Trading Tuesday - Nigeria Strengthens Financial Credibility with FATF Exit, Bond Market Surge, and Strategic Investments as Global Markets Navigate Energy Volatility and Trade Realignments

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Nigeria’s financial credibility strengthens with its Financial Action Task Force (FATF) delisting and rising investor confidence, while global markets react to shifting energy, gold, and trade developments. From bond auctions to major clean energy and tech partnerships, both local and international trends signal dynamic investment opportunities ahead.

Nigerian News & Market Update

Nigeria’s removal from FATF grey list marks boost for financial credibility – CBN:

Nigeria’s removal from the Financial Action Task Force (FATF) grey list signals restored global confidence in its financial system after major anti-money laundering and transparency reforms led by the CBN and other agencies. - Premiumtimes

Paypal Signs Payments Wallet Deal with OpenAI’s ChatGPT:

PayPal is partnering with OpenAI to enable instant shopping and payments directly within ChatGPT starting in 2026, connecting millions of users and merchants through its payment network. - dmarketforces

DMO Cuts Rates on Nigerian Bonds, Turns Down Excess Demand:

Nigeria’s Debt MAnagement Office (DMO) cut bond yields and rejected excess bids as investor demand surged to ₦1.27 trillion against a ₦260 billion offer at its October auction. - dmarketforces

Skymark Partners raises ₦11.49 billion in latest commercial paper issuance:

Skymark Partners listed ₦11.49 billion in new commercial papers on FMDQ, expanding its short-term debt programme to support business growth and sustain investor confidence. - Businessday

ntel set to return to Nigeria’s telecoms market early 2026:

Ntel will re-enter Nigeria’s telecom market in early 2026 as a digital-first Mobile Virtual Network Operator (MVNO), focusing on innovation, affordable connectivity, and sustainable broadband inclusion. - Premiumtimes

Nigeria signs €100million clean energy investment deal with UNIDACO:

Nigeria’s Energy Commission signed a €100 million Memorandum of Understanding (MoU) with UNIDACO Limited to boost renewable energy development and advance the country’s clean energy transition under the Renewed Hope Agenda. - Thesun

WACOT secures €1.26million grant from DEG Impulse to boost organic sesame farming:

WACOT Limited secured a €1.26 million grant from Germany’s DEG Impulse to empower 3,500 sesame farmers in Jigawa and Kebbi with organic, climate-smart farming practices and boost Nigeria’s non-oil exports. - Thesun

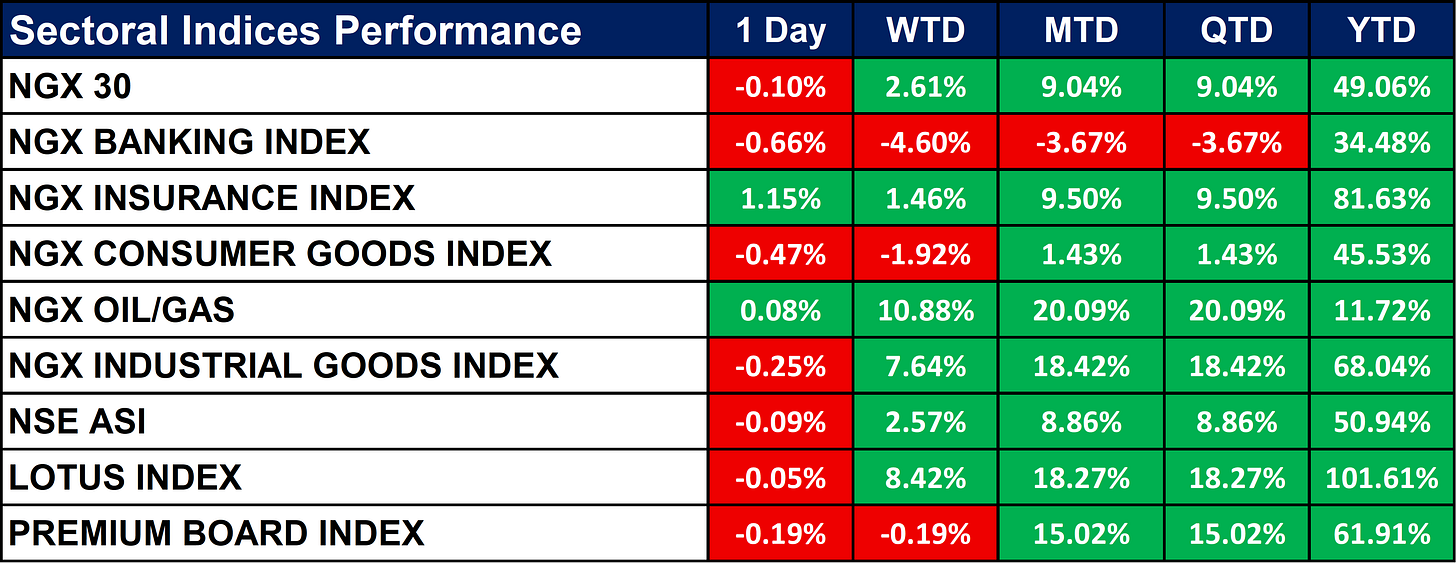

Nigeria Sectoral Indices Performance

The table below shows that the NGX Insurance Index led the market with a 1.15% daily gain and a strong 81.63% YTD growth, while the Banking Index lagged with a 0.66% daily decline. Most indices showed positive month-to-date (MTD) and quarter-to-date (QTD) performance, with the Lotus Index up over 100% YTD. Overall market (NSE ASI) slightly dipped 0.09% today but remains up about 51% year-to-date.

