Trading Tuesday - Nigeria Deepens Market Reforms as Global Energy and Inflation Shifts Shape Investor Outlook.

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap-up. In this edition, we spotlight key developments shaping Nigeria’s economy from rising metering rates and new oil licensing rounds to the NGX’s broad-based losses and the upcoming T+2 settlement shift. Globally, oil markets firmed on increased Middle East supplies, while easing inflation in Brazil and shifting trade flows in India hint at changing macroeconomic trends.

Nigerian News & Market Update

Ellah Lakes opens ₦235billion public offer:

Ellah Lakes Plc has launched a ₦235 billion public offer to fund its agro-industrial expansion and strengthen Nigeria’s food security through upgraded processing and integrated operations. - Punch

Oil Production - NUPRC To Begin 2025 Licensing Round From December 1:

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) will launch the 2025 oil licensing round on December 1 to boost crude production and attract over $20 billion in investments, aligning with Nigeria’s $1 trillion economy target. - Channels

Nigeria’s Capital Market to Adopt T+2 Settlement Cycle Nov. 28:

Nigeria’s capital market will transition to a faster T+2 settlement cycle on November 28, 2025, to boost efficiency, liquidity, and investor confidence in line with global standards. - dmarketforces

Metering rate rises to 55% – NERC:

Nigeria’s electricity metering rate rose slightly to 55.01% in August 2025 as NERC advanced reforms and funded new meter installations to boost transparency and revenue collection. - Punch

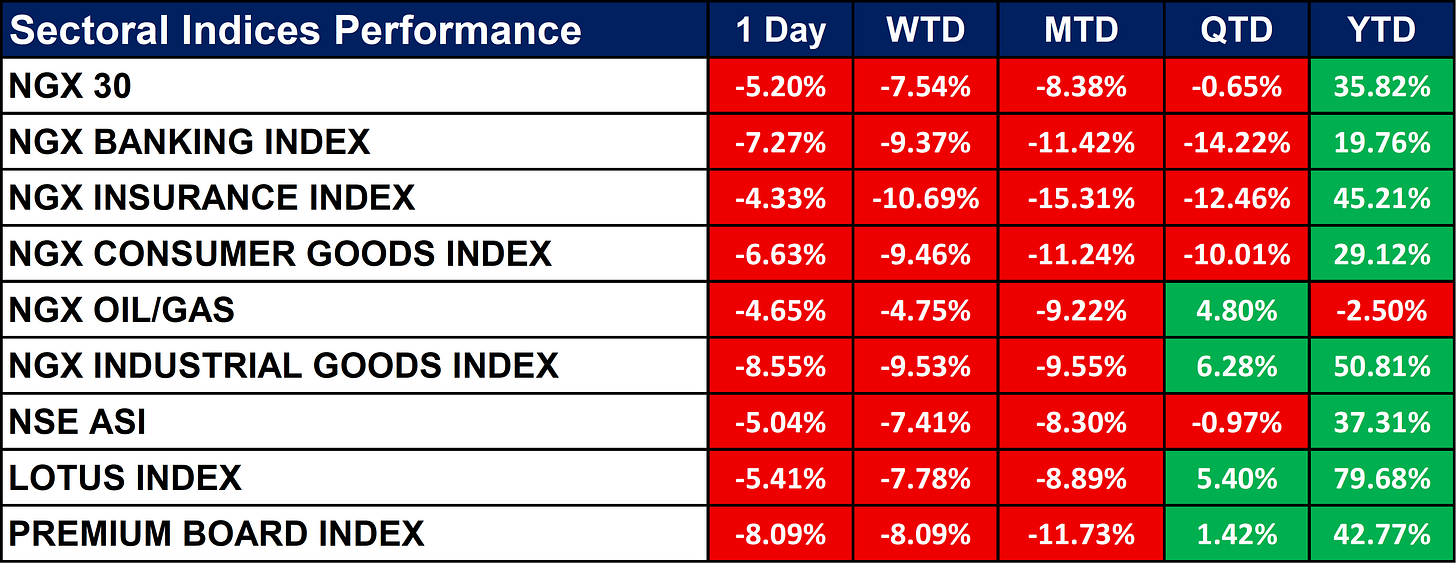

Nigeria Sectoral Indices Performance

The table below shows that the NGX market saw broad losses, with all major sectoral indices declining sharply on the day led by Industrial Goods (-8.55%) and Banking (-7.27%). Week-to-date and month-to-date performances were negative across all sectors, signaling persistent market weakness. Despite recent declines, year-to-date returns remain positive, with the Lotus Index (+79.68%) and Industrial Goods (+50.81%) leading overall gains.

