Trading Tuesday - Nigeria Boosts Power, Gas and Financial Sectors as Global Markets Track Inflation, AI-Driven Exports, and Energy Supply Risks

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap. Investors can expect insights on Nigeria’s ongoing power and gas sector reforms, strategic banking partnerships like TAJBank’s Hajj Savings Scheme, and key capital market developments including SEC’s 2026 recapitalisation plan. Globally, attention remains on inflation dynamics in Mexico, robust Taiwan exports fueled by AI demand, and geopolitical risks impacting oil supply.

Nigerian News & Market Update

TAJBank, NAHCON sign MoU on Hajj savings scheme:

TAJBank and the National Hajj Commission of Nigeria (NAHCON) have partnered to expand the Hajj Savings Scheme, enabling aspiring pilgrims to save and access halal funding more easily through TAJBank’s ethical and digital platforms. - Punch

Oil Block: FG Slashes Signature Bonus To $3 — $7 Million:

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has slashed signature bonuses for the 2025 oil licensing round to $3–$7 million to attract more investors and boost Nigeria’s upstream activity. - Channels

FG Begins ₦185billion Gas Legacy Debt Repayment:

The Federal Government has approved a ₦185billion repayment to gas producers to restore supply, revive investment, and improve Nigeria’s power generation. - Channels

Niger Delta Power Holding Links Geregu 450MW To National Grid:

NDPHC has restored 450MW at Geregu and recovered multiple dormant turbines, adding significant capacity to the national grid and boosting Nigeria’s power generation. - Leadership

SEC Sets 2026 Recapitalisation Plan:

The SEC will begin a major recapitalisation of all capital market intermediaries in 2026 to strengthen institutions and boost Nigeria’s investment landscape. - Dmarketforces

Greenwich Holdings appoints Ariyibi pioneer GMD:

Greenwich Holdings has appointed Samson Ariyibi as its first Group Managing Director as it prepares to begin full operations under its new financial holding structure. - Punch

