Trading Tuesday - Nigeria Soars on Earnings; Global Markets Hit Speed Bumps

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Global markets were mixed as weak economic data and trade tensions weighed on sentiment. U.S. and European stocks dipped, especially tech and chip shares, while M&A activity surged, driven by AI. Commodities showed varied performance, with energy prices falling and cocoa and silver gaining. In Nigeria, equities performed strongly. Stanbic IBTC and Beta Glass reported impressive earnings, and industrial and insurance sectors led gains. Delta remained the top oil-producing state, while Lagos recorded zero output.

Nigerian News & Market Update

Stanbic IBTC shares hold firm at ₦101:

Stanbic IBTC Holdings' stock held steady at ₦101, driven by strong Q1 2025 results showing an 85.6% rise in pre-tax profit to ₦116.4billion. The stock has gained over 74% year-to-date. The company attributes its growth to innovation, operational excellence, and a strong team. It also secured a ₦172billion loan from China Development Bank to boost operations and strengthen Africa-China trade ties. - Punch

Beta Glass Records 63% Revenue Growth in H1, PAT(Profit After Tax) Soars 337%:

Beta Glass Plc reported strong H1 2025 results with net sales up 63% to ₦78.2billion and profit after tax rising 334% to ₦18.7billion. Operating profit and EBITDA(Earnings Before Interest, Taxes, Depreciation, and Amortization) also saw major gains, driven by strong market demand, efficient operations, and strategic pricing. CEO Alexander Gendis highlighted the company's resilience despite economic challenges and noted ongoing investments in sustainability, including a new solar power plant. Beta Glass remains optimistic for H2 2025, aiming to expand operations and maintain growth momentum. - Thisday

With 100m Barrels, Delta Retains Lead as Nigeria’s Top Oil-producing State, Lagos Records Zero Output:

Delta State led Nigeria’s crude oil production from Nov 2023 to Sept 2024 with 99.9 million barrels, over a third of the national total. Akwa Ibom, Bayelsa, and Rivers followed, making up nearly 90% of output. Rivers State topped gas production with 391.3 billion scf(standard cubic feet), while Delta, Bayelsa, and Akwa Ibom also contributed significantly. Lagos recorded zero oil and gas output due to unresolved asset issues. The data highlights the Niger Delta’s key role in Nigeria’s oil and gas sector and the need for more investment in underperforming regions. - Thisday

