Trading Tuesday - Nigeria Secures Major Energy and Investment Deals as Global Markets Weaken on Oil Price Drop and U.S.–China Trade Tensions

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Nigeria saw strong investment moves as OPEC kept oil forecasts steady, Shell approved a $2billion gas project, and the government signed major renewable energy and EU credit deals. Bond yields hovered near 16% as the DMO planned ₦900billion Q4 borrowing. Globally, markets weakened amid U.S.–China trade tensions, falling oil prices, and soft data from South Africa

Nigerian News & Market Update

OPEC forecasts gasoline-led rise in 2026 oil demand:

The Organization of the Petroleum Exporting Countries (OPEC) kept its 2025–2026 oil demand and supply forecasts unchanged, with demand seen rising to 106.5 mb/d by 2026. Jet fuel will drive 2025 growth, while gasoline leads in 2026. Non-OPEC+ supply gains remain steady. - Punch

Tinubu Welcomes Shell’s $2billion New Offshore Gas Investment In Nigeria:

Shell approved a $2billion gas project in Nigeria’s HI Field to produce 350 mmscf/d by 2028, supporting NLNG Train 7. It’s the third major Final Investment Decision (FID) under Tinubu, raising new investments to over $8billion. - Channels

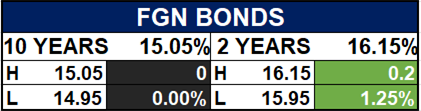

Nigerian Bonds Yield Tracks Below 16% Amidst Cautious Action:

FGN bond yields stayed flat at 15.98% amid cautious trading, while Treasury bill yields dipped slightly to 17.39% ahead of inflation data. - dmarkrtforces

FG seals $435million agreement to boost renewable energy development nationwide:

Nigeria signed $435million renewable energy deals to boost power access and local manufacturing, with VP Shettima citing $410billion investment potential by 2060. - Businessday

DMO Plans ₦900billion Borrowing From FGN Bonds In Q4:

The Debt Management Office (DMO) plans to raise ₦720–₦900billion in Q4 2025 through reopened 5-year and 7-year FGN bonds to fund domestic needs.

Nigeria’s total public debt rose to ₦152.4trillion ($99.66billion) as of June 2025, up 2% from March. - LeadershipEU, Nigeria seal ₦320billion credit deal for agriculture boost:

The European Union (EU) approved a €190million (₦320.5billion) credit line through the European Investment Bank (EIB) to boost financing for Nigerian farmers and agribusinesses. The facility aims to expand access to credit, promote climate-smart agriculture, and strengthen Nigeria’s agri-value chains. - Punch