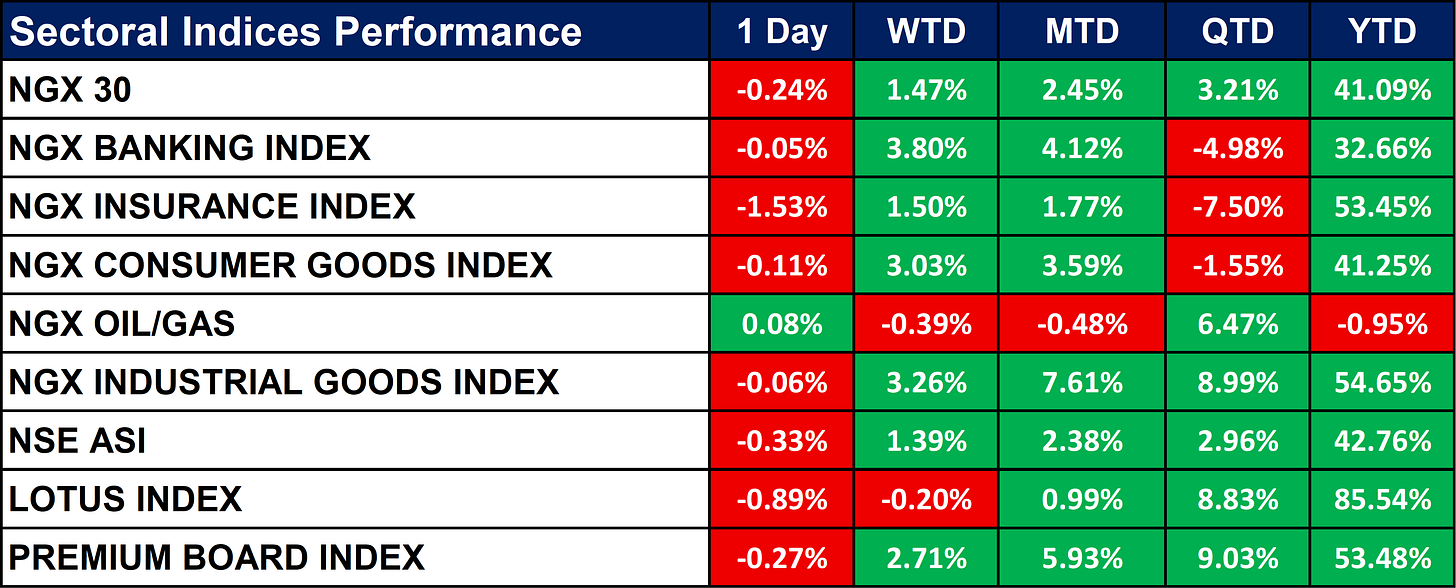

Nigeria Sectoral Indices Performance

The table below shows that Most sector indices declined on the day, with Insurance (-1.53%) and Lotus (-0.89%) posting the biggest losses, while Oil/Gas inched up (+0.08%). Weekly and monthly performance remained broadly positive across sectors, showing sustained short-term strength. Year-to-date returns are strong overall, led by Lotus (+85.54%), Industrial Goods (+54.65%), Insurance (+53.45%), and Premium Board (+53.48%).

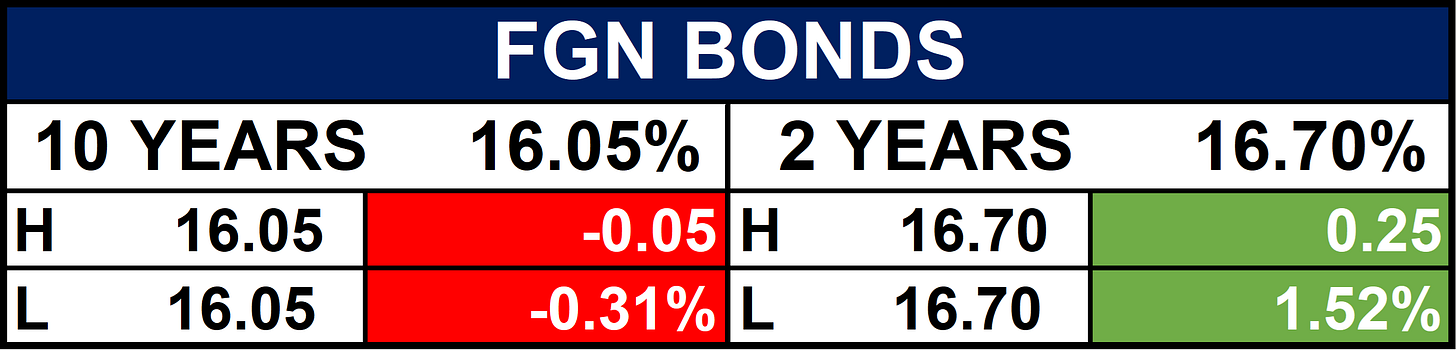

Fixed Income (FGN Bonds

Global News & News Update

Mexico’s inflation accelerates more than expected, central bank notes further risks:

Mexico’s inflation rose to 3.80% in November, slightly above expectations, prompting the central bank to warn of higher risks ahead from potential tax hikes and trade uncertainties. - Reuters

Russia’s Syzran oil refinery halted by December 5 drone attack, sources say:

A Ukrainian drone strike damaged Russia’s Syzran refinery, forcing a shutdown of its main crude unit and halting oil processing for an estimated month of repairs. - Reuters

German exports unexpectedly rise in October due to EU trade:

German exports in October inched up 0.1% on stronger EU demand, offsetting sharp declines in shipments to the U.S. and China. - Reuters

Bank of England sees budget cutting inflation by around 0.4-0.5 percentage points:

The Bank of England says Rachel Reeves’ budget will lower UK inflation by about 0.4–0.5 percentage points for a year starting mid-2026. - Reuters

AI demand powers Taiwan November exports to fastest growth in 15-1/2 years:

Taiwan’s November exports surged 56% y/y to a record $64.05billion, driven by strong chip and AI demand, with U.S. shipments up 182% and China up 16.5%. - Reuters

