Trading Tuesday - Nigeria Suspends Import Levy as Reserves Rise; Global Markets Cautious Before Fed Decision

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Nigerian markets closed mixed, with long-term gains still led by Insurance and Lotus indices. The government suspended the 4% import levy, reserves rose to $41.66 billion, and non-oil exports boosted the trade surplus. Globally, sentiment was cautious ahead of the Fed’s expected rate cut, European data was mixed, South Africa and the UK faced structural challenges, energy prices rallied, equities mostly fell, and the dollar weakened.

Nigerian News & Market Update

FG Suspends 4% FOB Import Levy:

The Federal Government has suspended the 4% Free On Board levy on imported goods after backlash from businesses and trade groups. Finance Minister Wale Edun said the policy posed risks to trade, inflation, and economic recovery. The suspension allows time for a review and consultation with stakeholders to design a more balanced and efficient revenue framework. - Channels

External Reserves Grow By 12% To $41.663billion:

Nigeria’s external reserves rose by $4.47billion in three months to $41.66billion, the highest since 2021, boosted by stronger investor confidence and rising diaspora remittances. The improved reserves have helped the naira appreciate to around ₦1,501/$, with analysts projecting near-term stability supported by steady inflows and non-oil exports. - Leadership

Commercial paper borrowing soars to ₦1.58trillion in 7 months as bank loans bite:

Nigerian firms raised ₦1.58trillion through commercial papers (CPs) in Jan–July 2025, more than double last year, as high interest rates make bank loans and bonds costly. CPs offer short-term funding relief, but analysts warn of refinancing risks and weak long-term investment if rates stay high. The trend shows both investor confidence and structural gaps in Nigeria’s credit markets. - TheSun

Agric produce, raw materials double non-oil exports to ₦18.4 trillion:

Nigeria’s non-oil exports doubled to ₦18.43 trillion in the first half of 2025, helping the country record a trade surplus of ₦12.64 trillion despite a drop in crude oil earnings. The surge was driven by agricultural and solid mineral exports, while oil theft declined to a 16-year low, boosting fiscal revenue, foreign exchange inflows, and investor confidence in the oil sector. - TheNation

