Trading Tuesday - NGX Strength Holds Amid Sector Rotation; Global Easing Signals Possible Foreign Inflows

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. The NGX opened the week higher, led by strong gains in insurance, banking, and consumer goods, though trading slowed as investors turned selective ahead of earnings. United Capital posted strong H1 results and expanded into Côte d’Ivoire, while Dangote Refinery advanced its CNG truck rollout. Globally, softer U.S. inflation boosted market sentiment and rate cut expectations, supporting emerging markets.

Nigerian News & Market Update

FG generates ₦5.21trillion from oil sales in H1:

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) generated N5.21 trillion in H1 2025, meeting 34.7% of its ₦15 trillion annual target. This includes revenue from oil royalties, gas sales, and penalties. It also recovered $459,226 from oil lifting debts. Experts warn the government against turning the commission into a revenue agency, saying it could discourage investment and harm the oil sector. They advise focusing on improving security, reducing regulatory hurdles, and encouraging exploration to boost long-term revenue. - Punch

Fuel distribution: Dangote takes delivery of CNG trucks:

Dangote Refinery has started receiving 4,000 CNG-powered trucks for its fuel distribution program, set to launch on August 15. The ₦720billion investment aims to cut fuel distribution costs, improve supply, support 42 million MSMEs, and create over 15,000 jobs. The initiative is expected to save Nigerians over ₦1.7trillion annually and enhance energy efficiency nationwide. - Punch

United Capital Shows Resilience in H1, Extends Five-Year Profit Streak:

United Capital Plc posted strong H1 2025 results with a 57% rise in earnings to ₦23.76 billion and a 54% increase in profit to ₦11.89 billion. It declared a ₦5.4 billion interim dividend and grew shareholders' funds by 25%. The company also expanded into Francophone West Africa through its new subsidiary in Côte d’Ivoire, aiming to deepen regional financial inclusion and investment. - Thisday

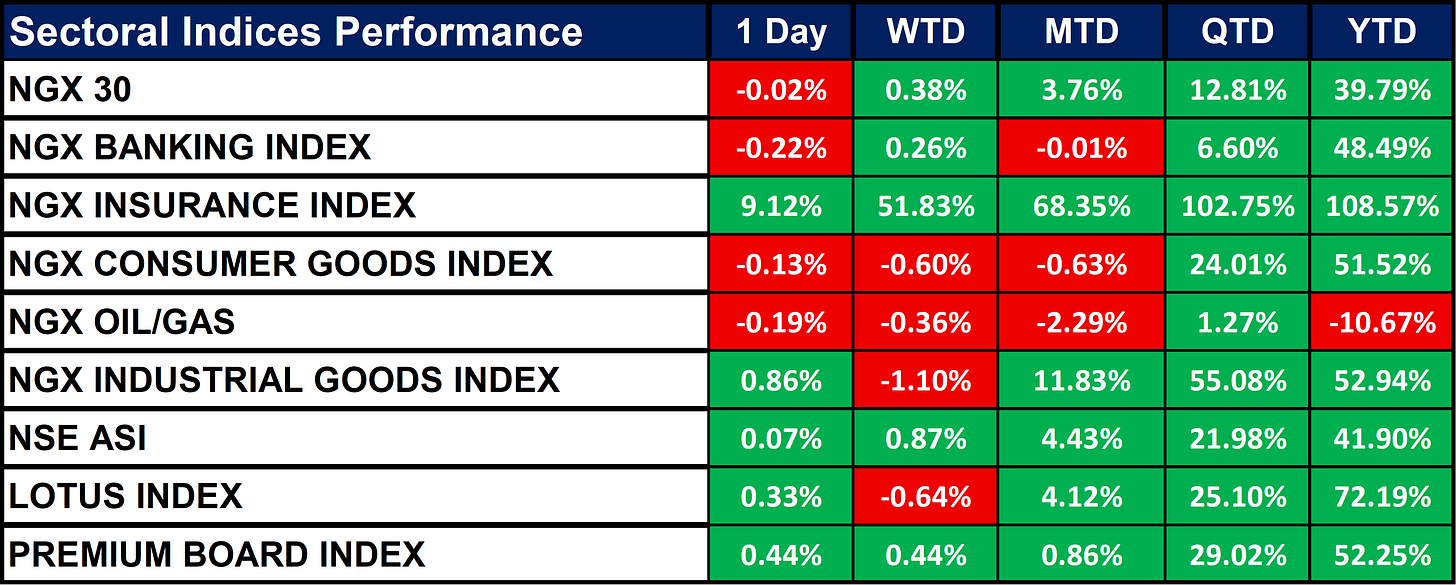

Nigeria Sectoral Indices Performance

The table below shows that the The NGX market was mixed, with the Insurance Index surging 9.12% and Industrial Goods up 0.86%, while most other sectors saw slight daily losses. Year-to-date, all sectors are positive except Oil/Gas (-10.67%), with Insurance (+108.57%) far outperforming.

