Trading Tuesday - Nigerian Bonds Boost Liquidity While Global Markets Face Volatility and Key Energy Developments

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. In Nigeria, fresh opportunities are emerging as the Debt Management Office launches attractive FGN Savings Bonds, while the Federal Government partners with TotalEnergies to unlock deepwater oil potential. The naira shows resilience with its strongest performance in six weeks, supported by improved liquidity and forex inflows. On the global front, markets reflect caution amid rising U.S. Treasury yields and fiscal uncertainties in the UK. Energy and commodity sectors see mixed movements, while inflation and investment trends evolve across major economies. Stay tuned as we unpack these key developments shaping both local and international markets.

Nigerian News & Market Update

Banks, investors to boost liquidity with FGN Savings Bonds:

Nigeria’s Debt Management Office has opened sales of FGN Savings Bonds for September 2025. The 2-year bond offers 15.54% and the 3-year bond 16.54% interest, both with quarterly payments. Investors can subscribe between ₦5,000 and ₦50 million, with settlement on September 10. The bonds are tax-exempt, listed on NGX, and backed by the Federal Government. Additionally, the DMO announced a ₦200billion bond offering, including a reopening of the June 2032 bond at 17.95%. - Punch

FG, oil firms sign contract for offshore blocks:

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has signed a Production Sharing Contract with TotalEnergies (80%) and Sapetro (20%) for two Niger Delta oil blocks awarded in 2024. The deal includes a $10million signature bonus, production-based incentives, and clear terms under the Petroleum Industry Act covering oil, gas, cost recovery, and community obligations. It is the first deepwater Production Sharing Contract (PSC) under the Petroleum Industry Act (PIA) and aims to boost investment, reserves, and Nigeria’s crude output toward the 3 million barrels per day target. TotalEnergies pledged swift, low-cost, and low-emission project delivery. - Punch

Naira starts September strong at ₦1,526 per dollar:

The naira strengthened to ₦1,526.09/$ on Monday, marking its strongest level in six weeks, supported by improved market liquidity and sustained dollar inflows. At the parallel market, it also gained 1.22% to ₦1,527.33/$, reducing speculative pressure. Experts from Cowry Assets, AIICO Capital, and PwC project continued stability due to CBN reforms and FX inflows. External reserves also rose to $41.27billion. Meanwhile, the US dollar weakened globally, hitting a five-week low, as markets anticipate softer U.S. labor data that could influence future Federal Reserve rate cuts. - Punch

CBN Mops up N1.19trn from OMO Bills, Rejects Excess Bids:

The CBN raised ₦1.19trillion from two Open Market Operations (OMO) auctions last week to curb liquidity and attract forex inflows. The 83-day and 84-day bills, offered at stop rates of 26.49% and 26.50%, drew ₦1.57trillion in subscriptions, mostly from offshore investors and local banks. Despite strong demand, many bids were rejected. Another auction is expected this week with ₦459.6billion maturities due. In the secondary market, Open Market Operations (OMO) yields eased slightly to 25.5% as investors sought placements. - DailyTimes

Dangote refinery boosts exports as Middle East refineries shut for maintenance:

The Dangote Refinery is boosting exports of petrol, diesel, and aviation fuel to Saudi Arabia and other Gulf countries as their refineries undergo maintenance. This has created a supply gap that Nigeria’s $20billion refinery is helping to fill. Dangote plans to ramp up production to 700,000 barrels per day by December, strengthening Nigeria’s role in the global fuel market. - DailyTimes

Stakeholders hail shea export ban, eye $6.5billion global market:

Nigeria has placed a six-month ban on raw shea nut exports to boost local processing and capture more value from the $6.5billion global shea market. Despite producing 40% of the world’s shea, the country earns less than 1% of market value due to decades of raw exports. Stakeholders say the move will create jobs, attract investment, and align Nigeria with other West African producers that already restrict raw exports. While challenges like smuggling and weak processing capacity remain, the policy is seen as a major step toward industrialising the shea sector and expanding value-added exports, including new access to the Brazilian market. - TheSun

