Trading Tuesday - Nigerian Equities Resilient Amid Bond Issuances; Global Markets Face Energy and Inflation Pressures

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Nigeria’s markets stayed active with Champion Breweries’ ₦58billion equity raise, Unity Bank’s merger progress, and strong demand for FGN bonds. Lafarge Africa’s ratings reaffirm resilience, while equities closed mostly positive, led by Oil & Gas and NGX 30. Globally, oil eased on the Organization of the Petroleum Exporting Countries plus allies (OPEC+) supply signals, while German inflation and U.S. shutdown risks kept investors cautious.

Nigerian News & Market Update

Champion Breweries targets ₦58billion equity raise to finance Bullet acquisition:

Champion Breweries will raise ₦58billion in equity and ₦45billion in bonds to acquire Bullet and expand operations. The funds will support working capital, packaging, and digital upgrades. This comes after a strong turnaround with profit of ₦2.3billion in H1 2025 and share price up 300% YTD. - BusinessDay

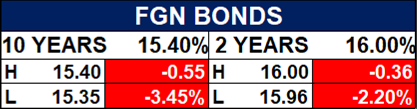

FG lists ₦200billion bonds for September:

FGN is offering ₦200billion bonds at ~17.95% in September 2025.

They are tax-exempt, trustee-eligible, and liquid assets for banks.

The Debt Management Office (DMO) has already raised ₦3.03trillion in 2025, driven by demand for long bonds. - PunchAMCON Shares Bought By Existing Shareholder, Unity Bank Clarifies:

Unity Bank said the Asset Management Corporation of Nigeria (AMCON)’s 34% stake was bought by an existing shareholder, not Providus. Shareholders approved the merger with 99.32% support, choosing cash (₦3.18/share) or Providus shares. The new bank will launch with 230 branches and stronger capital. - Leadership

GCR Affirms Lafarge Africa’s AA+, A1+ Credit Ratings, Outlook Stable:

GCR affirmed Lafarge Africa’s AA+(NG)/A1+(NG) ratings with a stable outlook.

Strong cash flow, ₦210billion liquidity, and minimal debt support resilience.