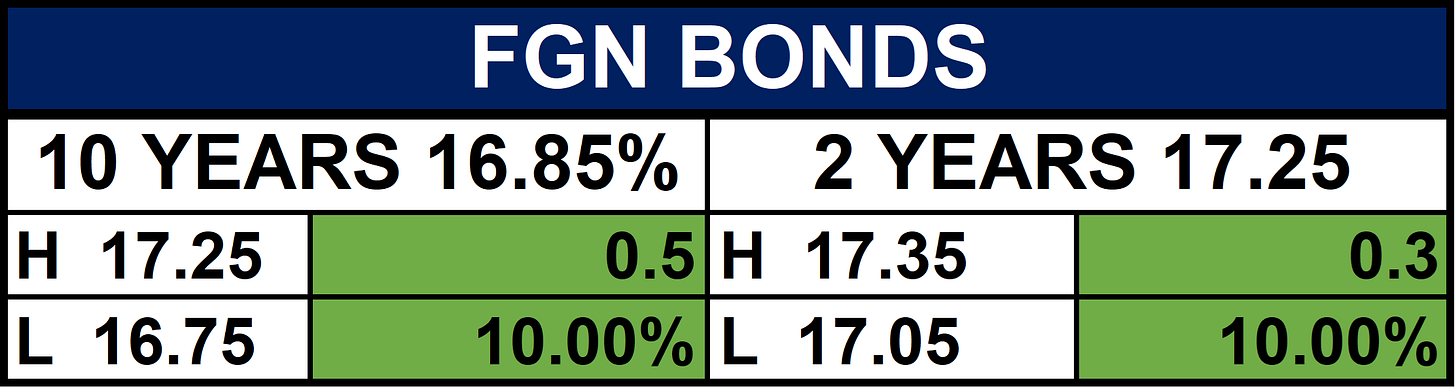

Fixed Income (FGN Bonds)

Global News & News Update

Stocks rise, bonds firm on reassuring US inflation data:

U.S. futures rose and the dollar slipped after softer-than-expected Consumer Price Index (CPI) data eased tariff-driven inflation fears and boosted expectations for Fed rate cuts. Treasury yields fell, while UK gilts came under pressure as strong wage data signaled persistent inflation. Investors are now focused on the upcoming Trump-Putin summit on Friday. - Reuters

Brazil consumer coffee prices fall in July for first time in 18 months:

Brazil's consumer coffee prices fell 1.01% in July the first drop in 18 months driven by lower farm prices after the 2025 harvest. This follows volatility in international markets, partly due to U.S. tariffs of 50% on some Brazilian goods, including coffee. While coffee futures in New York recently rose 8% over trade concerns, it's unclear if tariffs will impact consumer prices yet, as the tariff increase started only this month. - Reuters

Consumer prices rise 2.7% annually in July, less than expected amid tariff worries:

The U.S. consumer price index (CPI) rose 0.2% monthly and 2.7% annually, with core CPI (excluding food and energy) increasing 0.3% monthly and 3.1% yearly, slightly above forecasts. The data led traders to increase expectations for Federal Reserve rate cuts starting in September. While tariffs impacted some price categories, many sectors showed little effect from import duties. - CNBC