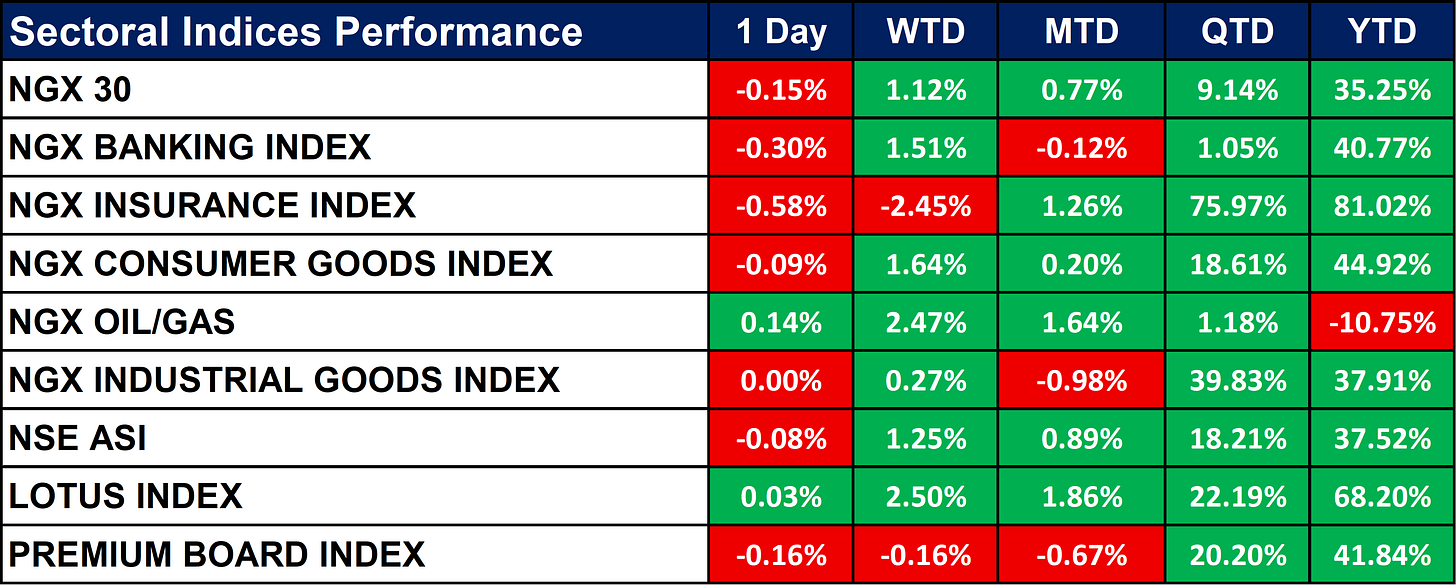

Nigeria Sectoral Indices Performance

The table below shows that the the NGX market closed mixed, with most sector indices slightly lower on the day. Oil & Gas and Lotus posted small gains, while Insurance, Banking, and Consumer Goods declined. Despite the daily dip, quarter-to-date and year-to-date returns remain strong, led by Insurance (+81% YTD) and Lotus (+68% YTD), while Oil & Gas lags at -10.75% YTD.

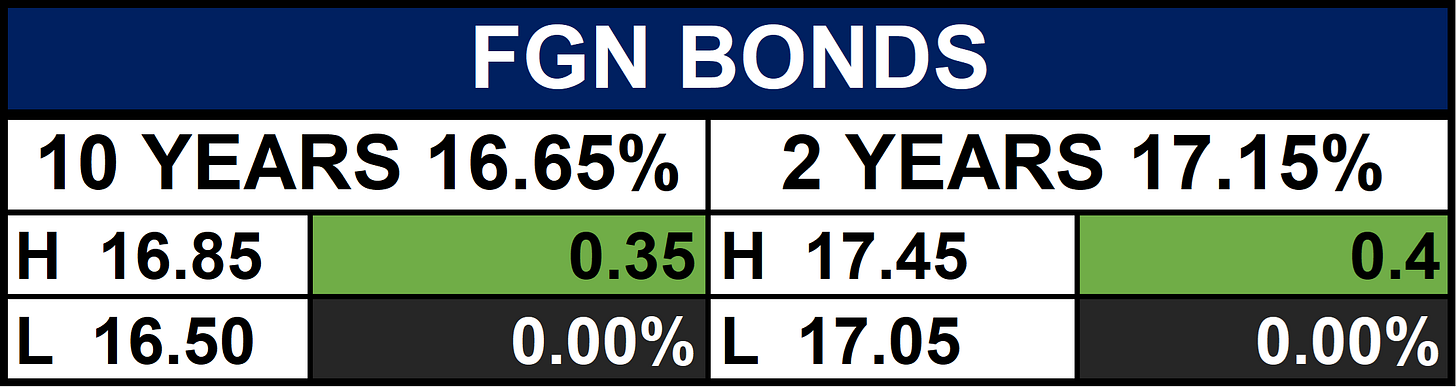

Fixed Income (FGN Bonds)

Global News & News Update

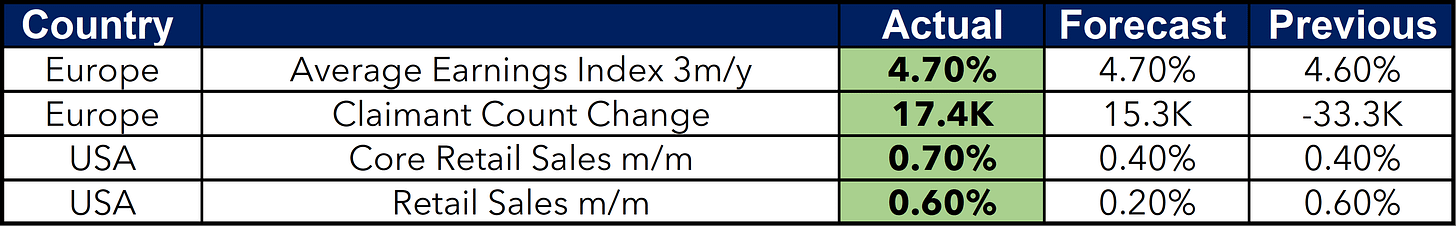

Fed opens September meeting with independence under threat:

The U.S. Federal Reserve began its two-day policy meeting on Tuesday, with markets largely expecting a 25 basis-point interest rate cut. The meeting comes amid pressure from President Trump and recent changes to the Fed’s Board of Governors. Investors remained cautious ahead of the announcement, while also watching UK labor market data and U.S. retail sales for additional economic signals. - Reuters

South Africa grants long-term leases to oil majors at key Durban fuel hub:

South Africa has granted long-term (25-year) lease access at its Island View Precinct to major oil companies and traders, including BP and Vitol, ending years of short-term lease disputes. The move, aimed at securing fuel supply and encouraging investment, covers the country’s main petrochemical hub, which handles about 70% of fuel imports. Lease agreements with Transnet National Ports Authority are set to be finalized by March 2026. - Reuters

German investor morale unexpectedly rises in September, ZEW finds:

German investor sentiment rose unexpectedly in September, with the Zentrum für Europäische Wirtschaftsforschung (ZEW) economic sentiment index climbing to 37.3 points, signaling cautious optimism despite the economy's weak performance. However, the current economic situation index fell to -76.4, reflecting ongoing risks from U.S. tariffs and domestic reforms. Analysts warn that hopes for a recovery may fade unless broader conditions improve. - Reuters

UK jobs market slows again, offering some inflation relief to Bank of England:

Britain’s jobs market showed signs of slowing in August, with payrolls falling for the seventh consecutive month and wage growth easing slightly to 4.7–4.8%. However, job vacancies rose for the first time since early 2021, suggesting a cautious return to hiring. The Bank of England is expected to keep interest rates on hold amid ongoing inflation concerns. - Reuters

Canada's annual inflation rate in August rises less than expected:

Canada’s annual inflation rose to 1.9% in August, driven by slower declines in petrol prices and slight food price increases. Core inflation remains soft, leading economists to expect the Bank of Canada to cut interest rates, likely starting with a 25 basis point reduction soon. - Reuters

