.'s AA+ credit rating, stating that revenue from Trump’s new tariffs could help offset the fiscal impact of his recent tax cuts and spending bill. Despite a rise in tariff income, the U.S. budget deficit still grew by 20% in July. S&P expects the deficit to decline gradually and maintains a stable outlook, while Moody’s downgraded the U.S. rating earlier due to rising debt concerns. - Reuters

European shares rise as investors weigh potential Russia-Ukraine peace deal:

European stocks rose slightly as hopes for a Russia-Ukraine peace deal boosted market sentiment. The STOXX 600 index gained 0.3%, though defence stocks fell on news of possible peace talks. Luxury stocks and JD Sports saw gains, while trading remained light due to summer holidays. Investors are also awaiting key insights from the upcoming Federal Reserve Jackson Hole symposium. - Reuters

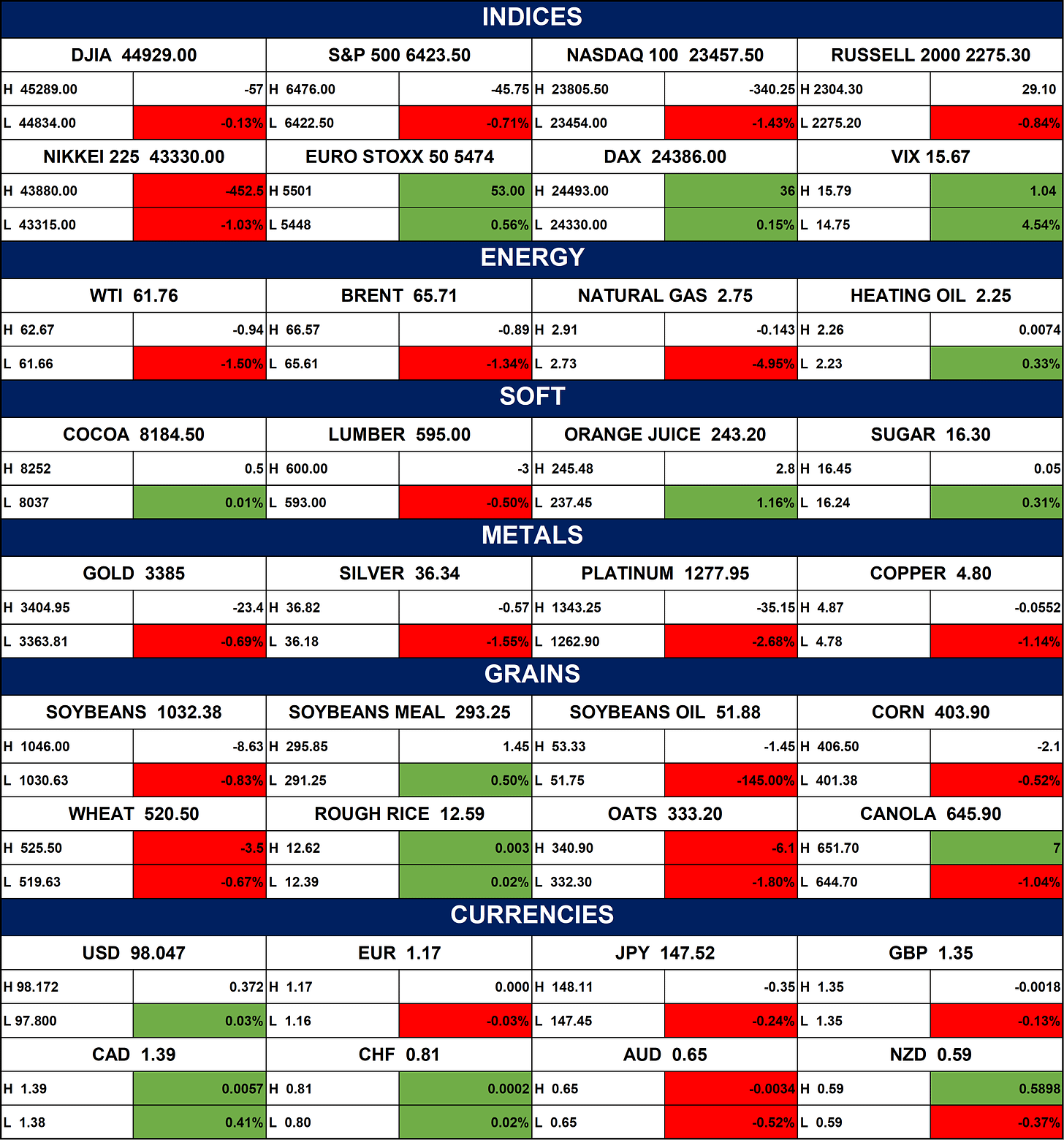

Indices, Commodities & Currencies

The table below depicts that the markets are mostly down across major indices, energy, and metals. Energy commodities like oil and natural gas saw notable drops. Most grains and metals also declined, while soft commodities were mixed. The U.S. dollar edged up slightly, while other major currencies were mostly flat or down. The VIX rose, signaling increased market volatility.

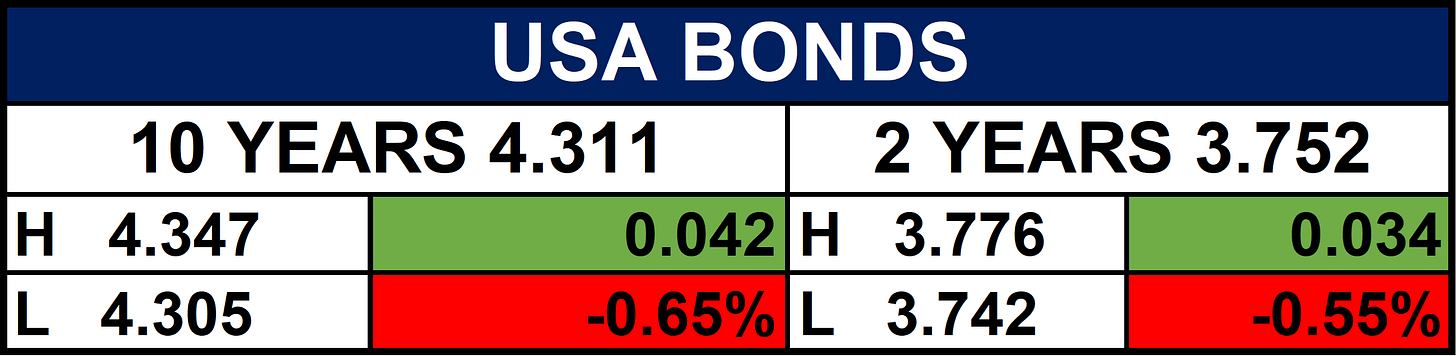

Fixed Income (USA Bonds)

Conclusion

While long-term investor sentiment in Nigeria remains positive, short-term pressure from inflation and FX instability may persist. Globally, markets are in a holding pattern ahead of policy signals from Jackson Hole. A dovish Fed tone could trigger asset price rebounds, while continued inflationary concerns might sustain volatility. Stay tuned for further updates as the macro and policy environment unfolds.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.