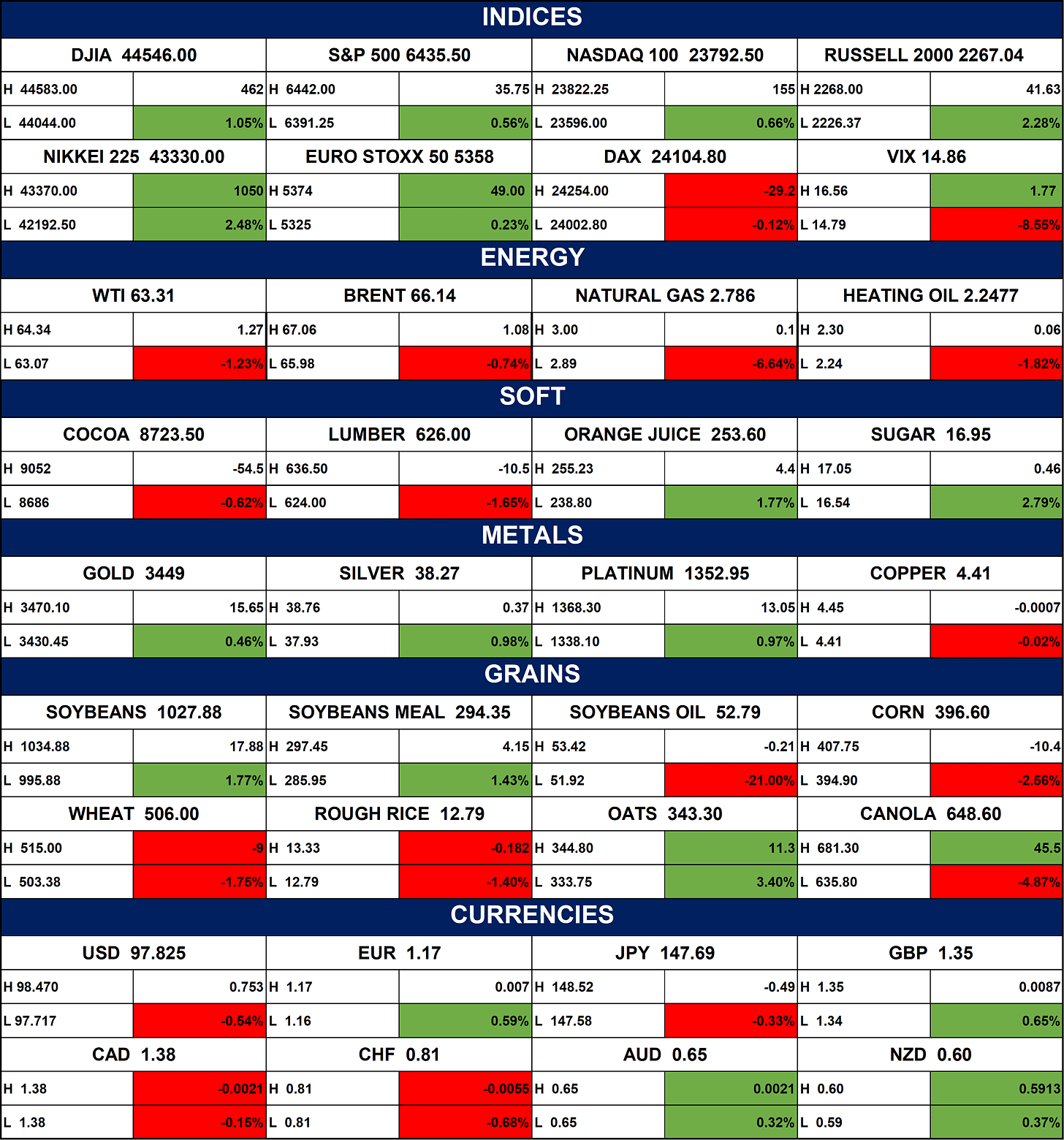

Indices, Commodities & Currencies

The table below depicts that the Global markets were mostly positive, with strong gains in major equity indices, especially the Nikkei 225, Russell 2000, and DJIA, while the VIX dropped sharply. Precious metals rose, most soy products gained, but corn, wheat, and canola fell. Energy was mixed, with crude oil slightly lower and natural gas plunging. Currencies saw modest moves, with USD slightly higher and some minor declines in CAD, CHF, and JPY.

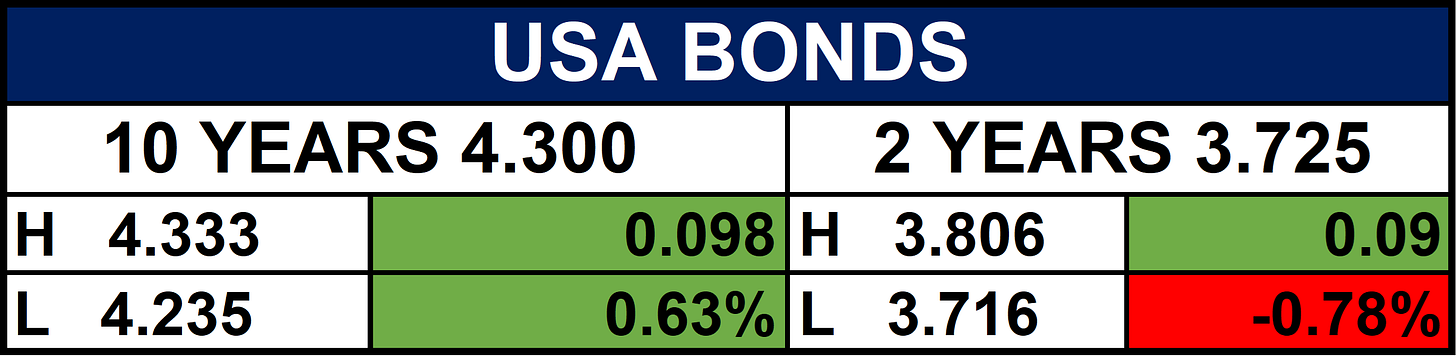

Fixed Income (USA Bonds)

Events

Conclusion

The NGX remains supported by strong sectors, earnings, and sentiment, though slower turnover hints at possible consolidation. Easing U.S. inflation and potential rate cuts may boost foreign inflows, while local corporate moves add resilience. Gains could continue, but profit-taking especially in insurance is a near-term risk.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.