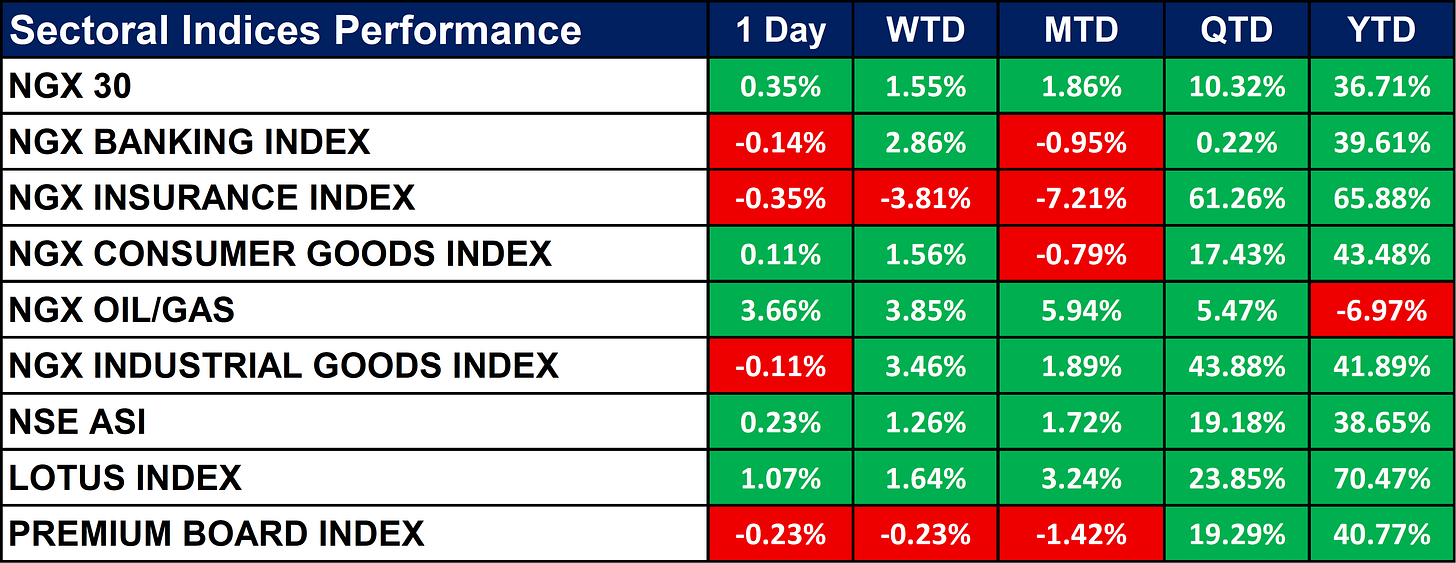

Revenue is set to surpass ₦1trillion in 2025 despite competition. - dmarketforcesNigeria Sectoral Indices Performance

The table below shows that the Nigerian equities closed mostly positive, with NGX 30 (+0.35%), Oil/Gas (+3.66%), and Lotus Index (+1.07%) driving gains.

Year-to-date, Insurance (+65.9%) and Lotus (+70.5%) lead performance, while Oil/Gas (-7.0%) remains the laggard. Broad market indices, NSE ASI (+38.7%) and Premium Board (+40.8%), show strong overall growth despite short-term mixed movements.Fixed Income (FGN Bonds)

FGN Bond Auction Result

Global News & News Update

Russia declares partial diesel export ban until year-end, extends gasoline ban:

Russia banned diesel exports and extended its gasoline ban to year-end after refinery attacks. The diesel ban targets resellers, not producers.

Shortages have led Crimea to impose rationing and price freezes. - ReutersSouth Africa’s utility Eskom makes first profit in eight years:

Eskom posted its first profit in eight years R16billion in FY2025 driven by debt relief, higher tariffs, and fewer power cuts (13 days vs. 329). The utility plans to reinvest R320billion over five years to upgrade infrastructure. However, rising municipal debt (R103.5bn) threatens its long-term viability. - Reuters

German inflation rises in September to highest level since February:

German inflation hit 2.4% in September, above forecasts, with core at 2.8%.

Euro zone inflation is also expected to rise, limiting chances of further ECB cuts.

Still, weak sales, imports, and jobs show deflation risks in Germany. - ReutersOil falls as OPEC+ plan adds to expectations of supply surplus:

Oil fell as OPEC+ plans a November output hike and Kurdistan exports resumed, raising oversupply fears. Brent slid to $67.27, WTI to $62.64, extending sharp losses. Weak demand and U.S. shutdown risks added pressure despite geopolitical tensions. - Reuters

