Trading Tuesday - Nigeria Balances Bond Supply, Gas Investments and Export Gains Amid Global Policy and Energy Shifts

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap, where Nigeria’s fiscal strategy, energy expansion and export diversification take centre stage. Investors will track the FG’s ₦900billion bond auction, gas sector milestones, and IMF growth outlook against persistent inflation risks. Globally, energy supply disruptions, AI-driven trade growth, and shifting monetary signals set the tone for market sentiment.

Nigerian News & Market Update

FG Targets ₦900billion Capital In Jan 2026 Bond Auction:

Nigeria’s Federal Government plans to raise ₦900bn at its January 26, 2026 bond auction by reopening three medium- and long-term FGN bonds with fixed coupons. - Channels

Seplat’s 300 MMscfd ANOH Project Achieves First Gas:

Seplat Energy has achieved first gas at its 300 MMscfd ANOH project after completing key pipeline infrastructure and securing regulatory approval, marking a major boost to Nigeria’s gas supply and energy transition. - Channels

Standard Chartered appoints Adelagun acting Nigeria CEO:

Standard Chartered Bank Nigeria has appointed long-serving executive Ayodeji Adelagun as Acting CEO, reinforcing leadership continuity and its strategic commitment to the Nigerian market. - Punch

IMF forecasts 4.4% growth for Nigeria, flags inflation:

The IMF projects Nigeria’s economy to grow by 4.4% in 2026 but warns that persistent inflation and reform fatigue could threaten recent macroeconomic gains. - Punch

Falcon Corp. Eyes Sustained Gas Expansion As Pioneer CEO Ezigbo Exits:

Falcon Corporation reaffirmed its commitment to sustained gas expansion and energy security as pioneer CEO Prof. Joseph Chukwurah Ezigbo retired after 31 years, with industry leaders celebrating his lasting legacy. - Leadership

Ibom LNG Signs $700m Gas Deal With UAE Group:

Ibom LNG signed a $700 million MoU with UAE-based Securo Investment Group to support the development of a 100 mscfd LNG facility in Akwa Ibom State, strengthening Nigeria–UAE energy cooperation. - Leadership

Cocoa beans, urea, others lead as non-oil exports hit $6.1billion in 2025:

Nigeria’s non-oil exports rose 11.5% to a record $6.1 billion in 2025, led by cocoa beans, urea and cashew nuts, marking a major boost to economic diversification efforts. - DailyTrust