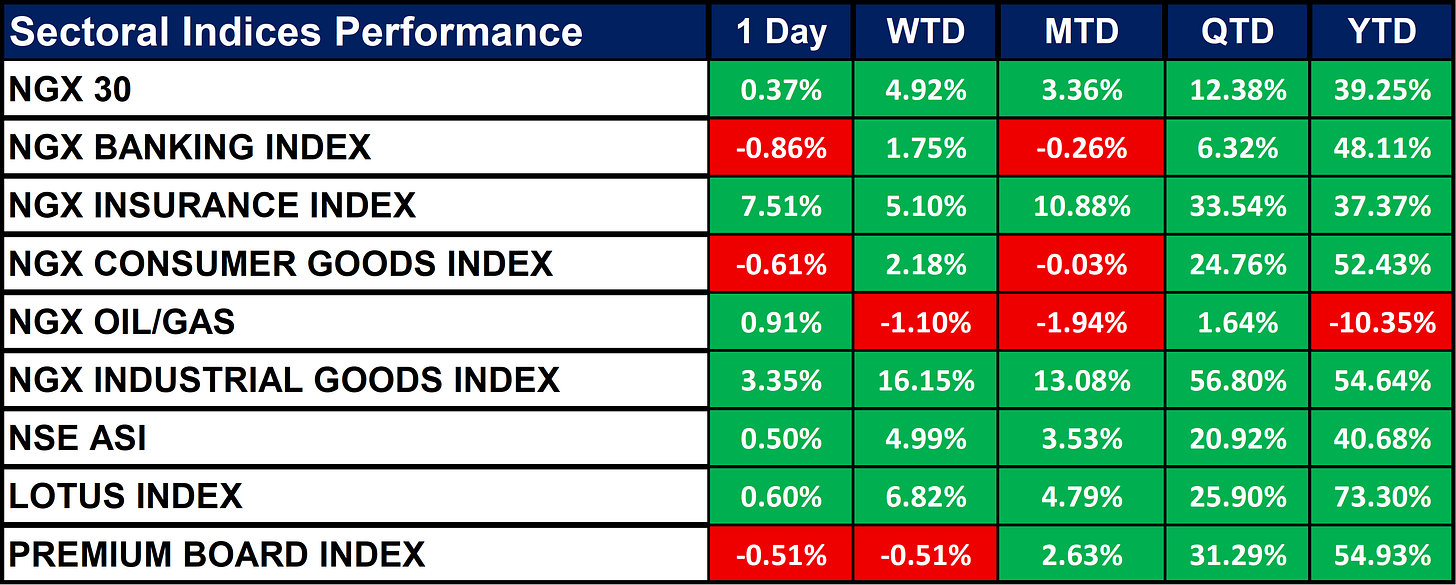

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian sectoral indices showed strong overall performance. The NGX Insurance Index led the day with a 7.51% gain, while the Industrial Goods Index posted the highest weekly (+16.15%) and quarterly (+56.80%) gains. Year-to-date, the Lotus Index (+73.30%), Premium Board (+54.93%), and Consumer Goods (+52.43%) topped the chart. In contrast, the Oil/Gas Index was the weakest, down -10.35% YTD. The broader NSE ASI remained strong, up +0.50% (1D) and +40.68% YTD, reflecting overall market resilience.

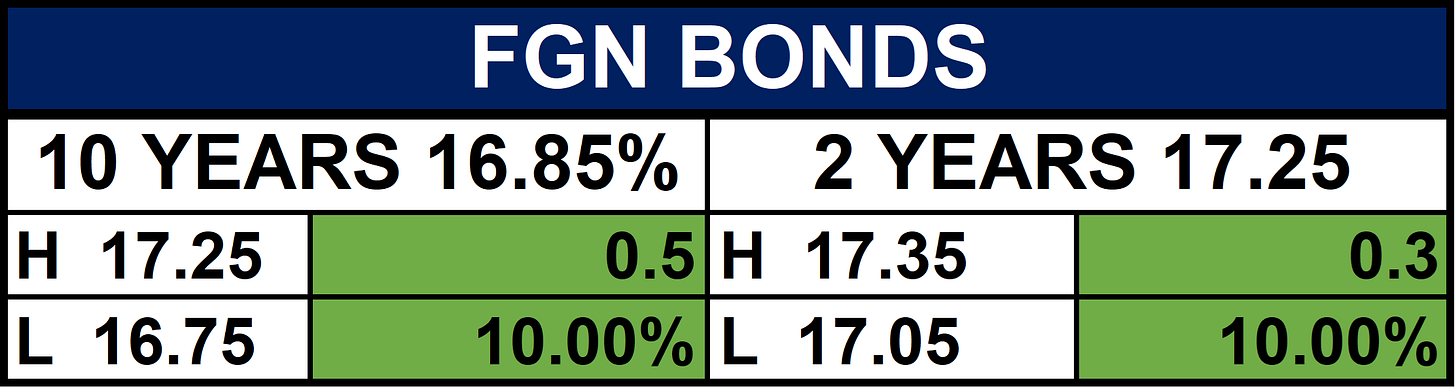

Fixed Income (FGN Bonds)

Global News & News Update

Stocks fall after weak economic data and more tariff threats:

U.S. stocks fell on Tuesday due to weak economic data and Trump’s tariff comments, raising concerns about stagflation. The Dow, S&P 500, and Nasdaq each dropped around 0.6–0.7%. Palantir rose 7% on strong revenue, while Caterpillar and Eaton declined on poor results. Despite the dip, strong earnings and easing inflation support a positive market outlook. - CNBC

European chip stocks fall after Trump says he will unveil new tariffs:

European stocks closed slightly higher, with the Stoxx 600 up 0.1%, boosted by gains in the FTSE 100 (+0.1%) and Germany's DAX (+0.4%), while France's CAC 40 dipped 0.1%. Semiconductor stocks reversed earlier gains after Trump announced upcoming chip tariffs. BE Semiconductor fell 2.3%, and VAT Group and STMicro dropped 0.9% each. - CNBC

Global M&A hits $2.6 trillion peak year-to-date, boosted by AI and quest for growth:

M&A value is up 28% from last year, driven by U.S. megadeals, increased corporate growth motivations from AI and regulatory changes, and a resurgence of private equity activity fueling deal momentum. - Reuters