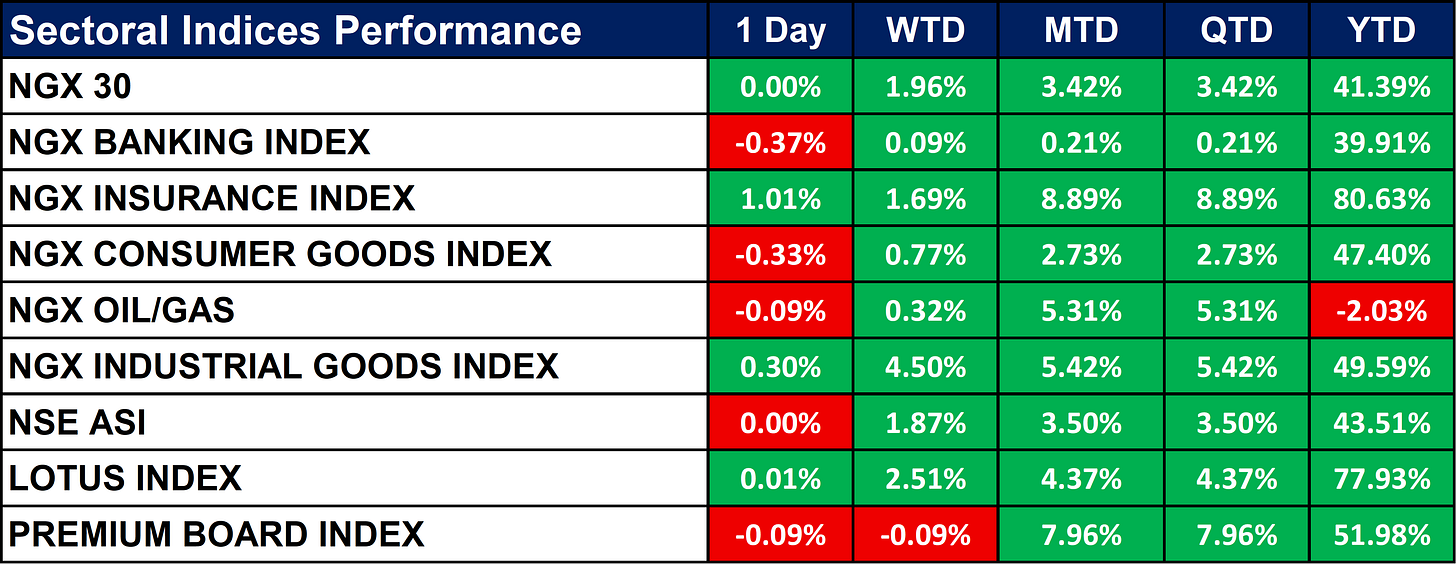

Nigeria Sectoral Indices Performance

The table below shows that the The NGX Insurance Index led gains with an impressive 80.63% YTD, followed by Lotus Index (+77.93%) and Industrial Goods (+49.59%). Overall market sentiment stayed positive as the NSE ASI rose 43.51% YTD, despite minor daily declines in Banking, Consumer Goods, and Oil/Gas.

The Oil/Gas sector remained the only laggard year-to-date, down 2.03%, amid cautious investor sentiment.Fixed Income (FGN Bonds)

Global News & News Update

China’s rare earth curbs put Europe’s auto industry at risk:

China’s tighter rare earth export curbs risk disrupting Europe’s auto industry as reserves run low, ANFIA warns, noting the metals are crucial for electric vehicles and global production stability. - Reuters

South African rand falls on disappointing mining data, risk-off sentiment:

The South African rand weakened after disappointing mining data and renewed U.S.-China trade tensions dampened risk sentiment. Gold prices hit a record high, but local stocks and bonds declined as investor caution persisted. - Reuters

India, US to hold trade talks as New Delhi seeks higher energy imports:

India and the U.S. will resume trade talks this week, with India set to boost U.S. energy imports as both sides aim to sign the first phase of a trade deal next month. - Reuters

Oil falls more than 2% on US-China trade tensions and IEA report:

Oil prices dropped over 2% to five-month lows as U.S.–China trade tensions escalated and the International Energy Agency (IEA) warned of rising supply and weaker demand. The IEA projects a 2026 oil surplus of up to 4 million barrels per day. - Reuters

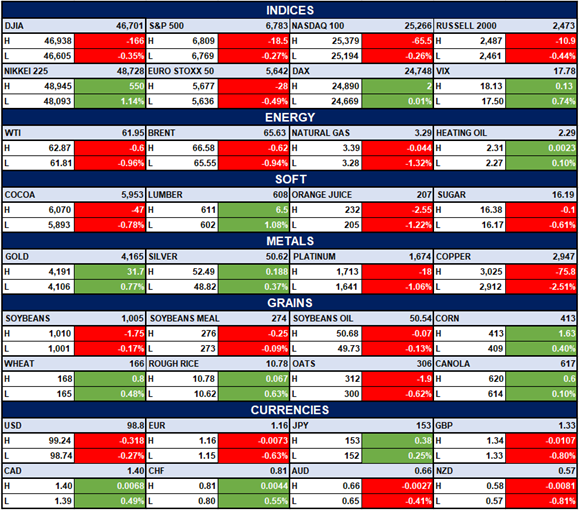

Indices, Commodities & Currencies

The table below depicts that the Global markets showed mixed performance. The U.S. indices like the Dow Jones and S&P 500 slipped slightly, while Nikkei 225 gained over 1%. In commodities, oil prices declined modestly, while gold and silver edged higher; copper fell over 2%. Among currencies, the USD weakened, while CAD, CHF, and JPY recorded small gains against major peers.

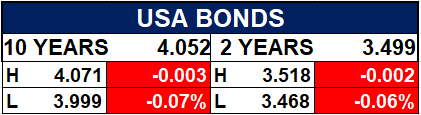

Fixed Income (USA Bonds)

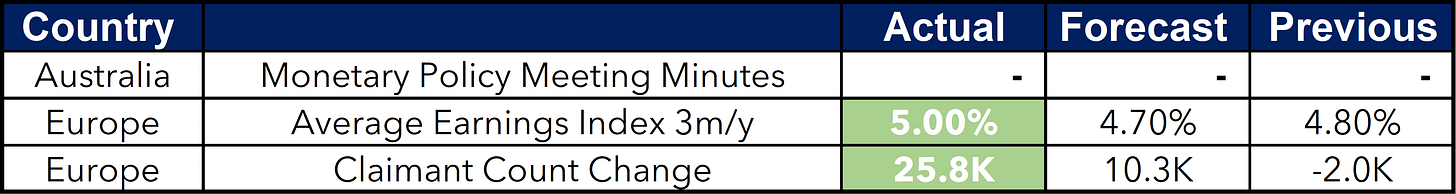

Events

Conclusion

Overall, Nigeria’s economic outlook remains driven by rising energy investments and fiscal activity, while global markets face renewed pressure from trade frictions and commodity volatility. Investors should stay alert for inflation data and international policy shifts that could influence both oil and bond markets.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.