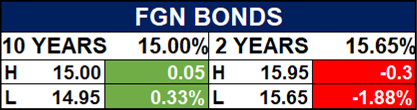

Fixed Income (FGN Bonds)

FGN Bond Auction Result

Global News & News Update

Bank of Korea considers gold purchases in medium term after long absence:

South Korea’s central bank is considering buying gold for its reserves for the first time since 2013, with timing dependent on the won and gold prices, while continuing to store its holdings in London. - Reuters

US strikes $80 billion deal for new nuclear power plants:

The U.S. government is partnering with Westinghouse, Cameco, and Brookfield to build $80 billion worth of nuclear reactors, advancing Trump’s energy dominance agenda amid rising AI-driven power demand. - Reuters

Oil falls 2% as investors weigh Russia sanctions, OPEC+ output plans:

Oil prices fell about 2% as investors weighed U.S. sanctions on Russia’s top oil firms, halted Indian imports, and the possibility of an OPEC+ output increase in December. - Reuters

UK unlocks $8.6 billion in trade and investment deals with Saudi Arabia:

The UK secured £6.4 billion ($8.6 billion) in trade and investment deals with Saudi Arabia to boost economic ties, including £5 billion in export finance and major corporate investments. - Reuters

US, Japan leaders sign rare earths, nuclear power deal ahead of Trump-Xi meeting:

Japan and the U.S. signed a deal to develop next-generation nuclear reactors and secure rare earth supplies, aiming to reduce dependence on China and strengthen energy and technology cooperation. - Reuters

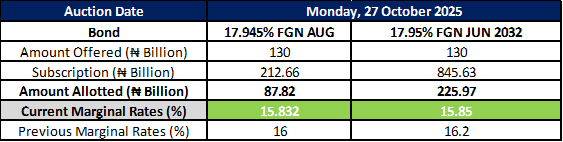

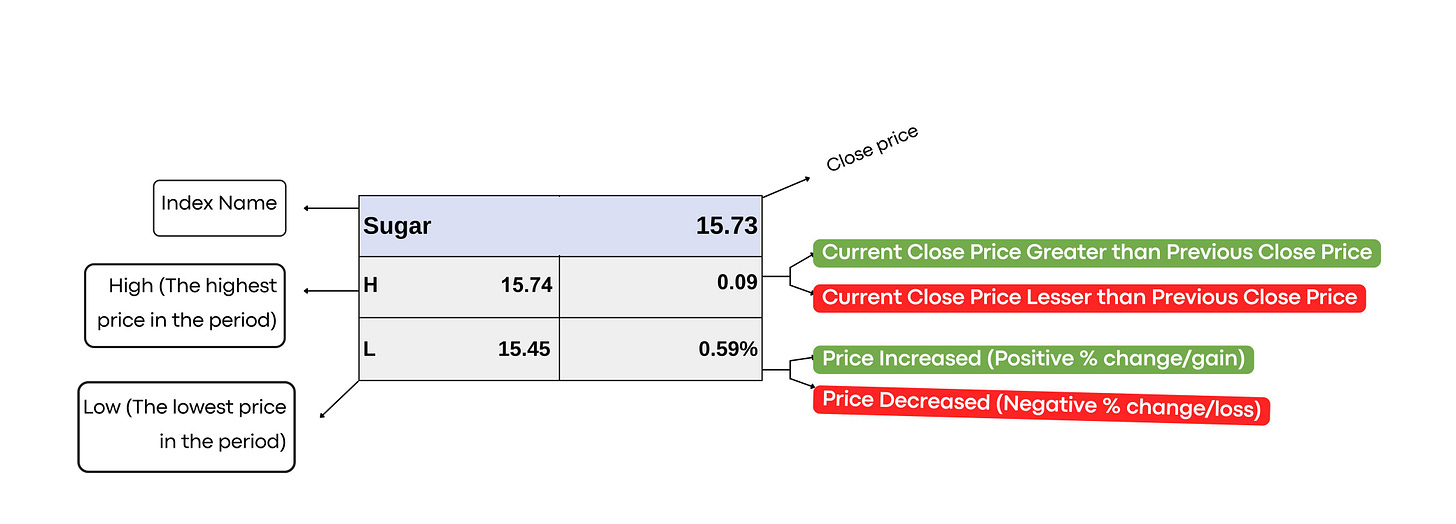

Indices, Commodities & Currencies

The table below depicts that the Global markets were mixed U.S. indices like the Nasdaq 100 and S&P 500 rose modestly, Oil prices (WTI, Brent) declined over 1%, weighing on the energy sector, while precious metals like silver and copper gained slightly. Agricultural commodities such as soybeans and wheat advanced, and major currencies traded narrowly with mild dollar weakness..

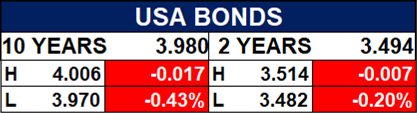

Fixed Income (USA Bonds)

Conclusion

With Nigeria’s renewed financial standing and strong sectoral momentum, coupled with evolving global energy and monetary policies, investors could anticipate moderate market volatility and selective growth opportunities. Continued reforms and strategic global alignments could further drive capital inflows and shape near-term market sentiment.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.