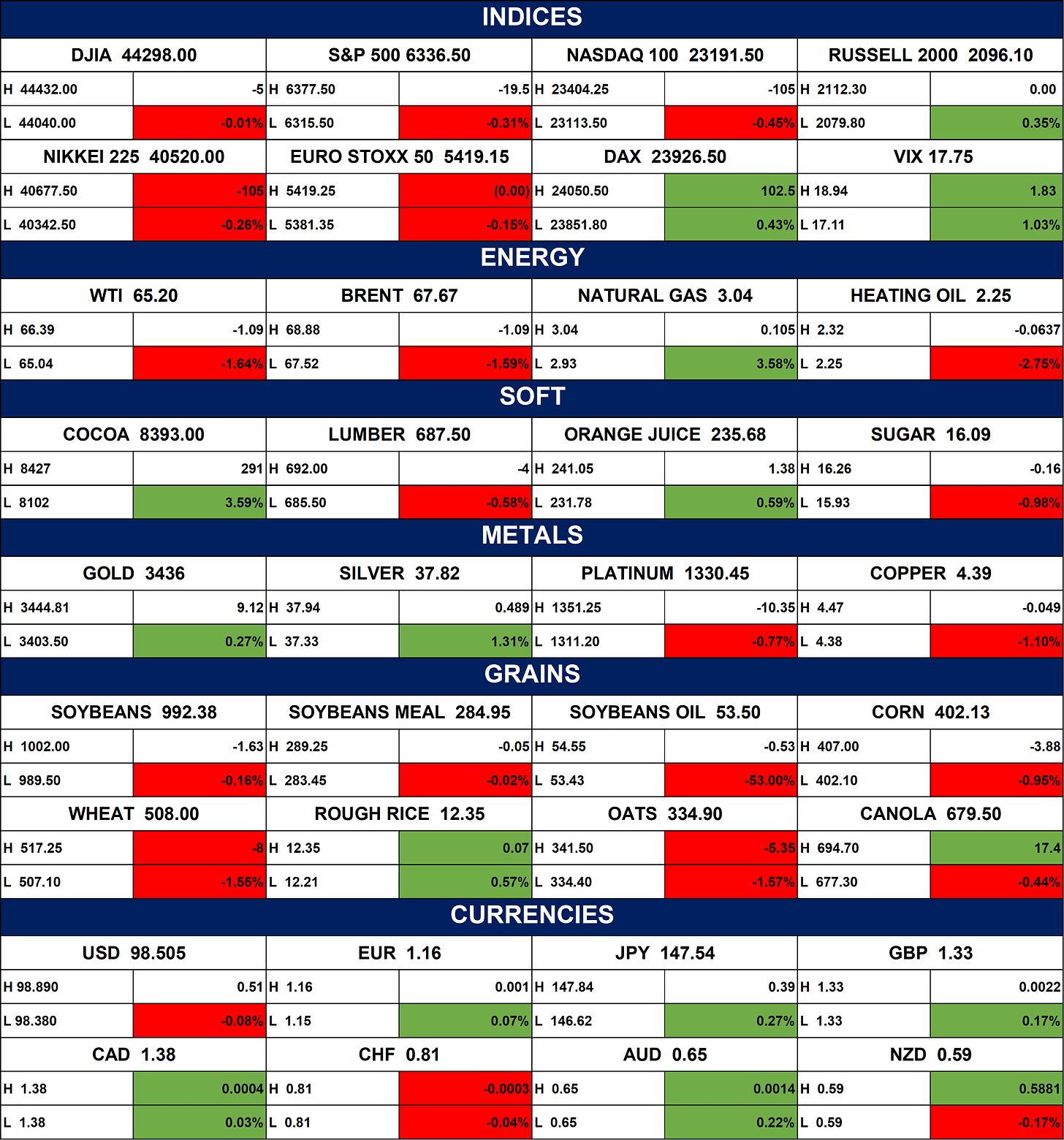

Indices, Commodities & Currencies

The table below depicts that the Global markets were mixed. The S&P 500, NASDAQ, and Nikkei declined, while DAX and Russell 2000 rose modestly. WTI and Brent crude fell over 1.5%, but natural gas surged 3.58%. Cocoa jumped 3.59%, while lumber and sugar declined. Silver (+1.31%) and gold (+0.27%) gained; platinum and copper fell. Grains mostly dropped, especially wheat and oats, though rough rice edged up. Currencies were stable with slight gains in EUR, JPY, and AUD, and a dip in the USD. Markets reflect caution amid volatility and falling energy prices.

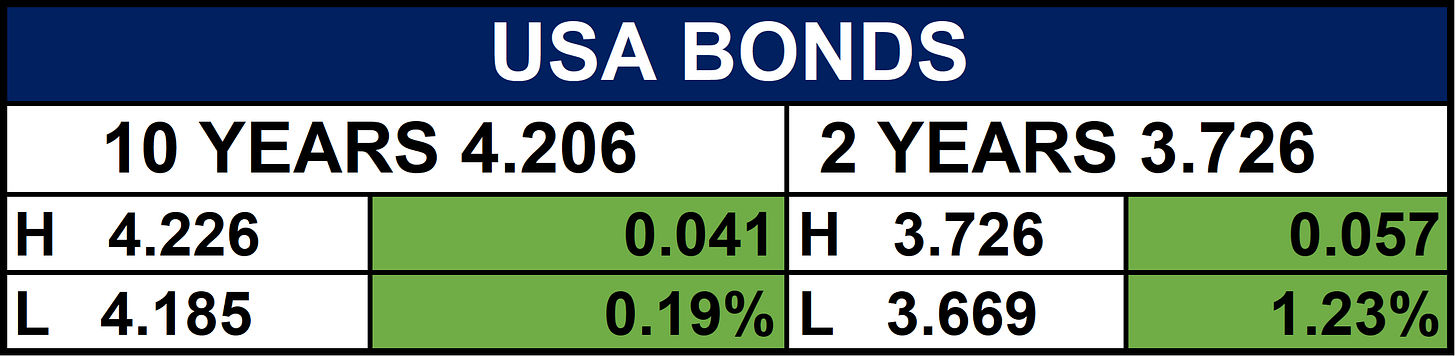

Fixed Income (USA Bonds)