Nigeria’s FX reserves hit $41.3billion in August:

Nigeria’s foreign reserves rose to $41.3billion in August, the highest since May 2023, boosted by stronger oil earnings, lower FX demand, and renewed foreign investor inflows. Oil output also improved to 1.53m barrels per day. Analysts say the build-up signals stability for the naira, though risks from global oil markets remain. The naira closed at ₦1,534/$1 but forward contracts showed optimism for steadier performance. - TheSun

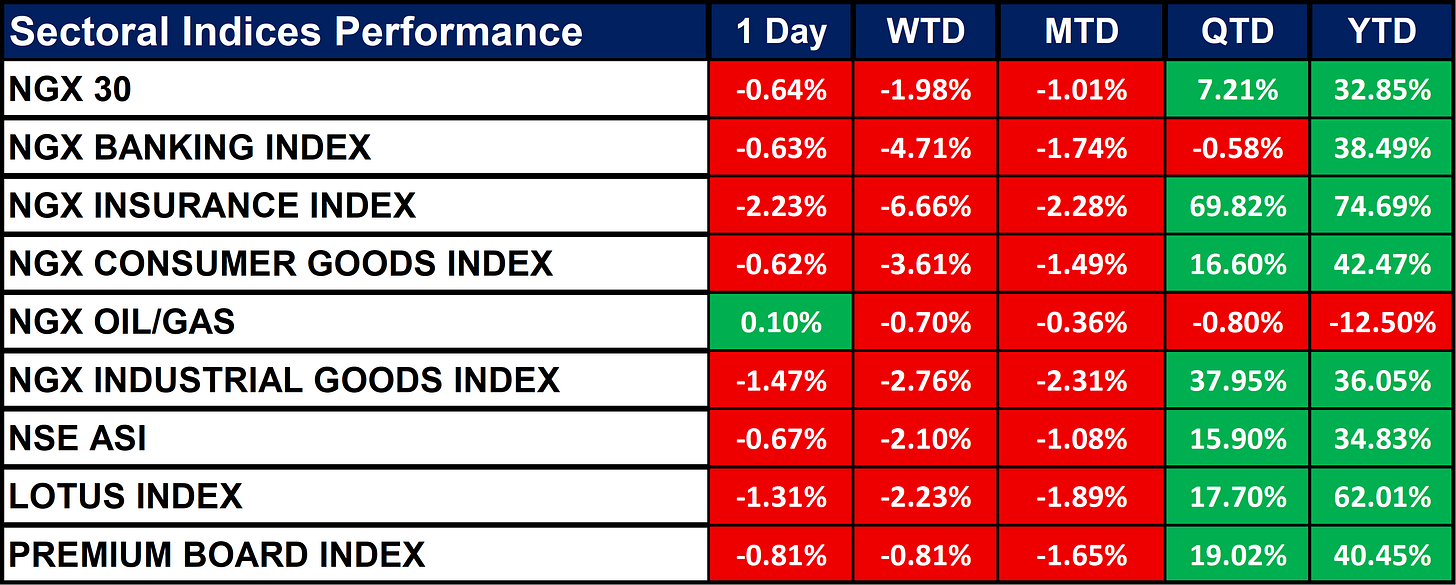

Nigeria Sectoral Indices Performance

The table below shows that Most NGX sector indices declined in the short term (1-Day, WTD, MTD), reflecting negative market sentiment. However, long-term (YTD) performance remains strong, led by the Insurance Index (+74.69%), Lotus Index (+62.01%), and Consumer Goods (+42.47%). The Oil/Gas Index was the only gainer today (+0.10%) but is still the worst performer YTD (-12.50%). Despite current losses, several indices show strong Quarter-to-Date (QTD) growth, especially Insurance and Industrial Goods.