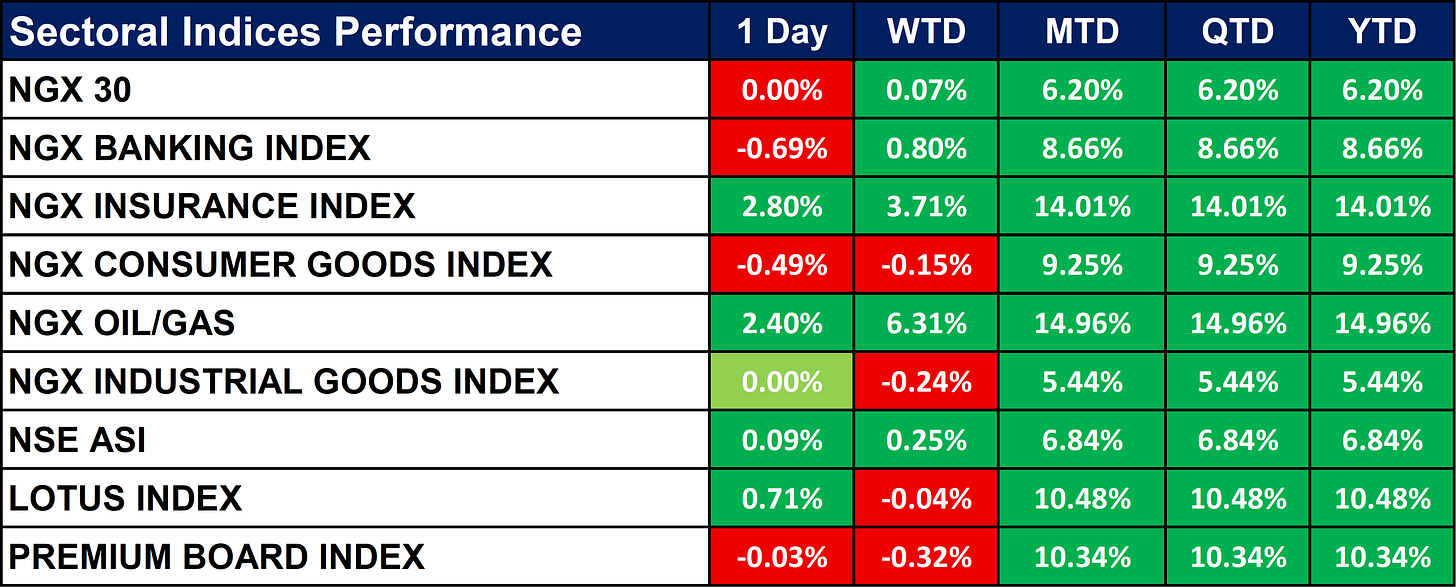

Nigeria Sectoral Indices Performance

The table below shows that the NGX Oil/Gas Index (+2.40%) and NGX Insurance Index (+2.80%) led sectoral gains, while the NGX Banking (-0.69%) and Consumer Goods (-0.49%) indices lagged. Overall, the NGX 30 remained flat for the day (0.00%) but is up 6.20% month-to-date and year-to-date.

The NSE ASI rose slightly by 0.09% on the day, bringing its year-to-date gain to 6.84%.

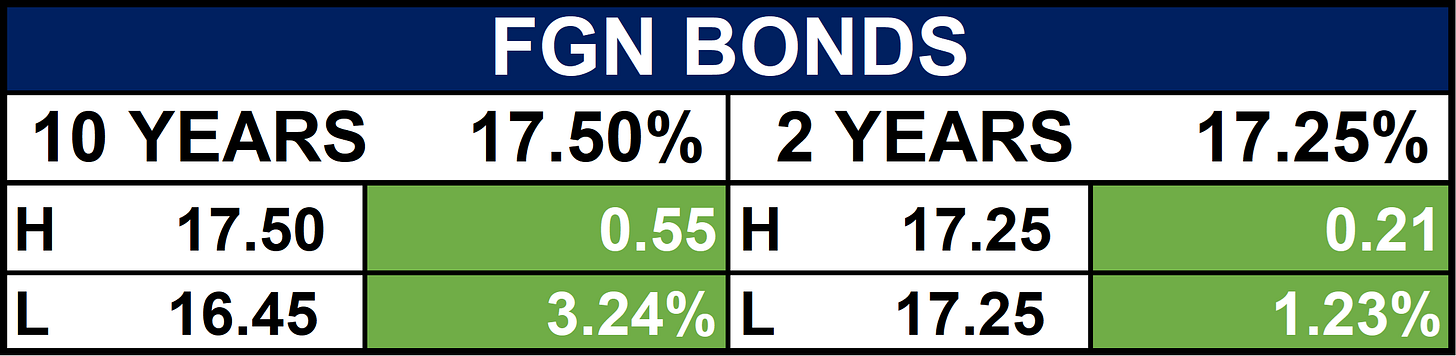

Fixed Income (FGN Bonds)

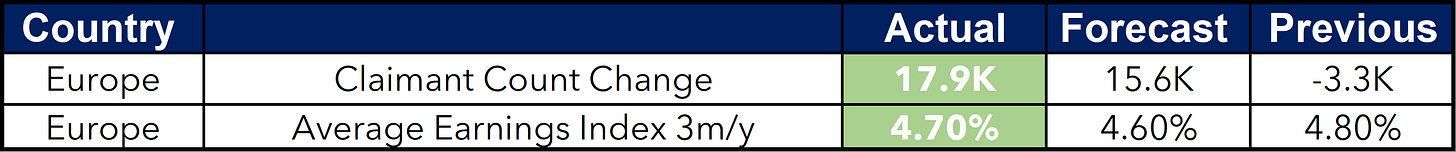

Global News & News Update

Kazakhstan’s Tengiz oil field to stay shut for another 7-10 days:

Kazakhstan’s giant Tengiz oil field is likely to remain shut for another 7–10 days after a power station fire, forcing the cancellation of CPC crude exports and potentially extending outages into February. - Reuters

Taiwan 2025 export orders hit record on solid AI demand:

Taiwan’s export orders hit a record $743.7 billion in 2025, driven by booming AI and chip demand, with strong growth expected to continue into 2026 despite trade and geopolitical risks. - Reuters

BOJ to signal more rate hikes as yen, politics fuel inflation risks:

The Bank of Japan is expected to revise up its 2026 growth forecast and signal readiness for further rate hikes amid yen weakness and rising inflation risks, while keeping the policy rate steady for now. - Reuters

Portugal’s Lifthium wins $210 million grant for lithium refinery:

Portugal’s Lifthium Energy received a $210 million EU grant to build a lithium refinery in Estarreja, aiming to supply batteries for two million EVs by 2030. - Reuters

Australia’s Origin Energy to extend operations of NSW coal-fired power plant to 2029:

Australia’s Origin Energy will extend its NSW Eraring coal-fired power plant operations to April 2029 to ensure energy supply while renewable projects scale up. - Reuters

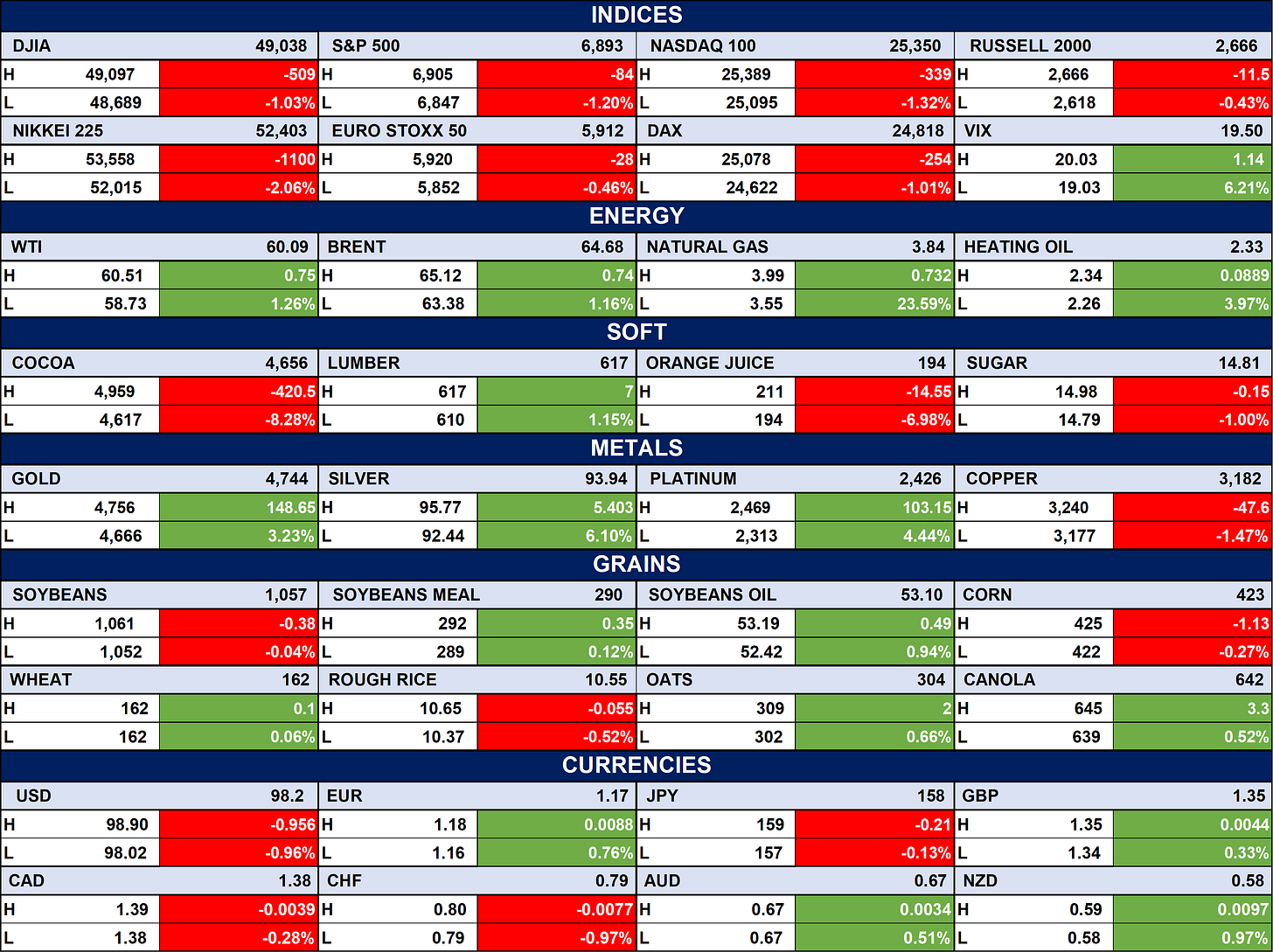

Indices, Commodities & Currencies

The table below depicts the Global equities closed broadly lower, with the S&P 500, Nasdaq 100, Nikkei 225 and DAX all posting declines, while volatility (VIX) rose sharply. Energy and soft commodities outperformed as WTI, Brent, natural gas, heating oil and lumber advanced, though cocoa and orange juice fell steeply.

Metals were mixed with gains in gold, silver and platinum offset by weaker copper, while currencies were largely stable with modest dollar softness against major peers.

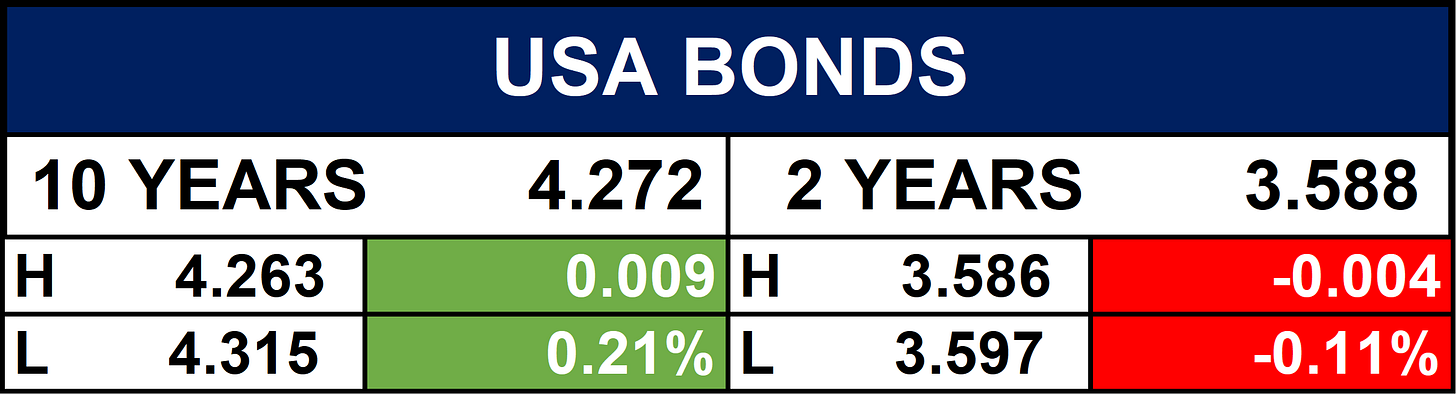

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, Nigerian fixed income markets may see mixed demand as supply increases and inflation expectations remain elevated. Energy and gas investments continue to support medium-term growth, while non-oil export gains strengthen diversification prospects. Globally, volatility from energy outages and central bank signals could influence capital flows into emerging markets like Nigeria.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.