Trading Tuesday - Nigeria Rides Infrastructure Wave Despite Tight Liquidity; Global Focus Shifts to Trade Talks and Oil

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Nigerian markets advanced, buoyed by gains in Oil & Gas and NGX 30, despite tighter liquidity from the ₦2.12 trillion Open Market Operations OMO) auction. Globally, investor sentiment remains cautious amid EU-China trade tensions and rising oil prices.

Nigerian News & Market Update

OMO Bills Auction Settlement Tightens Money Market Liquidity:

CBN’s ₦2.12 trillion Open Market Operations (OMO) auction settlement tightened money market liquidity, pushing rates slightly higher despite sustained investor demand for T-bills. - dmarketforces

NNPCL revenue drops to ₦4.2trillion as oil production drag in September:

The Nigerian National Petroleum Company Limited (NNPCL)’s September report shows declines in revenue, profit, and production across oil and gas, citing maintenance and project delays, while highlighting progress on key pipeline projects. - Businessday

Kano, Katsina, Jigawa plan ₦50 billion fund to set up regional electricity market:

Kano, Katsina, and Jigawa states are partnering to create a regional electricity market and raise ₦50 billion to boost power access and invest in Kano DisCo’s core investor, Future Energies Africa. - Premiumtimes

Private Sector, Diaspora to drive ₦500 billion South East Infrastructure Agenda – SEDC MD, Okoye:

The South East Development Commission has unveiled a ₦500 billion infrastructure plan to transform the region through coordinated investments in industry, agriculture, power, and youth development, with strong backing from government, private sector, and diaspora. - Thesun

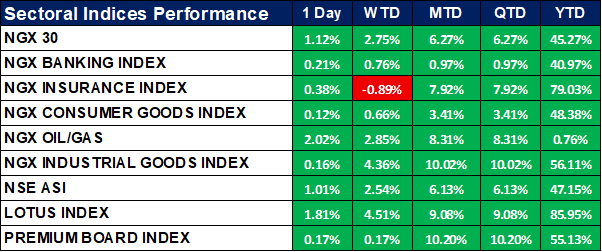

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian equities advanced, with the NGX All-Share Index up 1.01% day-on-day and 2.54% week-to-date. Oil & Gas (+2.02%) and the NGX 30 (+1.12%) led daily gains, while Insurance was the only laggard week-to-date (-0.89%). Year-to-date, the market remains strong driven by the Lotus (+85.95%) and Insurance (+79.03%) indices.

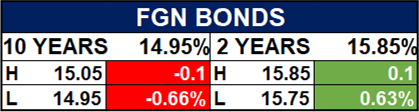

Fixed Income (FGN Bonds)

Global News & News Update

EU trade chief to meet China’s Wang to discuss rare earths:

The European Union (EU) has invited China to Brussels for urgent talks to resolve tensions over Beijing’s tightened rare earth export restrictions, which are straining EU-China trade relations. - Reuters

Senegal debt servicing projections for years ahead rise sharply, document shows:

Senegal raised its 2026–2028 debt service projections by about CFA 3.2 trillion ($5.8 billion) amid efforts to address undisclosed debts and restart its $1.8 billion IMF program. - Reuters

Ukraine parliament amends 2025 budget, raises defence spending to wartime record:

Ukraine’s parliament has increased 2025 defence spending to a record $70.86 billion amid ongoing war with Russia, partly funded by a G7-backed loan using interest from frozen Russian assets. - Reuters

Oil rises in choppy trade as investors focus on supply signals:

Oil prices inched up slightly amid choppy trading, as concerns over oversupply and U.S.-China trade tensions kept investors cautious despite hopes for a fair trade deal. - Reuters

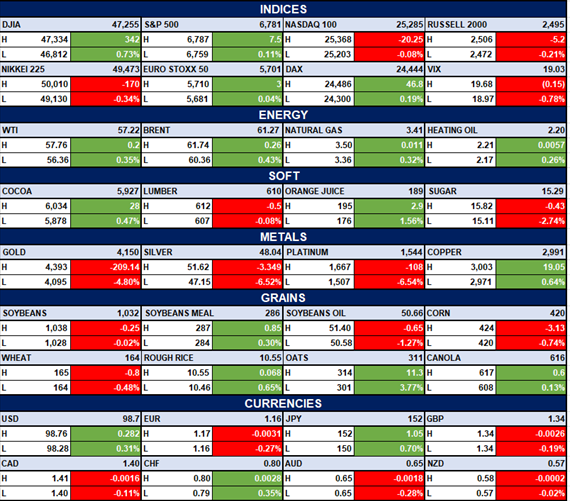

Indices, Commodities & Currencies

The table below depicts that the Global markets were mixed. The U.S. indices like the Nasdaq and Russell 2000 slipped, while Europe’s DAX posted modest gains. Energy prices firmed. Gold and silver fell sharply, while grains and soft commodities showed mixed performance; the U.S. dollar strengthened broadly against major currencies.

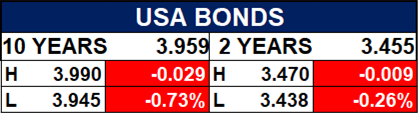

Fixed Income (USA Bonds)

Conclusion

Looking ahead, Nigerian markets may face short-term liquidity pressures, while global trends especially developments in energy, China’s export policy, and conflict-related spending could drive volatility. Investors should monitor oil supply dynamics and local fiscal reforms for potential opportunities.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.