Shell seeks buyer for 20% stake in Brazilian oilfield cluster:

Shell is seeking a buyer for a 20% stake in its Brazilian Gato do Mato oilfield to fund offshore development while remaining the project operator. - Reuters

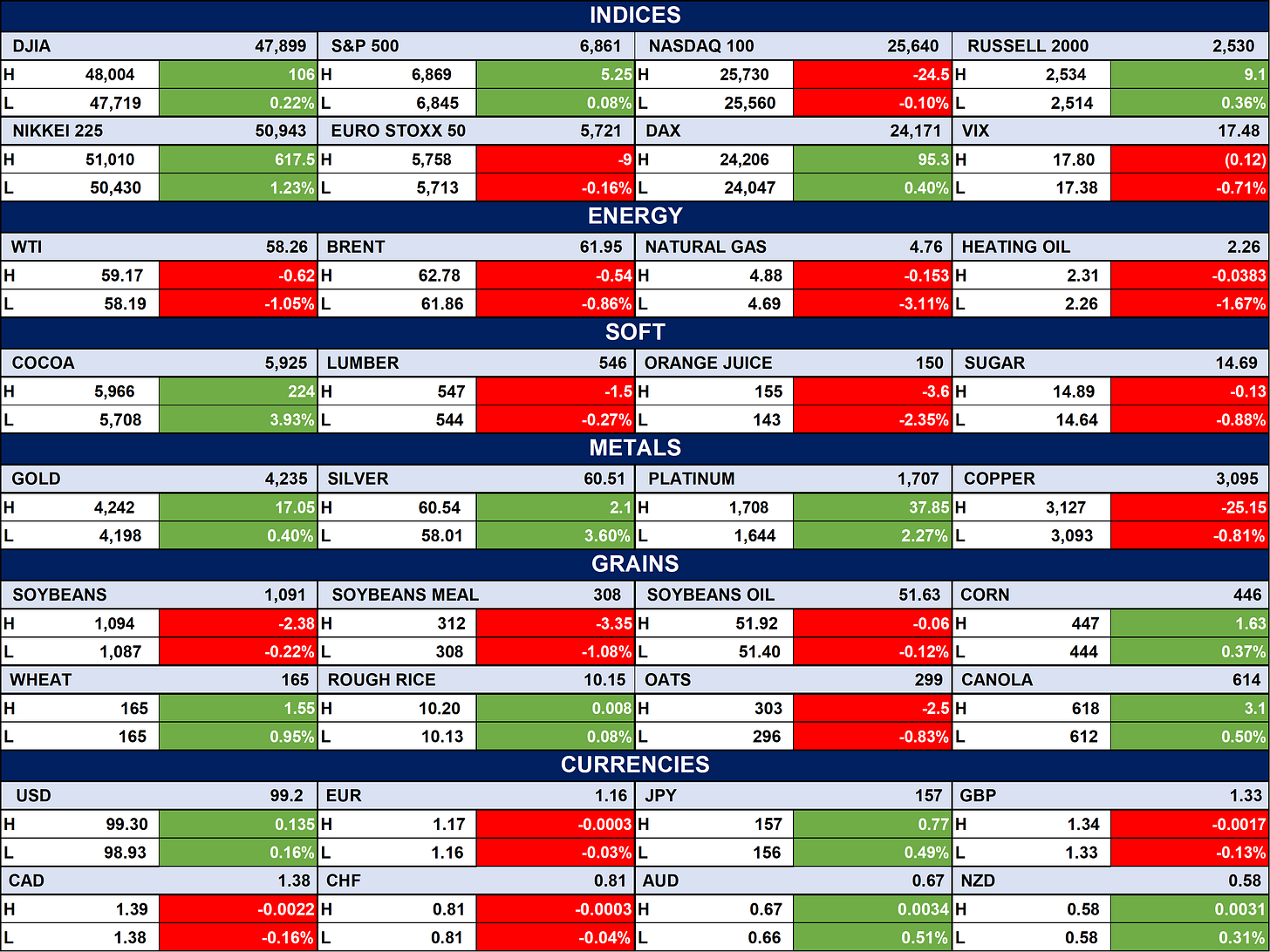

Indices, Commodities & Currencies

Global equity markets showed mixed performance, with the Nikkei 225 gaining over 1%, while the Nasdaq 100 and Euro Stoxx 50 edged lower. Energy prices mostly declined, with WTI and Brent crude down over 0.5%, and natural gas falling 3.1%, while heating oil also retreated. Precious metals were stronger, while grains were mixed, corn and wheat gained slightly, and soy products mostly declined.