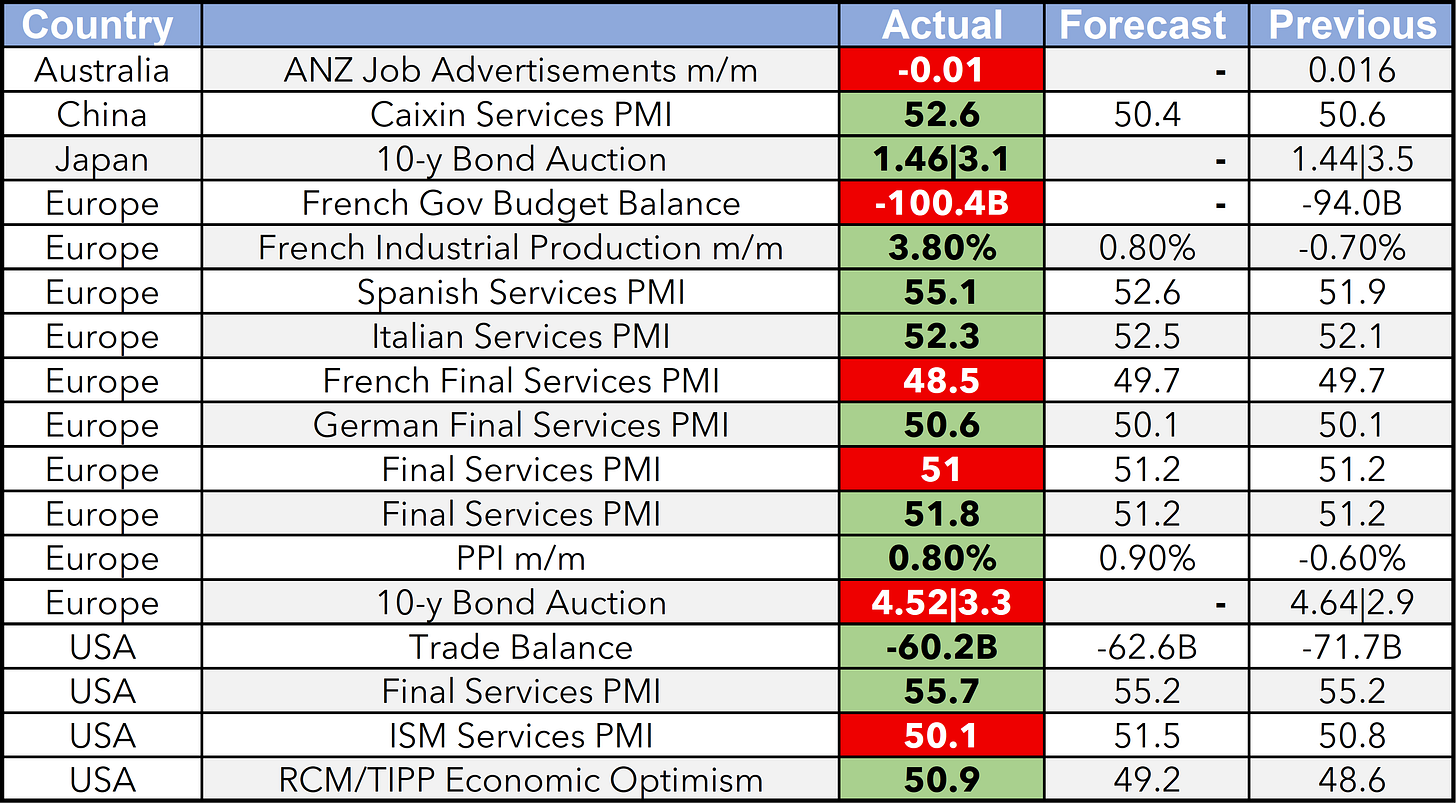

Events

Conclusion

As Nigerian equities shine supported by solid earnings and sector rotation investor sentiment remains cautious globally amid tariff threats and weak macro data. The Nigerian market may continue to benefit from strong corporate results and defensive sector strength, especially in industrials and financials. Globally, expect continued volatility as investors weigh policy risks against strong earnings and M&A momentum. Watch for commodity price shifts and central bank cues as catalysts in the coming week.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.