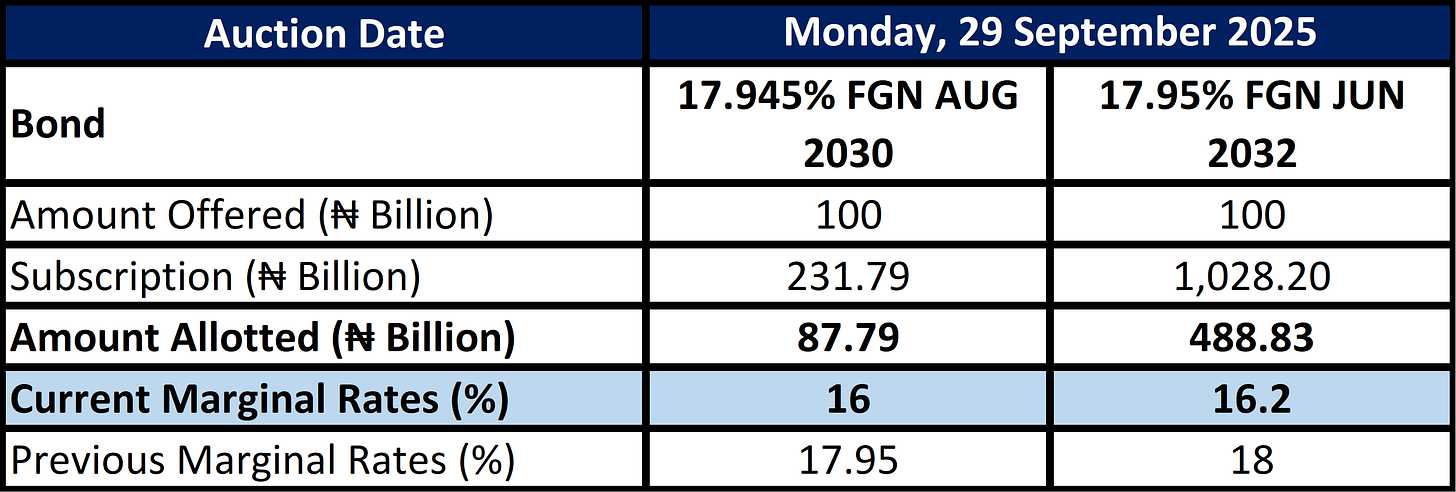

Indices, Commodities & Currencies

The table below depicts that the Global markets were mixed: Dow Jones (-0.38%) and S&P 500 (-0.35%) fell, while Nasdaq 100 gained (+0.21%). Oil slipped (WTI -0.95%, Brent -0.94%), but Natural Gas (+1.32%) and Orange Juice (+2.54%) rose.

In currencies, the USD weakened (-0.19%), while CAD (+0.22%) and NZD (+0.52%) strengthened.

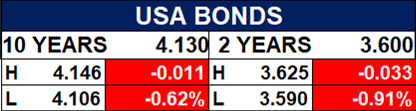

Fixed Income (USA Bonds)

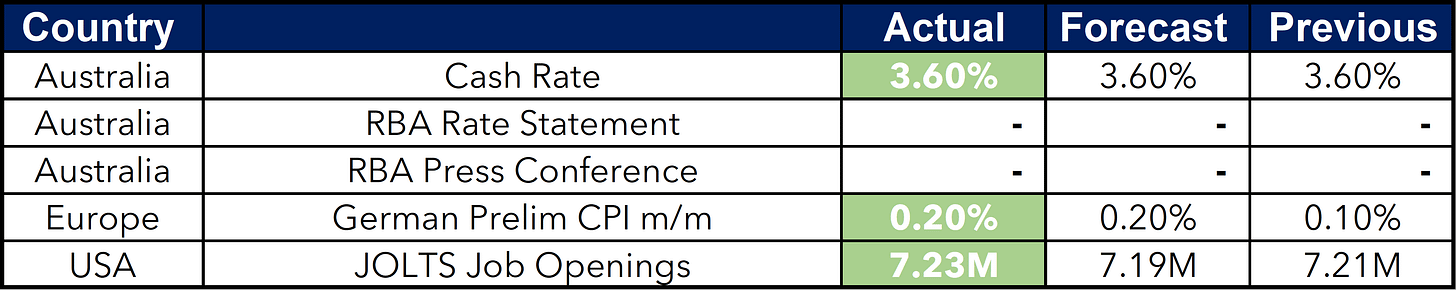

Event

Conclusion

Looking ahead, Nigerian markets may see continued inflows into equities and bonds, supported by lower interest rates, robust corporate actions, and improving GDP momentum. Sectors like insurance, consumer goods, and industrials look well-positioned for medium-term growth, while oil & gas remains pressured by both local and global supply-demand shifts. Globally, investors face mixed signals: inflationary pressures in Europe, policy uncertainty in the U.S., and shifting oil dynamics. These underline the need for diversification, defensive positioning, and close monitoring of energy and monetary policy trends. Nigerian investors can take advantage of resilient local sectors while keeping global risk factors in view.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.