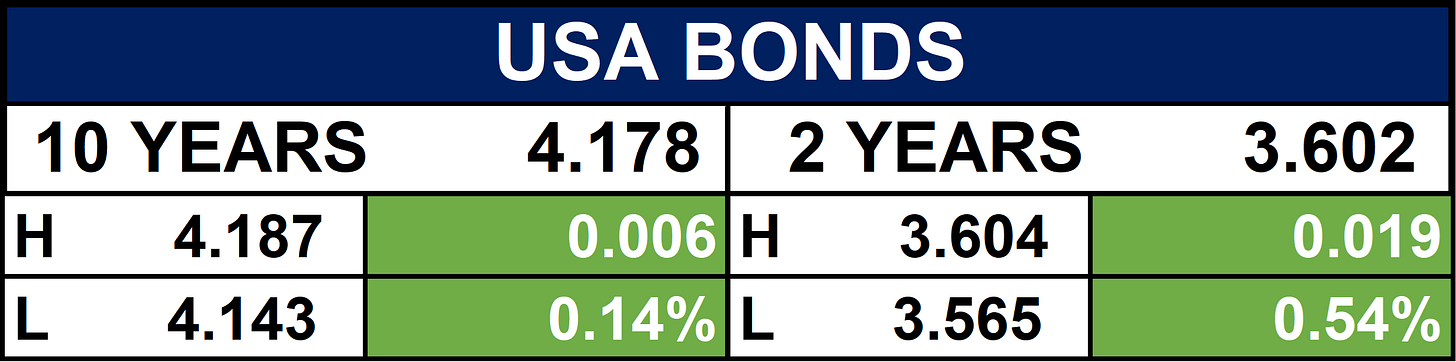

Fixed Income (USA Bonds)

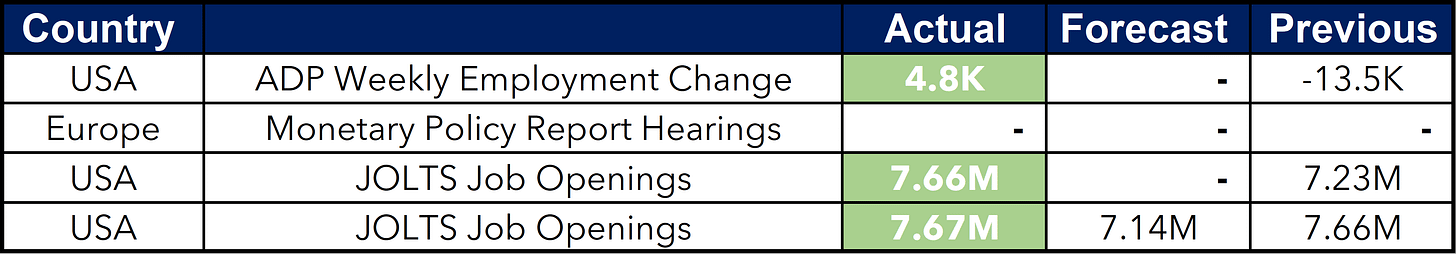

Event

Conclusion

Looking ahead, Nigerian investors may see renewed opportunities in energy and financial sectors, supported by government interventions and infrastructure expansions, while global markets could remain sensitive to inflation trends, supply disruptions, and technology-driven export growth. Strategic positioning across these sectors could offer balanced returns amid mixed equity and commodity movements

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.