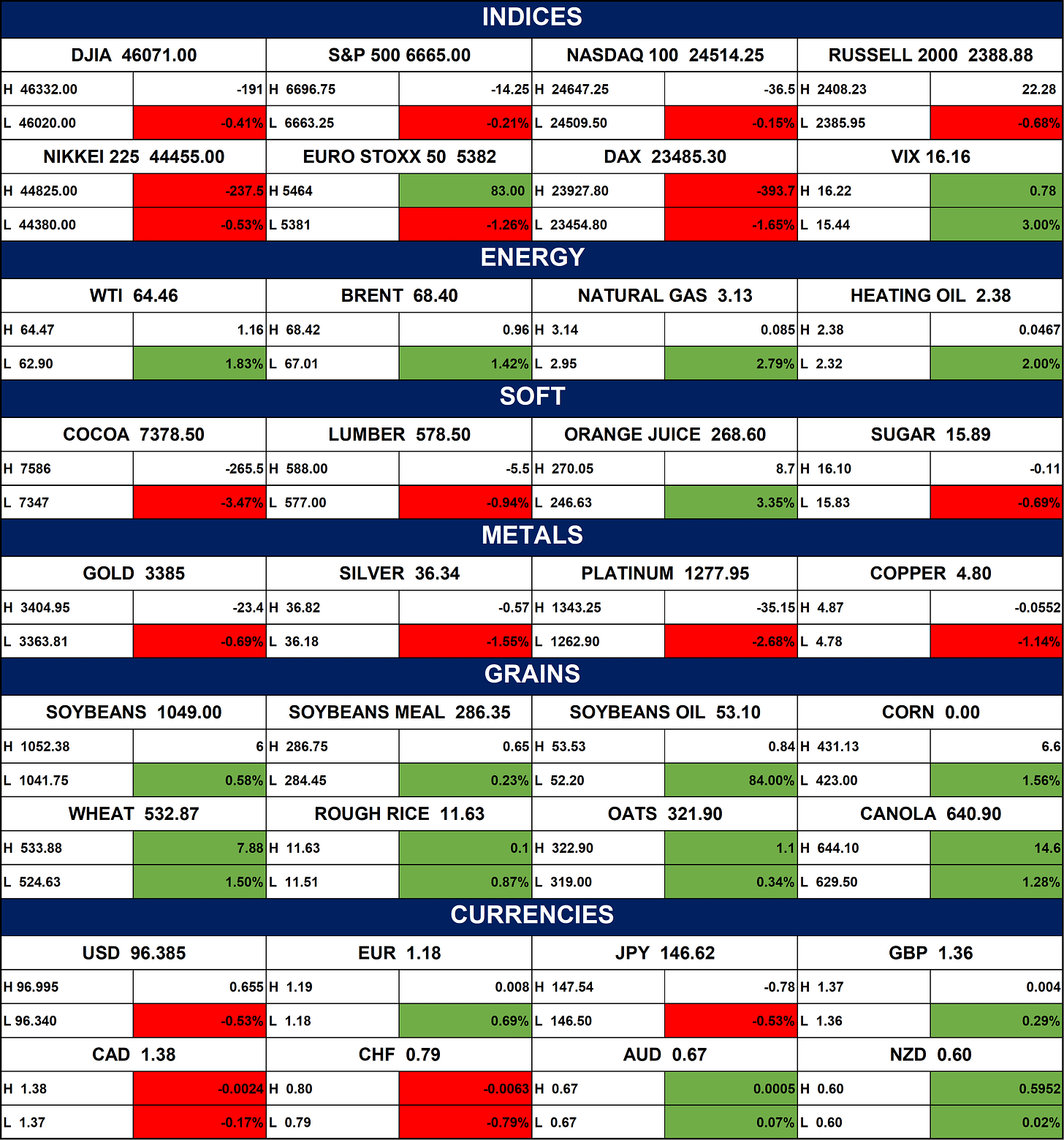

Indices, Commodities & Currencies

The table below depicts that the Global equities were mostly weaker. US indices and Japan’s Nikkei fell, while Europe was mixed with gains in Euro Stoxx but losses in Germany’s DAX. Energy prices rallied strongly, led by natural gas and heating oil. Soft commodities were mixed: cocoa slid while orange juice jumped. Metals dropped across the board, with platinum and silver hit hardest. Grains traded broadly higher, with wheat, soybean oil, and canola leading gains. The US dollar weakened, allowing the euro, pound, and New Zealand dollar to strengthen, while safe-haven currencies like the yen and franc also fell.

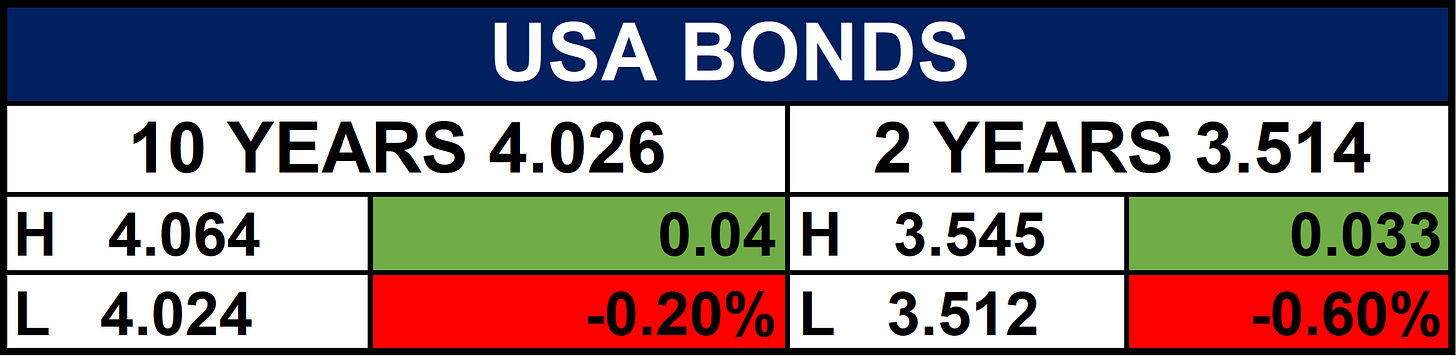

Fixed Income (USA Bonds)

Events

Conclusion

Nigerian markets may gain near-term support from stronger reserves, rising non-oil exports, and improved foreign inflows, helping stabilize the naira. However, high borrowing costs and refinancing risks could dampen momentum. Globally, the Fed’s expected rate cut may provide short-term support for risk assets, though inflation concerns and central bank independence issues could limit gains. Energy markets are likely to stay firm, while currency volatility may persist as policy paths diverge across major economies.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.