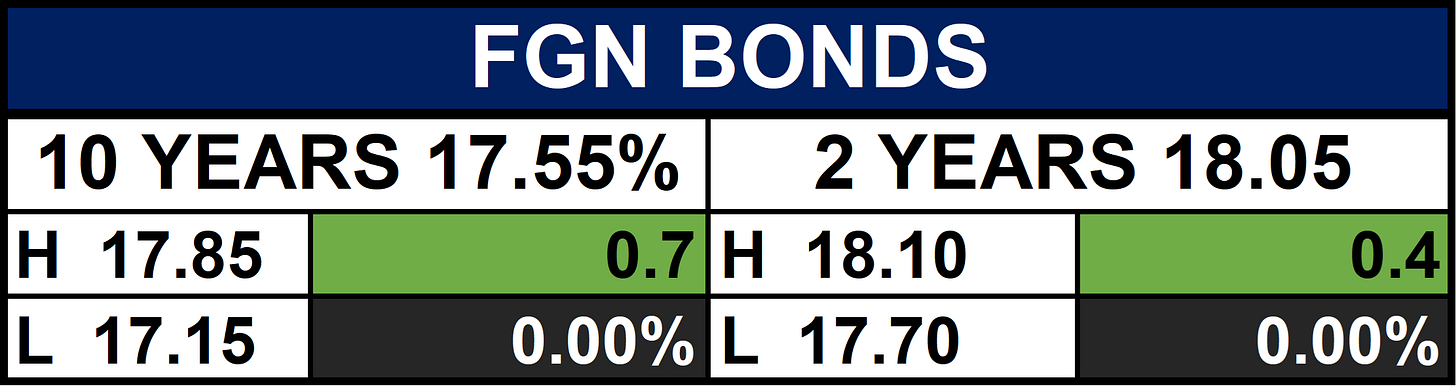

Fixed Income (FGN Bonds)

Global News & News Update

Treasury yields jump on prospect of US having to refund tariff money with 30 year yield topping 4.97%:

U.S. Treasury yields rose on Tuesday after a court ruled most of Trump’s tariffs were unconstitutional, raising concerns the government may need to refund collected tariffs potentially worsening the fiscal deficit. The 10-year yield hit 4.275%, and the 30-year yield rose to 4.978%, pressuring stocks, with the Dow falling over 500 points. Global bond yields also climbed. The ruling may lead to increased Treasury issuance. Investors are also watching upcoming jobs data that could influence the Fed’s next rate decision. - CNBC

UK borrowing costs hit highest since 1998, pound slides on fiscal worries:

Britain's 30-year borrowing costs rose to their highest level since 1998, and the pound fell over 1.5% on Tuesday, reflecting investor concerns about the UK’s rising debt and the Labour government’s ability to manage public finances. Markets reacted to fiscal uncertainty, a cabinet reshuffle by PM Keir Starmer, and expectations of a tough upcoming budget. Analysts now expect the Bank of England to hold interest rates at 4% until the end of 2026, dampening hopes for rate cuts and raising fears of weaker investment and consumer confidence. - Reuters

Russia has made substantial progress in fighting inflation, central bank official says:

Russia has made significant progress in reducing inflation, according to central bank deputy governor Alexei Zabotkin, ahead of a key interest rate decision on September 12. After raising rates to 21% in 2024 to cool inflation driven by war-related spending, the central bank began cutting them in June, with the current rate at 18%. Inflation dropped to 8.79% in July, down from 9.40% in June, and the bank aims for 4% by 2026. The ruble has strengthened over 40% against the dollar, helping ease import prices. However, Zabotkin cautioned that it’s too early to declare inflation fully under control. - Reuters

Colombia's 2025 natural gas investment seen up 35% to $1.1 Billion, Naturgas association:

Colombia’s investment in its natural gas industry is expected to rise by 34.6% to $1.1 billion in 2025, up from $817 million in 2024, according to Naturgas president Luz Stella Murgas. Most of the funds $1.007 billion will go toward exploration and production, with $50 million for distribution and marketing. The increase aims to address a growing gas deficit, projected to reach 20% by 2026, amid reduced exploration tied to President Gustavo Petro’s shift away from fossil fuels. - Reuters

Brazil's economy slows sharply in second quarter but still beats forecasts:

Brazil’s economy grew 0.4% in Q2 2025, slowing from 1.3% in Q1 but still beating expectations. Growth was supported by strong services and extractive industries, while household spending and industrial output rose modestly. However, investment and government spending declined. The slowdown supports expectations of easing inflation, possibly allowing the central bank to begin cutting its 15% interest rate later this year. - Reuters

Russian seaborne diesel exports fell in August, data shows:

Russia’s seaborne diesel and gasoil exports fell 6% in August to 3.1 million metric tons, due to Ukrainian drone attacks that damaged key oil facilities. About 17% of Russia’s oil processing capacity was shut down as a result. Exports from Novorossiisk dropped 12%, while shipments from Primorsk rose 5.4% after maintenance completion. Turkey and Brazil remained top importers, along with Morocco, Tunisia, and Senegal. - Reuters