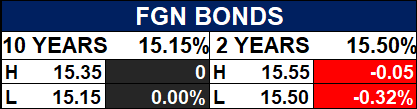

Fixed Income (FGN Bonds)

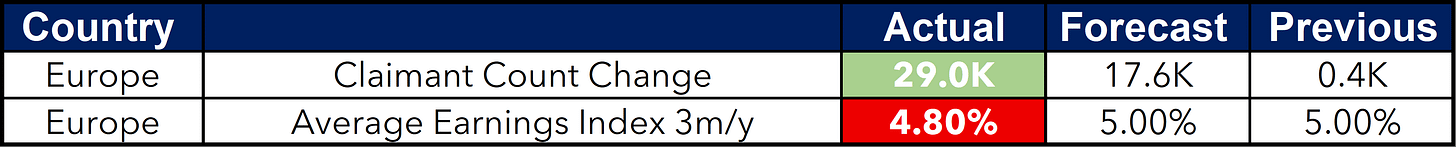

Global News & News Update

Saudi Arabia, Iraq, Kuwait increase supplies to India in December, sources say:

Saudi Arabia, Iraq, and Kuwait will boost crude oil supplies to India in December as Indian refiners shift from Russian barrels amid tightening Western sanctions. - Reuters

Brazil’s inflation slows in October, paves way for early 2026 rate cut:

Brazil’s inflation slowed to 0.09% in October, below expectations, strengthening prospects for an interest rate cut early next year. - Reuters

India’s cotton imports to hit record high on duty exemption, low output:

India’s cotton imports are set to rise nearly 10% to a record 4.5 million bales in 2025/26 due to duty-free imports and crop damage that pushed local output to a 17-year low. - Reuters

TotalEnergies, QatarEnergy and Petronas sign exploration agreement in Guyana:

TotalEnergies, QatarEnergy, and Petronas have signed a five-year deal with Guyana to explore a shallow-water oil block, paying a $15 million entry bonus. - Reuters

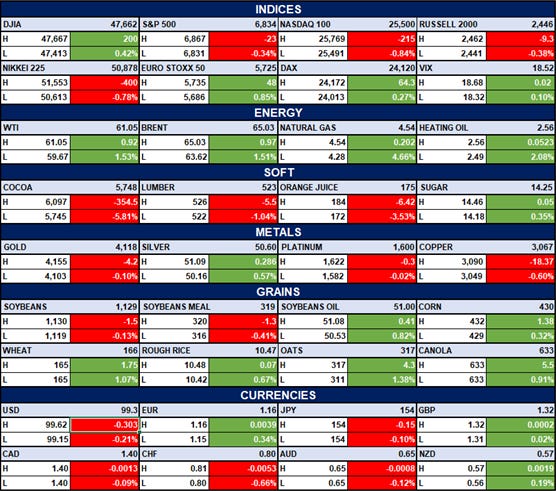

Indices, Commodities & Currencies

The table below depicts that the Global markets were mixed. The U.S. indices were mostly lower, with the Dow up 0.42% but Nasdaq down 0.84%. Energy commodities gained as WTI and Brent rose over 1.5%, while cocoa and lumber dropped sharply in soft commodities. The U.S. dollar weakened slightly against major currencies, while grains and metals posted modest gains.

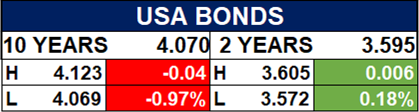

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, investors could brace for continued volatility in the Nigerian market amid sector-wide weakness, even as reforms and capital market upgrades support long-term resilience. Globally, energy price dynamics and softer inflation trends may drive renewed interest in commodities and emerging markets as 2025 progresses.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.