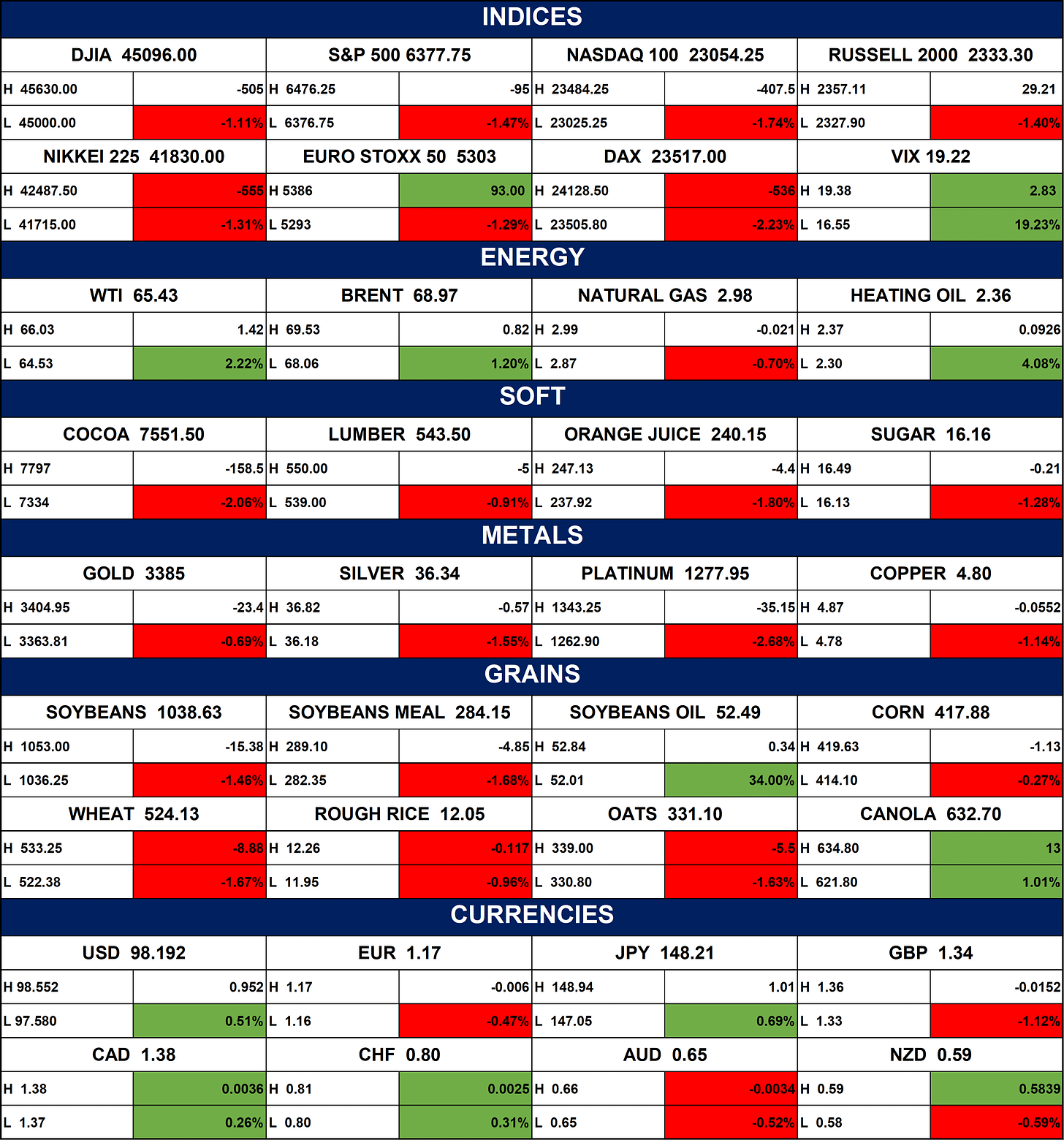

Indices, Commodities & Currencies

The table below depicts that the global stock markets mostly declined, with major indices like the DAX, NASDAQ, and S&P 500 down, while the Euro Stoxx 50 rose. Energy prices, especially oil and heating oil, increased. Most soft commodities and metals dropped, but some grains like soybean oil and canola gained. The US dollar strengthened slightly, while the euro and British pound weakened. Overall, markets showed caution with rising volatility.

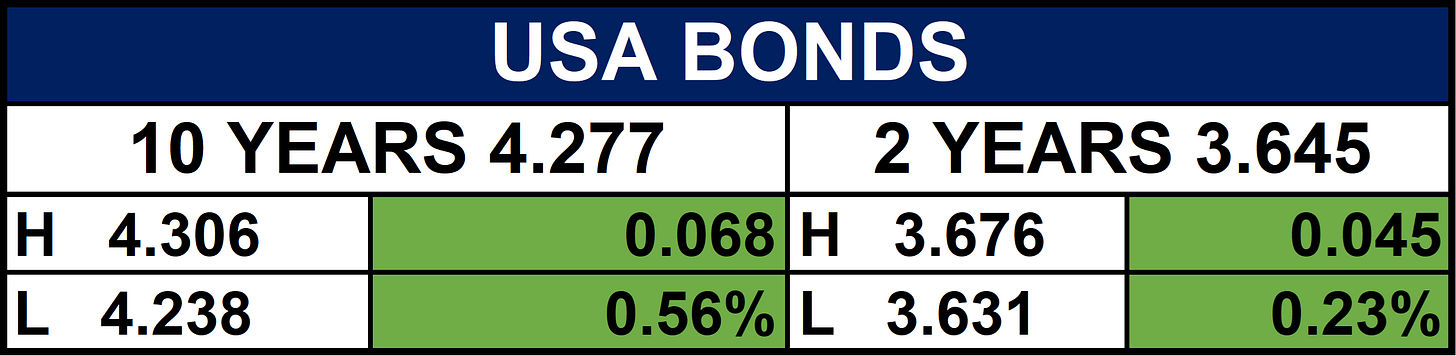

Fixed Income (USA Bonds)

Events

Conclusion

Today's updates highlight the strong connection between Nigerian financial markets and global economic trends. Nigeria’s effective debt management and energy partnerships are boosting market confidence and liquidity, while currency stability shows positive momentum. Meanwhile, rising global treasury yields and geopolitical issues are creating cautious investor sentiment, affecting stocks and commodities. Staying informed is key as Nigeria leverages its resources and reforms, and the world faces ongoing inflation and fiscal challenges.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.